Get the free or-lb-50

Get, Create, Make and Sign or-lb-50

Editing or-lb-50 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out or-lb-50

How to fill out or-lb-50

Who needs or-lb-50?

Comprehensive Guide to the or-lb-50 Form

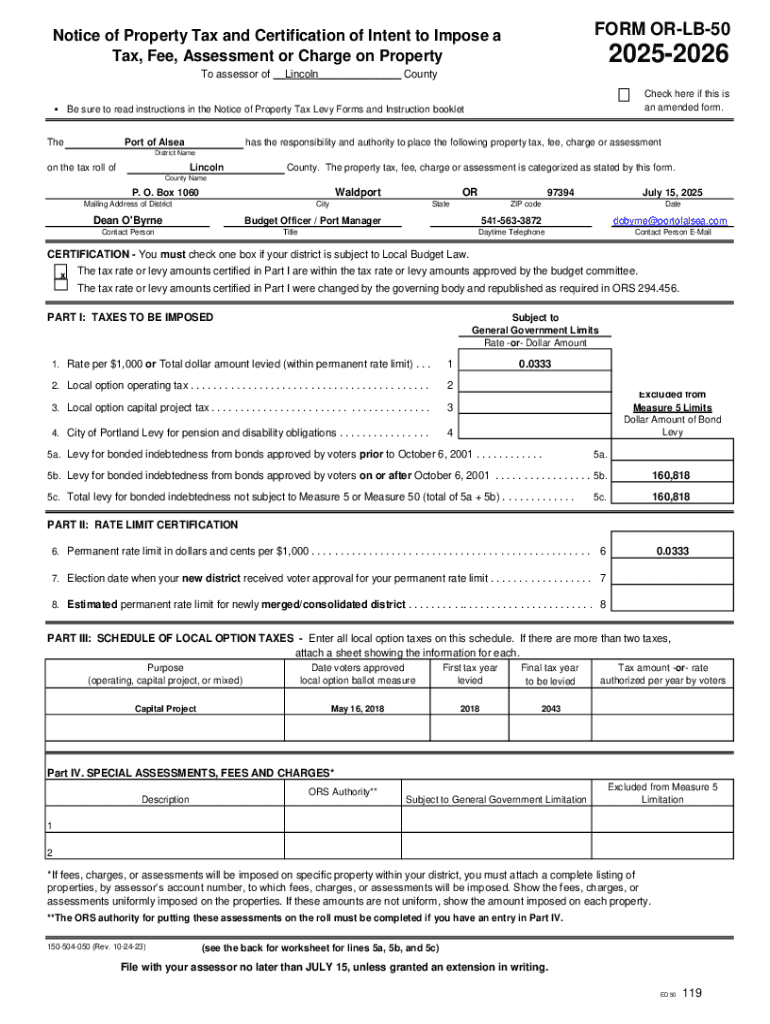

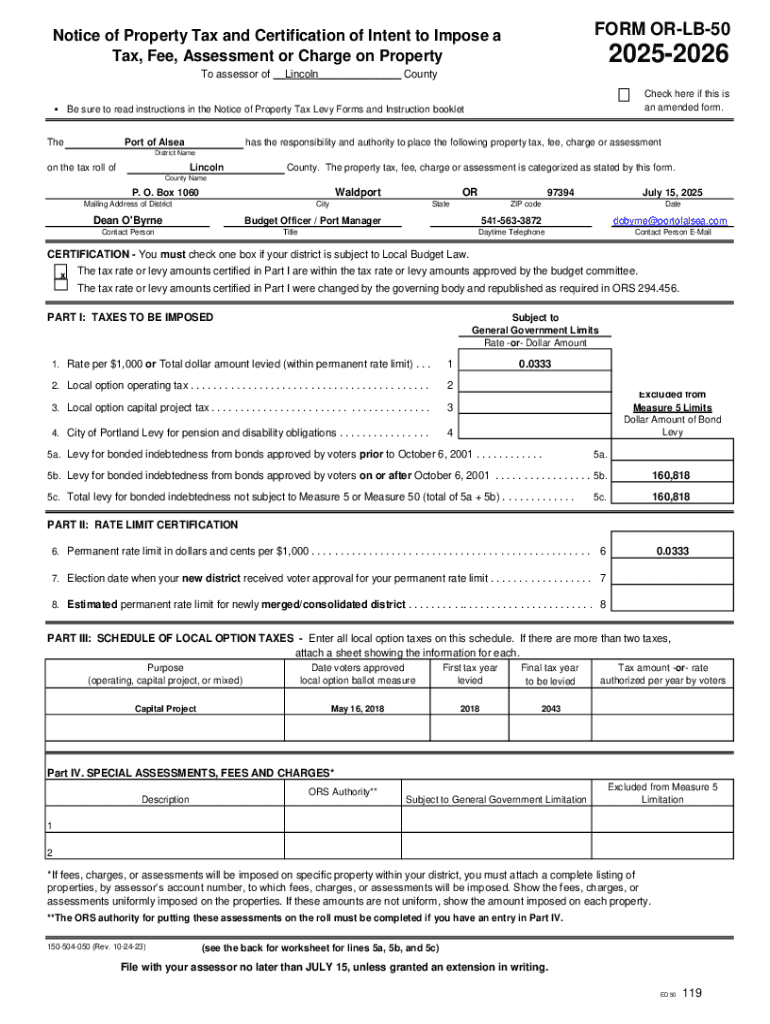

Overview of the LB-50 form

The or-lb-50 form is a crucial document in property tax management within various jurisdictions. Specifically designed to alert taxpayers about changes in property assessments, its primary purpose is to communicate important financial implications related to local government taxation. By providing detailed information, this form ensures that property owners are informed of their obligations and any adjustments affecting their taxes.

