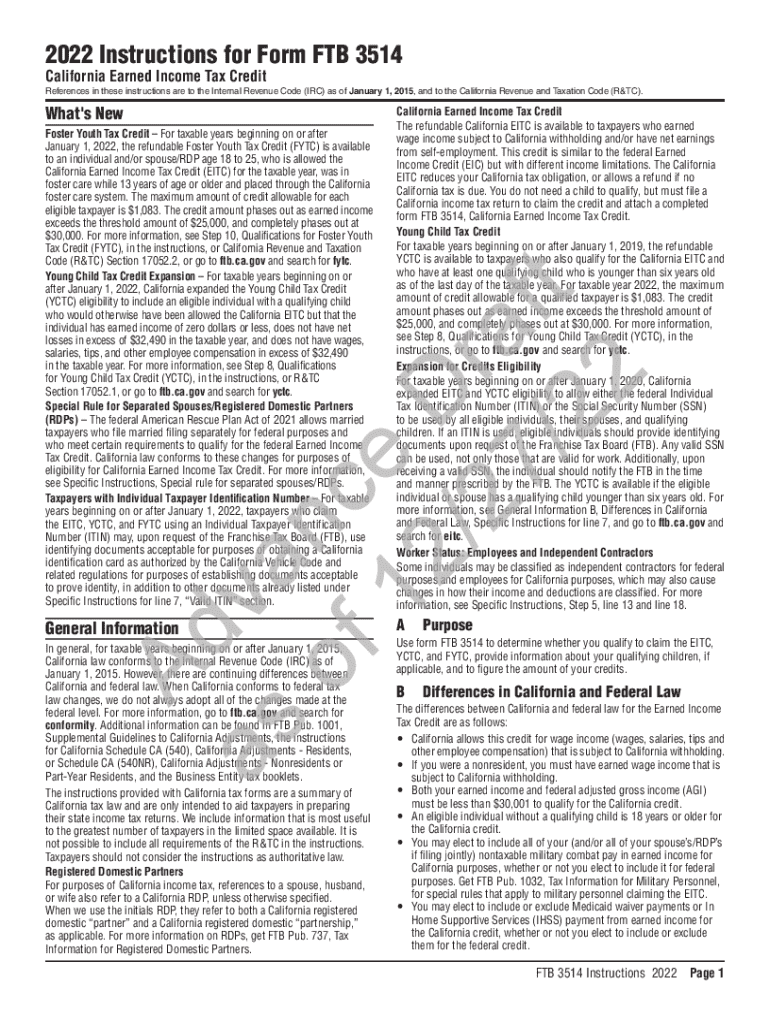

Get the free Ftb 3514

Get, Create, Make and Sign ftb 3514

Editing ftb 3514 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ftb 3514

How to fill out ftb 3514

Who needs ftb 3514?

A Comprehensive Guide to the FTB 3514 Form

Overview of FTB 3514 Form

The FTB 3514 form, also known as the California Child and Dependent Care Expenses Earned Income Credit, serves a critical function for California taxpayers. It is primarily aimed at individuals who incur costs related to childcare while they work or seek employment. Understanding this form's purpose is vital for anyone looking to claim eligible credits.

This form has several key features, including the ability to provide a tax credit that can significantly reduce tax liability. By accurately completing and submitting the FTB 3514, eligible taxpayers can benefit from important financial relief, making it easier to balance work and childcare responsibilities.

Timeliness and accuracy in submitting the FTB 3514 form are paramount. Late or incorrect submissions can lead to denial of credits, resulting in missed opportunities for savings. Thus, understanding the process right from the start can ensure you maximize your benefits.

Eligibility and qualification for FTB 3514

Do you need to file the FTB 3514? This question often arises among parents and caregivers in California. The form is specifically for those who have added childcare expenses related to seeking or maintaining employment. If you think you might qualify, it’s crucial to understand the specific criteria.

Those able to claim the FTB 3514 typically include working parents with dependents under 13, as well as individuals with disabled dependents. Income limits may also apply, along with other criteria that could exempt certain individuals from needing to file, such as those who claim other specific tax credits.

Step-by-step guide to filling out FTB 3514

Completing the FTB 3514 form can seem daunting, but breaking it down into manageable sections simplifies the process. Start by gathering all necessary personal and financial information to ensure a smooth filing experience.

Key sections include:

To ensure accuracy, take time to double-check every section. Mismatched numbers or incorrect information can lead to processing delays or the denial of credits. Utilizing interactive tools offered by pdfFiller can further enhance your accuracy by providing prompts and guidance.

Interactive tools for FTB 3514 form completion

pdfFiller offers a range of interactive features that make filling out the FTB 3514 more efficient and user-friendly. Their fillable fields allow for easier input, and you can even e-sign documents directly on the platform.

Features like auto-save and cloud storage capabilities mean your work is secure. If you step away from your form, you can return without losing any input, making the process seamless.

pdfFiller’s form editing tools enable customization so that you can annotate or comment on the document, perfect for collaboration with partners or tax professionals. Sharing features also make it easy to get feedback or submit to multiple parties without hassle.

