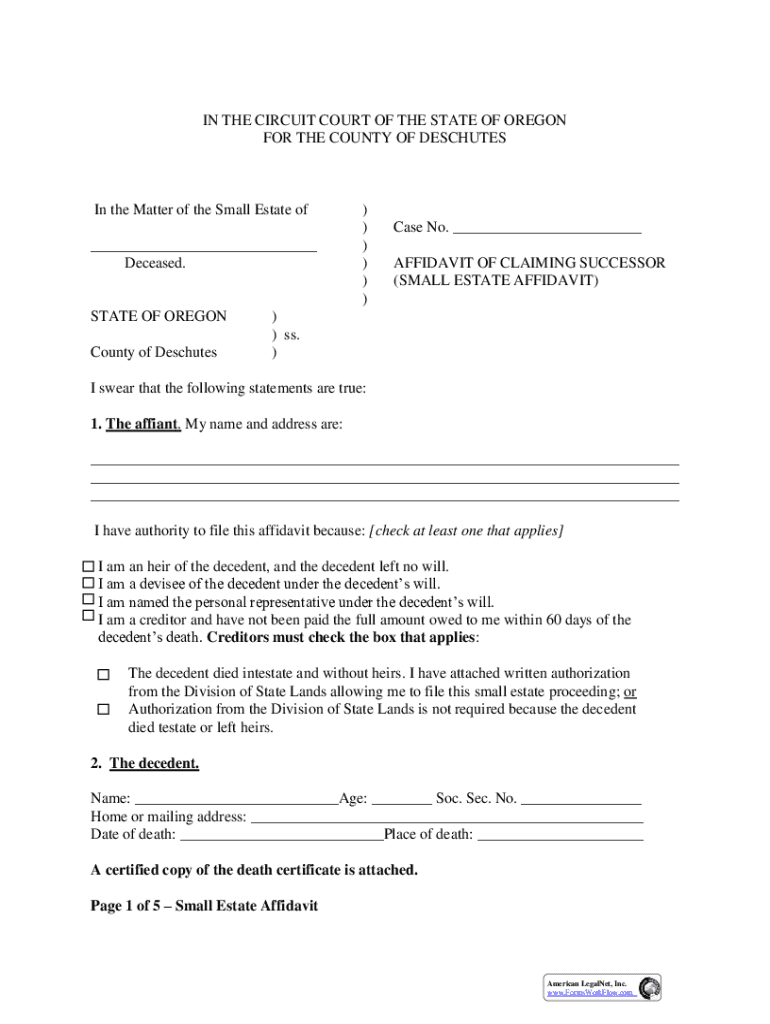

Get the free Small Estate Affidavit

Get, Create, Make and Sign small estate affidavit

How to edit small estate affidavit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out small estate affidavit

How to fill out small estate affidavit

Who needs small estate affidavit?

A Comprehensive Guide to the Small Estate Affidavit Form

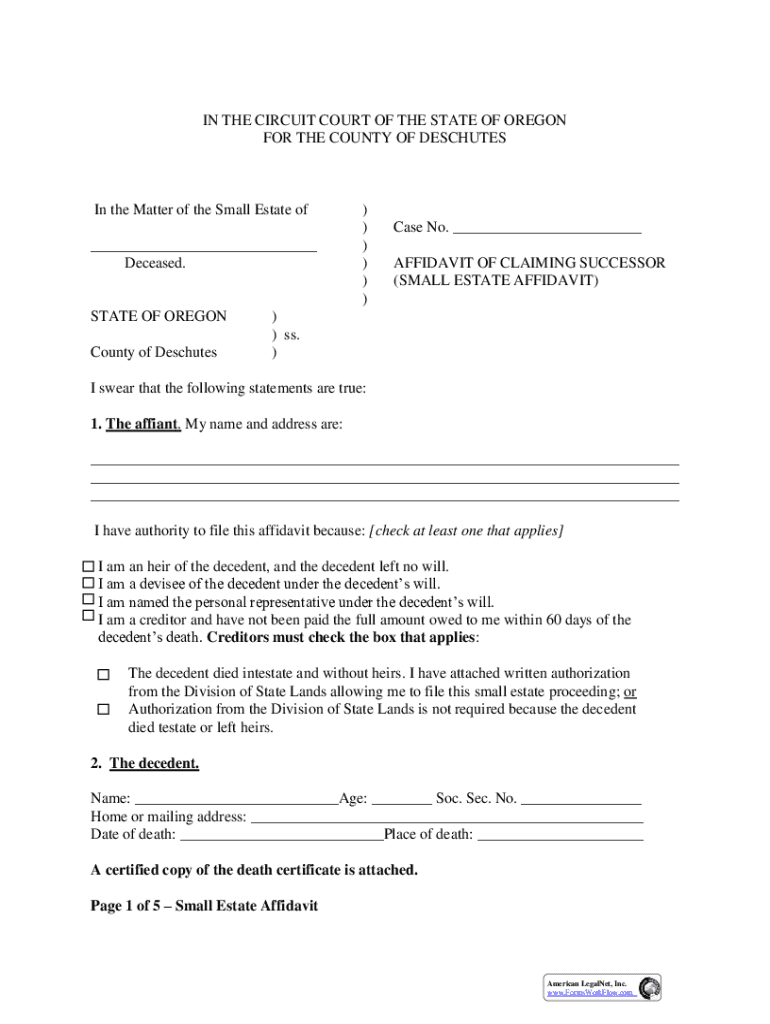

Understanding the small estate affidavit

A small estate affidavit is a legal document that allows heirs to claim assets from a deceased person's estate without going through the full probate process. It serves as a simplified method for transferring ownership of property, streamlining what can otherwise be a time-consuming and costly procedure. This form is particularly beneficial when the value of the estate is below a certain threshold, which varies by state.

