Get the free Insurance Waiver Form

Get, Create, Make and Sign insurance waiver form

How to edit insurance waiver form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out insurance waiver form

How to fill out insurance waiver form

Who needs insurance waiver form?

Insurance Waiver Form: Your Essential How-to Guide

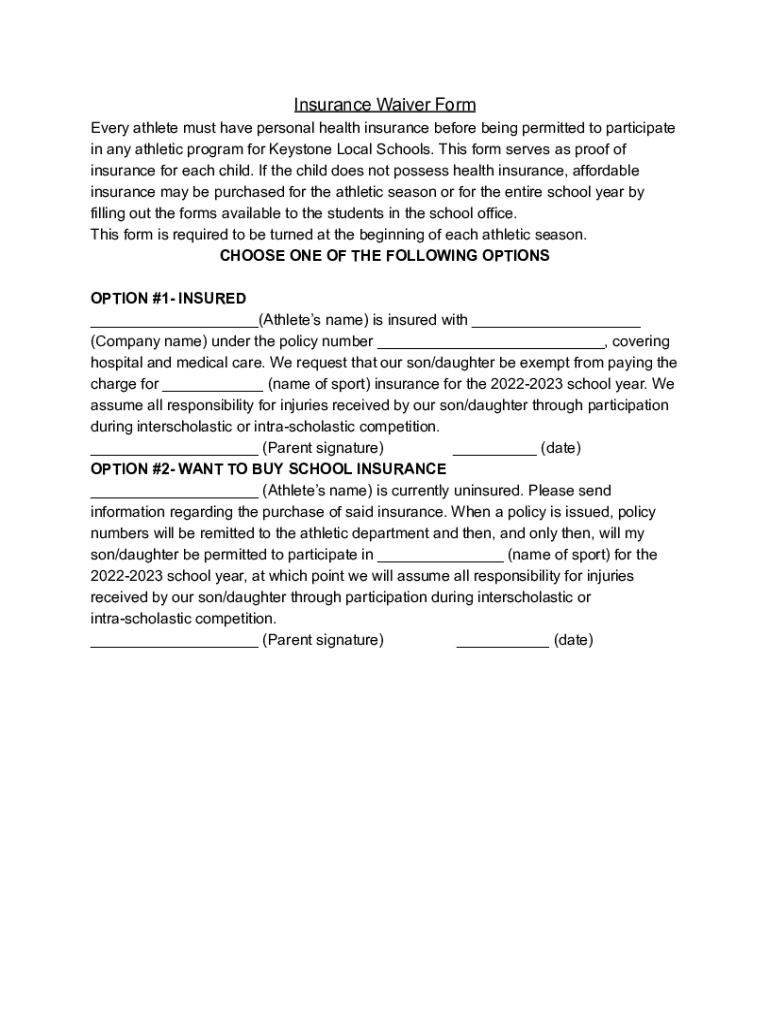

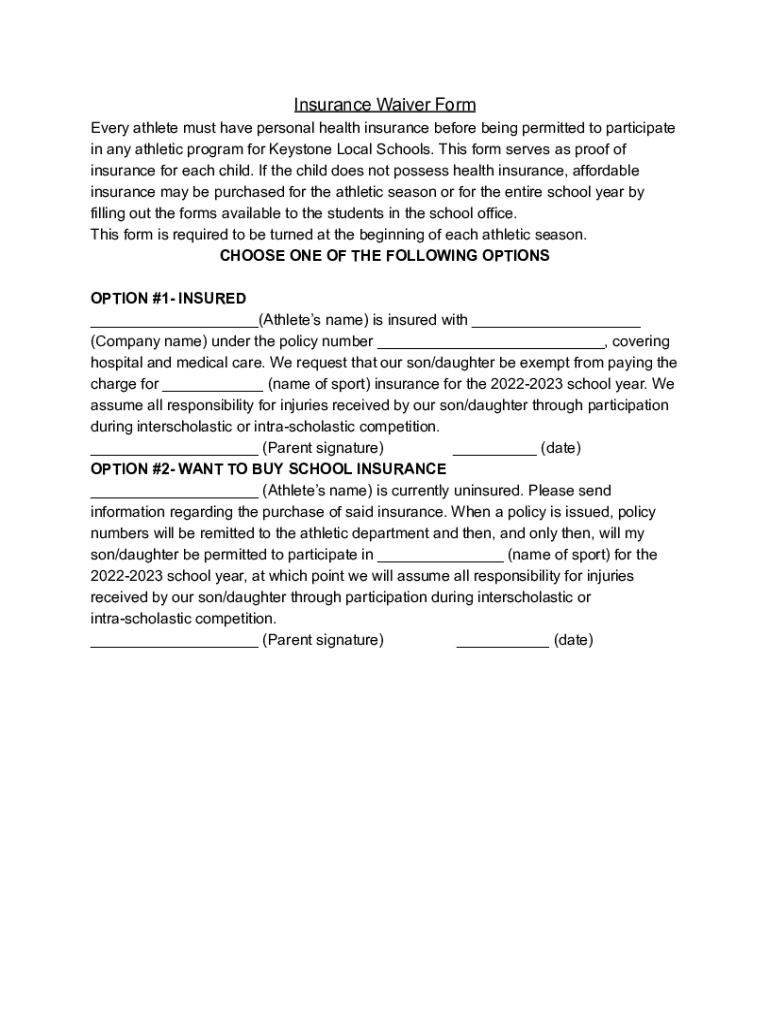

Understanding the insurance waiver form

An insurance waiver form is a document that allows individuals or groups to opt out of certain insurance coverages. The primary purpose of this form is to affirm that the signatory understands the risks involved by waiving their right to specific insurance benefits. It is commonly used in various scenarios, such as educational institutions requiring students to either provide proof of insurance or formally decline the institution's coverage options.

