Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding Form 8-K: Essential Insights for Companies and Investors

Understanding Form 8-K: An Overview

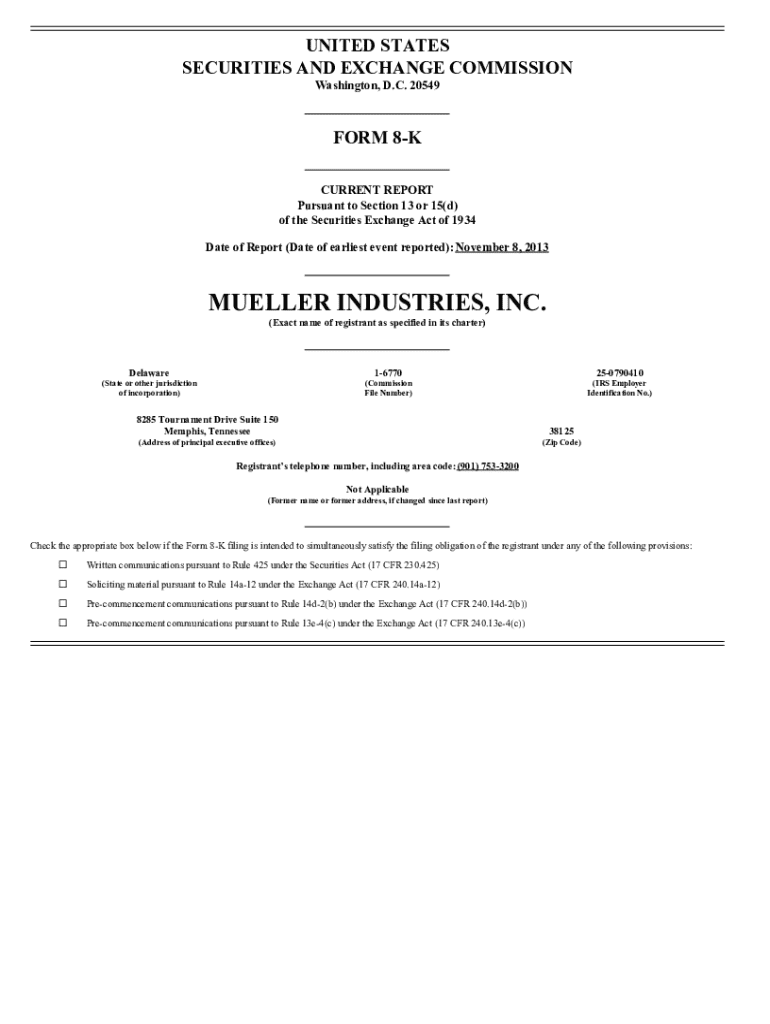

Form 8-K is a crucial report that publicly traded companies in the U.S. must file with the Securities and Exchange Commission (SEC) to disclose significant events or corporate changes that could potentially affect shareholders. This form plays a pivotal role in corporate governance, ensuring that investors stay informed about crucial developments said to impact investment decisions.

Since its introduction in 1934, Form 8-K has evolved alongside regulatory changes aimed at enhancing transparency and accountability within the financial markets. The form serves as an official notice, ensuring timely reporting of significant events, thus facilitating a more informed investment environment.

When is Form 8-K required?

Companies are required to file Form 8-K in response to specific events designated by the SEC. Certain situations trigger the necessity of submitting this form, which helps create a robust framework for corporate communication.

Following the occurrence of any of these significant events, companies must adhere to strict filing deadlines, typically filing Form 8-K within four business days.

Navigating the structure of Form 8-K

Form 8-K comprises various sections designed to capture essential information accurately. Each section is typically categorized by item numbers corresponding to the specific situations that necessitate the filing.

In filling out Form 8-K, companies must provide detailed descriptions of each event, adhering closely to the SEC's guidelines to avoid common pitfalls such as incomplete disclosures or erroneous data.

Reading and interpreting Form 8-K

Decoding Form 8-K involves understanding key terminology and being able to analyze the financial implications of the reported events. Investors should familiarize themselves with terms commonly found in these filings to enhance their comprehension.

Understanding how to analyze these terms within a filing can serve as a valuable skill for investors keen to navigate potential investments, especially when seeking to identify risks or opportunities that arise from significant corporate events.

Form 8-K items: A deep dive

Each item on Form 8-K conveys crucial information pertinent to stakeholders. For instance, Item 1.01 pertains to entering material agreements, providing insights into upcoming ventures that could influence market perception.

Analyzing historical Form 8-K filings can reveal significant trends in corporate governance and investor relations, illustrating how events have influenced stock performance over time.

Benefits of filing Form 8-K

Filing Form 8-K has numerous benefits for companies, particularly in enhancing transparency and fostering trust with investors. By providing timely disclosures, firms can mitigate reputational risks and demonstrate adherence to regulatory requirements.

For investors, Form 8-K filings serve as a valuable tool, providing real-time insights that can inform investment decisions, assess risk, and understand market reactions to significant corporate events.

Best practices for filing Form 8-K

Establishing internal protocols for monitoring events that may require a Form 8-K filing is crucial. Companies should invest in a systematic approach to ensure smooth and timely disclosures.

Leveraging technology not only simplifies the filing process but also enhances accuracy and ensures effective communication within teams regarding necessary disclosures.

Frequently asked questions about Form 8-K

Despite its significance, there remains confusion surrounding Form 8-K. Understanding the implications of filing timelines and accuracy is essential for companies.

Interactive tools and resources

To aid companies and individuals in the filing process, various tools and resources are available. Templates for Form 8-K can streamline the documentation process, ensuring consistency.

Interactive resources and platforms like pdfFiller empower users with cloud-based editing and management tools, fostering efficient document handling and collaboration.

Industry insights and trends in 8-K filings

As regulatory landscapes shift, recent changes affecting Form 8-K have garnered attention. Keeping abreast of updates in SEC rules can collectively shape corporate reporting practices.

Staying informed about these trends can equip companies and investors with the knowledge needed to navigate investments prudently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 8-k directly from Gmail?

How do I complete form 8-k online?

How do I fill out the form 8-k form on my smartphone?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.