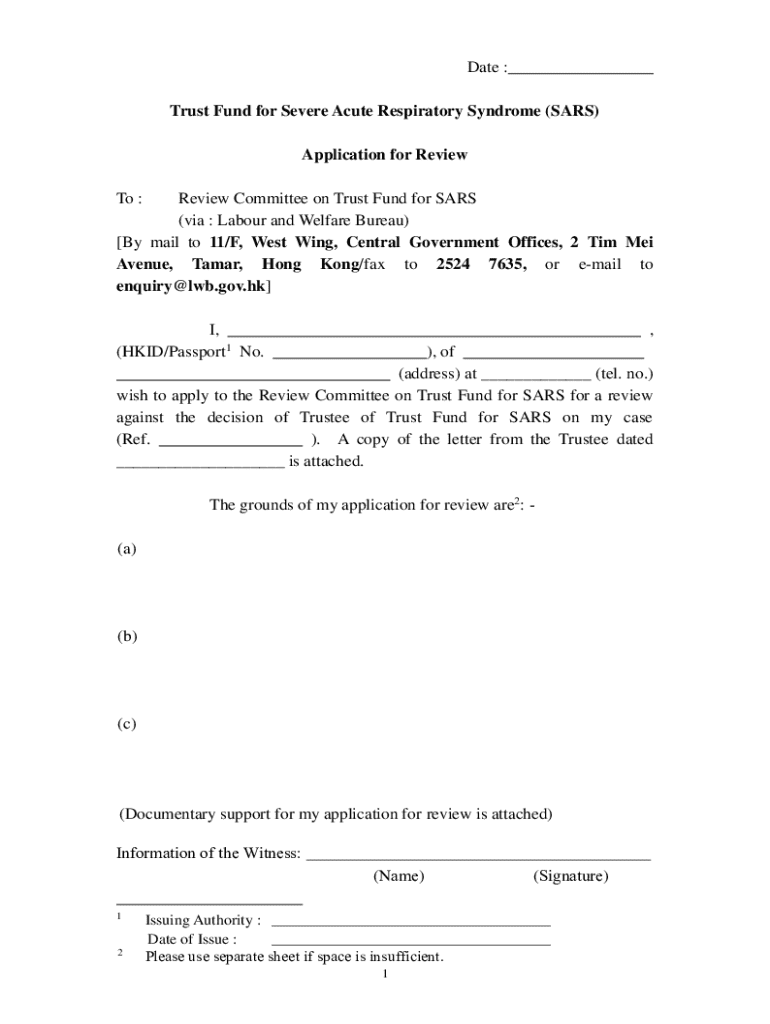

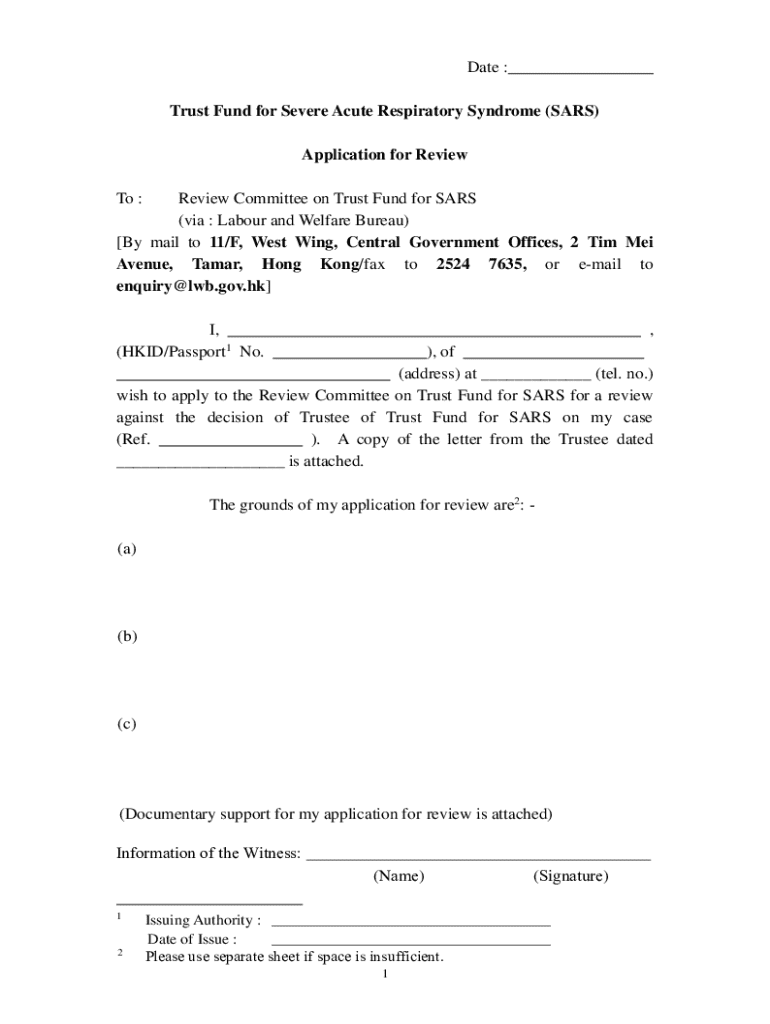

Get the free Trust Fund for Severe Acute Respiratory Syndrome (sars) Application for Review

Get, Create, Make and Sign trust fund for severe

Editing trust fund for severe online

Uncompromising security for your PDF editing and eSignature needs

How to fill out trust fund for severe

How to fill out trust fund for severe

Who needs trust fund for severe?

