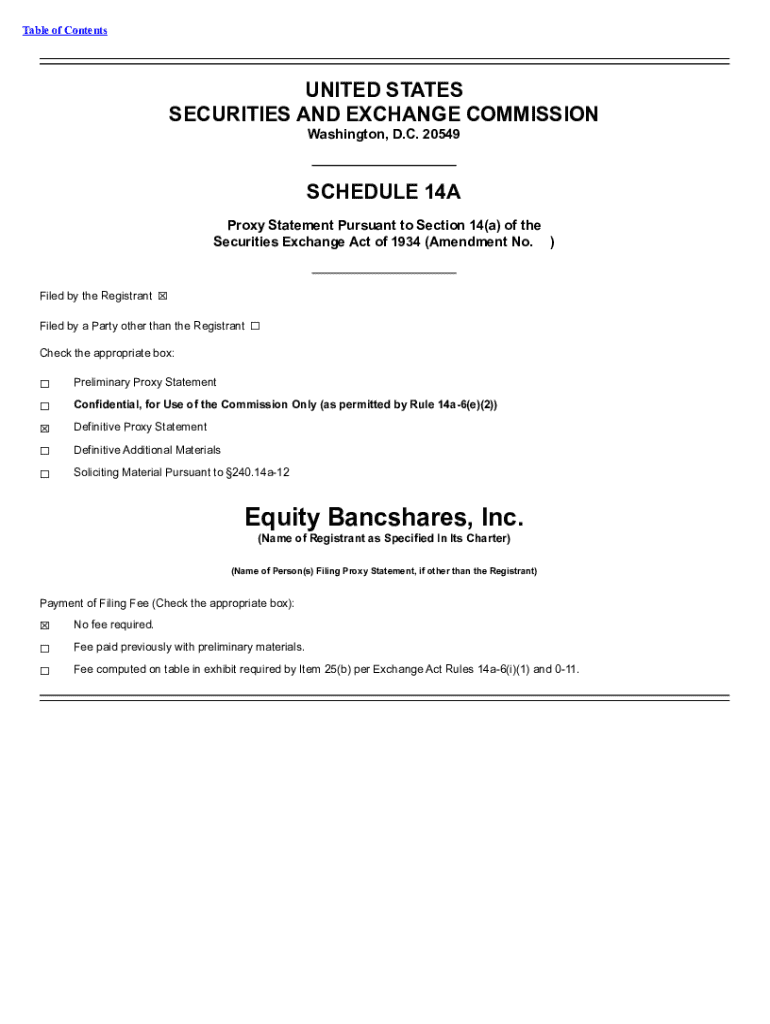

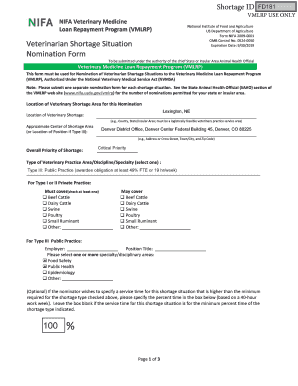

Get the free Schedule 14a

Get, Create, Make and Sign schedule 14a

How to edit schedule 14a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 14a

How to fill out schedule 14a

Who needs schedule 14a?

