Get the free Cumulative E-file History 2022

Get, Create, Make and Sign cumulative e-file history 2022

Editing cumulative e-file history 2022 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cumulative e-file history 2022

How to fill out cumulative e-file history 2022

Who needs cumulative e-file history 2022?

Cumulative E-File History 2022 Form: A Comprehensive Guide

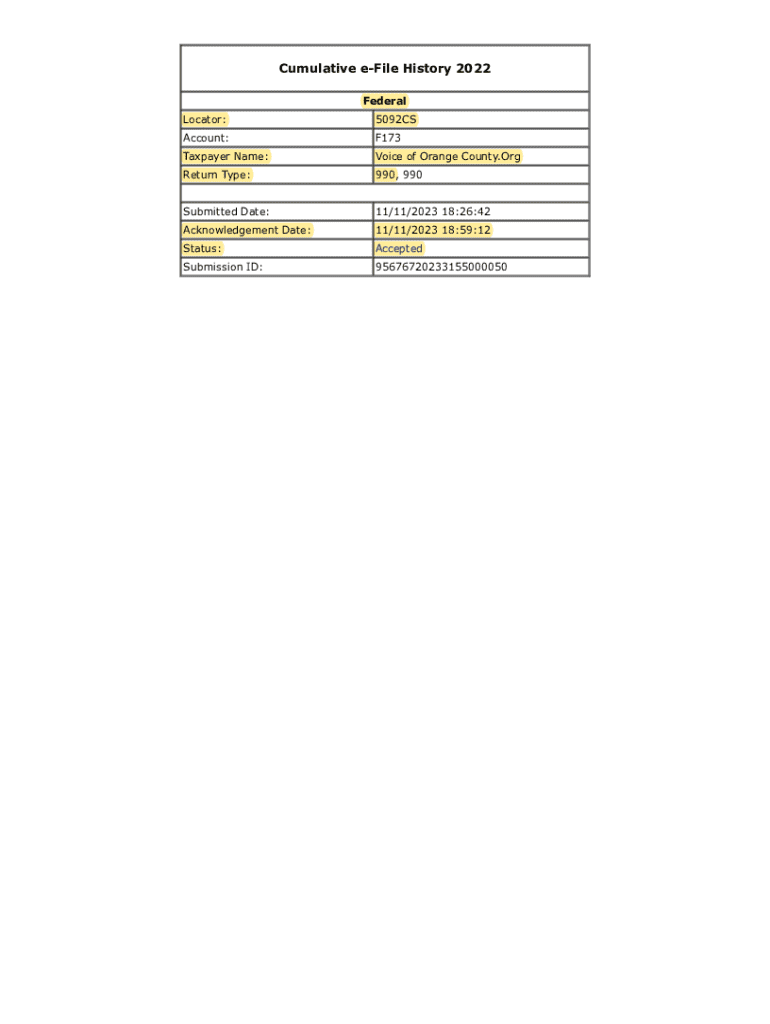

Understanding the cumulative e-file history 2022 form

The cumulative e-file history 2022 form serves as a crucial tool for tracking and documenting your electronic filing activities with the IRS. This comprehensive record helps both individuals and businesses maintain an accurate timeline of their e-filing submissions, showcasing each year's compliance efforts. Given the increasing reliance on electronic filings, having an organized e-file history has never been more important.

Any taxpayer who utilizes electronic filing for their tax submissions should consider filing the cumulative e-file history 2022 form. This includes both individual taxpayers and businesses that handle various tax obligations electronically. Key deadlines typically align with the traditional tax filing calendar, often running from January through April in the United States, although specific filing dates may vary based on your situation.

Key features of the cumulative e-file history 2022 form

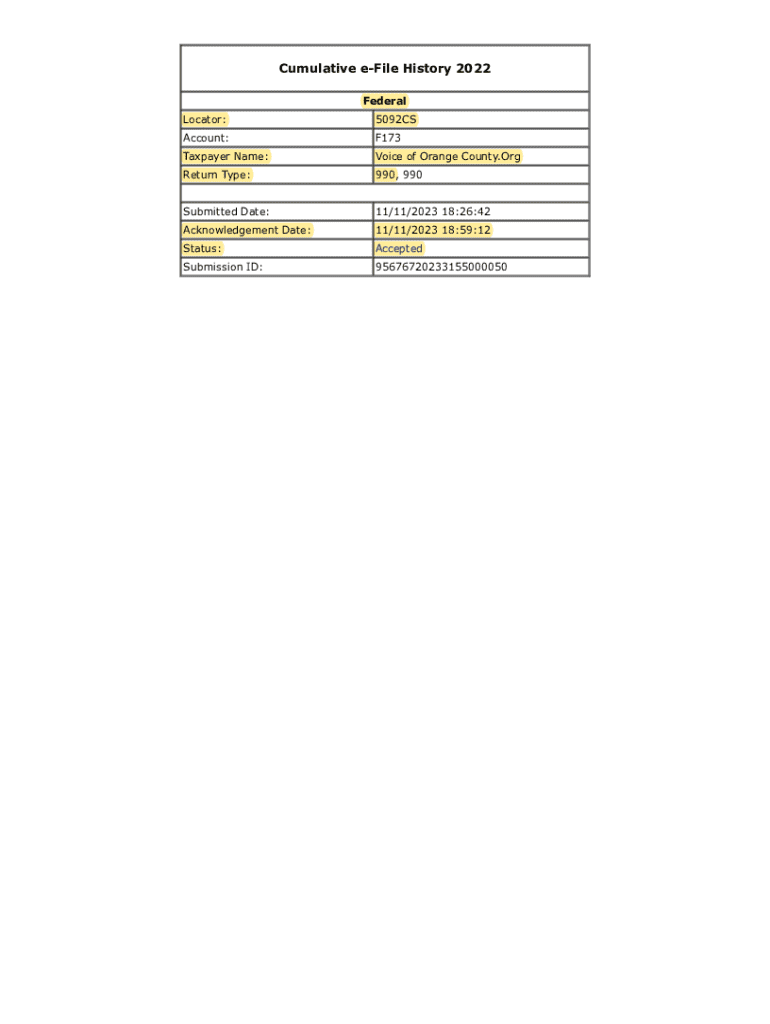

The cumulative e-file history 2022 form captures essential data points that reflect a taxpayer's filing activities. This includes dates of submission, types of forms filed, and the status of each submission (accepted, rejected, etc.). By compiling this information, the form provides a clear overview of your e-filing performance over time.

Compared to traditional paper filing, e-filing offers a quicker, more streamlined process that minimizes potential errors and allows for faster processing. However, it is vital to maintain an accurate e-file history. If discrepancies arise, an organized record can assist in swiftly resolving any issues by providing documentation of your submission timeline.

Step-by-step guide to accessing the cumulative e-file history form

Locating the cumulative e-file history 2022 form on pdfFiller is straightforward. Users can navigate to the specific section for tax-related forms and quickly search for the e-file history template. The platform is designed to facilitate ease of access and offer a variety of templates suitable for various needs.

Navigating pdfFiller’s user-friendly tools allows for quick customization to tailor the form for personal or business use. Options to integrate logos or adjust sections ensure that users can create a document that meets their unique requirements.

Filling out the cumulative e-file history form

Completing the cumulative e-file history 2022 form involves several sections that cumulatively depict your tax filing status. The 'Personal Information' section captures your name, address, and social security number. Accurate data entry here ensures a clean record as inaccuracies can create filing complications.

The 'Financial Information' section necessitates that you input key financial figures such as your taxable income and any deductions claimed. Following this, the 'Tax Details' section will require input concerning the specific tax forms you have filed. Lastly, the 'Summary of E-Filing History' collates your submission information, showcasing its acceptance or rejection status.

Common pitfalls to avoid include failing to keep supporting documentation correlated with your filings or neglecting to update your form if you have changes in your financial situation.

Editing and enhancing your form with pdfFiller

pdfFiller offers sophisticated editing tools that can elevate the quality of your cumulative e-file history form. Once you've entered your data, you can refine your entries by utilizing the platform’s editing functions, which allow you to add text, modify fields, or integrate additional comments where necessary.

Annotations can be beneficial for providing context to specific entries or for marking areas that require further review. Ensuring that your form is organized can significantly aid in future reference or audits.

Electronic signing and submission process

Once your cumulative e-file history 2022 form is complete, the next step involves electronic signing. pdfFiller has streamlined this process, allowing users to eSign documents directly on the platform. This feature enhances security and ensures that your submission is legally binding and recognized by tax authorities.

To submit your form safely, follow the designated submission pathway on pdfFiller. This process ensures that your document is sent securely without risk of data exposure. After submission, tracking your form's status is easy with pdfFiller’s user dashboard, allowing you to confirm acceptance or identify any further actions required.

Collaborating on the cumulative e-file history form

Collaborating on the cumulative e-file history 2022 form is crucial, especially for businesses handling multiple submissions. pdfFiller provides tools to enable seamless sharing of the form with team members or tax advisors. This allows for collective input, ensuring no detail is overlooked.

Utilizing collaboration features allows users to leave feedback, edit jointly, and track changes effectively. You can also set permissions and access levels, ensuring that only authorized personnel can make modifications or view sensitive information.

FAQs and troubleshooting common issues

Common questions regarding the cumulative e-file history 2022 form often stem from uncertainties about filing timelines and the requirements linked to each section. It’s crucial to note that if you encounter discrepancies or errors during filling, swift rectification is essential. Utilize pdfFiller’s troubleshooting guides to address these issues efficiently.

If errors persist even after correction attempts, it may be prudent to seek professional assistance. Tax professionals can provide clarity on complex issues or filing disputes, especially when managing multiple e-file submissions.

Maintaining your e-file history for future reference

For future reference, archiving your cumulative e-file history forms properly is crucial. Establish best practices for filing and maintaining records, which could involve categorizing documents by year or type of filing. Utilizing pdfFiller’s storage solutions allows you to keep your files securely accessible whenever needed.

Organizing your forms not only assists with immediate needs but also lays a solid foundation for next year’s filing. By keeping your records tidy and consolidated, you can reduce the stress associated with tax season.

Leveraging pdfFiller for future document management

Beyond the cumulative e-file history 2022 form, pdfFiller offers a host of features that can enhance your overall document management experience. From contract management to invoicing solutions, users can explore additional templates and create a diverse document ecosystem.

Case studies of individuals and teams utilizing pdfFiller illustrate how the platform streamlines workflows and improves efficiency. By seamlessly integrating pdfFiller into your document management strategies, you can ensure ongoing success and adaptability in the fast-paced world of digital documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get cumulative e-file history 2022?

How do I complete cumulative e-file history 2022 online?

How do I complete cumulative e-file history 2022 on an Android device?

What is cumulative e-file history 2022?

Who is required to file cumulative e-file history 2022?

How to fill out cumulative e-file history 2022?

What is the purpose of cumulative e-file history 2022?

What information must be reported on cumulative e-file history 2022?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.