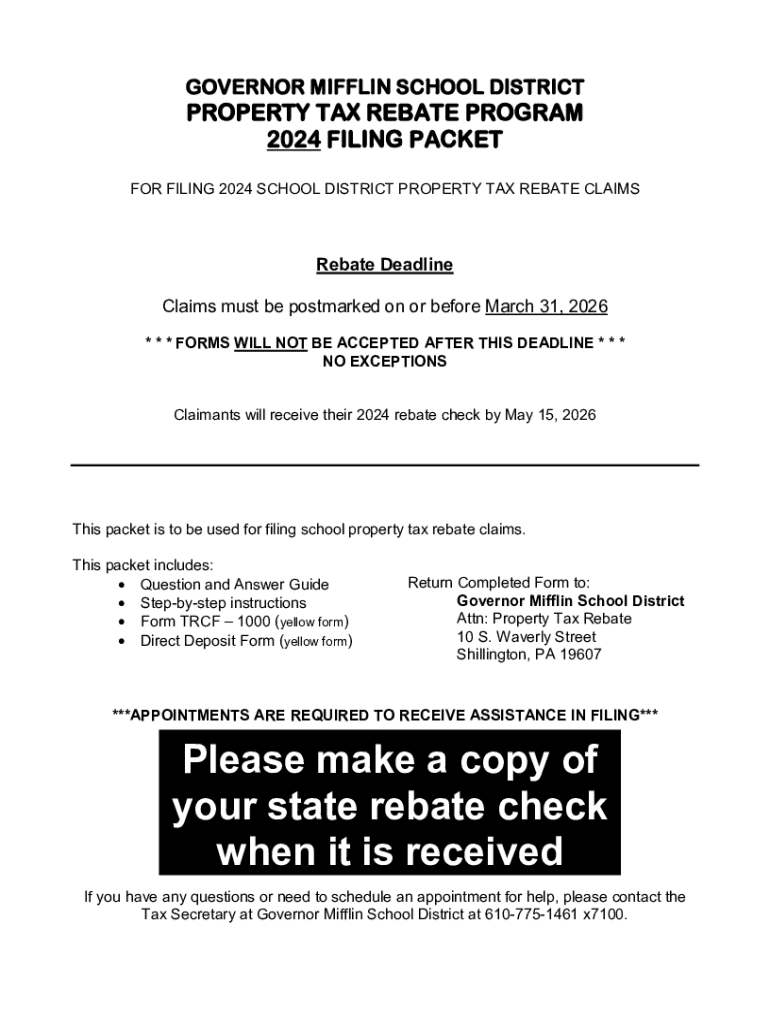

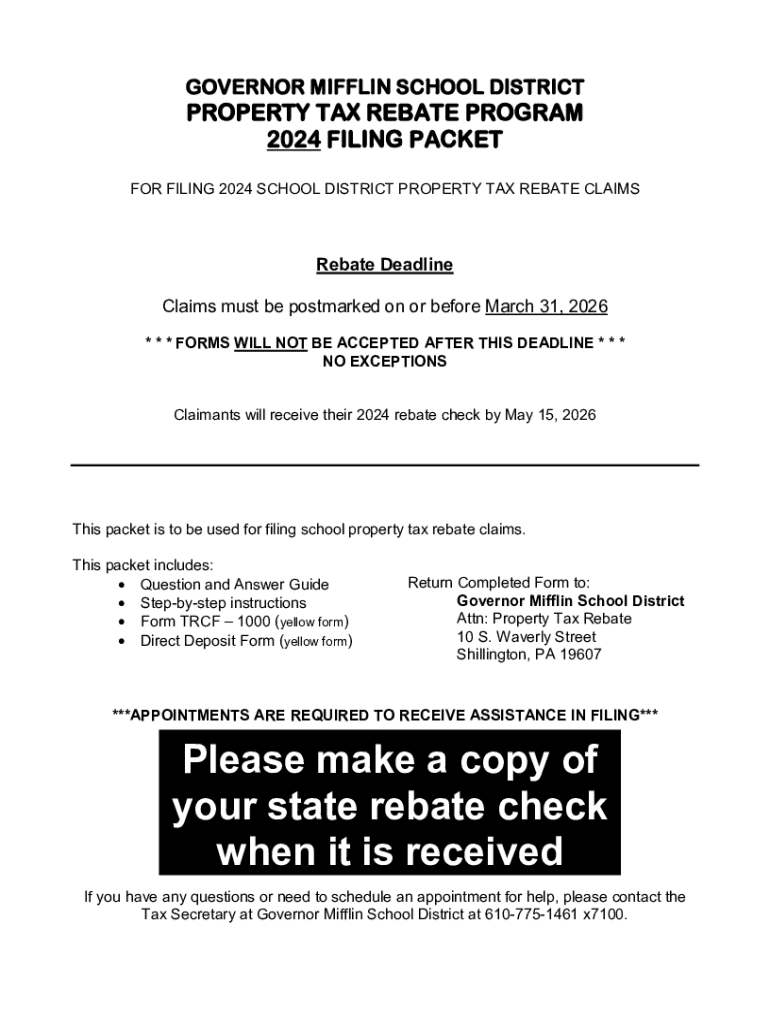

Get the free Property Tax Rebate Program 2024 Filing Packet

Get, Create, Make and Sign property tax rebate program

Editing property tax rebate program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax rebate program

How to fill out property tax rebate program

Who needs property tax rebate program?

Property Tax Rebate Program Form: Comprehensive Guide

Understanding the property tax rebate program

Property tax rebate programs are designed to provide financial relief to homeowners by offering a refund on a portion of their property taxes based on specific criteria. These programs vary significantly by state and locality, but they generally aim to alleviate the tax burden, especially for vulnerable populations such as low-income households and seniors.

The importance of the property tax rebate cannot be overstated. For many homeowners, property taxes represent a significant monthly and annual expense. By participating in these programs, individuals may receive funds that can help cover living costs or allow for reinvestment into their homes.

Some key benefits of participating in the property tax rebate program include increased awareness of financial help available, potential reduction in monthly expenses, and the ability to stay within budget while still enjoying the comforts of homeownership. Knowing that help is available can ease financial anxiety and promote stability within communities.

Eligibility criteria for the property tax rebate program

To qualify for the property tax rebate program, applicants must meet several eligibility criteria specific to their state or locality. General requirements typically include residency in the jurisdiction where the property is located, as well as compliance with established income limits and property ownership stipulations.

