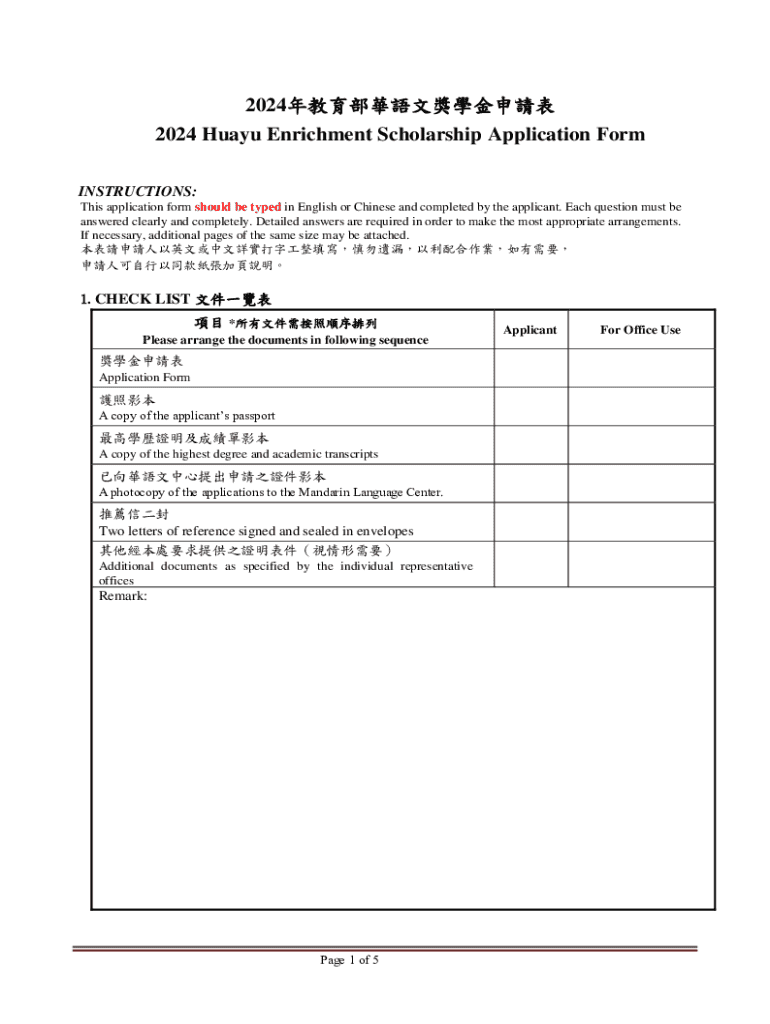

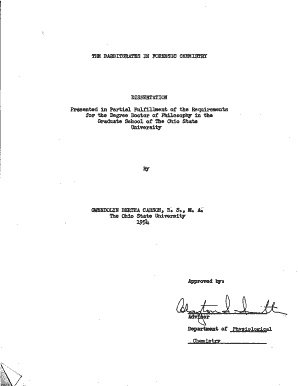

Get the free 2024年教育部華語文獎學金申請表

Get, Create, Make and Sign 2024

How to edit 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024

How to fill out 2024

Who needs 2024?

How to Effectively Use the 2024 Form on pdfFiller

Understanding the 2024 form

The 2024 form is a crucial document for individuals and businesses alike, designed for accurate reporting of financial data in compliance with current regulations. Its purpose is to streamline the tax filing process while ensuring that all necessary financial information is captured succinctly. This form incorporates updates that reflect changes in tax laws and conventions from the previous year, making it essential to stay informed about its specifics.

Key differences in this year's form include new sections for reporting digital currency transactions, extended deadlines, and changes in deduction limits. These updates can significantly impact how individuals and businesses approach their tax filings, reinforcing the need to understand these variations.

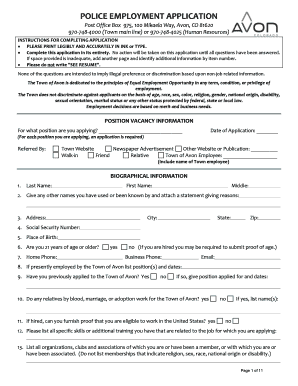

Who needs to use the 2024 form?

The 2024 form targets a diverse audience. Individuals filing personal tax returns, businesses reporting corporate income, freelancers accounting for contract work, and small businesses navigating unique deductions all fall within the bracket of users needing this form. Each group has specific situations that warrant the use of this document, emphasizing the importance of following the guidelines accurately.

For freelancers, understanding the nuances of self-employment taxes is vital, while small businesses must remain vigilant about keeping proper records to maximize deductible expenses. Ignoring these specifics can lead to financial penalties or lost deductions, making advisement from tax professionals all the more crucial.

Key features of pdfFiller for the 2024 form

pdfFiller offers a comprehensive suite of document editing tools that are invaluable when working with the 2024 form. Users can easily edit PDFs directly in a secure, cloud-based environment, which allows for real-time collaboration. This feature is particularly beneficial for teams working on financial documents, enabling seamless communication and quick adjustments.

With its eSigning functionality, pdfFiller simplifies the process of legally signing the 2024 form electronically. The platform ensures that all signatures are securely captured, using advanced security measures like encryption and audit trails to protect sensitive information.

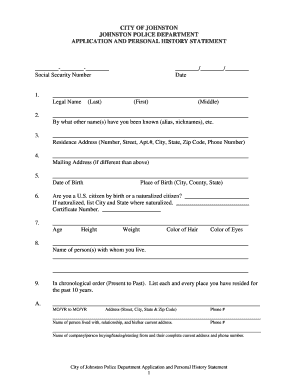

Step-by-step instructions for filling out the 2024 form

Accessing the 2024 form on pdfFiller is straightforward. