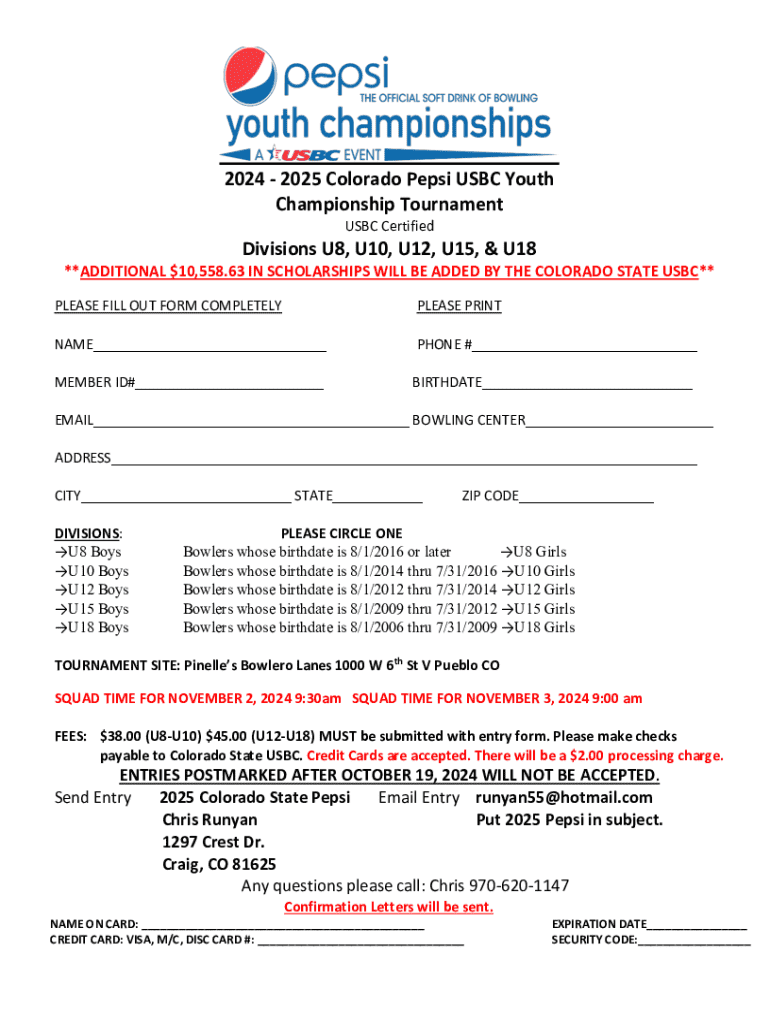

Get the free 2024 - 2025 Colorado Pepsi Usbc Youth Championship Tournament

Get, Create, Make and Sign 2024 - 2025 colorado

Editing 2024 - 2025 colorado online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 - 2025 colorado

How to fill out 2024 - 2025 colorado

Who needs 2024 - 2025 colorado?

2024 - 2025 Colorado Form: Your Comprehensive Guide

Overview of the 2024 - 2025 Colorado Form

The 2024 - 2025 Colorado Form is essential for individuals and businesses in the state to report their incomes, deductions, and credits accurately. Accurate filing is crucial to avoid penalties, ensure compliance with state laws, and maximize potential tax return benefits. Understanding who needs to file and being aware of deadlines will greatly enhance your tax preparation process.

Types of Colorado forms for 2024 - 2025

In Colorado, taxpayers will encounter various forms related to individual income taxes and business taxes. Understanding these forms ensures that you file the correct documents without confusion. The primary returns include the standard forms every taxpayer needs to submit.

Furthermore, taxpayers can access a plethora of tax resources that can simplify the filing process. Online platforms provide valuable information, including frequently asked questions and guidance on using the forms correctly. Resources secure optimal use of the forms available.

Additionally, schedules and additional forms allow taxpayers to claim extra deductions or credits. This is crucial for maximizing eligible savings.

Key changes for 2024 - 2025

Tax regulations evolve, and the 2 year brings several significant changes that could impact your filing process. New legislation may introduce new requirements or amend existing ones, requiring taxpayers to adapt promptly.

Filling out the Colorado form

Filling out the Colorado form correctly is vital for a smooth tax season. Following a structured approach can minimize errors. Start by gathering all necessary documentation, including income statements, previous tax returns, and receipts for deductible expenses.

It's also essential to familiarize yourself with common mistakes made when filling out these forms. Double-checking figures and reviewing the instructions will help reduce the likelihood of errors. Using tools that facilitate form completion can simplify the process.

Managing your Colorado form

Once you've filled out your Colorado form, managing it effectively is the next step. Options for editing and updating your forms can streamline the process, especially if you notice errors or need to add information later.

Frequently asked questions

Navigating the complexities of tax filing often raises questions. Understanding common inquiries can alleviate some stresses associated with the filing process.

Special considerations

Certain situations require special forms or considerations when filing taxes. If you qualify for specific credits or encounter unique tax circumstances, be aware of the relevant forms to ensure compliance and maximize potential returns.

Tools and resources for effective form management

Utilizing efficient tools and resources can greatly improve the tax filing experience. pdfFiller offers a range of features tailored for users, ensuring seamless editing, signing, and management of forms from any device.

Navigating Colorado form-related websites

Navigational skills are vital when it comes to leveraging online tax resources effectively. The Colorado Department of Revenue website is the primary hub for accessing relevant tax forms and information. Familiarizing yourself with its layout will save you time and frustration.

Final tips for successful tax filing

Preparation isn't exclusive to the tax season. Maintaining organized records throughout the year can ease the filing process significantly. Additionally, being proactive about changes in tax forms and regulations can be invaluable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2024 - 2025 colorado in Gmail?

How do I fill out the 2024 - 2025 colorado form on my smartphone?

How do I edit 2024 - 2025 colorado on an iOS device?

What is 2024 - 2025 colorado?

Who is required to file 2024 - 2025 colorado?

How to fill out 2024 - 2025 colorado?

What is the purpose of 2024 - 2025 colorado?

What information must be reported on 2024 - 2025 colorado?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.