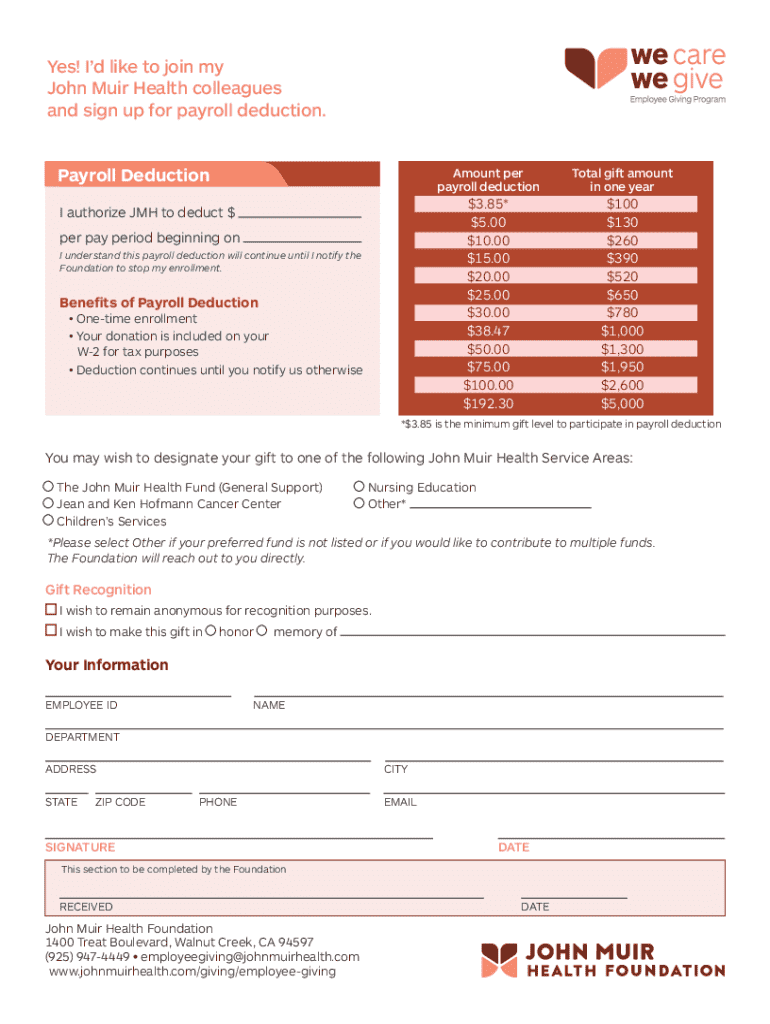

Get the free Give the Gift of Health Through John Muir Health

Get, Create, Make and Sign give form gift of

How to edit give form gift of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out give form gift of

How to fill out give form gift of

Who needs give form gift of?

How to Give the Gift of Form: A Comprehensive Guide

Understanding the concept of a gift of form

A gift of form is a formalized method of transferring ownership or rights of an asset from one individual, the donor, to another, the recipient, through structured documentation. This concept is essential because it ensures the transaction is legally recognized and can protect the rights of both parties.

Formalizing gifts through documentation not only satisfies legal requirements but also enhances clarity in ownership and expectations regarding the gifted item. Additionally, it avoids potential disputes or misunderstandings that could arise in informal arrangements.

The legal implications of a gift of form are significant. Failing to document a gift correctly can lead to complications, especially during events such as tax assessments or disputes among beneficiaries. Understanding these implications forms the basis of a secure gifting process.

Key components of a gift of form

When preparing a gift of form, several main elements must be clearly defined to ensure the document is comprehensive and legally sound. These components include:

Common types of forms used for gifting include a 'Gift Affidavit' and a 'Gift Deed'. Each serves different purposes but reinforces the necessity of detailed documentation in gifting.

When to use a gift of form

Formal documentation for gifting should be utilized in various situations. For instance, when transferring high-value assets such as real estate, vehicles, or significant financial gifts, a gift of form becomes crucial.

The benefits of using a formal gift form include legal clarity, protection against misunderstandings, and, in some cases, tax benefits for both the donor and the recipient. In addition, formal documents become significant during estate assessments or legal disputes.

Some exceptions may exist; small or informal gifts often do not require documentation, but there remains a risk of ambiguity without it. When in doubt, however, it's wise to opt for formalization.

Step-by-step guide to preparing a gift of form

Preparing a gift of form involves a structured approach to ensure all essential elements are covered. Here's a step-by-step guide:

Interactive tools for managing a gift of form

Utilizing technology can streamline the process of managing your gift of form. pdfFiller offers various features that enhance document management, including easy editing, e-signatures, and cloud-based storage.

Collaborative tools enable teams to work effectively on drafting and reviewing documents. This ensures that all stakeholders are informed, and their feedback can be incorporated quickly.

Moreover, pdfFiller allows users to request edits and approvals through its platform, further simplifying the gifting process and ensuring all documentation is accurate and legally enforceable.

Common mistakes to avoid when gifting

When preparing a gift of form, certain pitfalls are common. Frequent errors include:

Related documents in the gifting process

In addition to a gift of form, various other documents may be relevant in the gifting process. For example, a 'Letter of Gift' serves as a personal touch that outlines the donor's intentions and feelings about the gift.

Donation receipts also play a role, particularly if the recipient plans to claim a tax deduction based on the gift received. Understanding how these documents interconnect enhances the integrity of the overall gifting transaction.

Exploring ways to give beyond traditional forms

While traditional gifting uses tangible assets documented through a gift of form, non-monetary gifts also deserve attention. Items such as experiences, knowledge, or skills can provide significant value without the need for formal documentation.

Charitable donations represent another avenue for gifting, where appropriate documentation aids in record-keeping and tax deductions as applicable. Utilizing pdfFiller can greatly enhance your ability to create custom documents tailored to different gifting scenarios.

Enhancing your gifting experience with technology

pdfFiller is designed to empower users in managing their gifting process with ease. Its cloud-based platform allows for access from anywhere, enabling users to edit documents, obtain e-signatures, and collaborate seamlessly.

Additionally, the document management features ensure that all gifts are documented properly and are easily retrievable for future reference. This organization not only fosters efficiency but also enhances the overall gifting experience.

Frequently asked questions about gifting using forms

Many individuals have questions regarding legal requirements for gifts. The most common queries revolve around the need for documentation, applicable tax regulations, or specific conditions that necessitate formalization.

Using pdfFiller for gifting documentation simplifies the process, with FAQs addressing user concerns and troubleshooting common issues. Informing oneself can make the gifting process smoother and ensure all parties are protected.

By understanding the intricacies of giving a gift of form, individuals and teams can navigate the gifting process confidently. From gathering required information to utilizing modern tools like pdfFiller, each step enhances the gifting experience and ensures all legalities are respected.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit give form gift of on an iOS device?

How do I complete give form gift of on an iOS device?

How do I fill out give form gift of on an Android device?

What is give form gift of?

Who is required to file give form gift of?

How to fill out give form gift of?

What is the purpose of give form gift of?

What information must be reported on give form gift of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.