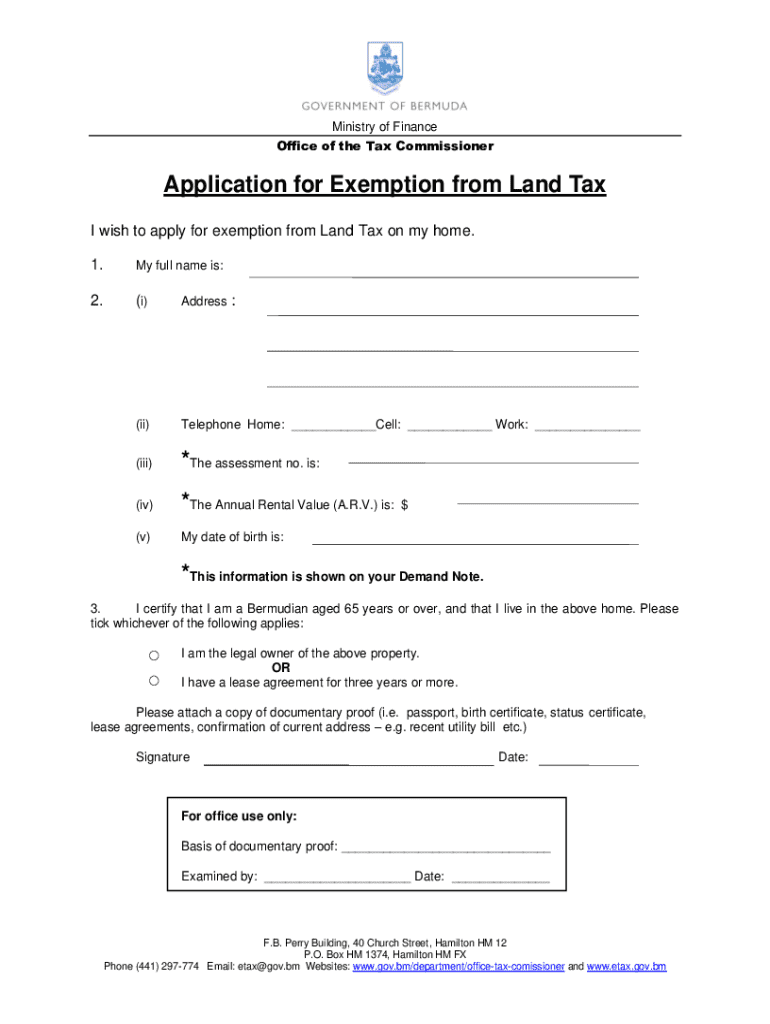

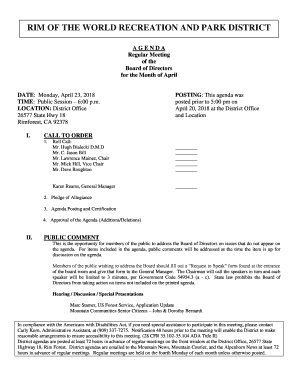

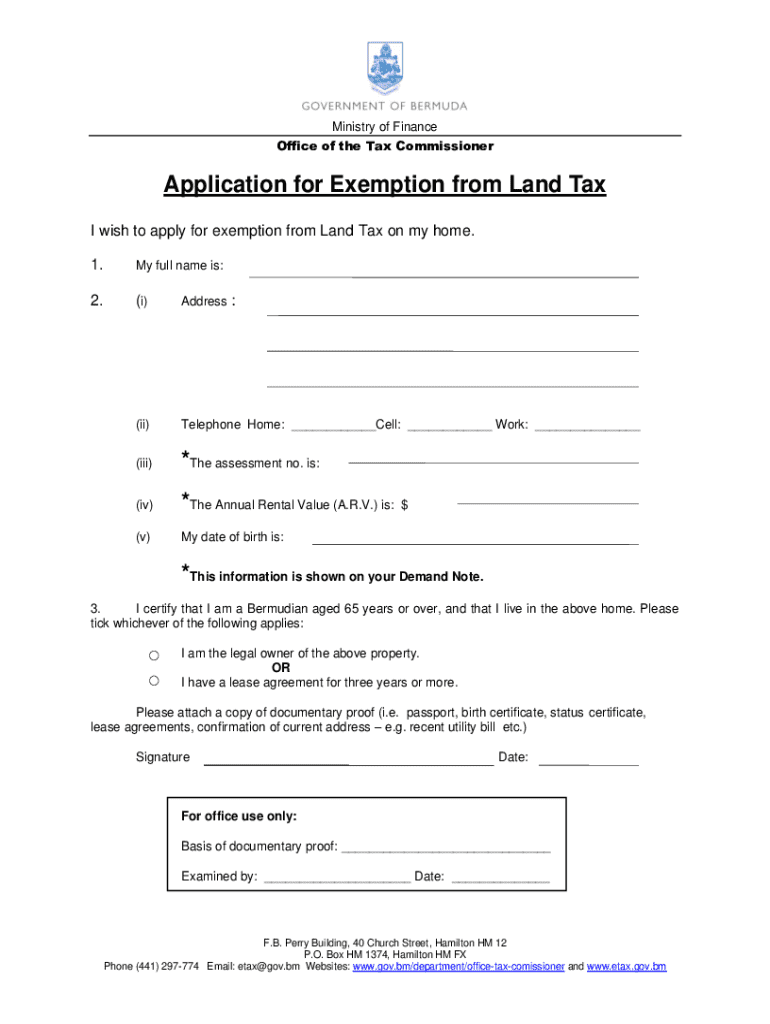

Get the free Application for Exemption From Land Tax

Get, Create, Make and Sign application for exemption from

How to edit application for exemption from online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for exemption from

How to fill out application for exemption from

Who needs application for exemption from?

Application for exemption from form: A comprehensive guide

Understanding the application for exemption

An application for exemption from a form is a formal request to be relieved from the obligation of submitting a specific form, usually under certain conditions or criteria. These exemptions often apply to individuals or organizations unable to fulfill standard documentation requirements due to unique circumstances.

Filing for exemption is essential as it allows individuals and entities to comply with legal or administrative requirements without undue burden. It’s a critical tool for ensuring that those who qualify don’t face unnecessary obstacles that could hinder their operations or personal affairs.

Common scenarios that might necessitate an exemption application include financial hardship, medical conditions, or other extenuating circumstances that render the completion of standard requirements impractical or impossible. Recognizing these scenarios is the first step towards a successful exemption application.

Eligibility criteria for exemption

