Get the free Bt Investor Choice Funds Additional and Regular Investments Request

Get, Create, Make and Sign bt investor choice funds

Editing bt investor choice funds online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bt investor choice funds

How to fill out bt investor choice funds

Who needs bt investor choice funds?

BT Investor Choice Funds Form: A Complete Guide to Your Investment Strategy

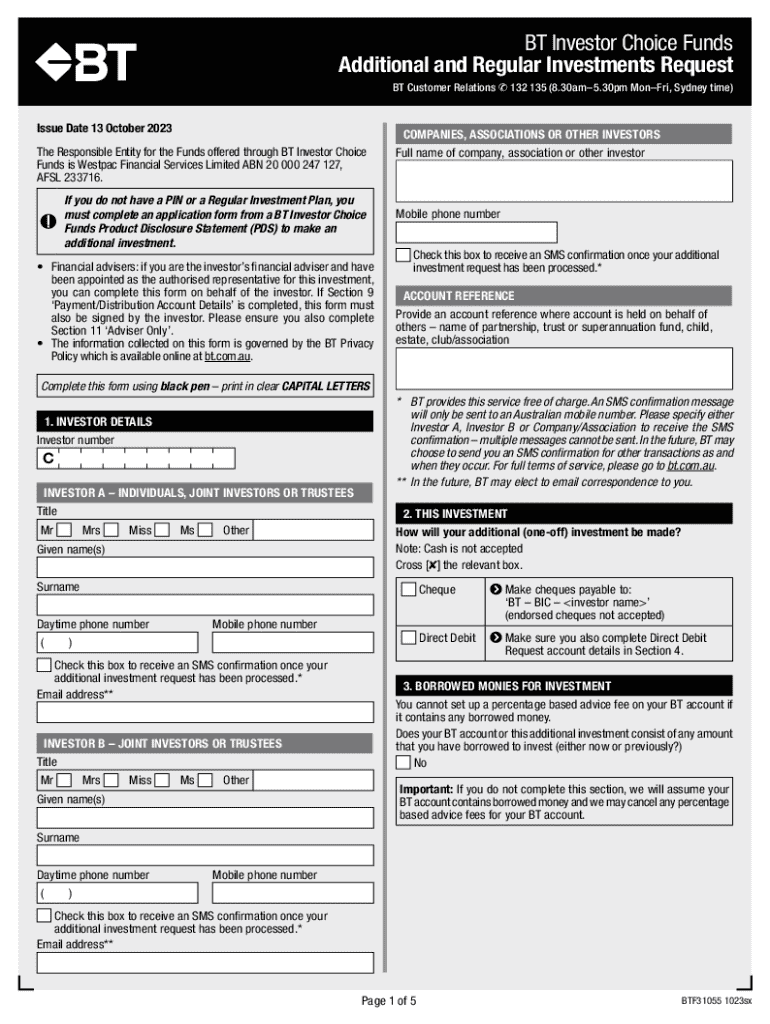

Understanding the BT Investor Choice Funds Form

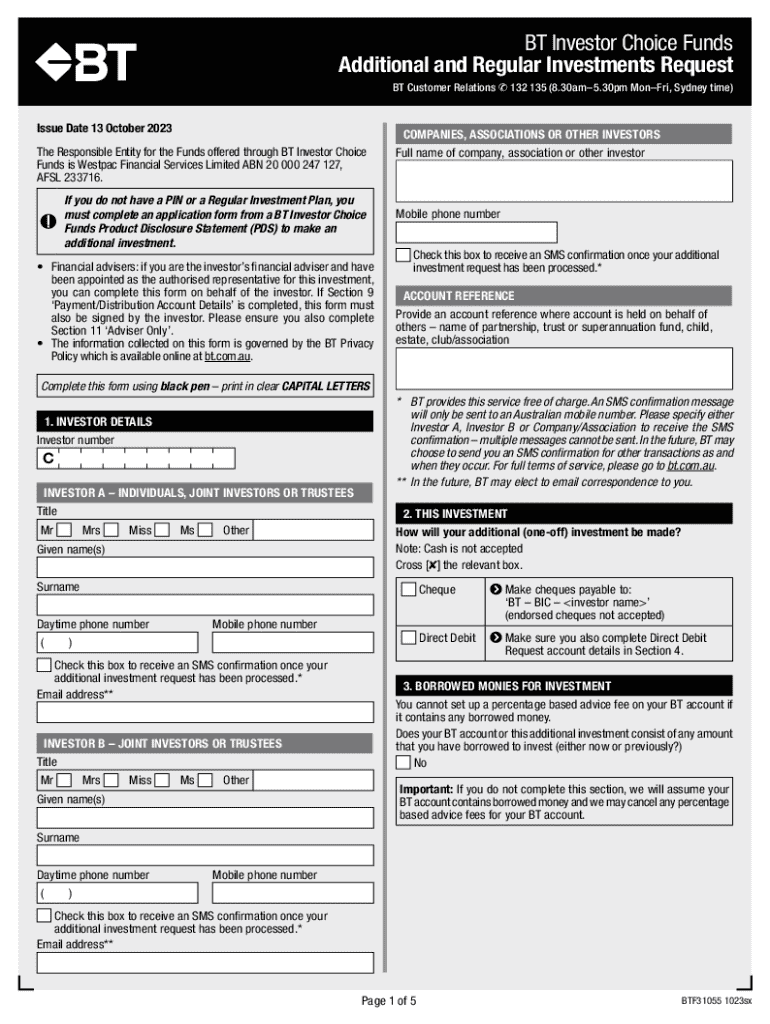

The BT Investor Choice Funds Form is designed to facilitate your investment choices within the BT Investor Choice platform. This form serves as a crucial document that enables investors to express their preferences on various investment options available under this scheme. Accurately completing this form is essential as it directly influences how your funds will be allocated across various asset classes.

Completing the form accurately not only ensures your intentions are well-represented but also helps in creating a tailored investment strategy that aligns with your financial goals and risk tolerance. The primary benefits include the flexibility to choose different types of investments and the opportunity to adjust your asset allocation as your financial situation or market conditions change.

Overview of the BT Investor Choice Funds

The BT Investor Choice Funds provide a versatile platform for investors, allowing them to diversify their portfolios. This suite of investment options encompasses a range of asset classes, enabling investors to customize their investments according to their individual risk appetites and financial goals.

