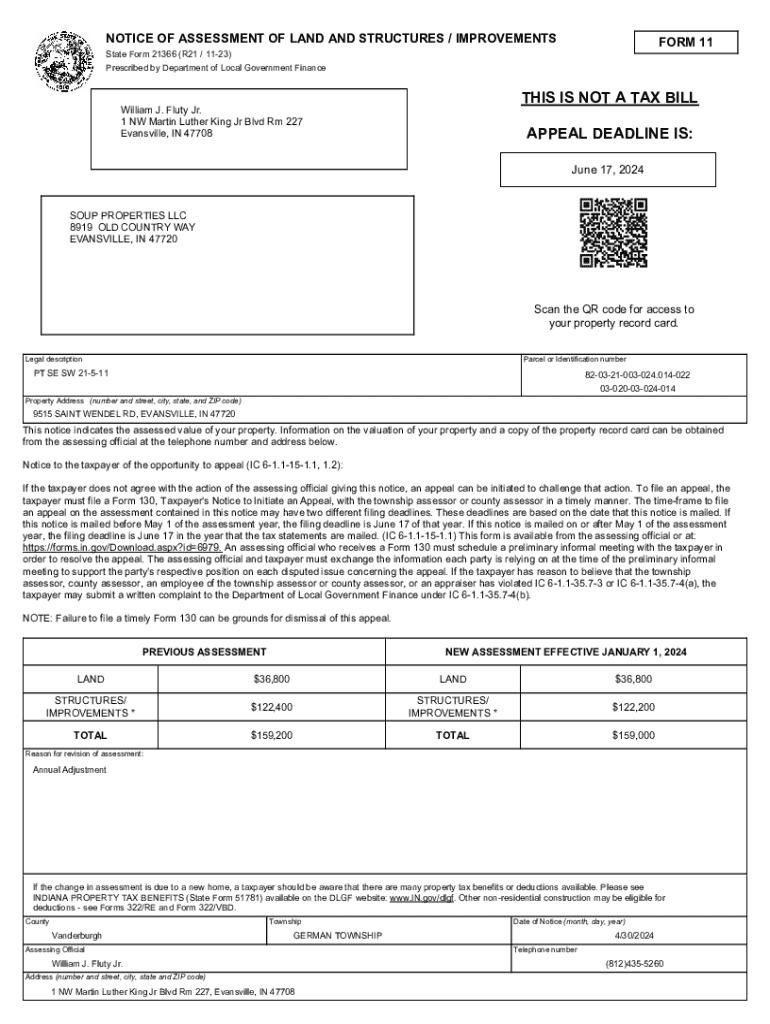

Get the free Notice of Assessment of Land and Structures / Improvements

Get, Create, Make and Sign notice of assessment of

Editing notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

Understanding the Notice of Assessment of Form

Overview of Notice of Assessment

The notice of assessment is a crucial document issued by tax authorities, summarizing the assessed value of property, and the corresponding taxes owed. It plays a vital role in property taxation as it outlines the amount of taxes homeowners must pay, ensuring transparency in the taxation process.

The primary purpose of this notice is to inform property owners of their tax obligations while providing a clear breakdown of the assessed value, tax rates, and any potential exemptions or adjustments. Understanding this document is essential for homeowners, as it directly impacts their financial responsibilities.

Understanding your notice of assessment

Your notice of assessment is packed with important details. Understanding its components is essential for compliance and planning. Key components include the tax year, assessment amount, charges breakdown, and due dates, each of which impacts how property owners address their tax responsibilities.

The tax year reflects the period during which the taxes pertain, while the assessment amount indicates how much you owe. A detailed breakdown of charges can help you understand where your money is going, and knowing due dates prevents late penalties. It's beneficial to familiarize yourself with common terminology related to assessments.

For instance, if your notice shows an assessed value of $300,000 with a property tax rate of 1.2%, your expected taxes would be $3,600 for that tax year. Familiarity with your notice allows for better financial planning and enables proactive management of property taxes.

