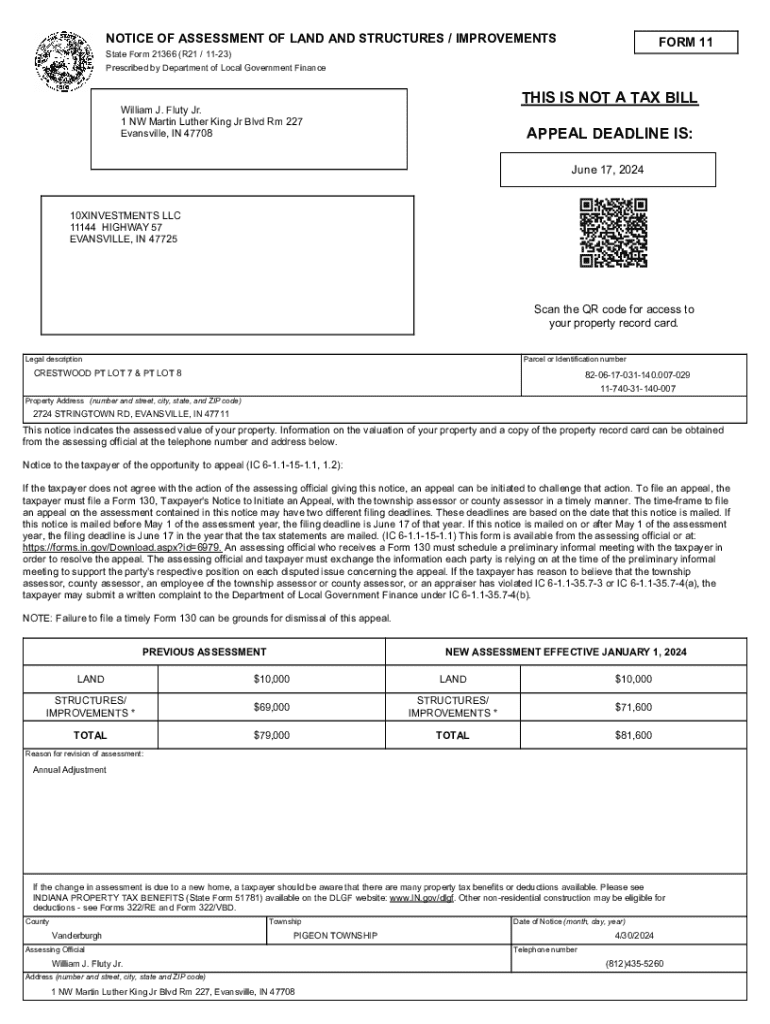

Get the free Notice of Assessment of Land and Structures / Improvements

Get, Create, Make and Sign notice of assessment of

How to edit notice of assessment of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of assessment of

How to fill out notice of assessment of

Who needs notice of assessment of?

A Comprehensive Guide to the Notice of Assessment of Form

Understanding the notice of assessment of form

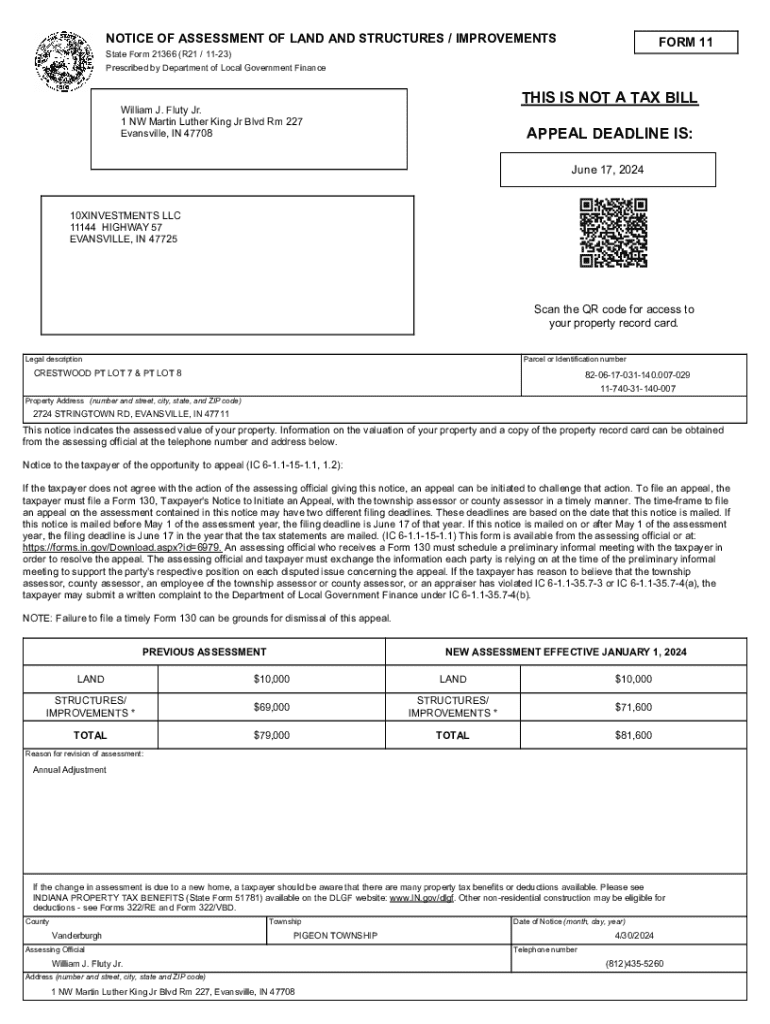

The notice of assessment of form is a crucial document that taxpayers receive from the tax authority after filing their annual income tax returns. This document serves the essential function of summarizing the taxpayer’s financial data—a reflection of their earnings, deductions, and tax obligations for the given fiscal year. Understanding the purpose of this notice is vital, as it outlines the total amount of tax owed or the refund expected.

