Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

A Comprehensive Guide to Sec Form 4

Understanding Sec Form 4

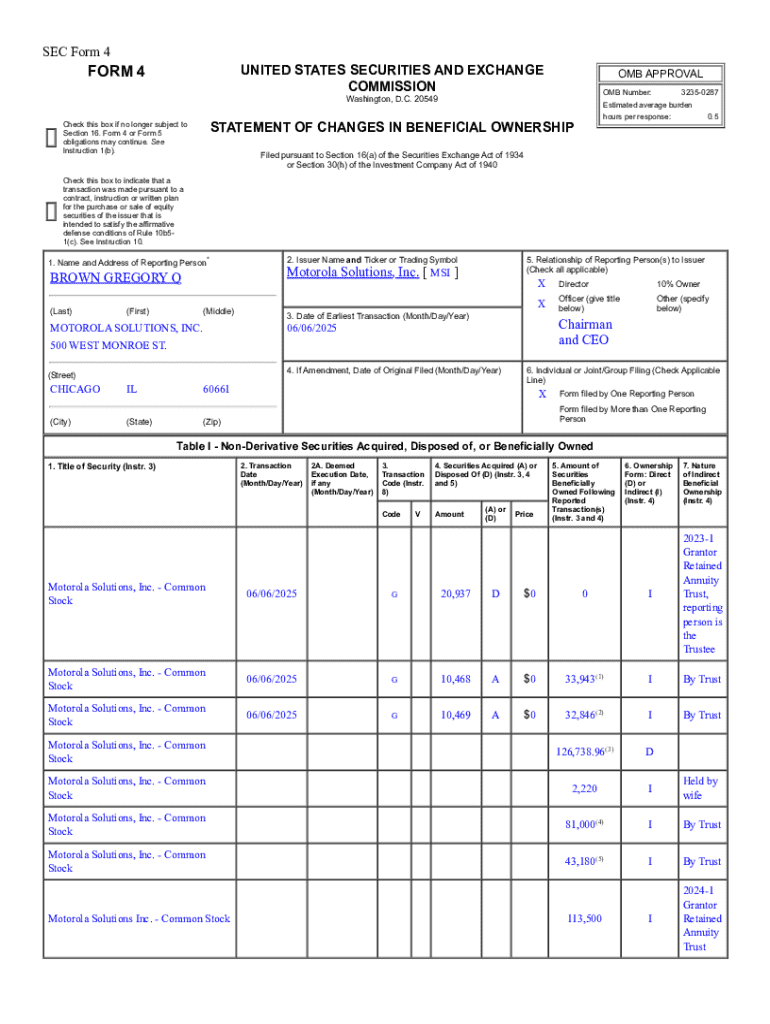

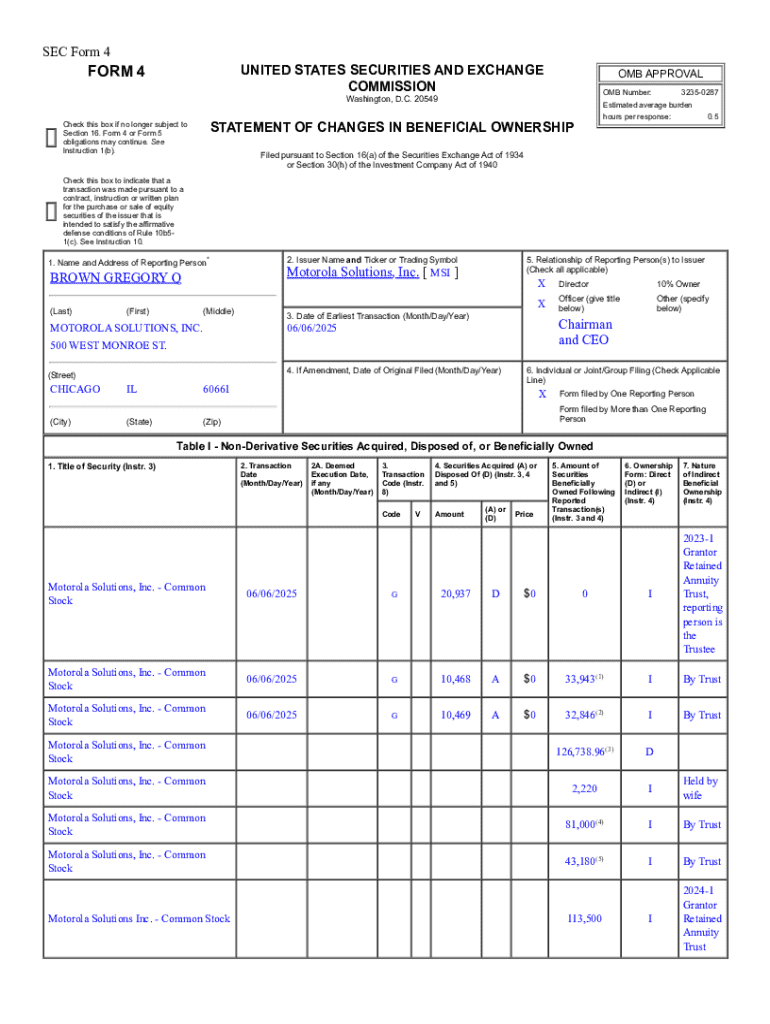

Sec Form 4 is a critical document required by the Securities and Exchange Commission (SEC) to disclose changes in ownership of securities by corporate insiders. This form provides transparency regarding who holds significant stakes in public companies, which helps to prevent insider trading and promotes fair market practices. By mandating that insiders report their transactions, the SEC aims to protect investors and maintain market integrity.