Schedule 14A Form: A Comprehensive How-to Guide

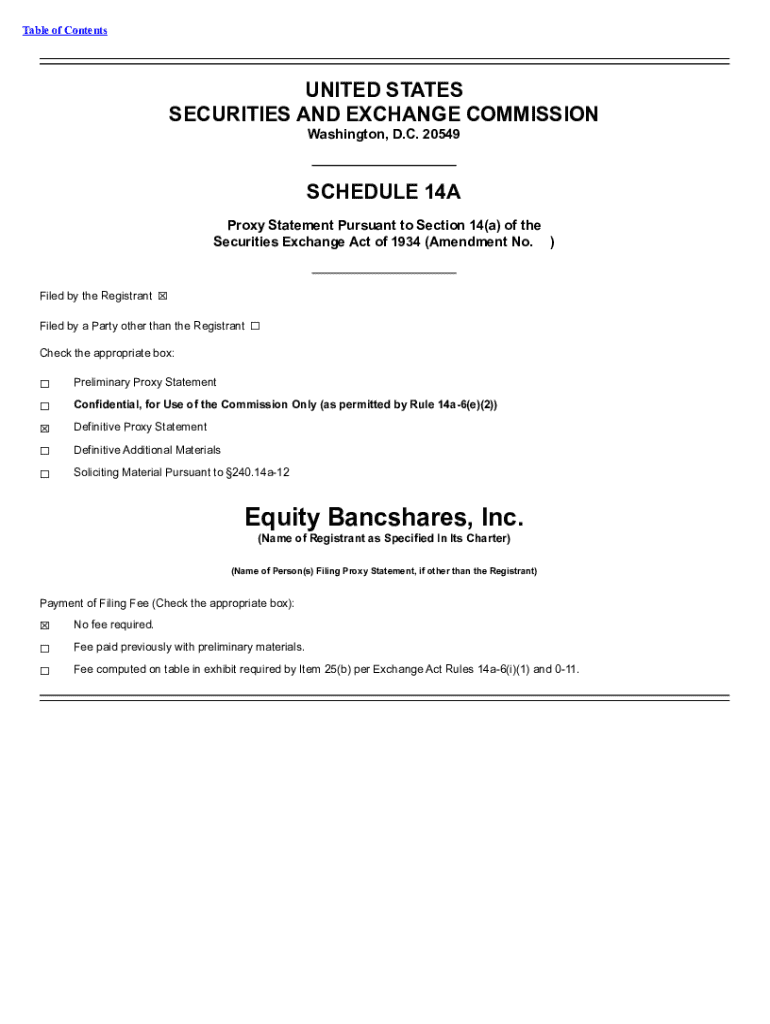

Understanding the Schedule 14A Form

The Schedule 14A Form is a crucial document filed with the Securities and Exchange Commission (SEC) as part of the proxy materials provided to shareholders. This form serves as a platform for corporations to disclose vital information regarding matters that require shareholder voting, including executive compensation, director elections, and other corporate governance issues. Its primary purpose is to ensure transparency in shareholder communications, fostering trust and informed decision-making.

Incorporating Schedule 14A filings into corporate governance practices not only aligns with regulatory requirements but also enhances the robustness of shareholder engagement processes. Properly completed filings guarantee that shareholders are equipped with relevant insights, thus supporting an informed vote.

Navigating the Schedule 14A Filing Process

Understanding who needs to file the Schedule 14A Form is essential for compliance. Most publicly traded corporations are mandated to file this form when soliciting shareholder votes, especially regarding annual meetings. However, there are exceptions, such as smaller reporting companies, which may face different requirements based on their reporting statuses.

Filing deadlines for the Schedule 14A may vary depending on the nature of the information disclosed and the size of the company. It is important to establish an internal timeline that aligns with SEC deadlines. Preparation typically involves collecting comprehensive information from various departments, ensuring accuracy, and ensuring full compliance with the rules set forth by the SEC.

Detailed Breakdown of Schedule 14A Sections

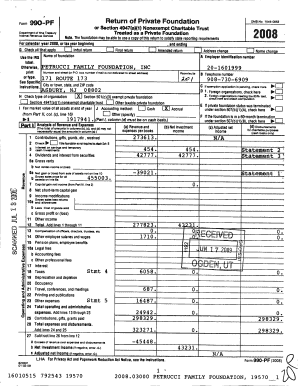

The Schedule 14A is structured to provide clear directives on several significant aspects of corporate governance. One of the key segments pertains to executive compensation disclosure. Companies are required to provide a clear picture of their executive pay packages, including salary, bonuses, stock options, and retirement plans. Transparency in this sphere is essential, as it not only meets regulatory requirements but also fosters a sense of accountability towards shareholders.

