Get the free P60 End of Year Certificate

Get, Create, Make and Sign p60 end of year

Editing p60 end of year online

Uncompromising security for your PDF editing and eSignature needs

How to fill out p60 end of year

How to fill out p60 end of year

Who needs p60 end of year?

Understanding the P60 End of Year Form: A Comprehensive Guide

Understanding the P60 end of year form

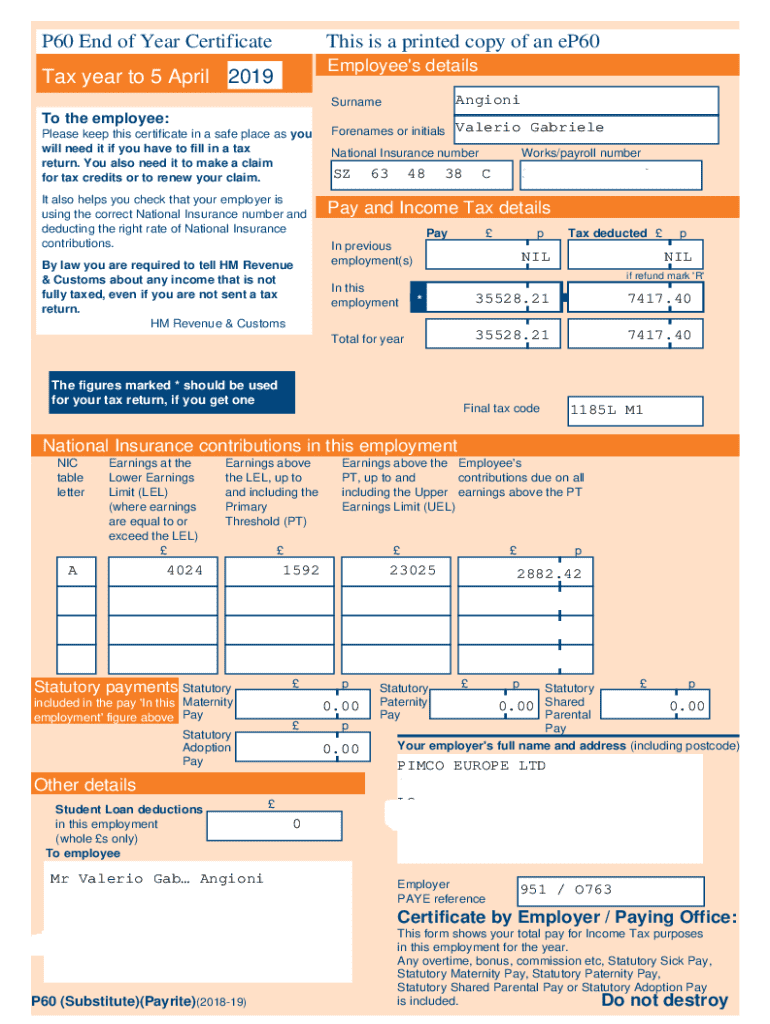

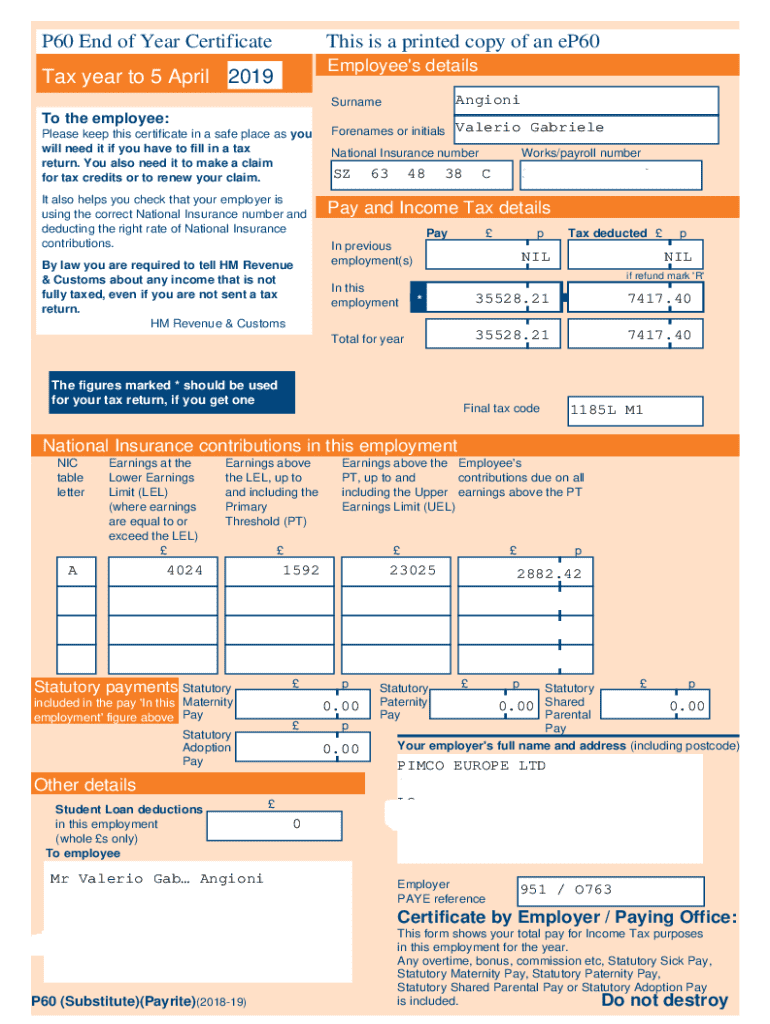

The P60 end of year form is a crucial document for employees in the UK, provided by employers at the end of every tax year. This form summarizes your total pay and deductions made for the year, including income tax and National Insurance contributions. As an official record, the P60 not only serves as proof of your earnings but also acts as a key resource for personal financial planning and tax reporting.

Issued to employees by their employers, the form compiles essential information from your payslips throughout the year, transforming complex earnings data into a digestible summary. Its significance lies in its accuracy and informative capacity concerning your overall tax contributions, making it an indispensable tool during the tax season.

Why you need your P60 form

The P60 form holds significant importance for several reasons, primarily serving as a foundation for accurate tax reporting. When it comes to submitting your self-assessment tax return, whether online or via traditional methods, having your P60 on hand ensures that you report your earnings accurately, minimizing the likelihood of tax-related penalties.

Additionally, if you believe you have overpaid on your taxes during the year, the P60 will be instrumental in claiming a refund. It provides respective figures needed to calculate the exact amount that may be refunded. Furthermore, for personal financial records, retaining the P60 can also aid in compiling your yearly income for loan or mortgage applications, making it a critical document for many roles beyond tax purposes.

How to obtain your P60 form

Your P60 form is typically issued annually by your employer at the end of the tax year, which runs from April 6 to April 5. Most employers are obliged to provide this document by May 31 following the end of the tax year. It's essential to ensure you receive it on time, as it’s a key component of your yearly financial records.

If you haven't received your P60, you should take the following steps to request it from your employer: First, contact your human resources or payroll department, either in person or via email, and inquire about your P60. If you prefer digital options, many companies now offer their employees access to online portals where pay documentation, including P60s, can be viewed and downloaded directly in PDF formats. This not only saves time but also provides easy access to important documents.

