Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding SEC Form 4: A Comprehensive Guide

Understanding SEC Form 4

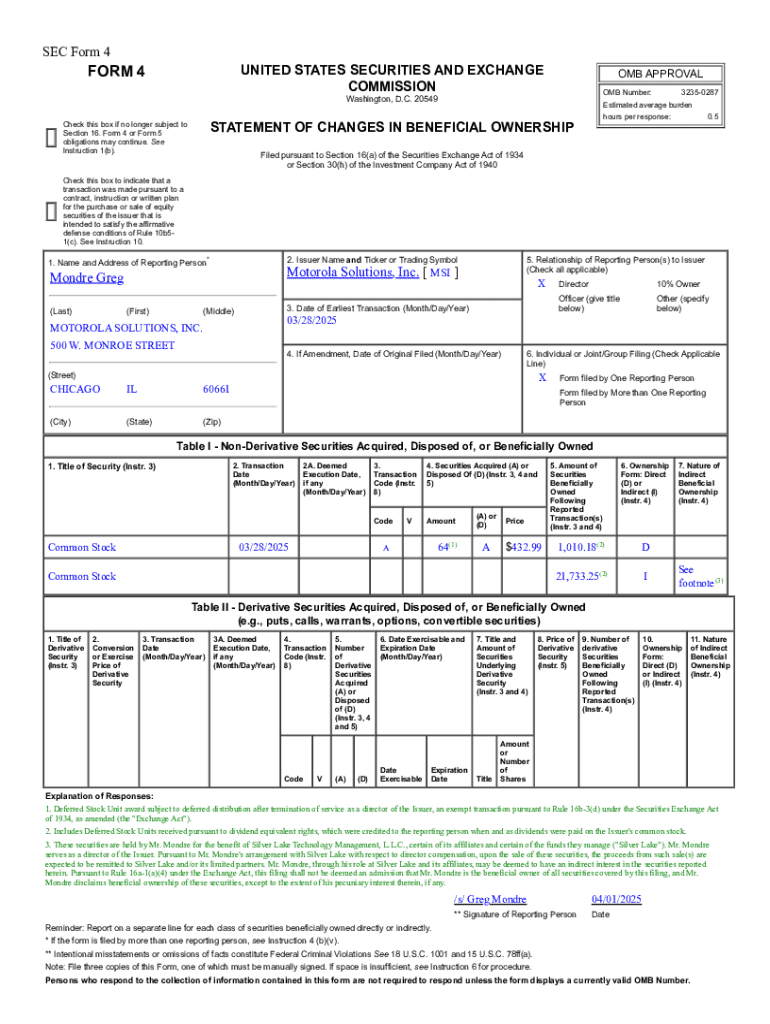

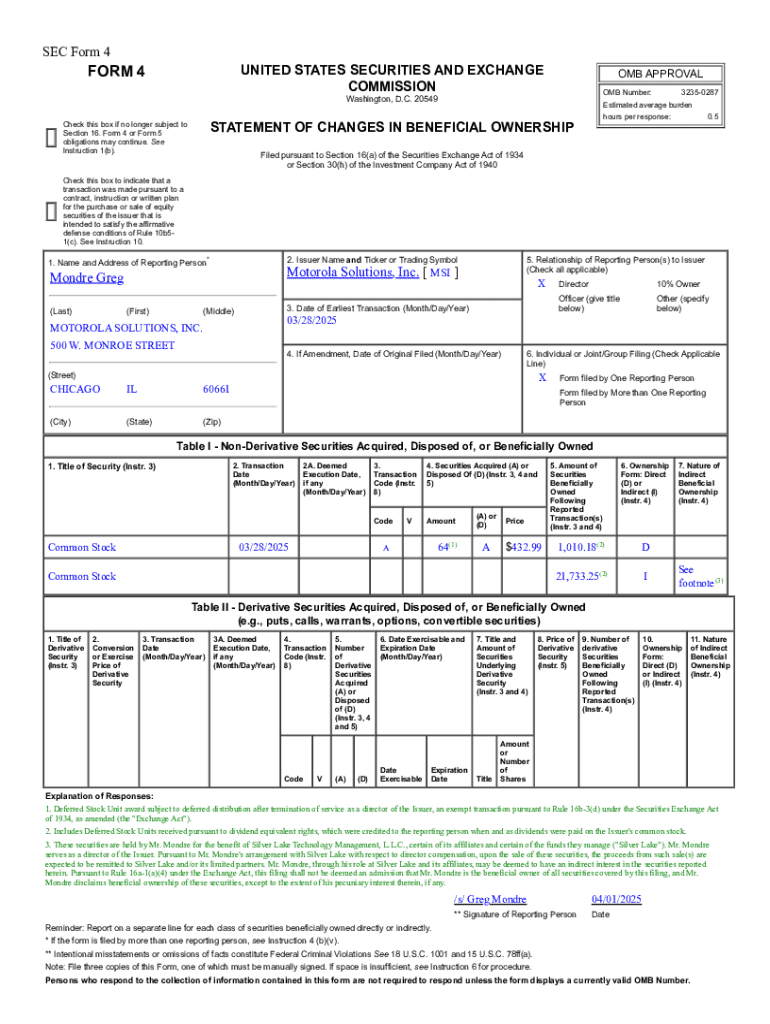

SEC Form 4 is a crucial document in the realm of securities trading, specifically designed to report changes in the ownership of equity securities. It is filed with the U.S. Securities and Exchange Commission (SEC) by corporate insiders, such as officers, directors, and shareholders who own more than 10% of a company’s stock. The purpose of this form is to provide transparency regarding the trading activities of these insiders, ultimately ensuring that potential investors are informed about significant ownership changes that may impact stock prices.

Filing SEC Form 4 is mandated under Section 16 of the Securities Exchange Act, making it an essential tool for regulatory compliance. Any change in ownership, whether through sales, purchases, or gifts, necessitates the filing of this form. Thus, corporate insiders must stay vigilant about their reporting obligations; failing to comply can lead to penalties and unwanted scrutiny.

Key components of SEC Form 4

To properly complete SEC Form 4, several key components must be addressed. First and foremost, the filing information requires the identification of the reporting person, the issuer’s name, and the trading symbol. The date of the event that triggers the reporting obligation is also critical. Without this accurate information, the filing may be considered incomplete or erroneous.