Another essential component of the Schedule 14A Form is the section on proposals and voting rights. This section elaborates on shareholder proposals — initiatives put forth by shareholders aiming to influence corporate practices. Such proposals play an important role in guiding corporate governance, allowing shareholders a voice in decision-making processes and directly impacting the direction of company policies.

Common challenges and solutions in completing Schedule 14A

Completing the Schedule 14A can present several challenges, particularly due to the complex legal language often used in filings. Interpreting these provisions and articulating them effectively is crucial. To address this, companies can involve legal professionals early in the drafting process and utilize clear, straightforward language wherever possible to ensure that shareholders clearly understand the disclosures.

Collecting the necessary information for the form represents another hurdle. Departments across the company, such as HR, finance, and legal, must collaborate to gather comprehensive data. This collaborative approach ensures that all pertinent information is accounted for and minimizes the risk of errors in the final submission. Companies should consider implementing project management tools to facilitate this data collection.

Leveraging technology for Schedule 14A filings

In the digital age, utilizing technology to streamline the Schedule 14A filing process can enhance both accuracy and efficiency. Employing digital tools such as pdfFiller allows companies to create, edit, and manage the Schedule 14A Form seamlessly. With the platform’s e-signature capabilities, obtaining necessary approvals becomes a hassle-free process.

Security is also a paramount concern when handling sensitive information related to Schedule 14A filings. Digital platforms like pdfFiller offer compliance management features that ensure secure document handling, from preparation to submission, thereby safeguarding shareholder data.

Impact of Schedule 14A on corporate dynamics

The Schedule 14A Form plays a significant role in shaping investor relations. Transparency and clear communication through these filings foster trust between companies and their shareholders. By providing shareholders with detailed information about governance and executive compensation, corporations demonstrate a commitment to accountability, which can influence investment decisions.

In addition, the corporate governance landscape is heavily influenced by the information disclosed in the Schedule 14A. By emphasizing governance structures and practices, companies can position themselves favorably in the eyes of investors, potentially increasing shareholder loyalty and enhancing corporate reputation.

Additional tools and resources for Schedule 14A filers

Accessing interactive templates can significantly ease the preparation of the Schedule 14A Form. Many online platforms, including pdfFiller, provide customizable templates that guide users through the necessary sections. These templates serve as excellent reference points, ensuring that filers include all requisite information while maintaining compliance with SEC regulations.

Additionally, educational resources such as webinars and newsletters can greatly assist those involved in the filing process. Staying informed on regulatory updates and new best practices ensures that individuals and teams are equipped to manage the complexities of Schedule 14A filings effectively.

Engaging with experts

Consulting with legal and financial professionals who specialize in corporate governance matters can provide invaluable insights when preparing the Schedule 14A. These experts can offer guidance on specific legal language, compliance requirements, and best practices, ensuring that submissions are not only complete but also strategically advantageous.

Building a network of professionals can further support teams in navigating complex regulatory environments. Workshops, and networking events focusing on corporate governance and SEC filings provide opportunities to learn and exchange ideas with industry veterans.

Related topics and further reading

Aside from Schedule 14A, understanding related forms such as the Form 10-K and Form DEF 14A is critical for anyone involved in corporate governance. Each of these forms serves specific purposes in SEC reporting and shareholder communication. Familiarity with how these forms relate to one another allows filers to craft comprehensive reports that fulfill regulatory requirements.

Furthermore, keeping an eye on upcoming trends in corporate filings is essential. The regulatory environment is constantly evolving, and adapting filing strategies to meet new requirements ensures ongoing compliance and operational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my schedule 14a in Gmail?

How can I modify schedule 14a without leaving Google Drive?

How can I send schedule 14a for eSignature?

What is schedule 14a?

Who is required to file schedule 14a?

How to fill out schedule 14a?

What is the purpose of schedule 14a?

What information must be reported on schedule 14a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.