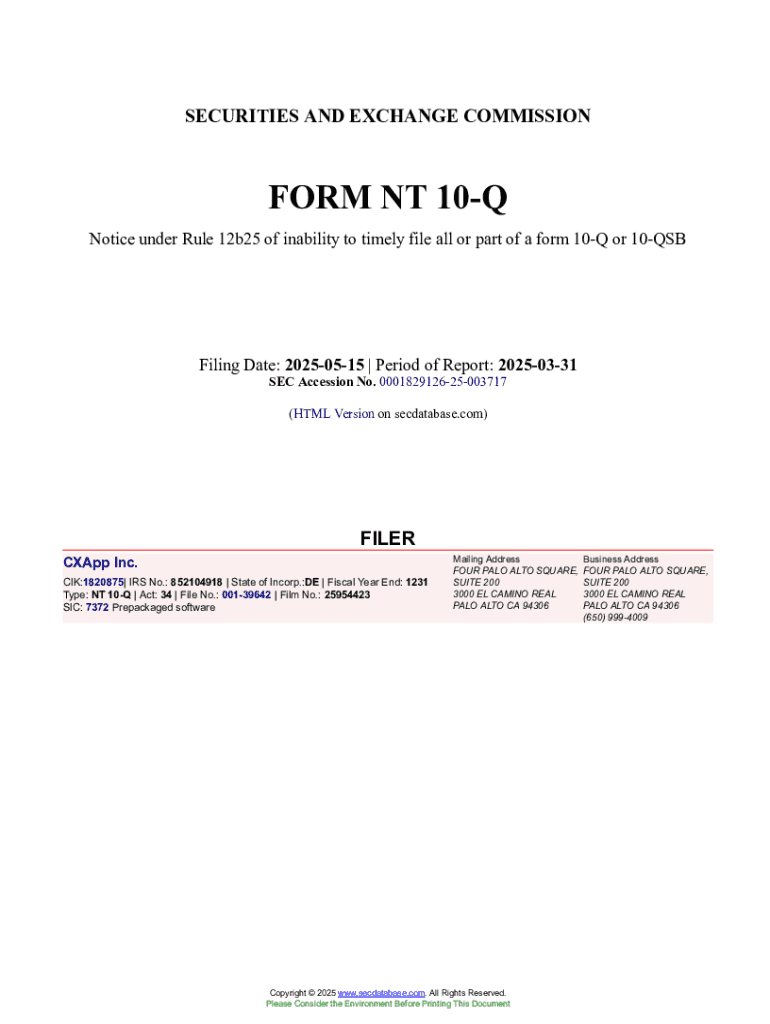

Get the free Form Nt 10-q

Get, Create, Make and Sign form nt 10-q

How to edit form nt 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form nt 10-q

How to fill out form nt 10-q

Who needs form nt 10-q?

