Get the free Notice of Assessment of Land and Structures / Improvements

Get, Create, Make and Sign notice of assessment of

How to edit notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

A Comprehensive Guide to the Notice of Assessment of Form

Understanding the notice of assessment of form

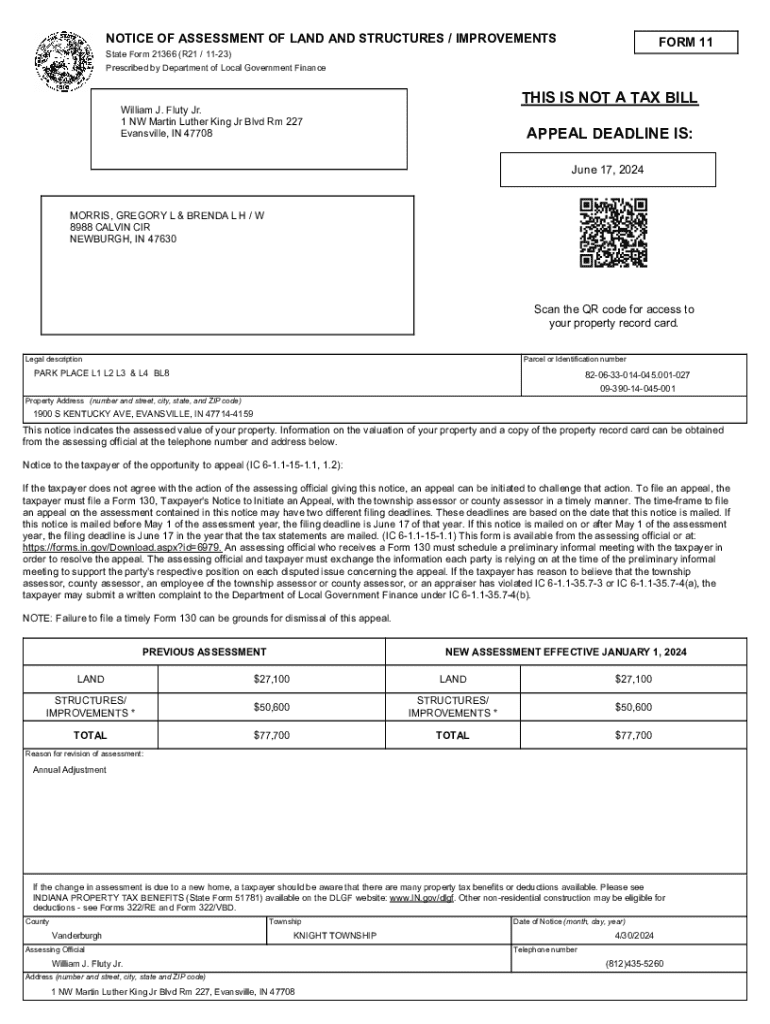

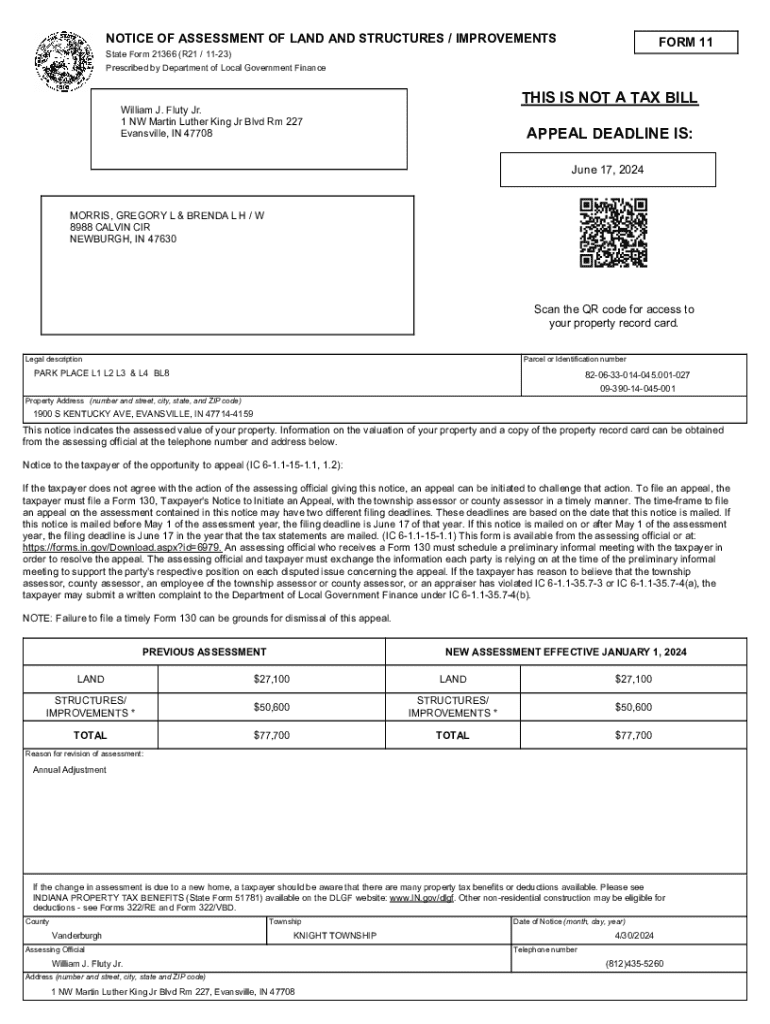

The Notice of Assessment (NOA) serves as a critical document in the tax assessment process, detailing the tax obligations of individuals and entities. This official notice is typically issued by tax authorities after the review of a submitted tax return, outlining the calculations that determine the amount of tax owed or any potential refund due. Understanding the NOA is crucial, as it impacts both financial planning and compliance with tax regulations.

The importance of the NOA cannot be overstated; it not only confirms the tax liabilities but also serves as a formal communication channel regarding any discrepancies or adjustments needed. Typically, the NOA will include vital information such as personal details, tax year, income reported, deductions claimed, and the resulting tax liability. Recognizing the differences between types of assessments—such as preliminary and final assessments—allows individuals to better navigate their tax responsibilities.

Accessing your notice of assessment

Finding your Notice of Assessment is essential for addressing your tax obligations. Most tax authorities provide access to the NOA through online portals and services, simplifying the retrieval process. For instance, accessing the IRS’s website in the United States allows taxpayers to view their assessment language and ensure accuracy. Additionally, traditional methods such as physical mail notifications are still commonly used, and it's important to keep an eye on your mailbox for this crucial document.