Understanding the significance of the or-lb-50 form is essential for individuals and teams involved in property management or ownership. This form plays a pivotal role in ensuring stakeholders are aware of their property assessments, which directly impact their budgeting, financial planning, and even longer-term investment strategies.

Understanding the components of the LB-50 form

The or-lb-50 form comprises several key sections that straightforwardly convey relevant information. Key identification details, including property location and owner particulars, serve to establish the form's context. Following this, financial details outline the assessed value of the property, tax calculations, and any outstanding amounts that the owner needs to address.

Moreover, certification areas require signatures and dates to validate the accuracy of the information submitted. To effectively navigate this form, it’s essential to familiarize yourself with common terms that appear, such as ‘Assessment’ — the estimated value of property for tax purposes, and ‘Tax Rate,’ which refers to the percentage of the assessed value that must be paid as tax.

Filling out the LB-50 form: step-by-step instructions

Filling out the or-lb-50 form can seem daunting, but breaking it down into manageable steps simplifies the process. Begin by gathering necessary documents, such as your property deed, previous tax statements, and related financial records. These documents provide the essential details you will need when completing the form.

Once each section is filled out, a thorough review is necessary. Check for accuracy in numbers and consult with a tax professional if you are unsure about any entries. Common errors include misreporting property details or miscalculating tax amounts, both of which can lead to complications later.

Editing and modifying your LB-50 form

Editing the or-lb-50 form is streamlined with platforms like pdfFiller. This tool offers convenient features that simplify the modification of PDF documents. You can easily upload your completed form for editing and input any changes necessary before submission.

Implementing version control is vital, especially if multiple revisions are required. Keep track to ensure that you have the most recent and relevant version at all times.

Signing and submitting the LB-50 form

Once you are satisfied with your or-lb-50 form, it’s time to sign and submit it. Electronic signing, or eSigning, is a modern option that pdfFiller supports. This capability not only accelerates the process but also provides security and verifiability, complying with legal requirements.

Be mindful of submission deadlines, as they can vary by locality and can significantly affect your property tax status. Falling behind can lead to additional fees or penalties.

Frequently asked questions (FAQs) related to form LB-50

It’s common for individuals to have questions while filling out the or-lb-50 form. One frequent inquiry pertains to the consequences of submitting an incorrectly completed form — typically, this can result in delays and potentially increased tax assessments. Fortunately, municipalities usually allow for corrections when identified promptly.

Multiple resources exist to assist users in filling out the or-lb-50 form, including local government websites, tax advisors, or platforms like pdfFiller that provide tutorials and access to necessary templates.

Related documents and templates

Alongside the or-lb-50 form, various other documents and forms can be critical for property tax management. Familiarize yourself with these forms to ensure a comprehensive understanding of your obligations and available options.

These related documents can often be accessed and downloaded via pdfFiller, streamlining the entire property tax process to ensure that you have everything you need at your fingertips.

Interactive tools and features on pdfFiller

pdfFiller recognizes the need for efficient document management, particularly concerning essential forms like the or-lb-50. Their platform offers a variety of tools to help users organize and track completed forms, making it easier to maintain records for personal or organizational purposes.

Utilizing these interactive features can significantly improve the efficiency of filling out and managing the or-lb-50 form within teams.

Enhancing your document creation experience

To further optimize your experience using pdfFiller while working with the or-lb-50 form, contemplate integrating other tools into your workflow. The platform provides the capability to connect with cloud storage services or collaborative applications, making it easier to store and share documents seamlessly.

Maximizing these advanced features not only saves time but can also enhance productivity for individuals and teams focused on managing property documentation.

Conclusion and next steps

Accurate and timely completion of the or-lb-50 form is vital to avoid complications down the road regarding property tax assessments. By leveraging the resources and tools available on pdfFiller, users can enhance their efficiency in managing necessary documentation.

Engaging with pdfFiller not only supports the successful submission of the or-lb-50 but also empowers users to streamline their entire document management process—making it a valuable resource for anyone involved in property management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit or-lb-50 from Google Drive?

How can I get or-lb-50?

How do I complete or-lb-50 on an iOS device?

What is or-lb-50?

Who is required to file or-lb-50?

How to fill out or-lb-50?

What is the purpose of or-lb-50?

What information must be reported on or-lb-50?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.