The key investment categories available include:

In terms of performance, BT Investor Choice Funds have shown resilience and adaptability in various market conditions, making it a compelling option for both conservative and aggressive investors. Regular performance reviews and market analyses are recommended to ensure your investments remain strategically positioned.

Step-by-step guide to filling out the BT Investor Choice Funds Form

Before completing the BT Investor Choice Funds Form, it’s essential to gather relevant information that will aid in accurately filling out your preferences. This includes personal identification details, financial status, investment objectives, and previous investment experiences.

The form is generally divided into sections, each addressing a specific area. Here is a detailed breakdown:

Be mindful of common mistakes that can lead to inaccuracies, such as omitting vital information or misunderstanding the allocation percentages. Thoroughly reviewing your form before submitting can mitigate these errors.

Editing and managing your BT Investor Choice Funds Form

Once the BT Investor Choice Funds Form is completed, you may want to make edits or revisit the information you've provided. Using pdfFiller’s tools greatly simplifies this process.

With pdfFiller, you can easily edit your form by adding or removing text, adjusting formatting, and ensuring the document meets submission standards. The platform also allows you to track revisions, making it easy to see what changes have been made, ensuring accuracy before final submission. Additionally, collaborating with team members is straightforward, allowing multiple stakeholders to review and approve the form.