For those preferring a digital approach, services like pdfFiller facilitate the secure access of your NOA online. To do this, you can simply log into the pdfFiller platform and utilize its features to retrieve and manage your NOA conveniently in PDF format. The platform’s encryption ensures your sensitive information remains secure while allowing you to easily access your documents from anywhere.

Detailed breakdown of the components of the notice of assessment

Each Notice of Assessment contains several key sections that provide comprehensive details about the taxpayer’s financial standing. Understanding these components is crucial for accurate tax compliance.

Steps to review your notice of assessment

Once you have your NOA, it’s vital to review it thoroughly to ensure its accuracy. Start by verifying your personal information to ensure that there are no discrepancies that could lead to future issues. Pay special attention to details such as your name, address, and Social Security Number.

Next, check your income sources against your records. Confirm that all earnings are reported accurately to avoid unexpected tax liabilities. After that, review your deductions and credits. Deductions can lower your taxable income significantly, so ensure all applicable deductions have been applied accordingly.

Lastly, understand your overall tax obligation by comparing this year’s assessment to previous ones. Identify any changes or anomalies that might warrant further investigation or prompt you to gather additional documentation for support.

Making corrections on your notice of assessment

Errors can occur in tax assessments; thus, it’s essential to know how to make corrections on your NOA. Common discrepancies may include incorrect income amounts, unclaimed deductions, or personal information errors. If you notice any issues, document them comprehensively, as this will assist you when contacting the tax authority.

