Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

A comprehensive guide to Form 10-Q

Understanding Form 10-Q

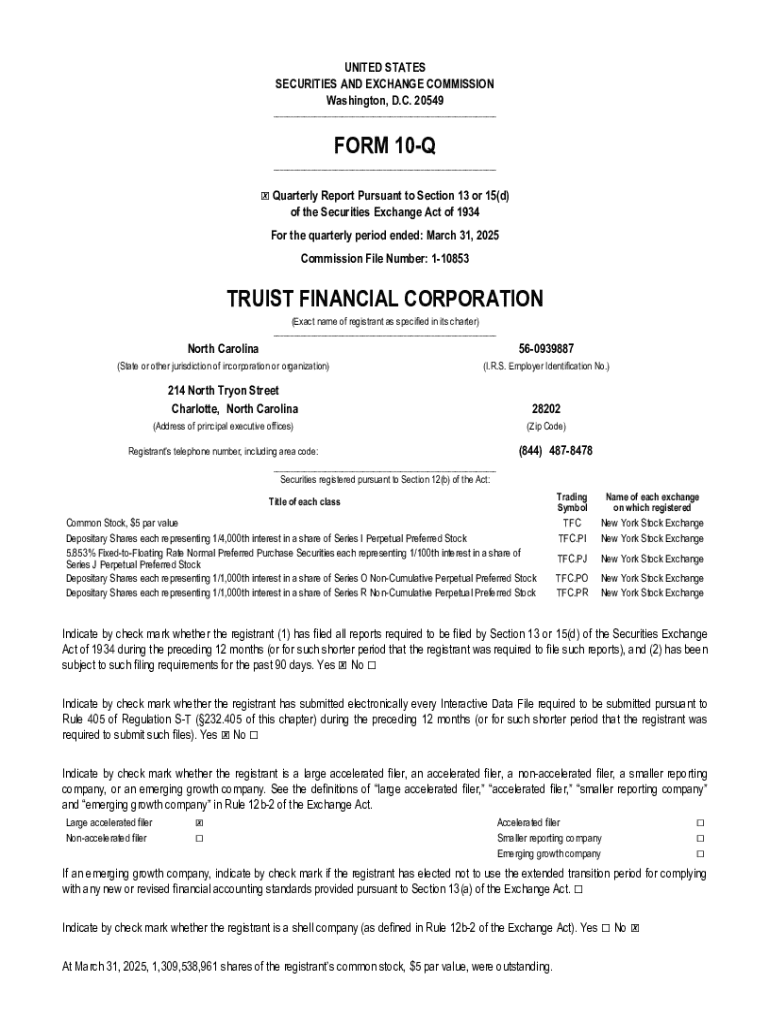

SEC Form 10-Q is a quarterly report filed by publicly traded companies to the U.S. Securities and Exchange Commission (SEC). This form provides investors and analysts with an ongoing view of a company's financial performance, making it an essential tool for evaluating a company's financial health. Unlike the more comprehensive annual Form 10-K, which provides detailed information about a company's performance over the entire year, the 10-Q focuses on the shorter period of a single quarter.

The significance of Form 10-Q lies in its ability to inform stakeholders about the company's financial status, operational results, and any significant events that may have impacted performance during the reporting period. The main difference between Form 10-Q and Form 10-K is that, while 10-K provides exhaustive details for an entire fiscal year, 10-Q captures a snapshot of financial activities on a quarterly basis and may include less audited information.

Other SEC filings include Form 8-K, which is used to report unscheduled events that are deemed important to shareholders, but the 10-Q remains a critical document for ongoing investor communication.

Typical users of Form 10-Q

Various stakeholders utilize Form 10-Q for different purposes. Investors are among the primary users, seeking to stay informed about the financial health and performance of their investments. Analysts also rely on these filings to conduct thorough research and analysis, providing reports and forecasts to potential investors.

Publicly traded companies use Form 10-Q as a compliance tool to fulfill regulatory requirements, ensuring that they maintain a transparent relationship with their investors and adhere to SEC guidelines.

Purpose and key filing elements of Form 10-Q

The primary objective of the Form 10-Q is to provide timely financial information that allows investors to assess the ongoing financial health of a company. This quarterly update plays a crucial role in maintaining transparency, facilitating informed investment decisions, and helping companies maintain trust with their shareholders.

Key components of Form 10-Q include:

How to fill out Form 10-Q

Filling out Form 10-Q requires meticulous attention and thorough preparation. It starts with gathering required financial data, which includes income statements, balance sheets, and cash flow statements. Accurate data collection is crucial, as these figures form the backbone of your financial statements.

Submitting accurate financial statements requires clarity in presentation. It’s essential to format the data correctly—typically in a comparative format—to enhance readability. Highlighting important financial trends can aid in clearer communication.

The MD&A section deserves careful crafting. Address key questions about financial performance, strategic directions, and potential challenges. Use clear language and a professional tone to convey your thoughts effectively.

Lastly, ensure that all additional disclosures comply with applicable regulations. This might include historical data, pending lawsuits, or changes in business conditions. Familiarize yourself with common disclosures, as these often appear in many filings.

10-Q filing requirements

Filing Form 10-Q is not optional for most publicly traded entities. Companies that exceed specific revenue thresholds must file this quarterly report to stay in compliance with SEC guidelines. Typically, any company indexed on a national exchange must adhere to these regulations.

Filing deadlines for Form 10-Q depend on the company's classification: generally, larger entities have 40 days from the end of the quarter to submit their reports, while smaller companies are given 45 days. Extensions may be available but must be requested, ensuring compliance with SEC standards.

Failing to file accurately or on time incurs stiff penalties. The SEC can impose fines for repeatedly negligent filings, which may lead to further scrutiny of the company’s practices and potentially harm stakeholder trust.

Key insights into Form 10-Q

Recent years have introduced several notable changes to Form 10-Q filing requirements, reflecting evolving regulatory landscapes and corporate governance standards. These updates often focus on increasing transparency and ensuring timely disclosures of critical risk factors that could affect performance.

Looking forward, it’s essential to stay abreast of potential future changes in requirements. Companies must proactively adjust their filing strategies to align with these possible shifts.

Common mistakes during filing include failure to update financial figures, neglecting to detail significant changes in the MD&A, and inaccuracies in providing quantifiable risk data. Avoiding these pitfalls is critical, as errors can lead to diminished investor confidence and heightened scrutiny from regulators.

How to access and manage Form 10-Qs

Accessing filed Form 10-Qs is straightforward; the official SEC website houses a comprehensive database of these documents, allowing investors and stakeholders to conduct searches by company name, ticker symbol, or filing date. Third-party resources also provide tools for advanced searches and offer enhanced navigation features.

For managing 10-Q filings, utilizing a platform like pdfFiller offers invaluable features. It allows users to easily edit, collaborate, and securely store their documents—all from a single cloud-based interface. With functionalities for electronic signatures and streamlined editing tools, pdfFiller optimizes the document management process significantly.

Final thoughts on optimizing your Form 10-Q process

Streamlining your Form 10-Q filing process starts with best practices in document management. Using tools like pdfFiller can enhance efficiency by automating reminders for interim filing dates, reducing the instances of overlooked deadlines.

Continual learning from past filings is beneficial, helping teams analyze previous reports for common pitfalls or areas for improvement. Regular reviews enable teams to refine their filing processes over time.

Encouraging team collaboration is crucial to ensure comprehensive reviews before submission. Multiple stakeholders should engage in vetting the report, limiting the chances of errors and enhancing overall quality.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 10-q in Gmail?

Can I sign the form 10-q electronically in Chrome?

How do I fill out form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.