Get the free Claim Notification Form

Get, Create, Make and Sign claim notification form

How to edit claim notification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claim notification form

How to fill out claim notification form

Who needs claim notification form?

Claim Notification Form - How-to Guide

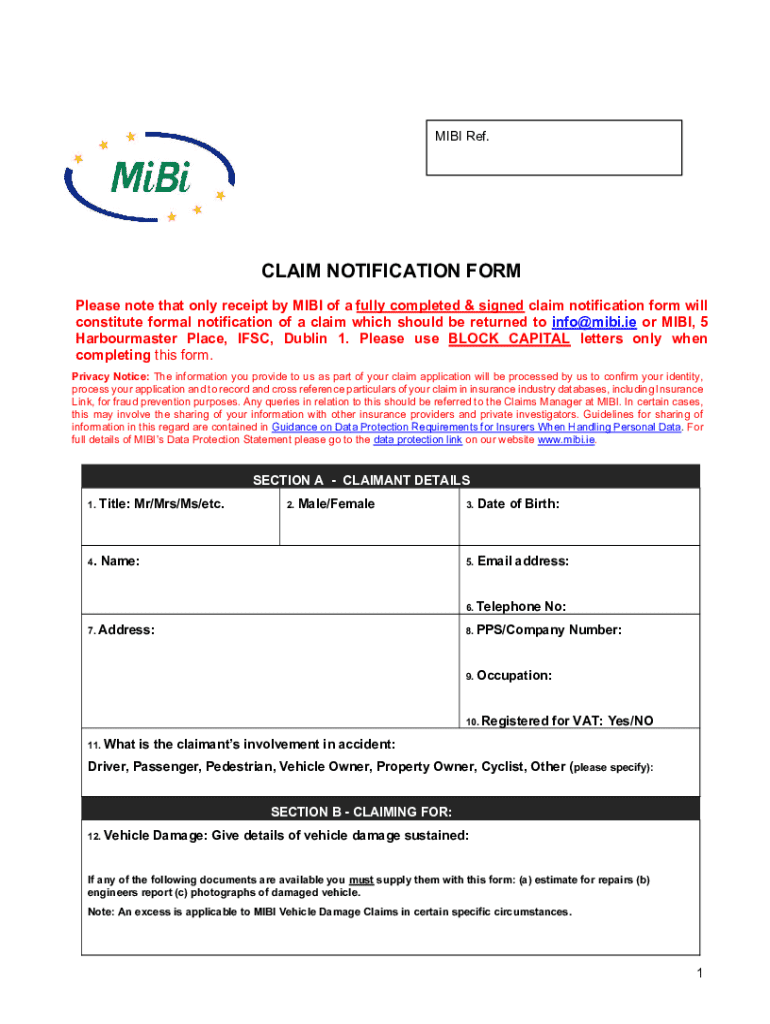

Understanding the claim notification form

A claim notification form serves as a critical document in the insurance industry and is often required by governmental agencies. This form allows claimants to officially notify an institution, such as HMRC, of their intention to submit a claim, detailing the circumstances necessitating it. By filing this form, claimants initiate the process of potentially receiving benefits or reimbursements.

The purpose of the claim notification form is not only to inform but also to create a documented trail of the claim process. It serves as a reference point throughout the reviewing process, making it easier for both the claimant and the authorities to keep track of the claim’s status.

Understanding the claim filing timeline is vital. Most forms stipulate deadlines based on when the incident occurred, varying by funding type and sector. Thus, being timely in your submission can significantly influence the outcome of your claim.

Who needs to complete the claim notification form?

Eligible claimants include individuals, businesses, teams, and organizations facing financial losses or seeking various forms of financial relief. If you find yourself in a situation where you have incurred a loss—be it due to damages, accident, or unanticipated expenses—you may need to complete this form.

Common scenarios requiring the notification may involve property insurance claims, tax relief claims, or losses incurred during a business operation. Understanding the criteria for who must fill out this form helps in streamlining the process, ensuring that only eligible claimants are submitting requests.

Detailed walkthrough of the claim notification form

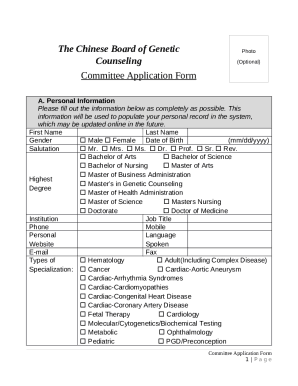

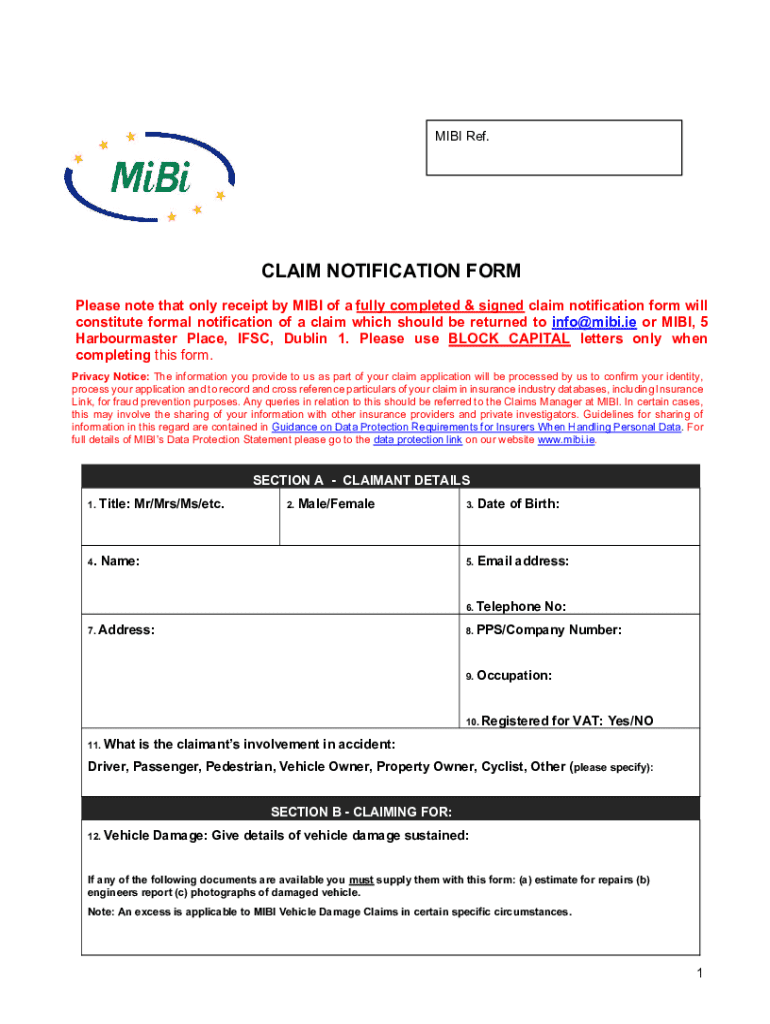

Completing the claim notification form may seem daunting, but breaking it down into sections can simplify the process. Each section serves a specific function, providing clarity on what information is expected.

Typically, the first section will require personal information, including the claimant's name, address, and contact details. Next, claim specifics need to be outlined, including the nature of the claim, the amount being requested, and relevant dates. Lastly, supporting documents, such as photographs, receipts, or previous correspondence, are often required to substantiate the claim.

Common pitfalls include incomplete sections or misinterpreting the information required. Always double-check each part of the form before submission to enhance the likelihood of timely processing.

Guidelines for preparing your claim notification

Preparing your claim notification involves meticulous organization and gathering all necessary information beforehand. Begin by collecting essential financial records, which may include bank statements, invoices, and receipts that directly pertain to your claim. This step ensures that you present a strong case.

Additionally, consider compiling project-related documentation if your claim pertains to business operations or project incidents. Having all documents ready will make completing the claim notification form more straightforward and less time-consuming.

When submitting the form, be sure to keep copies of everything for your records. Not only does this help in case of follow-ups, but it also aids in maintaining clarity if any discrepancies arise.

How to submit the claim notification form

Submitting your claim notification form can be done in several ways. The most convenient method is online submission via dedicated portals or platforms like pdfFiller, which allow you to fill out, edit, and send the form directly from your device.

To submit online, follow these basic steps: log into your account, access the required form, provide the necessary information, attach any supporting documents, and click 'submit.' Ensure you receive a confirmation email or message for record-keeping. Alternatively, you can submit forms via mail or in person if the agency allows.

Be mindful of deadlines associated with claims submissions. Many institutions, including HMRC, require that forms be submitted within a set period post-incident to process your claim effectively.

What happens after submission?

Once your claim notification form has been submitted, it enters a review process where it will be assessed based on the information provided. This may take various lengths of time depending on the complexity of the claim and the policies of the institution processing it.

During this review, you may be contacted for further information or clarification. Anticipating follow-ups can help expedite the overall timeline. Additionally, you should receive an acknowledgment of receipt of your claim, serving as a record that your submission was successful.

Frequently asked questions about the claim notification form

A common question relates to whether there’s a need to notify HMRC in advance before submitting the claim notification form. Generally speaking, notifying in advance can facilitate the process, providing HMRC with context ahead of formal submission.

Regarding amendments, if you need to change information after submission, consulting the relevant guidelines to understand the procedure for amendments is crucial. Be prepared for potential repercussions if substantive changes are made post-filing.

Common errors in the claim notification process

Errors in the claim notification process can be detrimental to your claim’s success. Misunderstandings about eligibility are common, leading many to submit claims incorrectly. It is vital to check the criteria beforehand, ensuring that you meet the requirements.

Incorrectly completed sections can also delay processing. Each part of the form must be filled out accurately to avoid unnecessary complications. Lastly, failing to provide or attaching the required supporting documentation often results in a rejected or delayed claim.

Utilize pdfFiller for your claim notification needs

pdfFiller offers a streamlined approach to filling out the claim notification form, allowing users to edit, eSign, and manage forms all from a single cloud-based platform. Its intuitive interface makes it easy for individuals and teams to navigate the complexities of form completion without added stress.

With features that enhance document management, such as real-time collaboration and storage, pdfFiller ensures a smooth experience from completion to submission. The integration of the eSignature option allows for a seamless approval process, making it a preferred tool for claimants.

Explore related topics for comprehensive claims management

To navigate successfully through claims management, understanding related topics is crucial. For instance, familiarizing yourself with R&D tax relief and other financial incentives can provide additional support during the claims process. Furthermore, adopting best practices for document management can streamline your operations, reducing the chances of errors.

Additionally, seeking tools and resources for ongoing claims support can provide continued assistance during complex cases. Engaging with these related topics can equip you with the knowledge necessary to manage your claims effectively and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my claim notification form directly from Gmail?

How can I get claim notification form?

How do I execute claim notification form online?

What is claim notification form?

Who is required to file claim notification form?

How to fill out claim notification form?

What is the purpose of claim notification form?

What information must be reported on claim notification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.