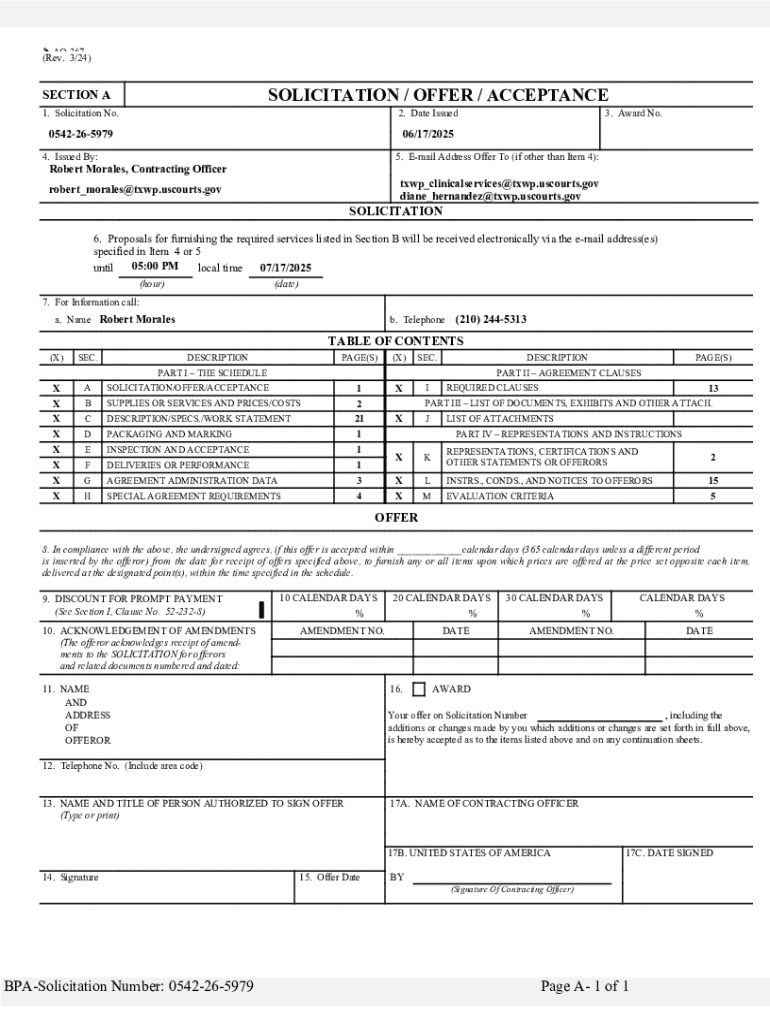

Get the free Ao 367

Get, Create, Make and Sign ao 367

Editing ao 367 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ao 367

How to fill out ao 367

Who needs ao 367?

A comprehensive guide to the AO 367 form

Understanding AO 367 form

The AO 367 form serves as a critical document within the framework of the German taxation system. It is primarily used for the declaration and transparency of financial data required by the tax authorities. This form is essential for individuals and businesses looking to comply with their legal obligations under the Abgabenordnung (AO), which outlines the rules and responsibilities related to public revenues, including taxes.

The importance of the AO 367 form cannot be overstated; correct completion is crucial not only for legal compliance but also for avoiding potential penalties and misunderstandings with tax authorities. Understanding the AO regulations ensures that users are aware of their responsibilities and the potential implications of inaccuracies.

The Abgabenordnung (AO) establishes comprehensive guidelines for various tax-related processes in Germany. It is vital to familiarize oneself with these regulations to navigate the complexities of taxation effectively.

Detailed breakdown of the AO 367 form

A thorough understanding of the structure of the AO 367 form is pivotal for successful completion. The form typically includes sections dedicated to personal identification, financial disclosures, and specific details pertinent to one's tax obligations.

Common usage scenarios for the AO 367 form include annual tax returns, adjustments following audits, or clarifications related to income discrepancies. For instance, if an individual has multiple sources of income or specific deductions, this form becomes instrumental in reporting these accurately.

Filling out the AO 367 form

Successfully completing the AO 367 form requires a systematic approach. Here’s a step-by-step guide to ensure you fill it out correctly:

For accurate completion, always cross-reference your entries with financial documents to prevent inaccuracies. Avoid common mistakes such as incorrect calculations, omissions of relevant financial details, or incorrect personal identifiers.

Editing and modifying the AO 367 form

In an ever-evolving digital landscape, editing PDF forms like the AO 367 form has never been easier. Tools like pdfFiller offer seamless solutions for making modifications without hassle. Start by uploading your AO 367 form onto the platform.

Once edits are made, saving changes and maintaining version control helps in tracking modifications. Collaborating with team members in real-time is another feature that enhances the efficiency of document management.

Signatures and eSigning the AO 367 form

Signing the AO 367 form is a critical step in ensuring its validity. Without a signature, the form may not be accepted by tax officials. In today’s digital age, eSigning provides a fast and efficient alternative.

Securing your document post-signature is essential, ensuring that it remains unaltered. Consider using pdfFiller’s security features to safeguard completed forms.

Managing the AO 367 form

Effectively managing documents like the AO 367 form requires strategic organization. Maintain a digital filing system where all versions of the form are stored in a manner that is both accessible and easily navigable.

Exporting and printing the completed form is also essential for maintaining a physical record. Ensure that all collaborative efforts on the AO 367 form are documented appropriately.

Frequently asked questions about the AO 367 form

Users often have questions leading to confusion when filling out the AO 367 form. Addressing these promptly can save time and prevent errors.

Legal insights related to AO 367 form

Understanding the legal implications surrounding the AO 367 form is vital for users. Key regulations govern how this form must be filled out and the consequences of inaccuracies.

Navigating these legal aspects ensures compliance and fosters a significant understanding of responsibilities related to the AO 367 form.

Conclusion: Mastering the AO 367 form with pdfFiller

Completing the AO 367 form effectively involves understanding its structure and implications. Employing pdfFiller’s comprehensive tools facilitates easier form handling, whether for editing, signing, or managing the document.

Utilizing pdfFiller not only streamlines the completion of the AO 367 form but also enhances collaboration and organization, ultimately leading to better management of critical documents.

In the realm of tax documentation, mastering the AO 367 form opens pathways to efficient compliance and proactive financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ao 367 online?

How do I edit ao 367 online?

How do I edit ao 367 straight from my smartphone?

What is ao 367?

Who is required to file ao 367?

How to fill out ao 367?

What is the purpose of ao 367?

What information must be reported on ao 367?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.