Get the free Form 990-ez

Get, Create, Make and Sign form 990-ez

Editing form 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez

How to fill out form 990-ez

Who needs form 990-ez?

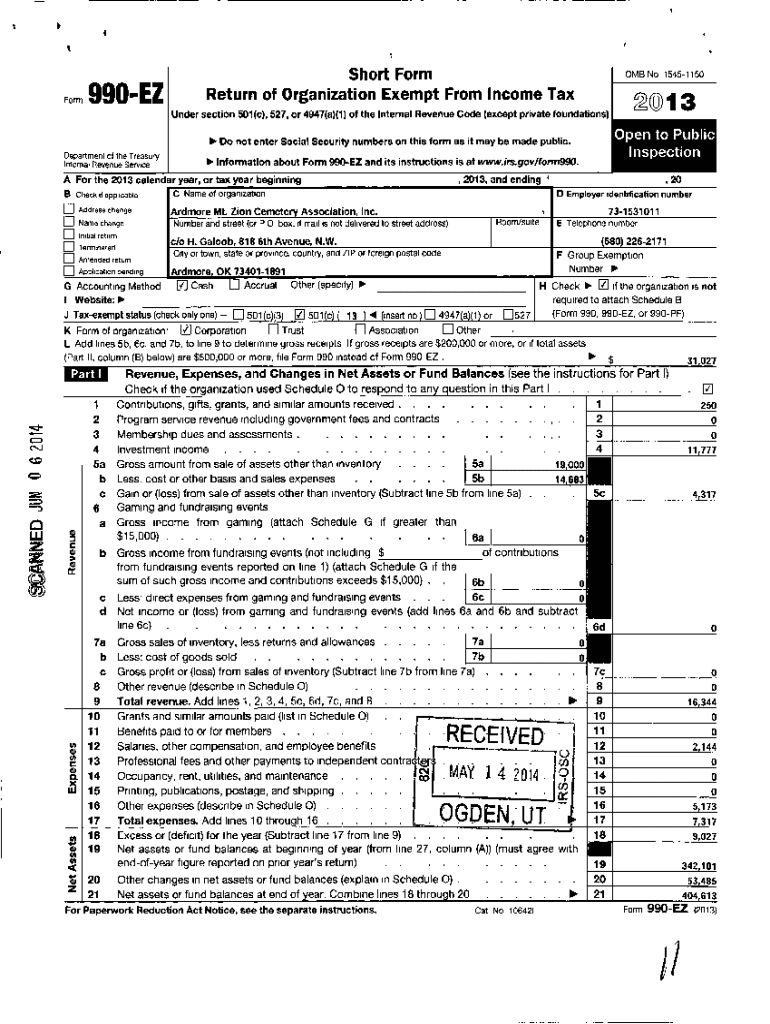

Understanding Form 990-EZ: A Comprehensive Guide for Nonprofits

Understanding Form 990-EZ: Your Essential Overview

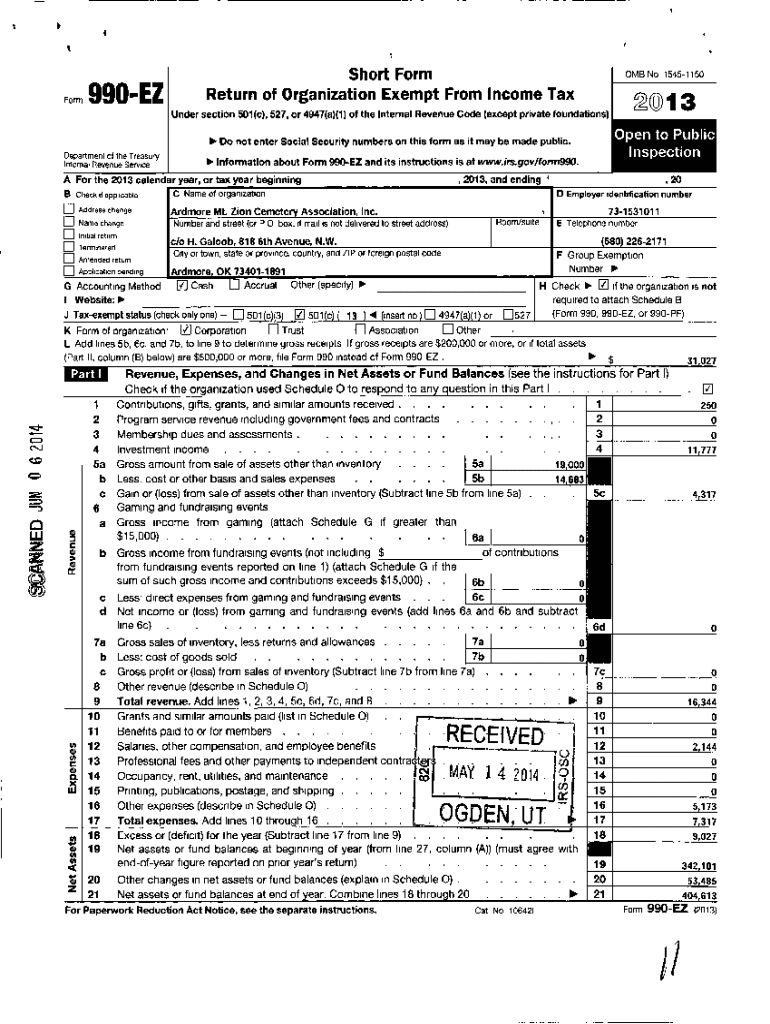

Form 990-EZ is a streamlined version of the traditional Form 990, specifically designed for smaller tax-exempt organizations. It serves as an annual tax return aimed at providing essential information about the financial performance, governance, and activities of nonprofits. The primary purpose of this form is to enhance transparency and accountability among organizations benefiting from tax-exempt status. Nonprofits must file Form 990-EZ to keep the IRS informed about their financial situation and ensure adherence to federal regulations.

Form 990-EZ is particularly important as it allows nonprofits to establish credibility with donors, stakeholders, and the public. By disclosing financial activities in a standardized manner, organizations can foster trust and attract potential funding. Comparing Form 990-EZ to its more comprehensive counterpart, Form 990, the former is simplified, making it easier for smaller organizations to report key financial data without overwhelming paperwork.

Who needs to file Form 990-EZ?

Not all nonprofits are required to file Form 990-EZ; specific criteria determine eligibility. Generally, organizations with gross receipts between $200,000 and $500,000 or total assets under $2.5 million must file this form. Some nonprofit categories, such as churches and certain government entities, are exempt from this requirement. Understanding who qualifies for filing helps organizations remain compliant with IRS regulations while managing their tax obligations effectively.