To file for a correction, gather the necessary documentation to substantiate your claims and submit a revision request to the tax office. Each tax authority has specific procedures for appealing assessments, so ensure to follow the prescribed steps meticulously. Utilizing pdfFiller’s platform can simplify this process, allowing you to fill out and submit the required forms electronically.

Responding to your notice of assessment

Upon receiving your NOA, you typically have several options. If you agree with the assessment, you may simply accept it and prepare for payment or adjustments accordingly. However, if you believe the assessment is incorrect, you can dispute it. Knowing how to navigate this process can save you considerable time and stress.

To dispute your NOA, prepare the necessary documentation, stating clearly why you believe there’s a discrepancy. Filing an appeal using pdfFiller is straightforward; simply select the relevant forms and complete them with detailed account information. Be mindful of the submission timelines set by the tax authorities, as failing to respond within these periods can lead to forfeited rights to appeal.

Understanding payment options post-assessment

After your NOA is finalized, it’s important to understand your payment options. Most tax authorities offer a range of payment plans, allowing taxpayers to settle their owed taxes promptly. It’s highly advisable to address any owed amounts as soon as possible to avoid additional penalties or interests that can accrue over time.

Being aware of the consequences of late payments is equally crucial. Most tax systems impose additional charges or interest if payments are not made by the specified deadline. Tools available within pdfFiller enable users to monitor payment deadlines and ensure timely compliance, significantly aiding in financial management.

Scenario analysis: What to do if you cannot collect in person

If circumstances prevent you from collecting your NOA in person, there are still viable solutions. Remote access to document collection has become increasingly prevalent, allowing users to retrieve important tax documents without needing to visit physical locations. Utilizing services such as pdfFiller allows you to securely access, sign, and share your NOA online, ensuring that you remain compliant regardless of your location.

When dealing with remote document collection, always practice security measures to protect sensitive information. Use strong passwords for online accounts and enable two-factor authentication where possible. By leveraging pdfFiller’s features, you can confidently manage and collaborate on documents, ensuring both ease of access and document security.

Planning for future assessments

Maintaining thorough records is essential for effective planning and future assessments. Keeping organized documentation not only facilitates accurate tax filing but also strengthens your case in the event of audits. Adopting strategies such as maintaining updated income records, receipts for deductions, and periodic reviews of your financial status can minimize potential liabilities.

Additionally, pdfFiller offers features that aid in managing and organizing your financial documents. Using this platform for future assessments enables you to conveniently edit, eSign, and store tax-related forms, ensuring seamless accessibility whenever you need them.

Common FAQs about notice of assessment forms

As you navigate your NOA, you may encounter several common questions, such as what happens if you lose your NOA. In such cases, don’t panic; you can retrieve a copy through your tax authority's online portal or request a new one via mail. Additionally, consider the time limits for disputes; most jurisdictions allow a specific period—often ranging from 30 to 90 days post-receipt—to contest any inaccuracies.

Preparing for a potential audit based on your NOA can also bring significant concerns. Stay proactive by gathering supporting documents and maintaining clear records, as this will streamline the audit process should it occur.

Related content for further exploration

Expanding your understanding of tax forms can greatly benefit your financial planning. Articles on tax deductions and credits can provide insight into opportunities for lowering your tax obligations. Additionally, guides on other tax forms and filings can round out your financial knowledge, while resources on best practices for tax filings and financial management help solidify your expertise.

Examples of notable cases

Real-life scenarios can shed light on the practical implications of navigating the NOA process. For example, consider a taxpayer who reviewed their NOA using pdfFiller and discovered discrepancies in reported income. By documenting the error thoroughly and swiftly filing for correction, they were able to adjust their tax liability effectively, thus avoiding penalties. In another case, an individual successfully appealed an assessment that overlooked valid deductions by leveraging detailed records and timely submission of the appeal forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify notice of assessment of without leaving Google Drive?

Can I sign the notice of assessment of electronically in Chrome?

How do I edit notice of assessment of on an Android device?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.