Next, the transaction details are fundamental, documenting the nature of the transaction – such as whether it was a purchase, sale, or gift of securities. It's essential to specify the number of securities that were either acquired or disposed of and include the price at which the securities were transacted. Lastly, ownership after the transaction must be clarified, indicating the total number of securities owned and the type of ownership, whether direct or indirect.

Detailed instructions for completing SEC Form 4

Completing SEC Form 4 can be streamlined with a step-by-step approach. Start with gathering all necessary information, including personal details, transaction specifics, and ownership data. This preparation is vital for a smooth filling process. Next, focus on accurately completing the header section, ensuring all fields are filled out correctly.

When detailing each transaction, clarity is key. Be precise about the number of securities involved and the price. Finally, it's important to review and double-check all provided information for accuracy before submission. Common mistakes include incorrect dates, missing transaction details, or failing to accurately describe the type of ownership, which can lead to compliance issues or regulatory inquiries.

Interactive tools for filing SEC Form 4

The process of filing SEC Form 4 is made significantly easier through tools like pdfFiller. This platform provides pre-made templates that streamline the form-filling process, ensuring that users have access to the latest and most accurate formats. Additionally, pdfFiller's real-time collaboration tools allow teams to work together seamlessly, making it easier to gather input and share information among stakeholders.