Key information included in your P60 form

The P60 form includes essential information summarizing your earnings and deductions over the tax year. It provides a clear breakdown of your total pay, including regular wages, bonuses, and any applicable benefits or allowances. Additionally, the document details total tax deducted and any National Insurance contributions made, giving you a complete picture of your financial contributions throughout the year.

This vital information enables you to verify your earnings and deductions for accuracy when filing your taxes. When reviewing your P60, ensure that the figures are consistent with your payslips. Cross-referencing your P60's totals with your individual payslips is a vital step toward confirming its validity.

Verifying your P60: What to double-check

Once you receive your P60, verifying its accuracy is crucial. Common errors can include salary discrepancies that may arise from manual processing errors or incorrect tax codes that may affect how much tax has been deducted from your earnings. An incorrect tax code could lead to underpayment or overpayment of taxes, which can create complications in filing your tax return.

If any discrepancies arise, you should contact your HR department as soon as possible to rectify the errors. Timely communication can help ensure that your tax return reflects accurate figures, preventing any potential tax issues.

Correcting your P60 form

If you discover that your P60 contains incorrect information, it’s essential to act quickly. The first step is to discuss the inaccuracies with your employer’s HR or payroll department. Provide them with the necessary documents, such as payslips, to support your claim of an error on your P60.

In some cases, if the employer fails to correct the issue, you may need to contact Her Majesty's Revenue and Customs (HMRC) directly. They can guide you on how to rectify the error and provide information on any steps required to ensure your tax records are kept intact.

P60 vs. P45: Understanding the difference

The P60 and P45 forms serve different purposes, and understanding these distinctions is crucial for tax-related clarity. While the P60 is issued at the end of the tax year summarizing your total income and taxes for that year, the P45 is provided by your employer when you leave a job. The P45 outlines your earnings and deductions up to your leaving date.

