Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding Sec Form 4: A Comprehensive Guide

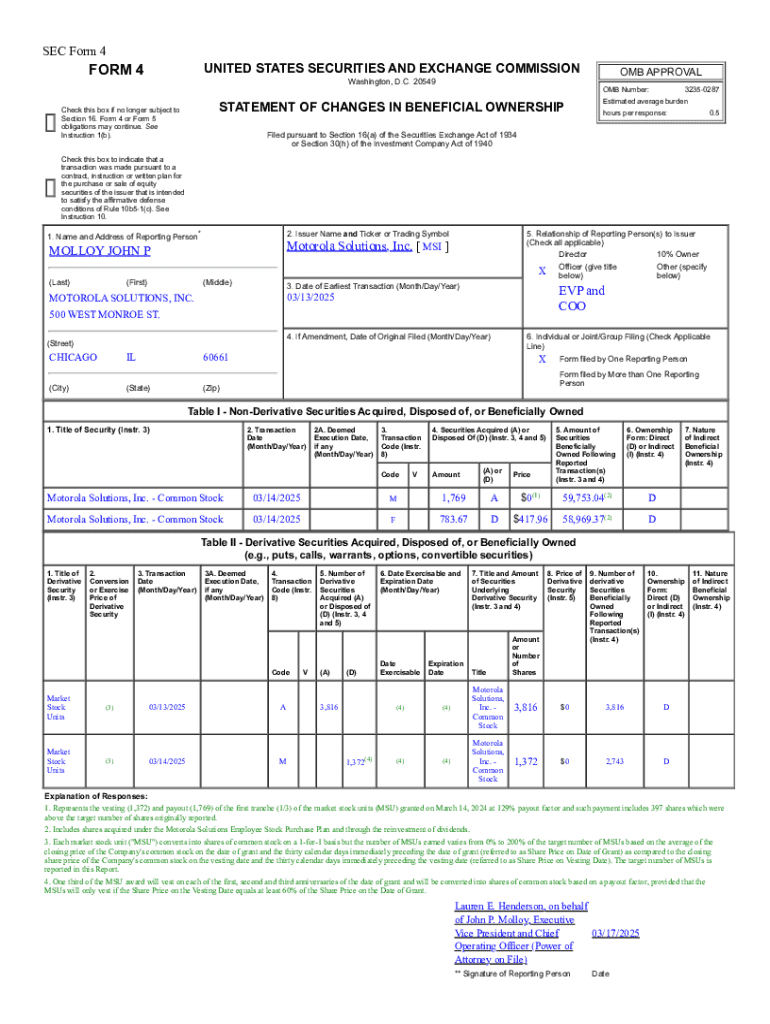

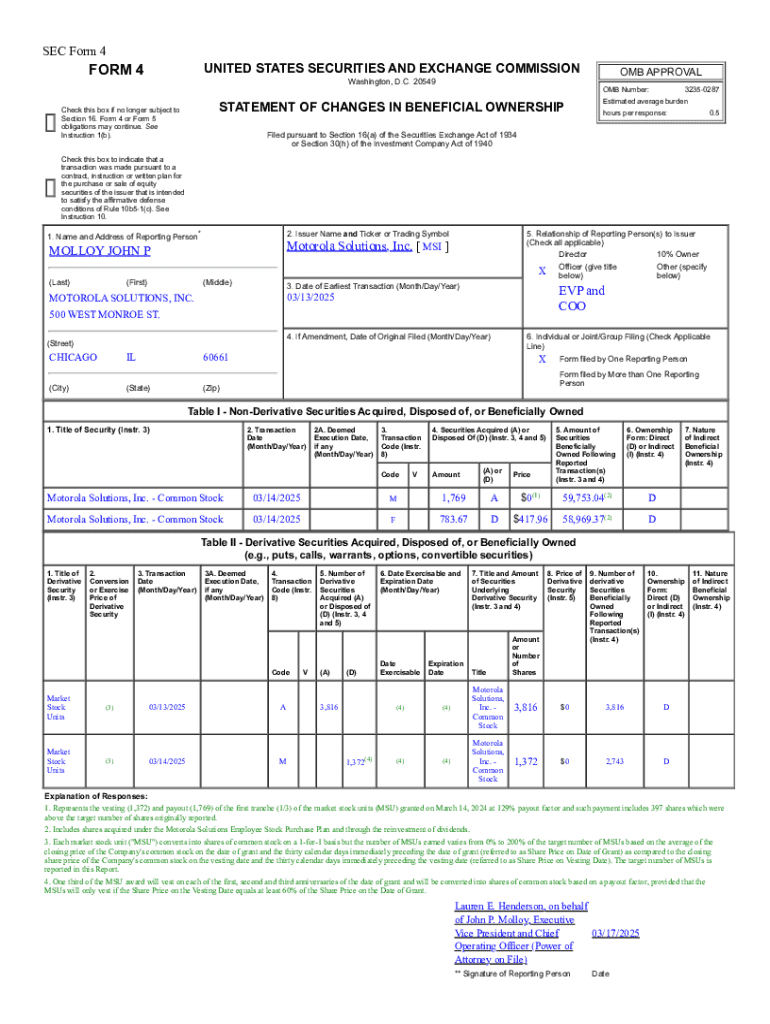

Overview of Sec Form 4

Sec Form 4 is a critical document mandated by the U.S. Securities and Exchange Commission (SEC), primarily designed for insiders of publicly traded companies. This form serves the purpose of reporting transactions in securities, ensuring transparency in the market and compliance with the federal securities laws.