The importance of Sec Form 4 cannot be overstated. It plays a vital role in fostering investor confidence, as stakeholders can track the buying and selling activities of executives and major stakeholders. Consequently, investors can make more informed decisions based on the actions of those who possess insider knowledge.

Who needs to use Sec Form 4

Individuals and organizations required to file Sec Form 4 typically include directors, officers, and beneficial owners of 10% or more of a company’s equity securities. These individuals are mandated to report their trades within two business days of the transaction date. Scenarios necessitating the filing of this form include stock purchases, sales, or any changes in ownership due to gifts or estate transfers.

Key components of Sec Form 4

Sec Form 4 includes several critical sections, such as the reporting person's identification details, the nature of the transaction, transaction date, and price per share. Each component provides essential information that supports the SEC’s mandate for transparency regarding insider trading practices.

Detailed breakdown of Sec Form 4 fields

The first section of Sec Form 4 is dedicated to transaction information, which includes the exact date of the transaction and the type of transaction. Common types include open market purchases and sales. The price per share is also disclosed, allowing regulators and investors to analyze the transaction value critically.

The reporting owner information is crucial, as it identifies who is making the report. Understanding the role of the reporting owner is important, as they are typically individuals tied to the company, such as executives and board members, who can significantly influence the company's direction.

Related securities need to be reported if the insider has financial interests in other companies engaged in transactions involving the reporting company. This might include derivatives, options, or other securities that correlate to the stock being reported.

Step-by-step instructions for completing Sec Form 4

To prepare for filing Sec Form 4, it’s essential to gather necessary documents and data about stock transactions. This will include details like the transaction type, date, and share price. Additionally, understanding filing deadlines is crucial, as delays can lead to penalties.

Filling out the Sec Form 4 requires clarity and attention to detail. Begin with the transaction information section: list the date, type, and price per share accurately. Move on to the reporting owner section, ensuring all details match the corporate records. The related securities section should be completed only if applicable, with a clear statement of how the securities relate to the reported transactions.

Before finalizing the form, it's essential to review for accuracy. Utilize a checklist to verify each section is filled out completely and correctly. Common errors include missing signatures or incorrect SEC form versions, so double-checking is vital.

Filing Sec Form 4

Filing Sec Form 4 can be accomplished through various methods, the most common being electronic submission via the SEC’s EDGAR system. This method is efficient and ensures your filing is formatted correctly for SEC review. For those opting for paper submissions, ensure that all forms are correctly completed, signed, and sent to the appropriate address to avoid delays.

Confirmation of your filing is crucial. First, you’ll receive acknowledgment from the SEC after your submission. It is advisable to retain this confirmation as proof of filing, as it can help prevent misunderstandings regarding compliance.

Common scenarios for filing Sec Form 4

One of the most frequent scenarios requiring Sec Form 4 is insider trading. Specifically, when an insider buys or sells stock in their own company, they are legally obligated to report these transactions to ensure full transparency and compliance with SEC regulations. Failure to report timely can lead to severe legal repercussions.

Changes in ownership also prompt the need for Sec Form 4 filings. This can include instances such as stock splits, mergers, or acquisitions. Additionally, insiders who handle multiple transactions in a short time frame can consolidate their filings but must accurately reflect each transaction's specifics.

FAQs about Sec Form 4

What happens if the filing deadline is missed? Late filings can lead to penalties, fines, and increased scrutiny from regulators. It’s crucial to file on time to avoid such consequences.

Yes, you can amend a filed Sec Form 4 if mistakes are found post-filing. It’s essential to file the amendment promptly and clearly indicate the corrections.

Penalties for non-compliance can be significant. Fines can range widely based on the severity of the oversight, with potential reputational damage accompanying failure to comply with SEC rules.

Additional tools and resources

Interactive tools available on platforms like pdfFiller offer users a robust means to fill out, edit, and eSign Sec Form 4. With the ability to collaborate in real-time, teams can ensure that all necessary checks are completed before the form is submitted.

Accessing fillable templates specifically designed for Sec Form 4 can simplify the submission process. Examples of completed forms can provide visual reference points, making it easier for first-time filers to ensure accuracy and compliance.

Best practices for managing Sec Form 4 compliance

Maintaining accurate records is pivotal when managing compliance related to Sec Form 4. A well-organized filing system ensures that all transaction details are readily accessible for future reference or audits. Companies should build a culture of accountability, fostering comprehension of SEC requirements among all involved parties.

Collaborating with legal and compliance teams enhances the accuracy of the filing process. Engaging with professionals ensures that all regulatory updates are promptly integrated into filing practices. It’s also vital to stay updated on regulations pertaining to Sec Form 4, as the SEC may adjust requirements based on market conditions and internal governance policies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sec form 4 without leaving Google Drive?

How can I send sec form 4 to be eSigned by others?

How do I fill out the sec form 4 form on my smartphone?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.