Submitting your FTB 3514 form

Once your FTB 3514 form is completed, it’s time to submit it. You can choose to submit electronically, which is faster and often preferred by the IRS, or you may opt to mail it in, ensuring it's sent to the right address and is postmarked appropriately to meet deadlines.

It's crucial to adhere to submission deadlines. Failure to submit on time can result in forfeiting your credits, so be aware of key dates throughout the tax season.

Troubleshooting common issues

Encountering issues when filling out the FTB 3514 can be frustrating. Common errors often arise from incorrect personal information, miscalculated figures, or details omitted in the exemptions section. Identifying these issues early can save considerable time.

In complex cases such as resolving discrepancies, seeking assistance from tax professionals can provide clarity. Additionally, maintaining direct contact with the FTB offers the best guidance on how to amend issues or re-submit if necessary.

Understanding your rights and responsibilities

As a filer of the FTB 3514, it’s essential to understand both your rights and responsibilities. Taxpayers are afforded certain rights, such as the right to appeal any decisions made by the taxing authorities or access all necessary forms and publications.

At the same time, filers are responsible for providing accurate information and adhering to deadlines. Failing to do so can lead to penalties, audits, or even loss of your tax credit.

Frequently asked questions (FAQs) about FTB 3514

Making a mistake on the FTB 3514 can happen. If you discover an error after submission, you will need to amend your return. This typically involves filling out a new form and clearly indicating which areas you are changing.

For those seeking further interpretation, keeping track of updates in tax legislation and accessing resources from the FTB website can help clarify various aspects of the submission process.

State-specific information and links

Understanding how the FTB 3514 form aligns with your state’s tax guidelines is crucial. Each state may have additional requirements or changes specific to their tax codes. Monitoring local updates and regulations ensures taxpayers are compliant and aware of any additional claiming processes.

User feedback and improvement suggestions

User-centered design keeps the FTB 3514 relevant and effective. pdfFiller actively seeks feedback from users to enhance the platform, making it easier for individuals to fill out necessary documentation like the FTB 3514.

Sharing your experiences can also lead to significant improvements in form design and user interfaces, ultimately benefiting every taxpayer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ftb 3514 on an iOS device?

How do I edit ftb 3514 on an Android device?

How do I fill out ftb 3514 on an Android device?

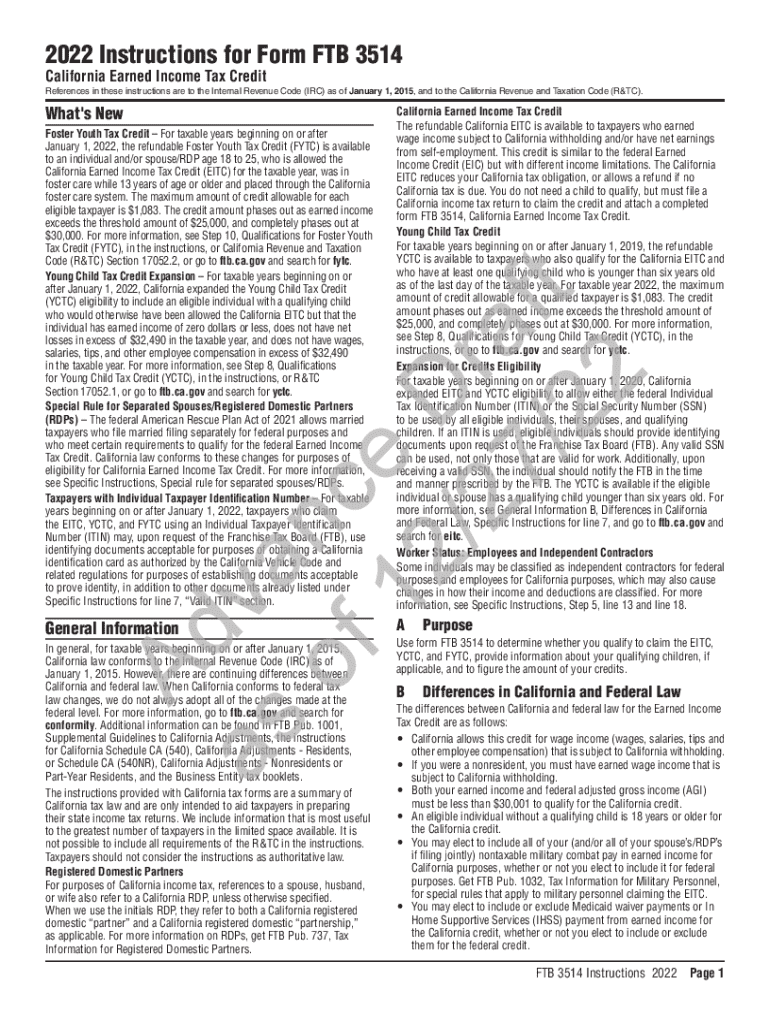

What is ftb 3514?

Who is required to file ftb 3514?

How to fill out ftb 3514?

What is the purpose of ftb 3514?

What information must be reported on ftb 3514?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.