Get the free Deduction Authorization

Get, Create, Make and Sign deduction authorization

Editing deduction authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out deduction authorization

How to fill out deduction authorization

Who needs deduction authorization?

Deduction Authorization Form: How-to Guide Long-read

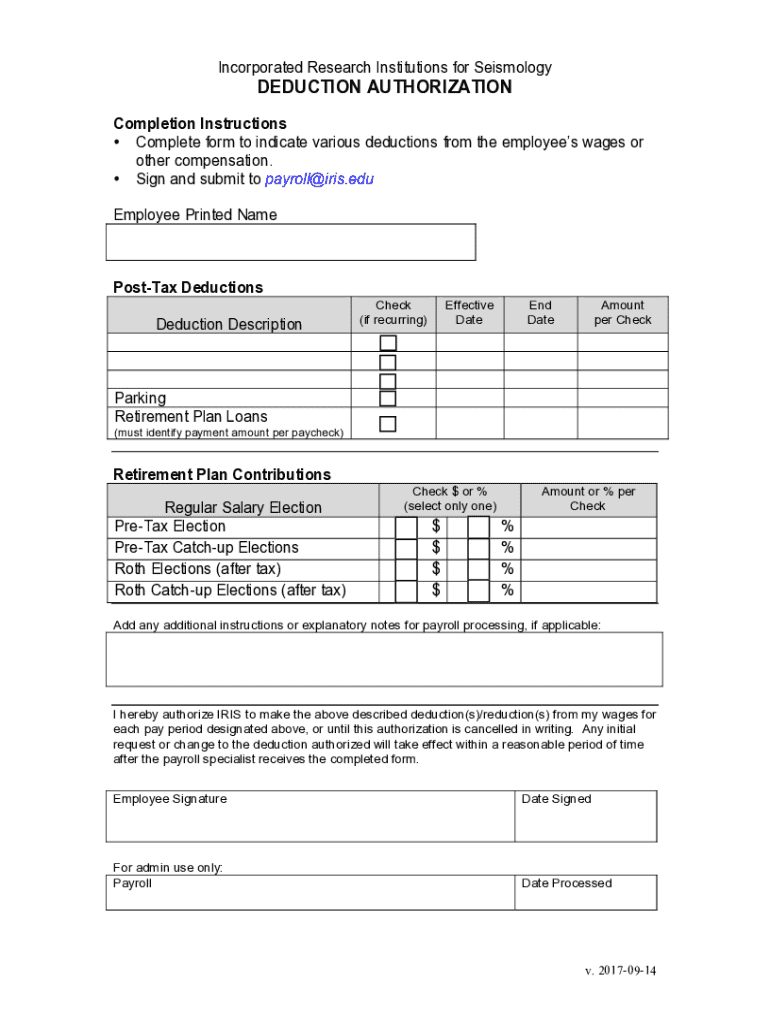

Understanding the deduction authorization form

A deduction authorization form is a critical document that enables individuals to authorize deductions from their salaries or bank accounts. This authorization can encompass a variety of uses—ranging from payroll processes to automatic bill payments. The significance of this form extends beyond mere consent; it is an essential tool pertaining to financial management that ensures funds are allocated properly and timely.

