Get the free Notice of Assessment of Land and Structures / Improvements

Get, Create, Make and Sign notice of assessment of

Editing notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

Comprehensive Guide to Your Notice of Assessment of Form

Understanding the notice of assessment

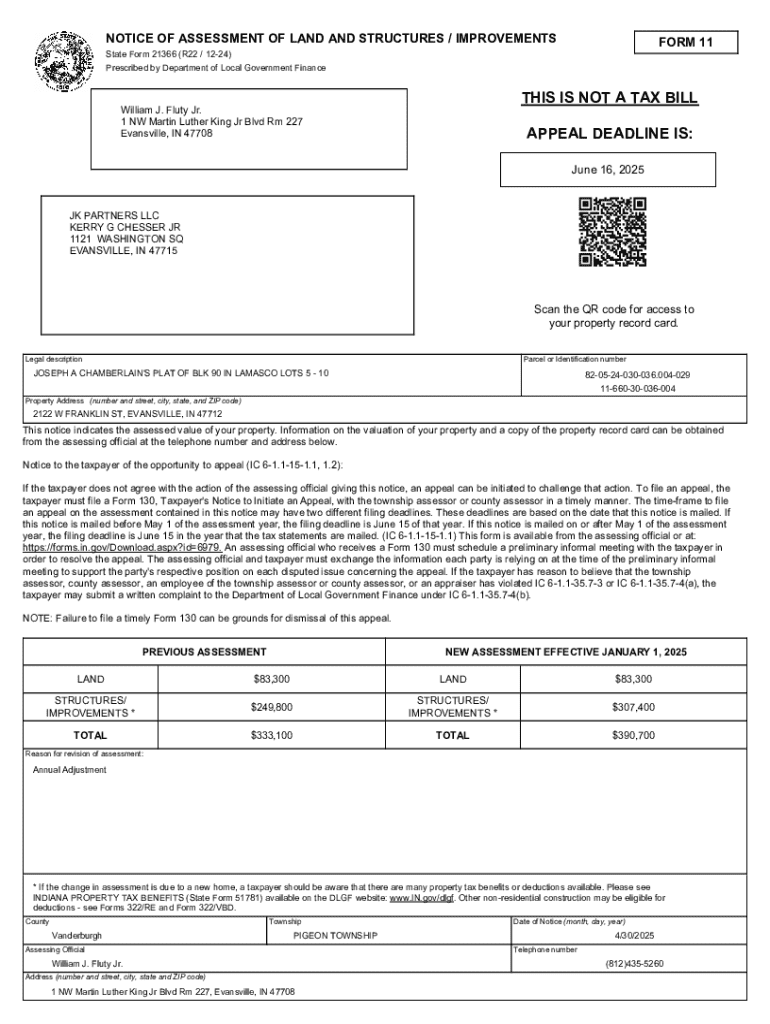

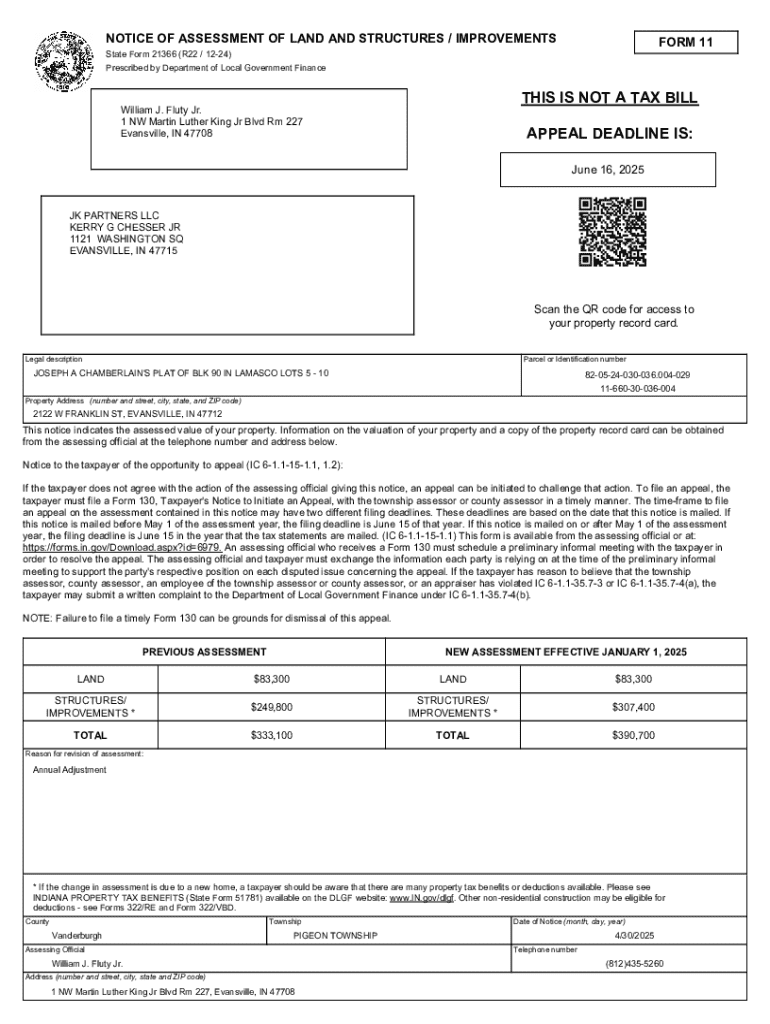

A Notice of Assessment (NOA) is a crucial document issued by tax authorities that summarizes an individual’s tax obligations for a given year. It serves as an official notification that provides taxpayers with details regarding their tax returns, including the amount of tax owed or the refund due. In essence, the NOA acts as a final statement of account that reflects how the tax authority has processed your filed tax return.

The importance of the NOA goes beyond merely summarizing tax figures; it plays a pivotal role in effective tax management. By reviewing the NOA, taxpayers can ensure that they have reported their income accurately, understand their obligations, and confirm that any adjustments or corrections made by the tax authority are justified. Furthermore, it provides a basis for future tax planning and decision-making.

Despite its significance, there are common misconceptions surrounding the NOA. Many individuals assume that the NOA is the same as their tax return, which is a fallacy. It's essential to differentiate between the two, as the NOA represents the tax authority's evaluation of your tax return rather than the original submission itself.

Key components of your notice of assessment

Understanding the structure of your NOA is vital to navigating your tax responsibilities effectively. The document typically contains several key components that provide valuable insights into your taxation status.

In a typical NOA, the top section contains taxpayer information followed by the assessment year prominently displayed. The tax calculation summary presents the income reported, along with applicable tax rates leading to the final tax due or refundable amount. This clarity is essential for understanding how the figures in your NOA were derived.

