Get the free Form or-10 Instructions

Get, Create, Make and Sign form or-10 instructions

Editing form or-10 instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form or-10 instructions

How to fill out form or-10 instructions

Who needs form or-10 instructions?

Comprehensive Guide to Form OR-10 Instructions Form

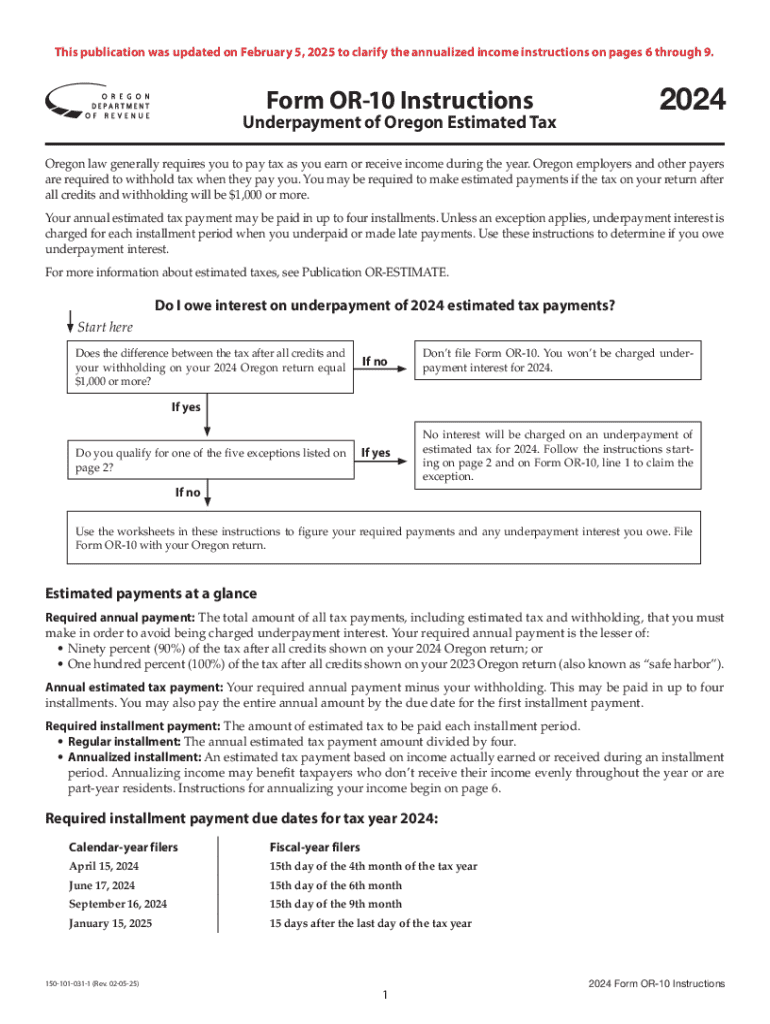

Overview of Form OR-10

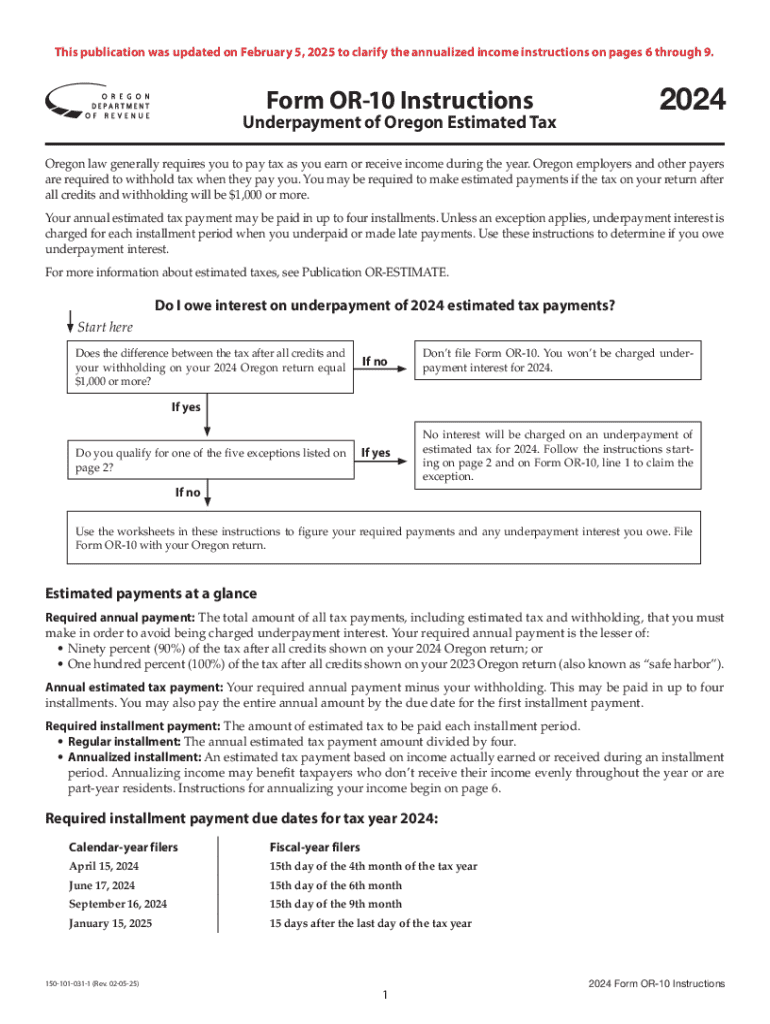

Form OR-10 is an integral document utilized by residents of Oregon for the purpose of reporting their state income and determining tax liabilities. The main objective of this form is to facilitate the assessment and collection of taxes according to Oregon's tax regulations. It assists the state in gathering pertinent financial information from taxpayers, which is necessary for proper tax calculation.

Understanding the significance of the OR-10 form is crucial for compliance with state tax laws. Filing this form accurately ensures that you fulfill your tax obligations while also enabling the state to secure revenue. It’s vital for taxpayers to recognize whether they fall into the category that requires them to submit this form.

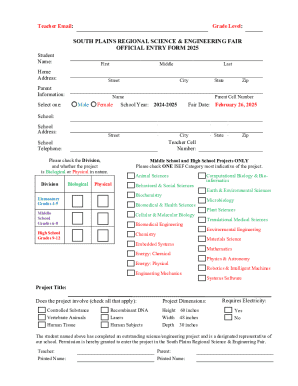

Who should file the OR-10 form

The OR-10 form is designed primarily for individuals who meet specific criteria according to Oregon's tax regulations. Generally, anyone who resides in Oregon and has a taxable income must complete this form. Additionally, non-residents who earn income from sources within the state also have an obligation to file.

Certain exceptions exist to ease the burden of tax filing. For example, individuals whose income falls below the threshold set forth by the state may be exempt from filing. Similarly, some individuals or teams, such as those involved in specific types of non-profit work, might find themselves outside the purview of requiring an OR-10 form.

Understanding the structure of Form OR-10

Form OR-10 is carefully structured to efficiently capture necessary financial data from filers. It consists of several key sections that gather individual-specific information, including personal demographics, income details, and eligible deductions and credits. Each section is crucial for enabling the accurate processing of the submitted form.

The 'Personal Information Section' requires data such as your name, address, and Social Security number, which are necessary for identification and linking to state records. The 'Income Section' focuses on all sources of income—wages, interest, dividends, and more—that contribute to your overall financial picture. Deductions and credits are equally important as they help reduce the taxable income you report, thus potentially lowering your tax liability.

Step-by-step instructions for filling out Form OR-10

Beginning the process of filling out Form OR-10 requires the preparation of necessary documents. Collecting these documents in advance will simplify the process and minimize errors during form completion. Essential documents may include W-2 forms, 1099 forms for other income sources, and receipts for deductible expenses.

Here is a breakdown of the sections you will fill out along with detailed instructions.

In order to avoid common mistakes such as incorrect Social Security numbers or misreported income amounts, double-check all entries for accuracy. Taking the time to review each section can safeguard against delays or complications post-submission.

Editing and customizing the OR-10 form

Using tools like pdfFiller, completing and customizing your Form OR-10 digitally becomes much simpler. Uploading your PDF document allows you to make necessary edits directly on your device. The platform offers various features, such as document signing and the ability to add annotations for future reference.

For teams working together on the form, collaborative options available through pdfFiller facilitate real-time updates, allowing multiple users to access and alter the document as needed. This streamlining of workflow ensures that the task remains efficient and organized.

Electronic signing and submission process

In today’s digital landscape, electronic signatures have become a vital component of the document submission process. By signing Form OR-10 electronically, you significantly reduce the time and complexities associated with traditional paper methods.

Signing the form electronically is straightforward. First, ensure that all sections of the OR-10 are completed accurately. Next, utilize the signing feature in pdfFiller to apply your signature digitally. Once signed, you will have various options for submission.

Managing your OR-10 form after submission

Once your Form OR-10 has been submitted, managing its status becomes essential. You can track the progress of your submission through the Oregon Department of Revenue’s online portals. This process allows you to stay updated on any potential issues or required actions following your filing.

Additionally, maintaining copies of your submitted forms is crucial for your records. Storing these documents securely ensures that you have access to them for future reference and for any potential audits. Always keep copies of your documents in a designated file for easy access.

Common issues and how to resolve them

Filing taxes can often generate questions and concerns among taxpayers. One of the most frequently asked queries about Form OR-10 pertains to the filing process itself—specifically related to deadlines and requirements. It’s important to familiarize yourself with the filing dates and be aware of potential penalties for late submissions.

Another common issue involves the need to amend or correct previous submissions. If a mistake is discovered after submission, it’s crucial to take action promptly. Oregon provides a structured process for making amendments, including specific guidelines for recording corrections to previously filed forms.

Privacy and data protection

When handling sensitive personal information, understanding your privacy rights is paramount. Tax documents like Form OR-10 require confidentiality, which is protected under various state laws.

pdfFiller prioritizes security, utilizing advanced technology to safeguard your documents. The platform employs encryption and robust data protection measures, ensuring your personal information remains secure during the editing, signing, and submission processes.

Language and accessibility options

Language barriers should not hinder compliance. Resources are available for non-English speakers to assist in understanding and properly completing the OR-10 form. Various guides and translation services can simplify the process.

Moreover, pdfFiller provides accessibility features that cater to individuals with disabilities, ensuring that everyone can navigate the platform and complete their tax forms effortlessly.

Feedback and improvements

User feedback plays a critical role in enhancing the OR-10 filing experience. Taxpayers are encouraged to share their insights and experiences, which can inform future updates and improvements to the process. Oregon's tax authorities value input from constituents to refine their systems and make filing more user-friendly.

Continuous improvements based on user input create a more efficient and transparent process. By fostering this dialogue, the state ensures that taxpayer needs are met in a timely and effective manner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form or-10 instructions from Google Drive?

How do I edit form or-10 instructions straight from my smartphone?

How do I fill out form or-10 instructions using my mobile device?

What is form or-10 instructions?

Who is required to file form or-10 instructions?

How to fill out form or-10 instructions?

What is the purpose of form or-10 instructions?

What information must be reported on form or-10 instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.