For example, many states require that applicants have a certain income threshold that doesn’t exceed a specific limit. Homeownership is another standard requirement; applicants must own the property for which they are seeking a rebate. It's critical to check local regulations, as they can vary widely.

Special considerations are often given to seniors, disabled individuals, and low-income households. These groups may benefit from additional exemptions or adjusted income limitations to ensure support is tailored to those who need it most.

How to apply for the property tax rebate

Applying for the property tax rebate is often a straightforward process, but it requires careful attention to detail. Here’s a step-by-step guide to help you navigate the application process successfully.

Many states allow applications to be submitted either online or via traditional paper forms. Online applications may offer quicker processing times and an easier method to track your application.

Using platforms like pdfFiller for e-filing offers several advantages, including automated form validation, easy edits, and secure submission. Alternatively, paper applications must be mailed to the appropriate local agency, which can often be slower.

If applying online, follow the instructions provided for the platform to fill out the form, review all entered information carefully, and submit it per the specified guidelines.

Detailed breakdown of the property tax rebate program form

The property tax rebate program form can seem daunting at first, but understanding each section enhances the likelihood of successful completion. The form typically consists of several key areas, each requiring specific information.

Common mistakes to avoid include omitting critical information, misreporting income, or failing to double-check for any clerical errors. Review your completed form with fresh eyes before submission to catch any mistakes.

Rebate amount calculations

Understanding how rebate amounts are calculated is essential for applicants. Various factors can influence the total rebate amount you might receive, primarily the assessed value of your property and your reported income levels.

For instance, properties with higher assessed values might qualify for a larger rebate, whereas income limits can cap the available rebate amount, ensuring that those with lower incomes benefit minimally. It's crucial to familiarize yourself with the specific calculations used in your state.

To illustrate, consider a hypothetical individual with a property assessed at $250,000 and an annual income of $40,000; this applicant may qualify for a rebate of approximately $750, depending on local rules governing the program.

Processing time and what to expect

After submitting your application for the property tax rebate, it’s important to know what to expect in terms of processing time. Generally, applications may take anywhere from a few weeks to a few months to process, depending on the jurisdiction's efficiency and volume of applications received.

To keep track of your application status, utilizing tools offered by platforms like pdfFiller is beneficial. These platforms often provide monitoring capabilities, allowing you to check your application's progression online without needing to make a phone call.

Costs associated with the application

When applying for the property tax rebate, it's important to consider any associated costs that may arise during the application process. Generally, filing fees are minimal or nonexistent for most state programs.

However, should applicants require assistance or use third-party services to help them fill out the forms, additional fees may apply. Examples include legal advice or tax preparation services.

Assistance with the property tax rebate application

Many individuals may find themselves needing assistance with their property tax rebate application. Thankfully, various resources are available to help, provided by local agencies and community programs aimed at aiding residents.

These resources often offer free application assistance and can guide individuals through the process step-by-step. Often, these local agencies have trained volunteers or staff that understand the nuances of the application, ensuring that every opportunity for deduction is fully realized.

Additional forms and related information

When navigating the property tax rebate program, applicants should be aware of other relevant forms beyond the primary rebate application. Depending on specific situations, additional documents may be required, such as income verification or supplementary exemption applications.

Additionally, it’s wise to stay informed about related tax relief programs that may exist in your area, which can offer further financial assistance. Making note of important deadlines is critical, as missing these cut-off points could jeopardize your rebate.

Frequently asked questions (FAQs)

Navigating the property tax rebate program can lead to several questions, especially around specific eligibility criteria or document requirements. Below are common inquiries applicants often have.

Key legislative framework surrounding property tax rebates

Understanding the legislative framework surrounding property tax rebate programs can provide insight into their structure and continuous evolution. Various laws dictate how these programs are administered at both state and local levels.

From revisions in eligibility criteria to changes in rebate amounts, new legislation can significantly impact program access for homeowners. Staying informed about recent changes can benefit potential applicants and ensure they do not miss out on available funding.

Engaging with the community

Engaging with your local community is a valuable approach for applicants undergoing the property tax rebate process. Local associations and social media groups can be rich in information and support that may not be readily available through government channels.

Sharing experiences, tips, and strategies with fellow applicants can foster a sense of community and empowerment, ensuring no one has to navigate the rebate process alone. Consider seeking out forums or discussions focused on property tax issues to connect with others in similar situations.

Conclusion on utilizing pdfFiller

In conclusion, understanding the property tax rebate program form is crucial for all homeowners looking to alleviate their financial burdens. pdfFiller stands out as a powerful resource for managing the complexities associated with this application process.

Recapping the benefits of using pdfFiller, it empowers users by enabling seamless form editing, electronic signatures, and collaborative features from a single cloud-based platform. By fully exploiting these tools, users can ensure their property tax rebate applications are submitted correctly and efficiently, ultimately paving the way for a smoother financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the property tax rebate program electronically in Chrome?

How do I fill out the property tax rebate program form on my smartphone?

How can I fill out property tax rebate program on an iOS device?

What is property tax rebate program?

Who is required to file property tax rebate program?

How to fill out property tax rebate program?

What is the purpose of property tax rebate program?

What information must be reported on property tax rebate program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.