For instance, if you review an NOA indicating you owe $2,000, the tax calculation summary will detail the process that led to this conclusion, allowing you to verify accuracy and raise questions if necessary. Always keep an eye out for adjustments or deductions, as these can significantly impact your final liability.

How to access your notice of assessment

Accessing your Notice of Assessment has become more straightforward with the advent of online services. You can typically receive your NOA via traditional mail or through an online tax portal.

To navigate your myTax portal efficiently, log in using your credentials, and look for the section labeled 'Notices' or 'Assessment Documents.' From there, you can view and download your NOA. If you encounter issues accessing the portal, ensure that your registration is current or contact the support line for assistance.

Common troubleshooting steps include checking your internet connection, ensuring you are using the correct login information, and clearing your browser cache. By taking these steps, you should be able to access your NOA quickly and easily.

Filling out and editing your notice of assessment

Once you've received your Notice of Assessment, it’s essential to review it thoroughly. However, if you notice any discrepancies that need correcting, filling out and editing specific sections can be necessary. Identifying the correct form for your NOA is the first step. Generally, tax authorities provide guidance on which forms to utilize for disputes or corrections.

To efficiently edit your NOA, consider using pdfFiller. This platform provides an intuitive interface that lets you upload your NOA and make necessary adjustments seamlessly. You can also incorporate digital signatures, which are increasingly becoming a requirement for filing corrected documents.