Trust fund for severe form: A comprehensive guide

Understanding trust funds for severe forms

Trust funds are legal entities established to hold and manage assets for the benefit of specified individuals. When it comes to individuals with severe conditions, trust funds serve a crucial purpose, ensuring their financial security and care without jeopardizing eligibility for government programs.

For those facing severe physical or mental disabilities, having a trust fund can provide peace of mind. Family members can allocate funds for their loved one's needs while complying with legal frameworks. Different types of trust funds cater to specific scenarios and objectives, which is essential for tailoring the fund to each individual's unique circumstances.

Types of trust funds for severe forms

Various types of trust funds cater to the unique needs of individuals with severe forms. Each type possesses distinct characteristics and benefits, making them suitable for different situations.

Special needs trusts

Special needs trusts are specifically designed to hold and manage assets for individuals with disabilities, allowing them to maintain eligibility for government assistance. The key feature is that the funds in the trust do not count against means-tested benefit limits.

Benefits include preserving benefits like Social Security and Medicaid while providing additional resources for quality of life enhancements, such as therapies and recreational activities. To qualify as a special needs trust, the beneficiary must have a qualifying disability.

Testamentary trusts

Testamentary trusts are those that are created through a will and become operative only upon the death of the grantor. They allow for the distribution of wealth to beneficiaries while controlling the terms under which those assets are used. This is particularly useful for individuals who may not be capable of managing funds due to mental or physical limitations.

Revocable vs. irrevocable trusts

Revocable trusts offer flexibility; the grantor can change the terms or dissolve the trust altogether. Conversely, irrevocable trusts provide greater asset protection and tax benefits but cannot be altered once established. It’s essential to assess which type aligns with the needs of the individual and their family.

Establishing a trust fund for severe forms

The process of establishing a trust fund for someone with a severe condition should start as soon as the need is identified. Early intervention ensures that the individual’s financial and care needs are met effectively.

Key parties involved in creating a trust fund typically include the grantor, who establishes the trust; the trustee, responsible for managing the trust; and the beneficiaries, who receive the benefits. Gathering necessary documentation is crucial for a smooth establishment.

Step-by-step guide to setting up a trust fund

Setting up a trust fund can seem daunting but breaking it down into manageable steps simplifies the process and ensures crucial details are not overlooked.

Managing a trust fund for severe forms

Once established, a trust fund for an individual with a severe form requires diligent management by the trustee. This includes ensuring that funds are used appropriately under the guidelines of the trust. Record-keeping and transparent reporting to beneficiaries maintain trust integrity and compliance.

The trustee's responsibilities extend to dealing with financial institutions and conducting ongoing transactions, fulfilling duties with diligence, and an understanding of the regulatory environment surrounding trust funds. Maintaining compliance with legal and tax obligations is crucial for the longevity of the trust.

Navigating legal and financial implications

Understanding the legal landscape surrounding trust funds for individuals with severe conditions is paramount. Specific laws govern how funds can be allocated and managed, particularly concerning eligibility for government benefits like Medicare and Medicaid. Failing to navigate these correctly can pose risks to the beneficiary.

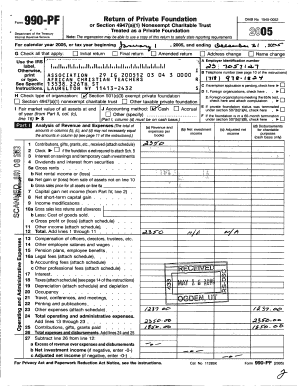

Tax implications are another critical consideration when setting up and managing a trust fund. Engaging with tax professionals to ensure optimal tax strategies will benefit both the trust and beneficiaries over time. Regularly reviewing and updating the trust to adapt to any changes in law or personal circumstances is also recommended.

Leveraging interactive tools for trust fund management

Technology can play a significant role in managing trust funds for individuals with severe forms. Platforms like pdfFiller empower users to create, edit, and manage trust-related documents efficiently. The ease of access allows for collaborative management among family members and professionals.

pdfFiller offers valuable features for drafting, editing, and signing trust documents. This cloud-based platform ensures that all relevant parties can interact with the documents seamlessly, making adjustments and updates straightforward.

FAQs about trust funds for severe forms

Addressing common questions about trust funds is crucial for prospective grantors. One prevalent question is about eligibility: what qualifies an individual as needing a trust fund? Understanding the criteria ensures that the proper steps are taken from the outset.

Additionally, it's vital to know what to do if circumstances change, such as illness progression. Regular evaluations of the trust and engaging beneficiaries in discussions about management can provide clarity and direction.

Best practices for ensuring trust fund effectiveness

To ensure that a trust fund for severe forms remains effective, regular reviews and adaptations to changing needs are essential. Engaging beneficiaries in discussions about the trust's purpose fosters understanding and alignment among all parties involved.

Educating trustees and family members on their roles is equally critical. Enhancing awareness of responsibilities ensures that everyone remains committed to the trust's objectives, maintaining its integrity and functionality for the long term.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my trust fund for severe in Gmail?

Can I edit trust fund for severe on an iOS device?

How can I fill out trust fund for severe on an iOS device?

What is trust fund for severe?

Who is required to file trust fund for severe?

How to fill out trust fund for severe?

What is the purpose of trust fund for severe?

What information must be reported on trust fund for severe?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.