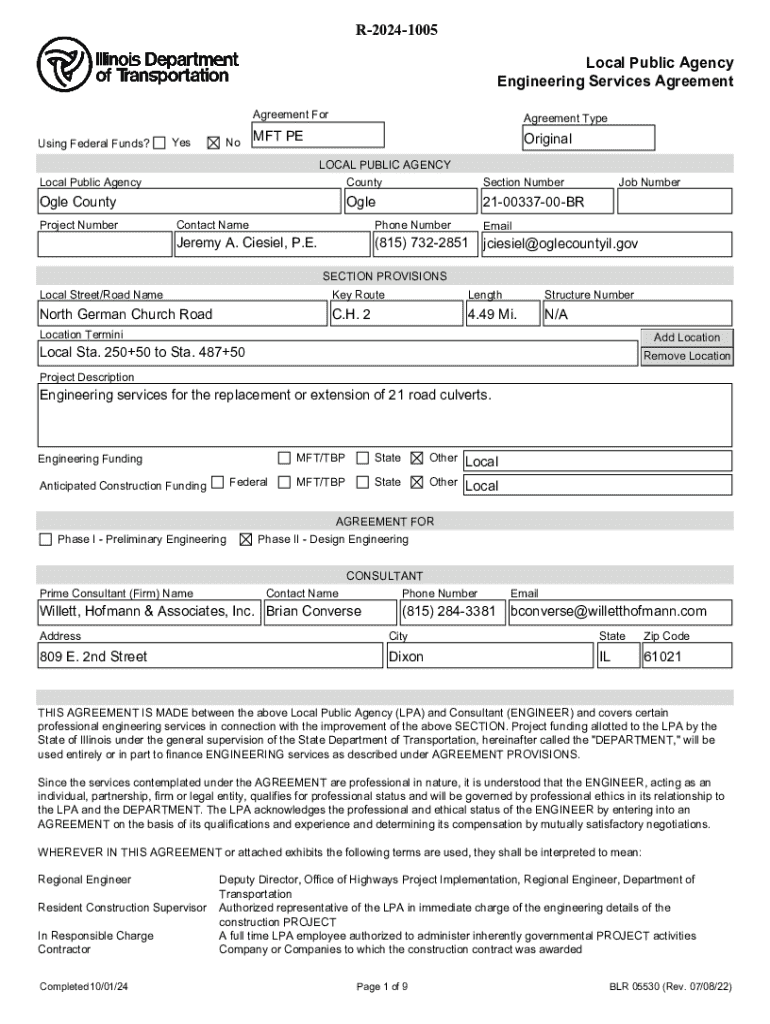

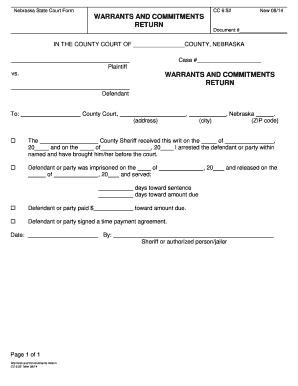

Get the free R-2024-1005

Get, Create, Make and Sign r-2024-1005

How to edit r-2024-1005 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out r-2024-1005

How to fill out r-2024-1005

Who needs r-2024-1005?

Comprehensive Guide to the r-2 Form

Overview of the r-2 form

The r-2 form is an essential document used primarily for specific compliance and reporting purposes. This form holds significant weight in handling various bureaucratic processes effectively and efficiently. Understanding its purpose is crucial for individuals and organizations alike as it ensures adherence to regulatory standards.

The r-2 form aids in documenting and consolidating necessary information required by fiscal authorities. Its significance is rooted in its role as a standard form that facilitates clear communication, transparency, and the proper handling of compliance-related activities.

Who needs to use the r-2 form

The r-2 form primarily targets businesses, fiscal agents, and organizations that need to report specific data to regulatory bodies. Its use is crucial for finance teams, compliance officers, and even individual taxpayers in relevant scenarios, underlining its importance across various sectors.

Typical use cases for this form include situations like tax submissions for business earnings, declarations related to compliance with local regulations, or reporting financial activities that fall under scrutiny from government agencies. Understanding when to utilize the r-2 form can significantly enhance an organization’s compliance strategy.

Accessing the r-2 form

To access the r-2 form, users can navigate directly to pdfFiller, where the form is readily available. By utilizing the platform's search functionality, one can quickly locate the specific form needed without hassle. pdfFiller's intuitive interface simplifies the process, allowing you to access the form from anywhere at any time.

In addition to pdfFiller, alternative sources include government websites or specific regulatory bodies' portals that might provide the form. However, for ease of use and additional resources, pdfFiller remains a highly recommended option.

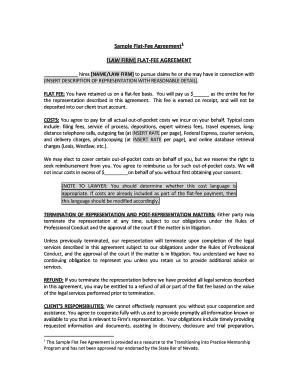

Filling out the r-2 form

Filling out the r-2 form requires careful consideration and organization of the needed information. Here’s a step-by-step guide to navigate the process effectively.