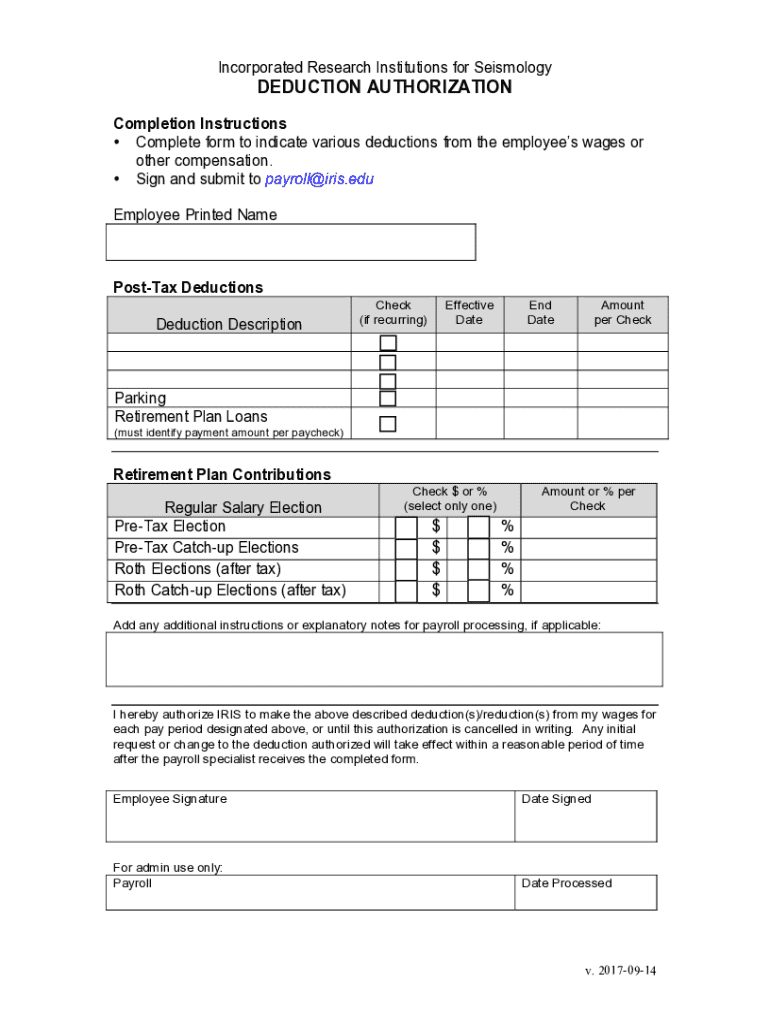

Key components of a deduction authorization form

A well-structured deduction authorization form consists of several key components that ensure clarity and legal integrity. The first section, personal information, requires the individual’s name, address, and social security number to identify the person granting the authorization accurately.

The deduction details section specifies the exact dedications, including the type (like health insurance or retirement contributions) and the amount and frequency of these deductions. Lastly, the form must be signed to indicate authorization, which not only serves as consent but also carries legal implications if contested.

Step-by-step instructions for completing the deduction authorization form

Filling out a deduction authorization form is straightforward if you follow a systematic process. Start by gathering all necessary information, such as recent pay stubs or bank statements, which will help you to accurately communicate your financial data.

Editing and customizing your deduction authorization form with pdfFiller

pdfFiller provides versatile features that empower users to create and edit their deduction authorization forms effortlessly. Its user-friendly editing tools enable individuals to personalize documents to meet their specific needs, saving time and hassle.

Managing your deduction authorization form

Once you've submitted your deduction authorization form, managing it becomes crucial for both personal and financial records. Keeping track of these documents ensures you remain organized and informed. Best practices for document management include digital storage and regular updates to reflect changes in financial circumstances.

Common mistakes to avoid when filling out a deduction authorization form

Filling out a deduction authorization form can be a straightforward task, but several common pitfalls can lead to complications. One significant mistake is providing inaccurate personal information, which can delay processing. Such errors often arise from rushing through the form or misunderstandings about the requirements.

Additional considerations when using the deduction authorization form

It is essential to understand your rights and responsibilities when filling out a deduction authorization form. Knowing the legal implications protects you from unauthorized deductions and ensures compliance with local financial regulations. Security is also paramount, particularly when sensitive personal information is transmitted.

Getting started with pdfFiller: Your one-stop solution for document management

pdfFiller stands out as a cloud-based platform designed to streamline your document management processes. Users gain access to a wealth of features tailored to enhance productivity and simplify tasks ranging from editing to collaborating on documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify deduction authorization without leaving Google Drive?

How do I complete deduction authorization online?

How do I fill out deduction authorization using my mobile device?

What is deduction authorization?

Who is required to file deduction authorization?

How to fill out deduction authorization?

What is the purpose of deduction authorization?

What information must be reported on deduction authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.