Understanding when to utilize each form is essential for accurate tax filing and compliance. For instance, you will need your P60 when submitting your annual tax return, while your P45 will assist new employers in determining your tax code.

Using your P60 form for tax rebates

One of the most beneficial uses of the P60 end of year form is its integral role in claiming tax rebates. If you've overpaid tax during the year – a common occurrence for many due to changing jobs or fluctuating income – your P60 provides the documentation needed to submit a claim.

The process of claiming a tax rebate is relatively straightforward and involves the following steps: First, ensure you have your P60 ready, as it contains the figures needed for the claim. Second, you can use HMRC's online services or call them directly to submit your claim. It's particularly essential to keep an accurate record of your employment history and a note of any changes in your income to substantiate your claim.

What to do if you lose your P60 form

Misplacing your P60 can be concerning, but replacement is possible. The first step is to contact your employer’s HR or payroll department and request a duplicate. Most employers retain records of P60s and should be able to issue a replacement swiftly.

If your employer is unable to provide a duplicate for any reason, you can contact HMRC for assistance. They can guide you on how to proceed and might provide information related to your tax contributions using your National Insurance number. Keeping a copy of your P60 in a readily accessible digital format, such as on pdfFiller, can help in preventing future loss.

P60 considerations for individuals with multiple jobs

For individuals juggling multiple jobs, each employer should provide a separate P60 for the total earnings made while working under them. Handling multiple P60 forms requires careful organization, as having several sources of income can complicate tax assessments and rebates.

When filing your tax return, sum up all earnings shown on your P60 forms, and account for any tax deductions made. It is essential that you accurately report your income to prevent tax issues later on.

Self-employed individuals: do you get a P60?

Self-employed individuals do not receive a P60, as this form is exclusively for employees. Instead, self-employed individuals are responsible for keeping track of their income and expenses, and they must submit a self-assessment tax return to report their earnings directly to HMRC.

For those in self-employment, maintaining accurate records for each financial year is critical. Instead of a P60, you might rely on invoices, bank statements, and receipts as supporting documentation when filing your returns. It is advisable to utilize cloud-based platforms like pdfFiller for organizing these documents, enabling seamless tracking of your financial activity.

P60 forms and umbrella companies

Workers engaged through umbrella companies, often utilized in temporary or contractual roles, receive a P60 at the end of the tax year as well. The umbrella company acts as an employer, managing tax deductions and National Insurance contributions on your behalf.

Understanding that umbrella companies handle payroll differently is crucial. When filing your tax return, treat your P60 from the umbrella company similarly to a traditional P60, ensuring you report the earnings and tax deducted accurately. Be proactive in reviewing the figures to ensure they align with your work history and expected deductions.

Important FAQs regarding your P60 form

Here are some frequently asked questions that often arise concerning the P60 form. First, many question whether they need their P60 to start a tax refund process. The answer is yes; the P60 contains critical data needed to initiate the process effectively. Another common misunderstanding is about the timings for requesting a duplicate P60 – it’s possible to request this form at any time if it’s lost, though it's advisable to do so promptly after confirming it's missing.

Navigating tax codes with your P60 information

Understanding the tax code included on your P60 is essential for ensuring you are being taxed correctly. Your tax code determines how much tax is deducted from your pay; thus, any discrepancies could result in paying either too much or too little tax. If you find your tax code overly complicated or suspect errors, you have the right to challenge your tax code with HMRC.

Taking proactive steps to verify your tax code can also empower you during your tax filings. If you suspect you're on the wrong tax code, gather all relevant documents, including your P60, and approach HMRC to establish what your actual code should be. Accurate tax code handling is particularly critical for avoiding unexpected tax bills.

Impact of national insurance changes on your P60

Changes to National Insurance contributions can significantly affect your P60 form. Any adjustments to rates or thresholds impact the amount deducted from your earnings, necessitating close attention during the tax year. When reading your P60, it’s vital to understand how these changes translate into your deductions.

It's advisable to keep informed about any adjustments in National Insurance rates, as these can affect your overall financial planning. Regularly consult official HMRC resources or financial news outlets to stay on top of any impending changes that may influence your contributions and ensure you’re prepared for how they will affect your P60 at the end of the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my p60 end of year in Gmail?

How can I edit p60 end of year from Google Drive?

How can I send p60 end of year for eSignature?

What is p60 end of year?

Who is required to file p60 end of year?

How to fill out p60 end of year?

What is the purpose of p60 end of year?

What information must be reported on p60 end of year?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.