Get the free Hea 1499

Get, Create, Make and Sign hea 1499

How to edit hea 1499 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hea 1499

How to fill out hea 1499

Who needs hea 1499?

A complete guide to the HEA 1499 Form

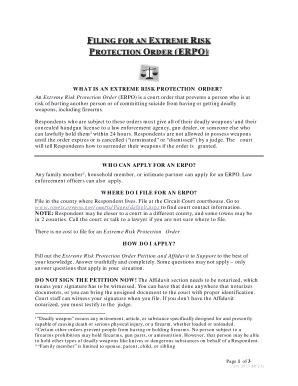

Understanding the HEA 1499 Form

The HEA 1499 Form is a critical document utilized primarily in educational settings, particularly for students who are applying for financial aid or scholarships. This form gathers essential administrative data that supports the financial aid application process, ensuring that institutions have the necessary information to evaluate funding eligibility.

Its importance lies in the fact that it serves as a vehicle for students to present their academic backgrounds, financial statuses, and personal identification to their schools. The HEA 1499 is not only relevant for the financial aid offices but also acts as a protective measure for students, ensuring all pertinent data is accurately reflected for financial assistance.

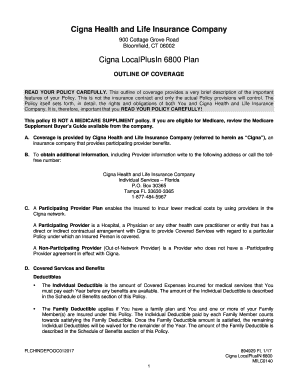

Features of the HEA 1499 Form on pdfFiller

pdfFiller offers a robust platform for handling the HEA 1499 Form efficiently, equipped with a suite of editing tools that make the document management process seamless. One significant feature is the comprehensive editing tools, which allow users to modify the content directly on the form. Users can edit text, add new sections, or even remove unnecessary parts, thus providing flexibility and control over the form's content.

The eSigning capabilities enhance this platform significantly, allowing for quick and secure signatures to validate the document without the need for printing. This feature is particularly valued in today's fast-paced environment where immediate accessibility and efficiency are paramount. Collaboration options further enrich the user experience by allowing teams to share the form, track modifications, and communicate all in one space, minimizing errors and misunderstandings.

Cloud-based accessibility empowers users to access the HEA 1499 Form from anywhere and on any device, ensuring that important documents are at your fingertips. The user-friendly interface offered by pdfFiller allows users to navigate the platform effortlessly, making document management less of a chore and more of a streamlined process.

Step-by-step guide: How to fill out the HEA 1499 Form

Filling out the HEA 1499 Form correctly can influence the efficiency of your financial aid application. Here’s a step-by-step approach that can guide you through the process.

Preparation before filling out the form

Before you begin, it’s essential to gather all necessary information and documents. This includes social security numbers, tax records, and educational details like schools attended and degrees obtained. Understanding the specific requirements for each section of the form will also enhance your efficiency during this process.

Detailed instructions for completion

Section A: Personal Information. In this section, you’ll be required to provide foundational information, including your name, contact information, and social security number. It’s crucial to ensure that all data is accurately inputted to avoid future complications.

Section B: Educational Details. List your educational history, which may include previous schools, degrees, and programs attended. Make sure the dates are accurate.

Section C: Financial Information. This section is critical for determining your financial aid eligibility. Provide accurate financial disclosures, including income, assets, and any other relevant financial data.

Common pitfalls to avoid

Many users often make common mistakes such as leaving sections incomplete or entering incorrect data. To ensure data consistency and accuracy across all sections, review each entry meticulously before submission.

Editing the HEA 1499 Form

After submitting the HEA 1499 Form, there may be circumstances requiring you to revise your submission. Users on pdfFiller can quickly learn how to make necessary changes to the form post-submission. The platform allows users to leverage advanced editing features, enabling smooth revisions that can adjust any part of the form as needed.

The ability to save versions of your form ensures that you can track your document history. This is particularly useful in preventing loss of data while making multiple edits, thus ensuring the latest version is always available for review or resubmission.

Signing the HEA 1499 Form

The importance of eSigning in document validation cannot be overstated. For the HEA 1499 Form, an eSignature provides the same legal validity as a handwritten signature, making it essential for confirming your agreement with the data provided.

Step-by-step eSigning process

To initiate the eSigning process on pdfFiller, simply open your completed form and select the 'eSign' option. You’ll have the choice to add multiple signers if needed, thus facilitating group participation for collaborative efforts. By following the prompts, you can easily place your signature in the designated area.

