Get the free Safe Harbor 401(k) Notice to Employees

Get, Create, Make and Sign safe harbor 401k notice

How to edit safe harbor 401k notice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out safe harbor 401k notice

How to fill out safe harbor 401k notice

Who needs safe harbor 401k notice?

Safe Harbor 401k Notice Form: How-to Guide Long-read

Understanding the Safe Harbor 401k Notice Form

A Safe Harbor 401k Notice Form is a critical document for employers with 401k retirement plans that aim to encourage employee participation. This form outlines how the plan meets specific IRS requirements that grant it 'safe harbor' status. Safe harbor plans are designed to avoid common compliance testing pitfalls by providing certain minimum benefits to employees, ensuring that the plan is deemed equitable.

The significance of this form lies in its role in fostering transparency and compliance between employers and employees. With a safe harbor 401k plan, employees can enjoy certain contributions from their employer, which can enhance their retirement savings and promote participation in the plan.

Importance for employers and employees

Employers benefit significantly from adopting safe harbor plans as they provide a streamlined path to comply with federal regulations while encouraging employee participation. By offering certain contributions, such as matching or non-elective contributions, employers can attract and retain talent while minimizing the risk of a compliance audit.

For employees, receiving clear and thorough notices means they can make informed decisions about their retirement savings. This form demystifies the plan's provisions, helping participants understand their options and contributions. Transparent communication fosters trust, encouraging higher participation and overall satisfaction with the retirement plan.

Key components of the Safe Harbor 401k Notice Form

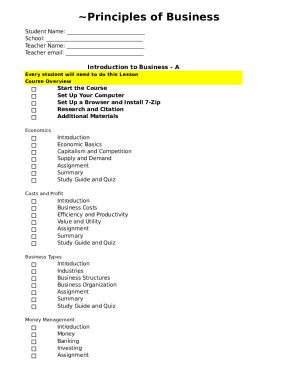

When drafting a Safe Harbor 401k Notice Form, several key components must be addressed to ensure employees receive all necessary information. This includes eligibility criteria, contribution limits, and plan provisions, which must be clearly outlined for optimal understanding.

In terms of format and presentation, it is crucial that the notice is designed with clarity in mind. Using plain language and well-organized sections promotes ease of understanding, reducing the risk of misinterpretation. Accessibility features, such as appropriate font sizes and colors, can also significantly impact how effectively the information is conveyed.

Step-by-step instructions for completing the Safe Harbor 401k Notice Form

To complete the Safe Harbor 401k Notice Form, gather all necessary information beforehand to streamline the process. Required details include the plan's specifications and compliance dates, ensuring you adhere to legal requirements.

After filling out the form, thorough review and proofreading are essential. This ensures that all information is accurate and current, reducing the likelihood of issues arising due to miscommunication.

Best practices for issuing the Safe Harbor 401k Notice

Timing is critical when distributing the Safe Harbor 401k Notice. Employers should issue this notice at least 30 days before the start of the plan year or any time the plan's provisions change. Regular distribution helps maintain compliance and keeps employees informed.

Additionally, employers must revise and redistribute the notice whenever there are changes to the plan's terms or contribution requirements. Keeping the notice up to date is vital for ensuring employees are aware of their rights and available benefits.

Interactive tools for managing Safe Harbor 401k notices

With the rise of digital tools, managing the Safe Harbor 401k Notice Form has become more straightforward. Platforms like pdfFiller provide users with efficient workflows for editing and customizing their forms. You can easily make updates without any hassle.

Using these tools streamlines the process, making it simpler for employers to manage the notices effectively.

Common challenges and solutions in Safe Harbor 401k notices

One primary challenge with the Safe Harbor 401k Notice Form is the potential for employee misinterpretation. Common misconceptions often arise around the eligibility criteria and contribution limits. To mitigate this, providing clarity and context in the notice, along with examples, can enhance understanding.

Compliance issues can also pose challenges. Employers must consistently track regulatory changes and ensure that their notices reflect the most current information. Regular training and updates can help avoid common compliance pitfalls.

Frequently Asked Questions (FAQs) section addressing common inquiries can also be beneficial. Topics such as eligibility, contribution amounts, and adjustments to notices should be clearly answered.

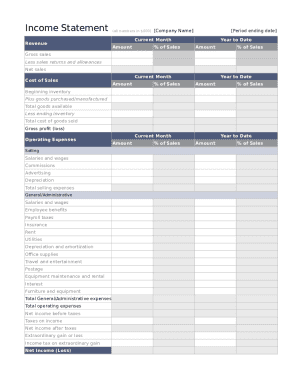

Sample notices and templates

Having access to sample notices can simplify the process of creating your Safe Harbor 401k Notice. A completed form serves as a visual guide that illustrates the key components and formatting requirements, allowing employers to comply with IRS stipulations effectively.

Access to tailored templates will save time and assure compliance with regulatory requirements.

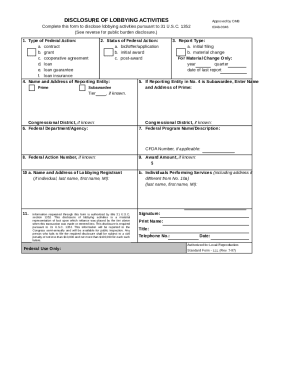

Legal considerations and responsibilities

Complying with the legal requirements surrounding Safe Harbor 401k plans is crucial. IRS regulations dictate specific guidelines regarding contribution levels and eligibility criteria. Employers must stay updated on these stipulations to ensure that their plans remain compliant.

Employers have specific obligations when it comes to disseminating these notices. Failing to provide timely or accurate information can lead to penalties and non-compliance issues. Thus, being proactive and organized in managing these notices ensures that both employer and employee interests are safeguarded.

Utilizing pdfFiller for Safe Harbor 401k notice management

PdfFiller streamlines the entire document management process for Safe Harbor 401k notices. With features designed specifically for handling these forms, users can effortlessly manage compliance paperwork from one central platform.

Using pdfFiller not only simplifies the completion of Safe Harbor 401k Notice Forms but also enhances overall document handling, ensuring a more organized approach to compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit safe harbor 401k notice on a smartphone?

How can I fill out safe harbor 401k notice on an iOS device?

How do I complete safe harbor 401k notice on an Android device?

What is safe harbor 401k notice?

Who is required to file safe harbor 401k notice?

How to fill out safe harbor 401k notice?

What is the purpose of safe harbor 401k notice?

What information must be reported on safe harbor 401k notice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.