Get the free Credit Card Deduction Change Request Form

Get, Create, Make and Sign credit card deduction change

How to edit credit card deduction change online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card deduction change

How to fill out credit card deduction change

Who needs credit card deduction change?

Comprehensive Guide to Credit Card Deduction Change Form

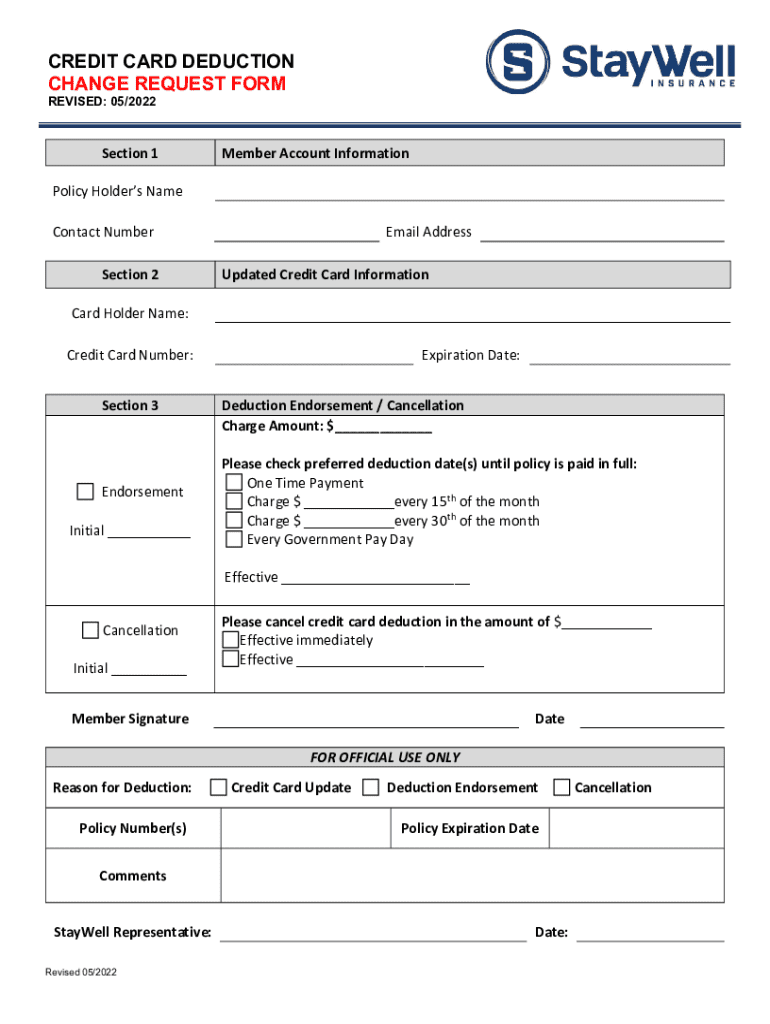

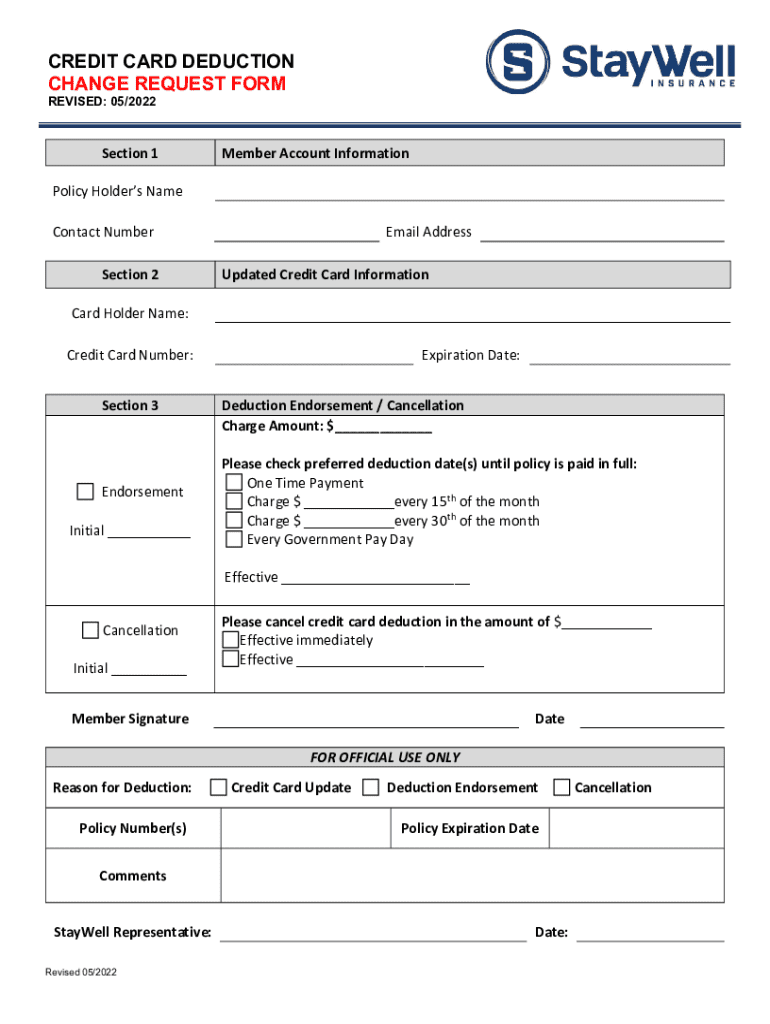

Overview of the credit card deduction change form

A credit card deduction change form is a critical document that enables individuals and organizations to modify their existing recurring credit card payments. Its primary purpose is to ensure that billing information is up-to-date, reflecting any changes in financial circumstances or preferences. This form is essential for the seamless management of financial transactions, helping to avoid missed payments or incorrect charges.

For individuals, this form aids in managing subscriptions and automatic payments, while teams can use it to handle shared expenses accurately. Properly documenting these changes aids in minimizing financial discrepancies and enhancing overall financial management.

Understanding credit card deduction changes

Changes in credit card deductions may arise from a variety of circumstances. The most common scenarios prompting such changes include relocating to a new address, shifts in income, or changes in financial priorities. For example, you might need to switch your payment method due to moving to a new bank or needing to update your credit card details after receiving a new card.

When credit card deductions are incorrect or not aligned with your current needs, they can have significant repercussions. Incorrect deductions can lead to budgeting issues, where you may overspend or face unexpected charges, ultimately disrupting your financial planning.

Key components of a credit card deduction change form

Filling out a credit card deduction change form requires specific information to ensure that the request is processed smoothly. Key components typically include personal identification details such as your name, address, and contact information. Additionally, you need to provide your credit card information, including the card number and expiration date, to verify the payment method.

Furthermore, you'll need to specify the reason for the deduction change, as this helps the processing authority understand the context of your request. Importantly, understanding the terms and conditions associated with your credit card is crucial. Providing inaccurate information can lead to rejection or delays in processing your request.

Step-by-step guide to filling out the credit card deduction change form

Here's a step-by-step guide to help you fill out the credit card deduction change form accurately.

