Get the free Form Adv

Get, Create, Make and Sign form adv

Editing form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

Understanding Form ADV: A Comprehensive Guide

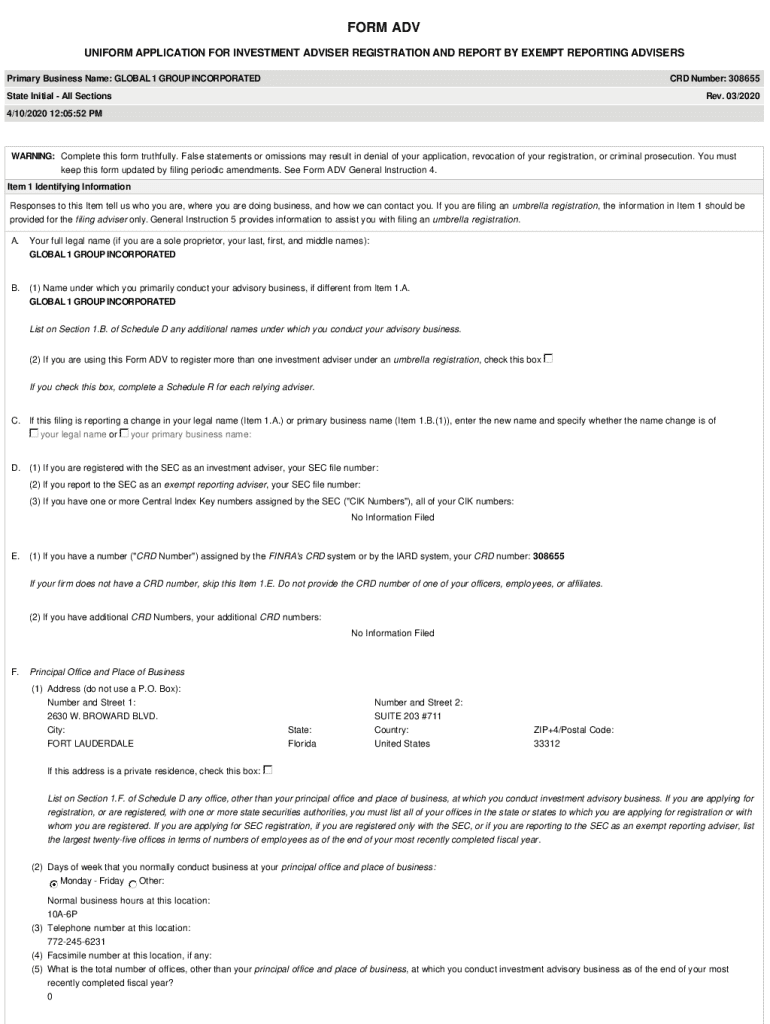

Understanding Form ADV

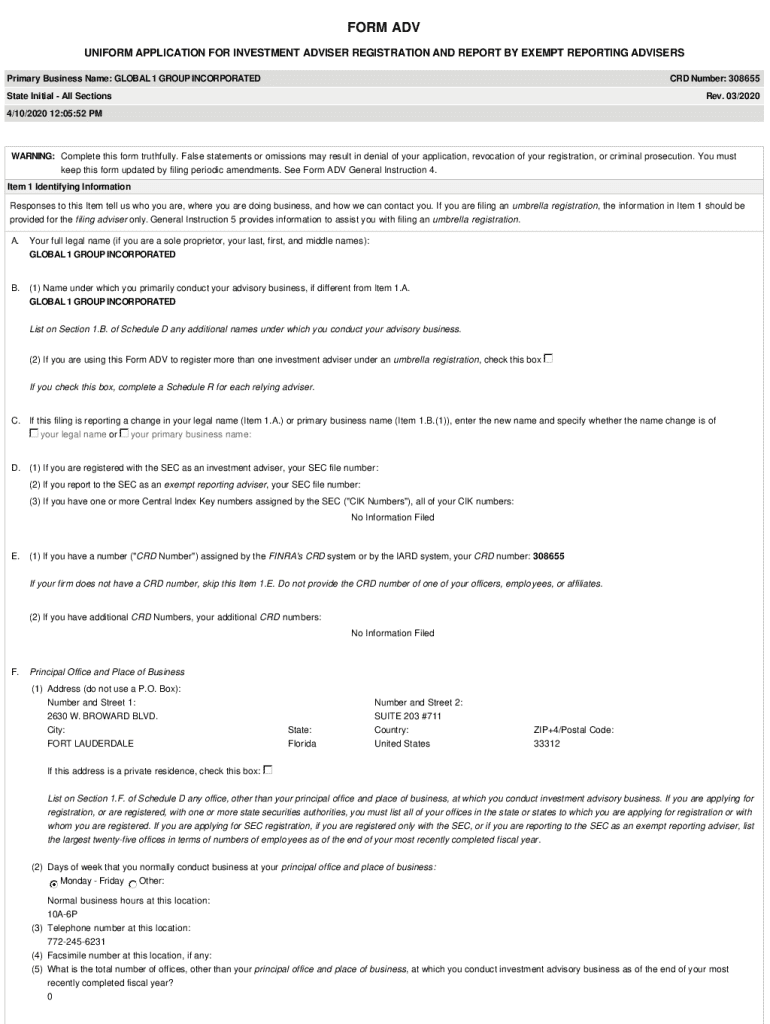

Form ADV serves as a critical document for investment advisers registered with the Securities and Exchange Commission (SEC) and state regulators. It is essentially a twin-part filing that provides essential information about the adviser, their services, fees, and potential conflicts of interest.