How to Fill Out a Form NT 10-Q

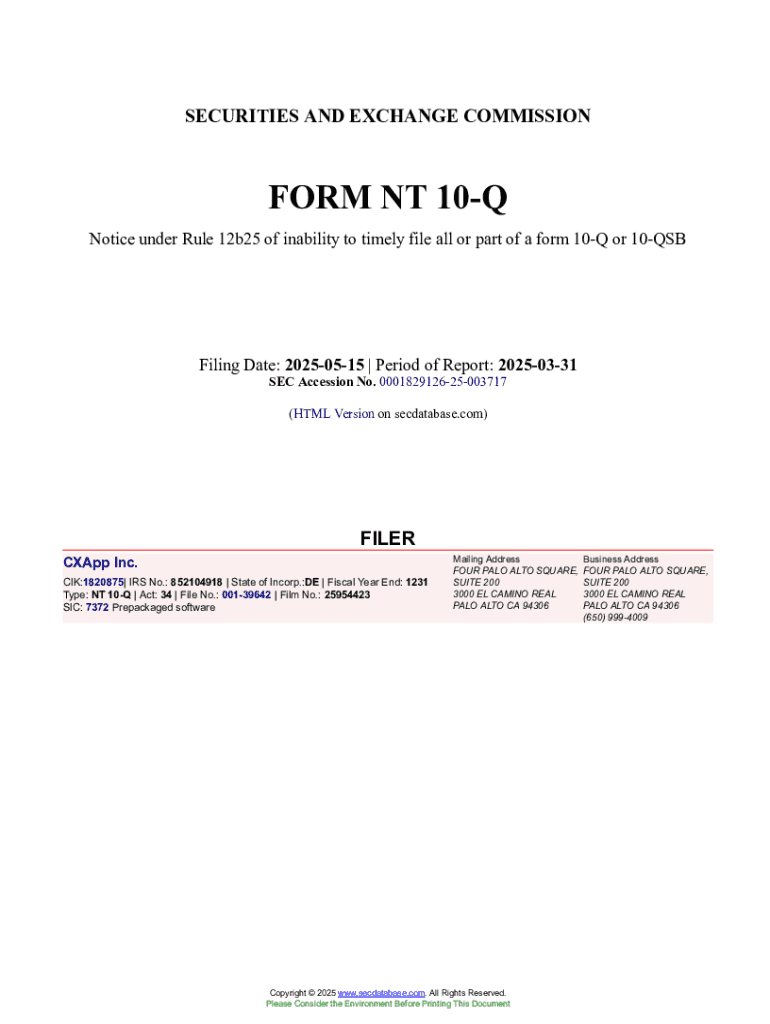

Understanding the Form NT 10-Q

Form NT 10-Q is a crucial document that publicly traded companies use to request additional time to file their quarterly reports. This form serves a dual purpose: it informs the Securities and Exchange Commission (SEC) of the delay and ensures that investors and stakeholders are aware of the company’s intentions regarding its financial disclosures. By officially notifying the SEC, companies can maintain transparency and protect their reputations, which is vital for investor confidence.

The importance of Form NT 10-Q cannot be overstated, as it provides companies with an extension to finalize their financial statements, which are often complex and time-consuming to prepare. Ensuring timely and accurate disclosures is essential not only for compliance but also for maintaining market integrity.

Who needs to file Form NT 10-Q?

Publicly traded companies are required to file Form NT 10-Q when they anticipate being unable to meet the filing deadline for their quarterly report. The primary criteria for filing include being subject to the SEC's regulations and facing circumstances that would warrant an extension, such as technical issues, significant legal matters, or the need for additional time to accrue and finalize data. Failing to file on time can have serious repercussions, including fines, loss of investor trust, and negative impacts on stock price.

Companies that meet these criteria must ensure they file Form NT 10-Q correctly and on time to minimize potential negative effects. Investors closely monitor these filings, as delayed disclosures may signal underlying issues within the company.

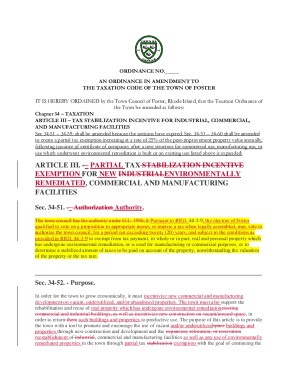

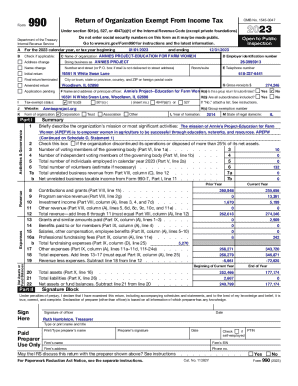

Key components of Form NT 10-Q

Form NT 10-Q consists of specific data fields that must be filled out correctly to convey the necessary information to the SEC. Each section of the form serves a distinct purpose, requiring different types of information, including the reason for the delay, the proposed filing date, and the company’s details. Understanding these components is vital for companies to ensure compliance and maintain their credibility in the market.

Common terminologies within the form include 'issuer,' which refers to the company filing the NT 10-Q, 'period covered,' specifying the quarter of the financial report, and 'expected filing date,' which indicates when the company anticipates submitting the complete 10-Q. Accurate understanding and usage of these terms can significantly affect the filing process and its reception by the SEC.

Filing options for Form NT 10-Q

Companies can file Form NT 10-Q electronically via the SEC’s EDGAR system, which provides a streamlined process. To access EDGAR, users must navigate to the official SEC website where they can log in or create an account, depending on their filing needs. The platform guides the user step-by-step through the filing process, ensuring that all required fields are completed accurately.

For companies that encounter technical difficulties or prefer a more traditional approach, filing by mail is also an option, although it is less commonly used today. Key considerations for offline filing include ensuring that the form is completed in full and mailed to the correct SEC address to avoid processing delays.

Preparing to fill out Form NT 10-Q

Before diving into the details of Form NT 10-Q, it is pivotal to gather all necessary documentation. This includes recent financial statements, stakeholder letters, management discussions, and any other relevant reports that could assist in justifying the delay. Having all information readily accessible can expedite the completion of the form and reduce errors.

Establishing a timeline is equally important when preparing for the filing of Form NT 10-Q. Companies should set internal deadlines that allow ample time for reviewing and editing the document prior to its submission to the SEC. Awareness of important deadlines, including the original filing date for the 10-Q and the extension period, is crucial for effective planning.

Step-by-step instructions for completing Form NT 10-Q

Completing Form NT 10-Q involves filling in several critical sections, each requiring specific information. The form typically starts with the issuer’s details, including the company’s name and contact information. Following this, companies must provide the period for which the 10-Q report is being filed and an explanation of the reasons for the filing delay.

Careful attention should be given to ensure that all required information is accurate and that the submitted rationale for the delay is clear and concise. A common pitfall is to provide vague explanations which could lead to the SEC requesting additional clarification, complicating the process. A thorough review and revisions of the document can catch errors or unclear language that may hinder acceptance.

Tools for managing Form NT 10-Q filings

Utilizing pdfFiller can significantly streamline the document creation and management process for Form NT 10-Q. The platform allows users to create, edit, and sign documents efficiently, making it ideal for teams working collaboratively on filings. pdfFiller’s cloud-based system means that information can be accessed from anywhere, allowing for flexibility in completing documents.

Beyond pdfFiller, other software tools can also aid in filling and filing requirements. These tools typically offer features like synchronization with financial data, document sharing capabilities, and electronic signature options. Choosing the right software can enhance efficiency and reduce the potential for errors.

Maintaining compliance after filing

Once Form NT 10-Q is filed, companies should monitor for any updates or additional requirements from the SEC. This includes staying informed about changes in regulations or any feedback from the SEC regarding the filing. Ongoing obligations often extend beyond the initial filing, requiring companies to remain diligent in their disclosure practices.

The repercussions of incomplete or late filings can be severe, including legal implications, penalties, and a potential decline in stock prices. Best practices for future filings include establishing a routine schedule for reviews, implementing checks against missed deadlines, and enhancing internal communication among teams responsible for financial reporting.

FAQs about Form NT 10-Q

Form NT 10-Q generates numerous questions from companies and stakeholders alike. Common inquiries revolve around what constitutes a valid reason for filing the form, the timeline for submitting, and what to do if the expected timeline changes after filing. Understanding the intricacies of each section and its implications can ease concerns and clarify processes for both new and experienced filers.

Furthermore, clarifications about specific terminologies used in the form can assist users in filling it out correctly. For instance, differences between 'issuer’ and ‘reporting company’ often confuse filers. Providing resources that explain terminology alongside the form itself can enhance the overall filing experience and reduce errors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form nt 10-q online?

How do I fill out the form nt 10-q form on my smartphone?

How do I fill out form nt 10-q on an Android device?

What is form nt 10-q?

Who is required to file form nt 10-q?

How to fill out form nt 10-q?

What is the purpose of form nt 10-q?

What information must be reported on form nt 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.