For instance, many colleges and universities require students to submit an insurance waiver form to demonstrate they have adequate health insurance coverage outside of the school's plan. Additionally, in the workplace, employees might need to fill out this form if they want to decline corporate health insurance because they already have coverage under a spouse's plan.

Who needs an insurance waiver form?

Various individuals and groups may need an insurance waiver form, with common examples including students and employees. Students, particularly in higher education institutions, frequently encounter this requirement when enrolled in courses that include health coverage options. Likewise, employees working in organizations that offer group health insurance may be asked to provide a waiver if they choose to keep their existing private insurance.

Importance of using the insurance waiver form

Submitting an insurance waiver form comes with several benefits. Firstly, it helps in cost savings. By opting out of institutional health plans, individuals can avoid paying for duplicate coverage that they do not need. Beyond the financial implications, such waivers also play a critical role in legal compliance and documentation.

Additionally, maintaining accurate records of insurance status ensures individuals are adequately covered in the event of a health crisis. It contributes significantly to overall health management, providing peace of mind while engaging in activities like sports or travel.

However, the omission of this form can lead to various risks. For instance, failure to submit a waiver could result in unexpected financial repercussions, especially in emergencies where insurance coverage is necessary. Individuals might also encounter limited access to healthcare facilities and services, leaving them in precarious situations.

Step-by-step guide to filling out the insurance waiver form

Filling out an insurance waiver form is a straightforward process, provided you have all the necessary information at hand. The first step is to gather personal information, including your full name, address, phone number, and email. Additionally, you’ll need to collect details about your current insurance provider, such as the company name, policy number, and type of coverage.

To access the waiver form, navigate to your institution's website or corporate HR portal. These forms are often downloadable PDF files. Once you have the form, fill in your personal details and include the relevant insurance policy information. Make sure to provide supporting documents if the institution requires proof of coverage, such as a copy of your insurance card.

After filling out the form, take time to double-check all the information. Utilizing tools like pdfFiller can assist in editing PDF documents, allowing you to annotate and add comments as necessary before finalizing the document for submission.

Signing the insurance waiver form

Once completed, the next step is to sign the insurance waiver form. This can be done electronically or physically. If you opt for electronic signing, pdfFiller provides a handy platform that allows you to eSign your documents securely and legally. This process simplifies the submission, making it easy to sign anywhere and anytime.

For those who prefer physical signatures, simply print the form, sign it by hand, and ensure it is scanned or photocopied for records before submission. It's essential to be aware of the differences in legitimacy and enforceability of electronic versus traditional signatures in your jurisdiction.

Submitting the insurance waiver form

Submitting your insurance waiver form is a crucial step that requires careful attention. Depending on the institution or organization's requirements, you can submit your form online or via mail. For online submissions, follow the institution’s specific guidelines, which usually involve uploading the signed document to a designated portal.

If you choose to mail the insurance waiver form, make sure to follow any guidelines provided, such as using specific envelopes or including a cover letter. After submission, confirm receipt of your form. Many institutions will send a confirmation within a specific timeframe—if you don’t receive one, don’t hesitate to follow up to ensure your waiver was processed.

Managing your insurance waiver form

Once your waiver form is submitted, it is crucial to keep copies of it for your records. Whether you save a printed copy or a digital one, having proof of your submission can save you from potential issues down the line. Using pdfFiller allows you to store these documents securely in the cloud, making them easily accessible when needed.

It is also important to know how and when to update your waiver form. If your insurance provider changes or your coverage circumstances change, you will need to submit a new waiver form. The process for updating usually mirrors that of the initial submission, but always check with your institution for any specific guidelines.

Frequently asked questions (FAQs)

Addressing common questions about the insurance waiver form can provide clarity not only for existing users but also for new ones. For instance, if your insurance provider changes, you will need to fill out and submit a new insurance waiver form reflecting those changes. Additionally, if you wish to withdraw your waiver after submission, it’s essential to contact your institution or organization directly to understand the processes involved.

Users often wonder how the waiver affects their health coverage. It’s important to note that a submitted waiver means you are opting out of the institution’s insurance; therefore, maintaining your own coverage is crucial to avoid any lapses that could leave you without health benefits.

User testimonials and success stories

Many users have shared positive experiences after using the insurance waiver form through platforms like pdfFiller. One student noted that the process made it easy to submit their waiver on time, preventing any issues with enrollment. Employees have also appreciated the simple submission process, which has streamlined the cumbersome paperwork into a user-friendly experience.

These testimonials highlight the effectiveness of pdfFiller in managing essential documents, reinforcing the convenience and peace of mind it offers users navigating through their insurance waivers.

Interactive tools and resources

To further assist users, pdfFiller provides a range of interactive tools and resources. Users can access customizable insurance waiver form templates, making it easier to generate forms that meet specific requirements. Additionally, pdfFiller's platform includes tools for editing and collaborating on documents, ensuring everyone involved has access to the latest version.

Best practices for using the insurance waiver form

To ensure a smooth experience with your insurance waiver form, follow these best practices. First, avoid common mistakes such as incomplete information or missing signatures, as these can lead to delays or rejections. Always read the guidelines provided by your institution carefully to understand their specific requirements.

Performing these best practices can not only save time but also ensure you're well-prepared as you navigate the insurance waiver process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit insurance waiver form on a smartphone?

How do I fill out insurance waiver form using my mobile device?

Can I edit insurance waiver form on an Android device?

What is insurance waiver form?

Who is required to file insurance waiver form?

How to fill out insurance waiver form?

What is the purpose of insurance waiver form?

What information must be reported on insurance waiver form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.