Signing the BT Investor Choice Funds Form

The signing process is a crucial step in finalizing your BT Investor Choice Funds Form. pdfFiller offers comprehensive eSigning features that ensure a smooth and efficient signing experience.

Electronic signatures are legally valid and recognized under various jurisdictions, providing a secure and convenient alternative to traditional signing methods. To complete the eSigning process, simply follow these steps:

Submitting the form: best practices

After completing and signing your BT Investor Choice Funds Form, the next step involves submission. You can choose between online or offline submission methods. Online submissions are typically faster and more efficient, while offline options may require mail or physical delivery.

After submitting, it’s important to have a follow-up plan in place. Keeping a copy of your submission and any confirmation documents ensures you have a record of your application. This can be crucial for referencing in future communications or adjustments to your investment choices.

Monitoring your investment journey

Your investment journey doesn’t conclude with the submission of the BT Investor Choice Funds Form. It is vital to regularly monitor your investments and track their performance to ensure they align with your financial goals.

Utilize various tools available through the BT platform for tracking fund performance, such as online dashboards, investment statements, and market news updates. Understanding your investment statements is critical, as they provide insights into how your funds are performing against market benchmarks. It's equally important to stay informed about market changes, allowing you to respond swiftly, whether that means rebalancing your portfolio or adjusting your risk exposure.

FAQs related to the BT Investor Choice Funds Form

As with any investment-related process, numerous questions may arise when filling out the BT Investor Choice Funds Form. Here are some of the most frequently asked questions:

Clarifications on policies and procedures related to your investments can often be found in the FAQs section of the platform or by directly consulting with a customer representative.

Seeking professional advice

While the BT Investor Choice Funds Form is designed for self-service completion, some investors may benefit from expert guidance. Engaging with a financial advisor is advisable, especially if you're uncertain about asset classes or your risk tolerance.

pdfFiller facilitates seamless connection with financial advisors, allowing you to discuss your investment strategy and ensure your investment choices align with your long-term goals. Having an expert review your BT Investor Choice Funds Form can lead to more informed decisions.

More information and support

pdfFiller provides a wealth of resources to support investors completing the BT Investor Choice Funds Form. From interactive tools to detailed guides, you can access materials specifically tailored to help individuals and teams effectively manage their documentation needs.

Customer support is readily available for any inquiries, featuring a robust FAQs section and live chat options to offer immediate assistance.

Understanding investment risks and responsibilities

As an investor, it’s imperative to understand the risks associated with the BT Investor Choice Funds. Familiarizing yourself with synthetic risk indicators and the inherent volatility involved with different asset classes is crucial.

Legal obligations as an investor are also significant. Make sure you comprehend your responsibilities, including disclosure of information and maintaining compliance with investment regulations. Furthermore, be aware of how time horizons and risk tolerance can influence successful investment outcomes.

Customizing your investment strategy

Personalizing your investment strategy is vital for executing a successful financial plan. By using the BT Investor Choice Funds Form, you can define your unique investment portfolio, reflecting your financial goals and desired risk levels.

Consider analyzing the historical performance of available funds to make informed decisions based on past results. Balancing risk versus return is a central theme; targeting investments that align with your financial aims requires continuous evaluation and adjustment.

Managing and renewing your investment commitments

Investment commitments require diligent management over time. Understanding how to navigate updates and transfers of investments through the BT platform is key to maintaining a healthy portfolio.

Conduct regular reviews of your investment choices, ensuring they remain aligned with your evolving financial circumstances. Being proactive about understanding the implications of any changes, whether due to market conditions or personal financial shifts, will help you stay on the path toward achieving your financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get bt investor choice funds?

How do I edit bt investor choice funds online?

How do I fill out bt investor choice funds using my mobile device?

What is bt investor choice funds?

Who is required to file bt investor choice funds?

How to fill out bt investor choice funds?

What is the purpose of bt investor choice funds?

What information must be reported on bt investor choice funds?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.