Tips for editing and managing your credit card deduction change form

Utilizing tools offered by pdfFiller can simplify the editing process for your credit card deduction change form. With features that allow you to edit and sign documents easily, you can ensure everything is accurate and tailored to your needs. pdfFiller’s user-friendly interface allows you to make changes quickly without hassle.

If you're part of a team or organization, collaborating is straightforward. You can share your completed form with relevant team members or stakeholders, facilitating collective input. Gathering electronic signatures is also streamlined through pdfFiller, allowing for a swift approval process.

Frequently asked questions (FAQs)

It's common to have questions surrounding the credit card deduction change form. Here are some frequently asked queries:

Best practices for submitting the change form

To ensure that your credit card deduction change form is submitted properly, adhere to these best practices:

Maintaining financial health post-submission

Once you've submitted your credit card deduction change form, monitoring your new deductions is vital. Regularly check your financial statements to ensure the changes have been implemented correctly. This ensures that you remain informed about your financial position and prevents any unexpected issues.

Adjusting your budget is equally important. By integrating new deductions into your monthly budget, you can maintain financial stability and plan accordingly for your expenses. Tracking these changes can help you manage your finances more effectively.

Additional information for users

There are several resources available to assist users in managing their financial affairs and credit card needs. Seeking out financial planning resources can provide valuable insights into managing budgets, expenses, and investments effectively. Additionally, if you require further assistance with credit card management or the change form process, don’t hesitate to contact your financial institution.

Furthermore, utilizing other features of pdfFiller can enhance your document management experience. From editing to eSigning, exploring these tools can streamline all of your documentation processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card deduction change without leaving Google Drive?

How do I edit credit card deduction change online?

Can I create an eSignature for the credit card deduction change in Gmail?

What is credit card deduction change?

Who is required to file credit card deduction change?

How to fill out credit card deduction change?

What is the purpose of credit card deduction change?

What information must be reported on credit card deduction change?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.