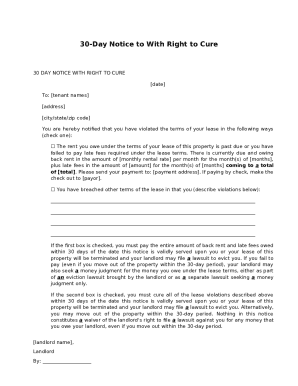

Failing to file Form 990-EZ can lead to severe consequences, including the potential loss of tax-exempt status. Nonprofits may face penalties, as the IRS often imposes fines for those that do not submit returns on time. It is crucial for organizations to closely monitor their filing obligations and meet all guidelines to avoid these compliance issues.

When to file Form 990-EZ: Key deadlines

Form 990-EZ must be filed annually, typically on the 15th day of the 5th month after the organization's fiscal year ends. For example, if the fiscal year concludes on December 31, the filing deadline would be May 15 of the following year. It is critical to be aware of these deadlines to ensure timely submissions and compliance with IRS regulations.

Should an organization require additional time to file, it can apply for a six-month extension. However, this extension must be requested before the original due date. Waiting until the last moment to request an extension can lead to late fees if not approached with sufficient foresight. Organizations that fail to file before the deadlines face substantial penalties, including fines that can add up significantly over time.

Preparing to file your Form 990-EZ: What you need

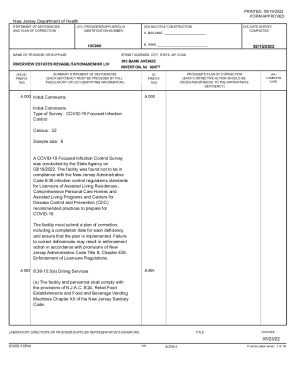

Preparation for filing Form 990-EZ is essential for ensuring accuracy and compliance. The organization must gather several crucial documents, including detailed financial statements, operational reports, and relevant schedules. These documents provide the necessary data to complete the form accurately, reflecting the organization’s financial status and governance.