Common pitfalls often involve incomplete sections or mismatched information. Avoiding these mistakes will save valuable time and prevent submission delays.

Editing the r-2 form

Editing the r-2 form can be done effortlessly using pdfFiller’s robust editing tools. Users can easily rectify mistakes, update information, or make necessary changes to the form’s content which reinforces document accuracy.

Best practices for effective revisions include:

Signing the r-2 form

Electronic signature options with pdfFiller make signing the r-2 form straightforward and secured. Users can choose from various eSigning methods, making the signing process seamless and compliant with legal standards.

Verification of signatures holds immense importance, as it ensures the legality and authenticity of the form during submission. Adhering to verification protocols will mitigate any issues down the line.

Managing your r-2 form

Keeping track of your submissions is crucial for maintaining order and compliance. pdfFiller offers efficient tracking tools that permit users to monitor the status of their form submissions actively.

Additionally, adhering to storage and archiving recommendations preserves the integrity and availability of the form. Utilizing pdfFiller’s cloud storage ensures safe access and easy retrieval of documents whenever needed.

Troubleshooting common issues

Encountering submission errors is a common occurrence when working with forms. Knowing how to navigate these issues can save time and stress. One of the most frequent errors is submitting incomplete forms, which can result in rejections or requests for additional information.

If you face issues, consult the FAQs related to the r-2 form. These can provide solutions to common queries and concerns, making the process smoother.

Updates and revisions for the r-2 form in 2024

The r-2 form may undergo revisions and updates to comply with the latest legal or procedural changes. For 2024, users should be aware of new requirements or modifications that could affect their submissions.

Staying informed about such changes is vital. Regularly checking pdfFiller for updates and utilizing their alerts will help ensure you’re always on top of the latest modifications related to the r-2 form.

Additional tools and resources in pdfFiller related to the r-2 form

pdfFiller provides numerous additional tools that complement the r-2 form. These include templates for similar forms, interactive learning materials, and resources to better manage your documents.

Accessing complementary templates tailored to your needs can streamline the documentation process, while interactive guides such as webinars can enhance your understanding of effective document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute r-2024-1005 online?

Can I edit r-2024-1005 on an iOS device?

How do I fill out r-2024-1005 on an Android device?

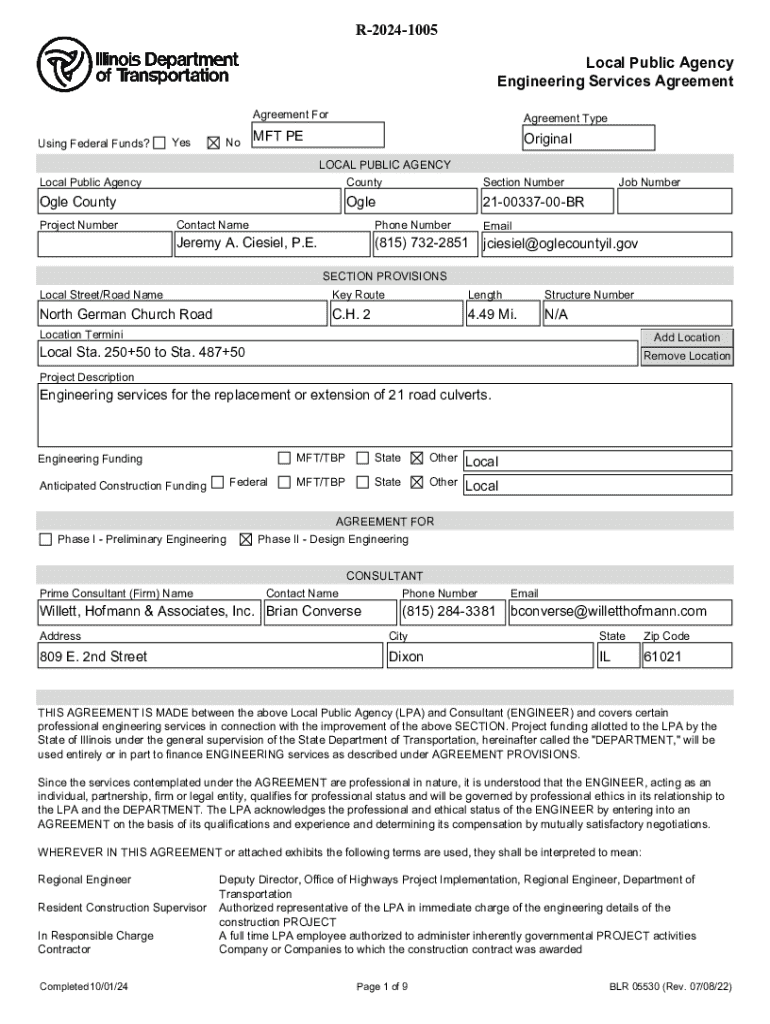

What is r-2024-1005?

Who is required to file r-2024-1005?

How to fill out r-2024-1005?

What is the purpose of r-2024-1005?

What information must be reported on r-2024-1005?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.