The importance of Form ADV cannot be overstated; it is designed to promote transparency in the financial services industry, ensuring that clients can make informed decisions when selecting a financial advisor. Individuals and institutional investors alike can access a firm’s Form ADV and assess its credentials alongside investment strategies offered.

Structure of Form ADV

Form ADV is structured into two main parts: Part I provides basic information about the advisory firm, while Part II delves deeper into the firm’s services and client disclosures. Each part serves a different purpose and contains unique information vital for clients and regulators.

Part I includes general details, such as the firm's ownership structure and disciplinary history, while Part II acts as a comprehensive brochure for clients, outlining fees, investment strategies, and potential conflicts of interest. Understanding these differences is crucial for anyone analyzing financial advisors.

Breaking down Form ADV Part

Part I of Form ADV is segmented into various sections, each revealing critical data about the advisory firm. This part addresses straightforward questions that lay the foundation for understanding a firm’s operations and standing.

For instance, Item 1 captures identifying information, such as the firm’s name, address, and contact details, while Item 2 provides insight into the business structure. Additionally, Item 3 allows potential clients to foresee the composition of offered services and associated fees, and Item 4 discloses any past disciplinary actions against the firm.

Interpreting the data in Part I is crucial because it gives potential clients a glimpse into the firm's legitimacy and operational transparency.

Breaking down Form ADV Part

Part II is where investors can find detailed information that directly affects their relationship with the adviser. Items 1 through 8 cover essential aspects like investment strategies and the overall fee structure. Whereas Items 9 through 18 focus on potential conflicts of interest and additional disclosures that could impact clients.

A thorough understanding of Items related to investment strategies and billing practices can reveal how well an adviser’s offerings align with a client’s financial goals. For example, if a firm heavily invests in a specific sector, such as technology, it could shape its risk profile.

How to access a firm’s Form ADV

Accessing a financial adviser’s Form ADV is straightforward. The SEC maintains an easy-to-navigate online platform, known as the Investment Adviser Public Disclosure (IAPD) website, where clients can search for advisory firms and their filings.

To find a specific firm's Form ADV, simply navigate to the IAPD website, input the firm’s name, city, or state, and hit search. By clicking on the firm's name, you'll access both Part I and Part II of their Form ADV, enabling you to review the full range of disclosed information.

What Form ADV doesn’t tell you

While Form ADV provides invaluable information, it does come with limitations. For instance, it may not give a complete picture of an adviser’s performance or their success with past clients. Furthermore, it lacks detailed insights into customer service quality and the firm's overall culture, which are critical in an advisor-client relationship.

Investors should recognize that supplementing their research with reviews, interviews, and third-party feedback is vital for a comprehensive understanding of a financial advisor's reliability and expertise.

Tips for reading Form ADV effectively

Reading Form ADV effectively requires knowing what indicators to look for. Potential investors should pay attention to any red flags that might indicate risk or instability. For instance, a high turnover rate of key personnel can be a warning sign. Also, carefully analyzing fees will provide insight into whether the firm’s services align with your budget.

Additionally, formulating questions based on the information gleaned from Form ADV can foster meaningful dialogue with potential advisors. Don’t hesitate to inquire about their investment philosophy or how past challenges were handled.

Comparing financial advisors using Form ADV

One of the most powerful uses of Form ADV is the ability to compare multiple financial advisors. By analyzing various Form ADVs, individuals can rank advisors based on crucial parameters, including experience, investment strategies, offered services, and fee structures.

Comparative analysis can help illuminate the differences between similar advisory firms. Look for advisors whose expertise aligns with your investment goals and check for any discrepancies in fee disclosures, which could impact future returns.

Best practices when choosing a financial advisor

Choosing the right financial advisor is a delicate process that should be approached with due diligence. Evaluating Form ADV should be an integral part of your decision-making process. Focus on aspects like the advisor's investment background, performance history, and any past disciplinary actions. These elements will guide you in identifying potential red flags.

Consistency in evaluating Form ADV across multiple advisors can help solidify your decision. If you notice certain firms have more issues than others, it may signal a pattern of risk or instability.

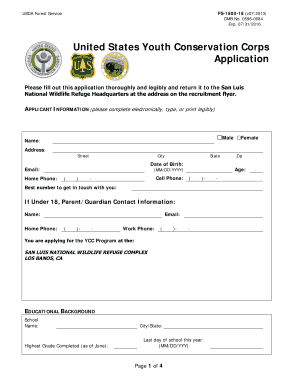

Leveraging pdfFiller for Form ADV management

Managing financial documents like Form ADV can be streamlined with tools like pdfFiller. This platform offers extensive features for editing, commenting, and securely filling out documents, saving time and improving organization.

With robust eSignature capabilities, users can promptly and securely share their completed Form ADV with stakeholders, ensuring confidentiality is maintained. pdfFiller not only simplifies these processes but enhances collaboration with cloud-based document management solutions.

Frequently asked questions about Form ADV

Several common queries arise concerning Form ADV. Prospective clients may wonder how frequently Form ADV must be updated or what to do if an adviser is unwilling to provide it. The answer is that firms must update Form ADV at least annually or whenever significant changes occur.

If an adviser is hesitant to provide their Form ADV, it may be a signal to look elsewhere. A willingness to share this document is essential for building trust in the advisory relationship.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

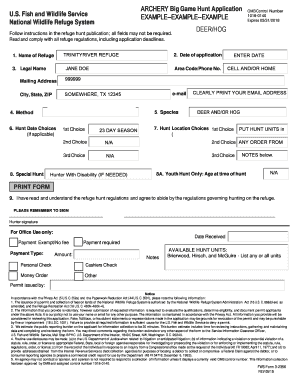

How do I complete form adv online?

How do I edit form adv online?

How can I edit form adv on a smartphone?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.