To successfully apply for an exemption, it’s crucial to understand the eligibility criteria. Key requirements often hinge on factors such as income thresholds and specific types of exemptions available within a jurisdiction. Individuals must consider these aspects carefully to ascertain their qualifications.

Income thresholds can vary significantly depending on the type of exemption. For example, low-income households might qualify for tax-related exemptions, while non-profit organizations may seek exemptions for licensing fees. Assessing which type of exemption applies to your situation is vital.

Identifying your eligibility requires careful documentation. A combination of financial records, identification documents, and proof of circumstances will often be necessary. Gather all relevant paperwork before initiating your application to enhance the process and avoid setbacks.

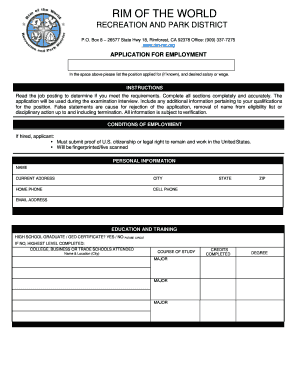

Preparing your exemption application

Preparing your application meticulously is essential for success. Start by gathering necessary documents related to your identity, financial status, and the reasons for seeking an exemption. Identification requirements can vary, but generally, you will need to provide a government-issued ID, proof of income, and any additional documentation relevant to your case.

In addition to identification, supporting evidence can bolster your application. This could include medical records, financial statements, or letters explaining your situation. Ensure that these documents are up to date and clearly outline your circumstances to facilitate the review process.

Drafting your application should include essential information such as your personal details, the type of exemption you are requesting, and a concise explanation of why the exemption is warranted. One common mistake applicants make is providing incomplete or unclear information, which can lead to delays or denials. Double-check your application for accuracy and detail.

Step-by-step process for submitting your application

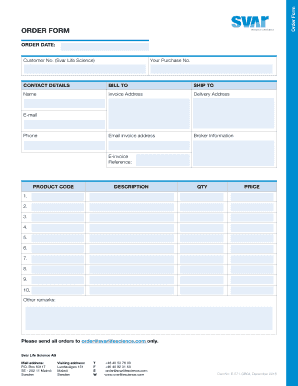

The method of submission can significantly impact the ease of your exemption application process. If you're looking for a streamlined approach, online submission via pdfFiller is highly recommended. To navigate the pdfFiller interface, start by creating an account and locating the necessary exemption form.

When uploading documents through pdfFiller, ensure that they are in acceptable formats, and use the editing tools provided to annotate or enhance your submission. Utilizing e-signature features will simplify the signing process, making it easy to submit your finalized application.

Alternatively, you can submit your application through mail or in-person. For mail-in applications, be sure to double-check that you have adhered to all instructions and included applicable documentation. When submitting in person, follow any specific guidelines set by the receiving office to avoid losing vital documents or missing key steps.

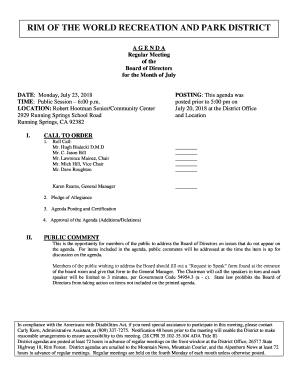

Tracking your application status

After submission, tracking your exemption application can provide peace of mind. pdfFiller offers a user-friendly dashboard that allows you to monitor the status of your application easily. Regular checking can help you stay informed about any required actions or additional documentation needed.

If after a reasonable period you haven't received a decision, you can contact customer support for updates. Be prepared to provide application identifiers or personal information to expedite the process. Additionally, understanding common reasons for denial can prepare you for any challenges you may encounter during the review.

In the event your application is denied, take the time to understand the reasons provided. Many denials result from misunderstandings concerning documentation or criteria. If eligible, consider appealing the decision with renewed clarity on the specific areas that led to denial.

Finalizing your exemption

Once your application is approved, documenting your exemption status is critical. This includes storing your approval notice securely, ideally both digitally and in physical form, to avoid losing crucial evidence of your entitlement. Keeping organized records will facilitate any future needs regarding your exemption.

Renewing your exemption status periodically is another essential step. Many exemptions have expiration dates or require reevaluation based on changed circumstances. Familiarize yourself with the renewal process and timelines to ensure that you stay compliant and avoid any lapses in your exemption status.

Interactive tools and support via pdfFiller

Leveraging interactive tools from pdfFiller can significantly enhance the application experience. Utilizing features such as smart forms can facilitate the collection of necessary data, while enabling easy edits and refinements along the way. This adaptability ensures that all user requirements are met with precision.

Accessing customer support through pdfFiller is straightforward and beneficial. Familiarize yourself with their best practices for assistance, which often include direct chat services and email communications for urgent inquiries. Additionally, community forums and a knowledge base serve as great resources for troubleshooting common issues.

Additional considerations

Staying informed about policy changes relevant to exemption applications is crucial. These policies can evolve, affecting eligibility criteria or procedures. Subscribing to newsletters or following official channels related to your exemptions can be helpful resources for ongoing updates.

Leveraging pdfFiller's features for document management also aids in keeping track of various forms and requirements. Collaborating with others within your organization or family is facilitated by their cloud-based systems, allowing multiple editors and signatories to handle documents efficiently and securely.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application for exemption from for eSignature?

Can I sign the application for exemption from electronically in Chrome?

How do I fill out application for exemption from using my mobile device?

What is application for exemption from?

Who is required to file application for exemption from?

How to fill out application for exemption from?

What is the purpose of application for exemption from?

What information must be reported on application for exemption from?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.