Managing your HEA 1499 Form with pdfFiller

Effective management of your HEA 1499 Form within your pdfFiller account ensures easy access and organization. Utilize the folder structure feature that allows you to categorize your forms, enhancing efficiency in document retrieval.

Shared access options enable collaborative efforts, allowing multiple users to engage with the document and make necessary updates or inputs. This openness not only fosters teamwork but also minimizes the potential for errors.

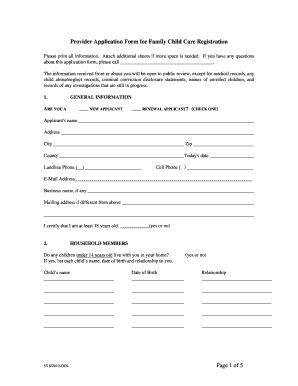

FAQs about the HEA 1499 Form

When filling out or submitting the HEA 1499 Form, questions or issues may arise. For instance, what if you’ve made a mistake after submitting the form? The best course of action is to reach out to your institution's financial aid office to discuss the errors and explore options for correction.

If you require support from pdfFiller regarding HEA 1499 issues, the support team is available to assist you with any technical questions or concerns. Processing times for responses may vary, so it's best to inquire via the platform's help center for the most accurate updates.

Additional tools and features related to HEA 1499

There is a range of related templates available that can accompany the HEA 1499 Form, enhancing your document management strategy. Exploring integration possibilities with other document workflows provides further customization options. Moreover, using analytics and tracking features helps users monitor the submission status, providing reassurance and transparency throughout the process.

Insights and best practices for form management

Maintaining accurate records is vital for any student or institution dealing with the HEA 1499 Form. Regular updates ensure that your form reflects the most current information, aligning with any changes in your personal or financial situations. Leveraging pdfFiller resources can provide continuous improvement in handling documents efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute hea 1499 online?

Can I create an electronic signature for the hea 1499 in Chrome?

Can I create an electronic signature for signing my hea 1499 in Gmail?

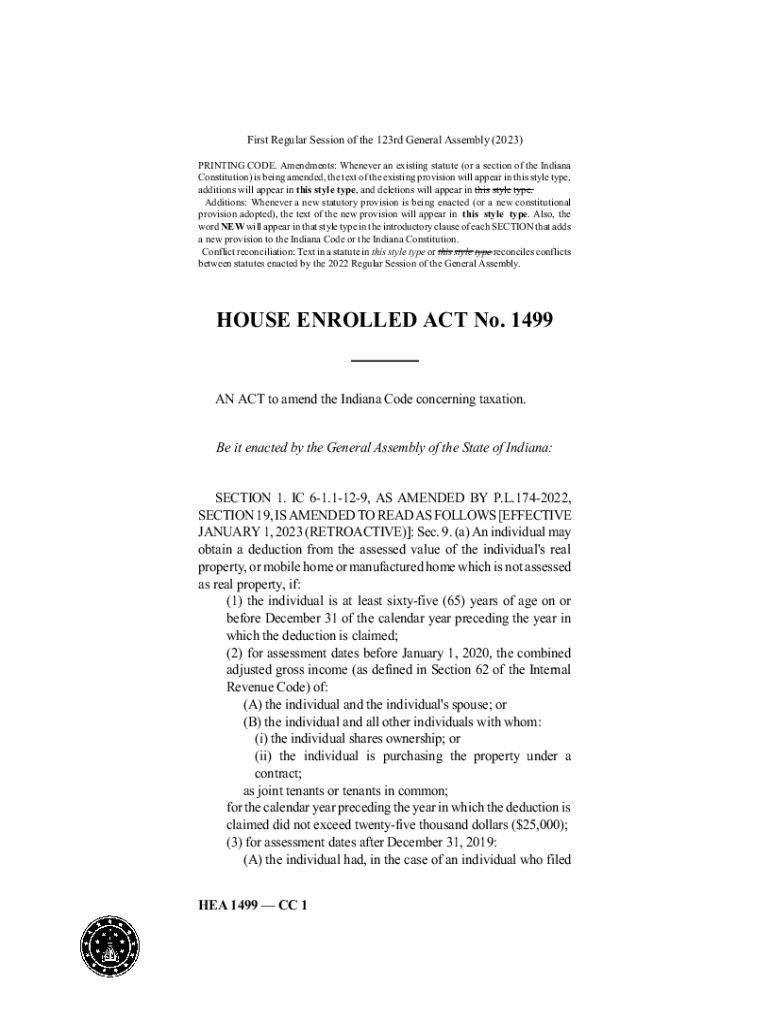

What is hea 1499?

Who is required to file hea 1499?

How to fill out hea 1499?

What is the purpose of hea 1499?

What information must be reported on hea 1499?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.