How to access your notice of assessment

Accessing your notice of assessment is a straightforward process. Most jurisdictions offer an online portal where you can log in to view or download your document, ensuring you have it at your fingertips. For those who prefer a physical copy, it can be requested directly from your local tax office.

When accessing the online portal, you may need to verify your identity through a secure method to protect your personal information. This could involve answering security questions or providing identifying documents, so be prepared with your identification details handy.

Filling out the notice of assessment form

Completing the notice of assessment form accurately is crucial. Start by collecting necessary information such as your property details and previous assessments to ensure accuracy. Next, you need to fill in your personal details correctly: your name, property address, and associated tax identification number are typically required.

Calculating your assessment involves applying the local property tax rate to the assessed value. To minimize errors, double-check your math and consult additional resources if needed. Common errors include neglecting to update personal information or miscalculating taxable amounts.

If you find mistakes after submitting your form, follow your local taxation guidelines for corrections, which usually involves submitting a re-assessment request along with any necessary supporting documents.

Editing and managing your form with pdfFiller

Once you have filled out your notice of assessment form, managing and editing it can be done effortlessly using pdfFiller. You can upload your completed document to the pdfFiller platform and take advantage of various editing tools designed for easy manipulation of PDFs.

Adding text, comments, or highlighting important sections can enhance clarity and ensure essential information stands out. eSigning your form allows for a quick and secure signature process. pdfFiller also gives users the option to witness their signatures digitally, adding an extra layer of authenticity.

Filing and submitting your assessment

Submitting your notice of assessment is the final step in managing your taxes effectively. The best practices for submission usually depend on whether you choose to file online or in person. Online submissions are often more efficient, allowing quick processing, while in-person submissions may offer an opportunity for immediate confirmations.

Regardless of your submission method, confirming receipt of your submission is vital. After filing, keep a copy of the submitted document along with the confirmation of submission for your records. This way, you can reference it in the future if needed.

Responding to your assessment

Understanding your rights regarding your notice of assessment is essential. If you believe your assessment is incorrect, it’s crucial to respond appropriately. Follow your local procedures to appeal the assessment, as timelines and required documentation can differ significantly between jurisdictions.

In many areas, a formal appeal petition will be required. It’s important to gather all necessary documents, such as previous assessments, comparable property values, and any other relevant evidence to support your claim. Local authorities often provide resources available to assist you throughout this process, guiding you on how to make a strong case.

Frequently asked questions

Several common questions arise regarding the notice of assessment. One frequent inquiry is how the assessed value is determined. This value is typically calculated based on various factors, including comparable property sales in the area and specific characteristics of the property itself.

If you own multiple properties, each will generally receive a separate notice of assessment. Each assessment can vary based on property value fluctuations and location. Many jurisdictions also offer exemptions or reductions under certain conditions, so it’s worth investigating if you are eligible.

Related resources and tools on pdfFiller

To make the property assessment process more manageable, pdfFiller provides numerous resources and tools. You can find templates related to tax assessments that simplify the documentation process. Additionally, there are calculators available to help determine estimated taxes based on your local rates and an array of checklists tailored to ensure you’re on track when filing taxes each year.

Utilizing these resources can significantly enhance your preparedness and streamline your filing process. By being informed and well-prepared, you can ensure your tax obligations are handled efficiently.

Key takeaways and next steps

Understanding your notice of assessment is crucial for effective tax management. Being proactive with your assessments helps avoid surprises and ensures compliance with local regulations. Utilizing pdfFiller's tools for document management and eSigning enhances efficiency, enabling you to focus more on other important areas.

Keep track of critical deadlines related to property tax assessments and submissions to ensure timely compliance. With the right knowledge and tools at your disposal, property tax management can become a smoother process, allowing you to leverage the full potential of your investments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my notice of assessment of in Gmail?

How do I fill out notice of assessment of using my mobile device?

How do I complete notice of assessment of on an Android device?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.