The importance of Sec Form 4 cannot be overstated as it facilitates the monitoring of insider trading, allowing both the SEC and investors to track how company insiders are buying and selling shares. This promotes fair trading practices and maintains investor confidence in the market.

Who needs Sec Form 4?

Individuals and entities required to file Sec Form 4 primarily include corporate officers, directors, and beneficial owners of more than 10% of a company's equity securities. These individuals are obligated to report their transactions within two business days, ensuring that any changes in their ownership stakes are public knowledge.

Common scenarios for submission include the purchase or sale of stock, options adjustments, and any other changes to the ownership of equity securities.

Key components of Sec Form 4

Sec Form 4 consists of several sections that collectors must accurately complete. These sections include Personal Information, Transaction Details, and Reporting Dates. Each component is vital for ensuring that the information reported is complete and compliant with SEC rules.

Understanding terminology

Accurate terminology is crucial when filling out Sec Form 4. Terms such as 'beneficial ownership,' 'derivative securities,' and 'direct reporting' are commonly used. Understanding these terms ensures that filers comply with regulations and avoid potential penalties.

Step-by-step instructions for completing Sec Form 4

Completing Sec Form 4 requires careful preparation and attention to detail. Start by gathering all necessary information, such as the details of the transactions and any supporting documents.

Next, fill out the form, beginning with the Personal Information section, where your identity and position are outlined. Then, detail transaction codes, which classify the nature of your stock transactions. Lastly, input the reporting dates and any additional notes that clarify unusual circumstances.

Common mistakes to avoid

Mistakes in submitting Sec Form 4 can lead to significant compliance issues. Common errors include inaccurate transaction codes, forgetting to file within the deadline, and incorrect personal information entry.

Editing and signing Sec Form 4

Editing Sec Form 4 can easily be accomplished using pdfFiller, a tool equipped with user-friendly features. Users can access the editing tools available on the platform to make necessary changes to their forms before submission.

Digital signature requirements

A digital signature is now widely accepted and enhances the efficiency of submitting video forms. To apply a digital signature through pdfFiller, users can follow the on-screen instructions that guide them through the signing process.

Secure submitting of Sec Form 4

When submitting Sec Form 4 online, it’s essential to follow best practices for security. Always ensure that the submission takes place through secured channels and confirm receipt of the document to complete the process.

Managing your Sec Form 4 files

Efficiently storing and organizing Sec Form 4 documents is crucial for any business professional. Leveraging cloud storage solutions provided by pdfFiller ensures that your documents are easily accessible and securely stored.

Collaborative tools for teams

For teams needing collaboration on Sec Form 4, pdfFiller offers sharing capabilities that allow team members to work together seamlessly. This enables simultaneous input and review, enriching the form completion process.

Transaction codes and their significance

Transaction codes serve as a critical way to classify different kinds of transactions reported in Sec Form 4. Each code represents a specific action like a purchase, sale, or a grant of stock options.

Accurately recording these codes allows the SEC to easily interpret the nature of insider trades, thereby enhancing market transparency.

Resources for further assistance

Filers can access numerous online resources for guidance on completing Sec Form 4 through the official SEC website. This includes updated regulatory information and filing guidelines.

Utilizing pdfFiller resources

pdfFiller offers a variety of tools and templates designed to streamline the completion of Sec Form 4. Additionally, customer support is available for any questions that may arise during the filing process.

Case studies and best practices

Individuals and teams sharing their success stories from filing Sec Form 4 illustrate the effectiveness of best practices in form management. Many users report that utilizing pdfFiller's platform significantly enhanced their filing accuracy and efficiency.

Implementing these best practices allows for smoother, more compliant filing processes, reducing the likelihood of errors.

Staying compliant with changing regulations

Being aware of changes in regulations affecting Sec Form 4 is crucial for all filers. Regularly check official SEC announcements and updates to ensure compliance with any new requirements.

Incorporating flexibility into your filing process is essential as regulations continue to evolve. This adaptability will ensure that your documentation practices remain robust and compliant.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sec form 4 for eSignature?

How do I make changes in sec form 4?

Can I create an electronic signature for signing my sec form 4 in Gmail?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.