The step-by-step guide to edit PDF forms on pdfFiller involves selecting the document, using the editing tools to change necessary fields, and signing the document digitally if required. This saves time and ensures your corrections meet compliance standards.

Collaborating on your noa with others

If you're collaborating with tax advisors or team members regarding your Notice of Assessment, sharing this document becomes crucial for transparency and collective decision-making. Utilizing tools within pdfFiller allows for efficient collaboration.

When collaborating, consider best practices such as establishing clear deadlines for reviews and adjustments. Many users find value in using commenting and feedback tools available in pdfFiller, as they allow discussions directly on the document.

Whether you're consulting with advisors for strategic tax planning or auditing purposes, leveraging collaboration tools can foster a more comprehensive analysis of tax obligations stemming from your NOA.

Managing assessment queries and disputes

It’s not uncommon to have questions or concerns regarding your Notice of Assessment. If you disagree with your assessment, you have the right to review and challenge it. Carefully examining your NOA is the first step in understanding any discrepancies.

It's crucial to adhere to any important deadlines associated with the dispute process, as these can vary by jurisdiction. This may include the time frame for submitting disputes or the evidence required to support your claims. For a successful dispute, provide detailed documentation, including your original tax return, any communications with tax authorities, and any corrections made.

Consider seeking guidance from tax professionals, especially if your case involves complex tax laws or regulations. Consulting with an advisor can provide insights into how to strengthen your dispute case effectively.

Keeping track of your tax assessments

Managing your tax assessments requires organization and diligence. Developing a personal tax calendar can help keep track of important dates related to tax returns, payment deadlines, and assessment notifications. This can mitigate the stress of tax season and ensure timely compliance.

Using tools like pdfFiller for ongoing document management is advantageous. You can store all relevant tax documents, including previous NOAs, tax returns, and related correspondence, in one secure location. This allows quick access and easy organization when needed.

By maintaining continuous organization, you can better prepare for future assessments, reduce uncertainty, and enhance overall efficiency in managing your tax responsibilities.

Related tax forms and documents

When dealing with your Notice of Assessment, there are several related forms and documents that you may frequently submit. It’s essential to understand how these interact with your NOA for comprehensive tax management.

Importance lies in maintaining organized documentation. Misplaced forms can lead to confusion and difficulties when managing your tax assessments. Utilizing interactive tools on pdfFiller can streamline the management of multiple documents, ensuring that you have everything you need at your fingertips.

With a structured approach to documentation, produce more accurate assessments, streamline processes, and improve interactions with tax authorities.

Additional scenarios and faqs

Receiving an incorrect Notice of Assessment can be frustrating. It’s important to understand the steps to rectify the situation. Should you find incorrect information on your NOA, the immediate action is to refer back to your original tax return to confirm your figures.

Frequently asked questions about the NOA include queries on how to correct mistakes and actions to take if you do not receive your NOA. Corrections to your NOA generally require filling out specific correction forms, detailing what is being contested, and resubmitting it to the tax authority.

If you haven’t received your NOA, verify whether your filing was processed. Check your online tax portal for updates and contact the help desk of your tax authority for further assistance. Understand that processing times can vary, but staying proactive will help ensure you remain informed about your tax status.

Navigational aids

To enhance your experience with managing your Notice of Assessment, utilize navigational aids that can help you quickly access related forms and resources. This structured approach makes tax management less daunting.

Incorporating quick information boxes can also be beneficial. Examples include contact information for support or reminders for filing deadlines. This facilitates efficient document handling and provides immediate answers when questions arise.

Conclusion: Optimize your tax management

Utilizing tools like pdfFiller for managing your Notice of Assessment can lead to effective tracking and better management of your tax obligations. The ability to edit, share, and collaborate on this document streamlines the entire process.

Leveraging cloud solutions not only aids in document organization but enhances accessibility, allowing you to manage tax responsibilities from anywhere. Take proactive steps to understand and manage your NOA effectively for a more stress-free tax season.

With the right knowledge and tools at your disposal, you can turn tax management from a daunting task into a seamless experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify notice of assessment of without leaving Google Drive?

Can I create an electronic signature for the notice of assessment of in Chrome?

Can I edit notice of assessment of on an Android device?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.