Moreover, pdfFiller's eSigning features enhance compliance and document validity, ensuring that all submissions meet the requirements set by the SEC. By signing electronically, users save time and maintain a clear audit trail of who approved the document and when, streamlining the process while enhancing security.

Managing your SEC Form 4 and related documentation

Once SEC Form 4 has been filed, organizing and storing these filings securely is crucial. Using tools like pdfFiller, users can easily manage their SEC filings, creating a systematic approach to documentation. This ensures that all important forms are easily accessible and properly archived, minimizing the risk of data loss or regulatory non-compliance.

Sharing the Form with stakeholders can be streamlined using pdfFiller, as it allows for secure sharing capabilities without compromising data integrity. Tracking changes and managing versions of the form is also simplified with this platform, enabling users to have a comprehensive view of the filing’s history and any updates that may occur.

Important transaction codes to know

SEC Form 4 includes specific transaction codes that describe the nature of each transaction executed by insiders. Understanding these codes is essential for accurate reporting. For instance, Code 'P' signifies a purchase of stock, while Code 'S' represents a sale. Familiarizing oneself with these codes is vital to ensure that all transactions are correctly categorized, which is crucial for maintaining compliance with SEC guidelines.

Other common transaction codes include 'G' for gifts and 'C' for the exercise of a derivative security. Properly using these codes helps maintain clarity and avoids confusion, particularly when insiders are conducting multiple transactions in short periods. Accurate coding also assists regulatory bodies in tracking insider trading activity efficiently.

Navigating SEC resources and regulatory guidelines

For accurate compliance, it's essential to consult the official SEC guidelines for Form 4. These guidelines are readily available on the SEC's website, outlining the requirements, deadlines, and best practices for filing. Frequent consultations can help individuals and organizations remain compliant with evolving regulations.

Additionally, the SEC website features a comprehensive FAQ section that addresses common queries related to Form 4, offering insights directly from the regulatory authority. By engaging with these resources, securities insiders can ensure they meet all necessary obligations and avoid penalties associated with delinquent filings.

Best practices for SEC filings and compliance

Timeliness plays a crucial role when it comes to filing SEC Form 4. Insiders must file the form within two business days following the transaction. Staying informed about the filing deadlines and ensuring timely submission helps avoid penalties and showcases adherence to regulations. Regular auditing of transaction activities can assist individuals in keeping track of what needs to be reported and when.

Moreover, it is imperative to keep abreast of changes in SEC regulations. Compliance requirements can shift, or new policies may be introduced, creating new filing obligations. Understanding the importance of accuracy in financial disclosures cannot be overstated, as any discrepancies could lead to reputational damage and potential legal issues.

Real-life scenarios: Case studies of SEC Form 4 use

Various public companies have provided notable examples of SEC Form 4 filings. For instance, high-profile executives often rely on Form 4 to report their stock transactions, which can significantly impact stock performance. An analysis of these filings reveals critical insights into how insider trading activity influences stock valuation and investor sentiment.

Additionally, case studies of common filing errors, such as incorrect transaction values or misclassification of securities, can educate others on the importance of diligence when submitting SEC Form 4. These lessons emphasize the need for meticulousness to avoid regulatory actions that can arise from simple mistakes.

Utilizing pdfFiller for comprehensive document management

Integrating SEC Form 4 with other financial documentation becomes streamlined with pdfFiller's cloud-based platform. Users can manage various types of financial documents in one location, which vastly simplifies review processes, updates, and sharing. The capacity for real-time feedback means that corrections or necessary changes can be made collaboratively, ultimately enhancing efficiency.

Moreover, testimonials from satisfied pdfFiller users highlight the benefits of using the platform for SEC filings. Users appreciate the seamless experience it provides, from filling out forms like SEC Form 4 to ensuring all documents are securely stored and readily accessible, which enhances compliance and organizational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sec form 4 without leaving Google Drive?

How can I send sec form 4 for eSignature?

How do I complete sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.