Common pitfalls when filing Form 990-EZ include incomplete data and misunderstanding IRS requirements. Organizations should strive for precision and clarity in their submission to avoid errors that could trigger audits or penalties. Developing a meticulous filing habit is vital, and employing organizational tools can help streamline this process.

Step-by-step process for e-filing Form 990-EZ

E-filing Form 990-EZ through pdfFiller is an effective way to simplify the submission process. The first step is to determine your preparation method: whether to file independently or seek professional assistance. Leveraging digital solutions such as pdfFiller can save time and enhance accuracy.

Each of these steps enhances the overall filing experience, ensuring compliance, accuracy, and peace of mind for nonprofit organizations. The guided process provided by platforms like pdfFiller helps users navigate the complexities of Form 990-EZ.

Interactive tools for enhanced document management

PdfFiller offers numerous interactive features to facilitate the filing process. Tools such as e-signing capabilities allow for quick approvals, essential for maintaining timely submission deadlines. Users can share returns with team members, enhancing collaboration as they work diligently on filing accurate forms.

An internal audit check feature is also crucial, enabling organizations to double-check their documents for compliance. This proactive approach aids in mitigating risks associated with noncompliance, making pdfFiller an essential resource for nonprofits.

Frequently asked questions about Form 990-EZ

When filing Form 990-EZ, organizations often have common queries regarding the implications of their filings. One prevalent concern is regarding penalties for late filing. The IRS imposes fines, and recurring failures can elevate these costs significantly over time.

Understanding these FAQs helps nonprofits navigate the intricacies of Form 990-EZ and promotes responsible reporting and compliance practices.

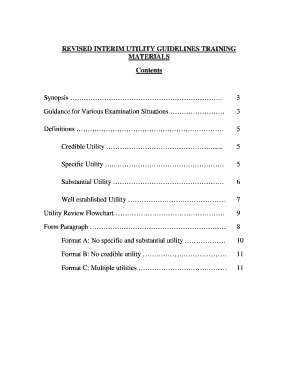

Specialized schedules required with Form 990-EZ

Filing Form 990-EZ might necessitate additional schedules that provide more detail about your organization’s activities. Notably, Schedule A, which outlines your public charity status, is crucial for demonstrating compliance with IRS regulations.

Submitting accurate schedules alongside Form 990-EZ is vital for transparency and accountability, showcasing how funds are utilized and affirming the organization's commitment to its mission.

Tips for successful filing with pdfFiller

Maximizing efficiency when filing Form 990-EZ can facilitate a smoother experience, particularly when using pdfFiller. Users can take advantage of features that allow for importing prior year’s data for consistency, which can simplify the process and save time.

These tips are designed to enhance the filing experience and ensure nonprofits can manage their reporting obligations efficiently.

Supported forms and resources in pdfFiller

PdfFiller supports a comprehensive list of forms essential for nonprofits, enhancing overall document management. Besides Form 990-EZ, organizations can file various tax-related documents and applications, streamlining their administrative workflows.

The availability of diverse forms and supporting materials empowers nonprofits to stay compliant while focusing on their mission-driven initiatives.

Experiences from fellow nonprofits: Testimonials

Real-world experiences from fellow nonprofits using pdfFiller highlight the platform's effectiveness. Users frequently express their appreciation for the intuitive interface and seamless e-filing capabilities.

These testimonials reflect the positive impact pdfFiller has made within the nonprofit community, reinforcing its value as a reliable document management solution.

Final steps before submission

Completing your filing process involves a last-minute checklist to ensure nothing is overlooked. Double-check all forms, attachments, and any required schedules to confirm that every section is filled accurately.

Following these steps will help prepare nonprofits for submission success, ensuring all requirements are met efficiently and accurately while utilizing pdfFiller's capabilities to facilitate the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 990-ez in Chrome?

Can I edit form 990-ez on an iOS device?

How do I complete form 990-ez on an Android device?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.