The notice of assessment is designed to ensure transparency in the tax assessment process, providing taxpayers a detailed breakdown of how their taxes have been calculated. It is typically issued by the revenue or tax office of the governing entity relevant to the taxpayer, such as the IRS in the United States or HM Revenue and Customs in the UK.

Key components of the notice of assessment form

The notice of assessment form comprises several critical components that provide vital information regarding a taxpayer's finances. Understanding these elements can greatly enhance the individual’s ability to manage their tax responsibilities effectively. Typically, the form includes sections for personal and financial information, a brief overview of tax calculations, and a summary of applicable deductions and credits.

Each section serves a specific purpose, helping to ensure that all relevant figures are accurately reported and comprehensively understood. Familiarity with the terminology found within each section can also help clarify any confusion in the assessment process. Below is a breakdown of essential sections:

Step-by-step guide to completing the notice of assessment form

Filling out the notice of assessment form requires a methodical approach to ensure complete accuracy. Here is a step-by-step guide to help you through the process.

Step 1: Gathering required information

Before beginning to complete the form, it’s essential to gather all relevant documents, which may include your previous tax returns, income statements (W-2s or 1099s), and receipts for deductions. Having these documents at hand allows for accurate data entry, minimizing errors.

Step 2: Filling out personal information

Next, you must enter your personal information accurately. Pay close attention to detail; any mistakes can result in processing delays. Common errors include misspellings of names and incorrect identification numbers.

Step 3: Entering financial information

In this step, you'll report your total income and any applicable deductions. Taxpayers can utilize interactive tools like the pdfFiller calculator to help automate some of these calculations, ensuring accuracy and compliance.

Step 4: Reviewing the form for completeness

Once the form is filled out, it is prudent to review it thoroughly. Create a checklist to confirm that all fields are completed, and double-check for any clerical errors before submission.

Editing and signing the notice of assessment form

Using pdfFiller is an efficient way to edit your notice of assessment form. The platform allows users to make changes to already completed forms, ensuring that all information is current and accurate. When it comes time to finalize your document, adding an eSignature on pdfFiller is straightforward.

Follow these steps to eSign your form:

For those working within a team, pdfFiller provides collaborative features that allow multiple users to manage documents efficiently, streamlining the workflow.

Submitting the notice of assessment form

The next step is submitting your completed notice of assessment form. Taxpayers can choose to submit their forms electronically (e-filing) or by traditional mail. Each method has its benefits, and the choice will depend on individual circumstances and preferences.

Here are critical deadlines to remember:

Once submitted, you should expect a confirmation receipt from the tax authority indicating that your submission has been processed.

After submission: What to expect next

After submitting your notice of assessment form, there is a typical timeline to process the information and issue a final assessment statement. Tax authorities often publish estimates for such timelines on their websites.

Should you wish to check the status of your assessment, most tax authorities provide online systems for tracking your submission. Be prepared for common post-submission scenarios that may arise, including:

Troubleshooting common issues with the notice of assessment

Tax season can bring about numerous challenges, especially regarding the notice of assessment form. Common issues can typically escalate from simple clerical errors to major discrepancies in financial reporting. Therefore, knowing how to troubleshoot these problems is essential.

Frequently asked questions can provide quick insights. If you find yourself needing more assistance, contacting your local tax authority directly can be invaluable. Prepare all relevant information beforehand to streamline the process, especially in situations involving discrepancies in assessments.

Resources for further assistance

If you find yourself needing more support while managing your notice of assessment form, pdfFiller has robust customer service options available. You can reach out via live chat or email for immediate queries.

Online forums dedicated to tax filing can also provide community support where users share their experiences. These platforms can give insights into best practices during assessments.

Real-life examples and scenarios

Understanding tax assessments can sometimes be clearer with real-life examples. For instance, consider an individual who diligently prepares their documents and files their tax return. After submission, they receive an assessment reflecting a small refund based on overpayments throughout the year.

Alternatively, businesses navigating assessments often face additional complexities, needing to account for various income streams and tax liabilities. A common scenario might involve dealing with a late submission, which could result in penalties. Demonstrating real-life outcomes helps clarify the stakes involved in the assessment process.

Regulatory and compliance information

A firm understanding of the legislative framework surrounding tax filing is crucial. Key tax laws affecting the notice of assessment vary from jurisdiction to jurisdiction, adding layers of complexity for taxpayers. Researching these regulations, along with state-specific considerations, ensures greater compliance.

Staying updated on changes in tax laws each year can significantly impact how you approach your notice of assessment form. For instance, any modifications in tax rates or allowable deductions could reveal strategies for effective tax planning.

Additional tools and solutions by pdfFiller

pdfFiller provides a variety of tools tailored for document management that can significantly enhance how users handle the notice of assessment form. From templates to online calculators, these resources empower taxpayers to streamline their processes and remain compliant.

Users benefit immensely from utilizing a cloud-based platform for tax document management due to the ease of access and collaboration. Success stories demonstrate how businesses and individuals have effectively reduced their administrative burdens by adopting pdfFiller. Ultimately, leveraging these solutions will facilitate a more efficient tax experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my notice of assessment of in Gmail?

Can I edit notice of assessment of on an iOS device?

How do I fill out notice of assessment of on an Android device?

What is notice of assessment of?

Who is required to file notice of assessment of?

How to fill out notice of assessment of?

What is the purpose of notice of assessment of?

What information must be reported on notice of assessment of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.