Benefits of using a small estate affidavit

Utilizing a small estate affidavit can significantly ease the administration of a deceased person's estate. One of the primary benefits is the ability to expedite the transfer of property, enabling heirs to access what they are entitled to without unnecessary delays. By avoiding the lengthy probate court proceedings, families can redirect their focus towards mourning and healing rather than being bogged down by legal complexities.

Additionally, the process is typically more cost-effective. Traditional probate can incur various fees such as court costs and legal expenses, whereas using a small estate affidavit often incurs minimal or no costs, depending on state regulations. This can make a substantial difference in financial matters for families already dealing with loss.

Eligibility criteria for using a small estate affidavit

Not everyone is automatically eligible to utilize a small estate affidavit. General requirements typically include that the decedent has passed away, and the estate is below a specified value. This value limit varies from state to state. Furthermore, the type of property in question is crucial; some estates consist of personal property, such as cars and furniture, while others may involve financial accounts and real estate.

Prepping for your small estate affidavit

Before diving into the affidavit process, it's important to prepare adequately. Gather all necessary documents to ensure a smooth filing. This includes the death certificate of the decedent, a comprehensive list of assets along with estimated values, and any specific affidavit templates that may be required by your state.

Confirming eligibility is equally crucial. Review local state laws for small estate qualifications and understand if there are any special cases or exceptions that could apply to your situation. This step can save time and avoid potential legal complications down the line.

Step-by-step guide to completing your small estate affidavit

To begin the completion of your small estate affidavit, start with downloading the appropriate form for your state. pdfFiller offers access to a variety of templates tailored to the legal requirements governing your area. Selecting the correct form is vital; using the wrong one could lead to delays or increased scrutiny during the submission process.

Once you have your form, carefully fill it out, ensuring all information is accurate. Each section of the affidavit typically requires specific details, such as information about the decedent's assets, the heirs, and the value estimates. Pay close attention to common pitfalls, such as leaving out required signatures or failing to complete all sections, as these can cause significant delays.

Notarizing your small estate affidavit

Notarization is a critical step in the affidavit process, as it provides legal authenticity to your document. It is essential to find a reliable notary who can witness your signature and acknowledge the affidavit. During the notarization session, you will typically need to present a valid ID and possibly other relevant documents that support your identification.

To ensure a smooth notarization, make sure your document is completely filled out but not signed until you are in the presence of the notary. Additionally, understanding your state’s specific requirements for notarization can help clarify what additional documents may be necessary.

Submitting the small estate affidavit

Once notarized, the next step is to submit your small estate affidavit to the appropriate authority. This typically involves local courts or county offices that handle such documents. Each jurisdiction may have unique submission guidelines, so it's wise to familiarize yourself with these details beforehand.

Timing can also play a role in the submission process. Different jurisdictions may have specific deadlines for filing affidavits, so it’s vital to follow any necessary timelines accurately. After submission, it’s common to wait for a response; however, be prepared to handle any unexpected delays or requests for further information from the court.

Additional considerations

When dealing with a small estate affidavit, it’s crucial to consider how to handle potential disputes or contests over the estate. If disagreements arise among heirs, the situation may escalate beyond the scope of a small estate affidavit and necessitate full probate proceedings.

In some scenarios, despite the small estate affidavit being an option, traditional probate may still be required. Situations like complex asset distribution, significant debts, or the involvement of minor children can complicate the process. Thus, consult with a legal professional if in doubt, as they can provide guidance specific to your circumstance.

Frequently asked questions about small estate affidavits

Many individuals have questions regarding small estate affidavits, including how to initiate the process, what constitutes a 'small estate', and how long it typically takes from start to finish. Addressing these common queries can provide clarity for those unfamiliar with the procedure.

Misconceptions can also arise, such as believing that all inheritors must agree to use the affidavit method or that certain assets are automatically excluded. It’s advisable to seek specific answers tailored to your state and situation to eliminate confusion.

Using pdfFiller for your document needs

pdfFiller is an invaluable resource for anyone needing to manage various documents, including a small estate affidavit form. With features that allow users to edit PDFs, eSign documents, and collaborate efficiently, it empowers individuals and teams to handle their documentation needs seamlessly on a single cloud-based platform.

The platform not only simplifies the process of document creation but also ensures the security and accessibility of your affidavits, allowing you to retrieve and manage essential information from anywhere, at any time.

Final thoughts on small estate affidavits

Navigating the small estate affidavit process can be manageable with proper preparation and understanding. This document can serve as a lifeline for family members in the often turbulent time following a death, guiding them toward a resolution without the burdens of extensive legal procedures. Taking advantage of digital tools like pdfFiller can significantly simplify this documentation handling, reducing unnecessary complexities.

Ultimately, the small estate affidavit form ensures that assets are distributed according to the wishes of the deceased, and using streamlined tools can make this process even smoother.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the small estate affidavit in Chrome?

How do I fill out the small estate affidavit form on my smartphone?

Can I edit small estate affidavit on an Android device?

What is small estate affidavit?

Who is required to file small estate affidavit?

How to fill out small estate affidavit?

What is the purpose of small estate affidavit?

What information must be reported on small estate affidavit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.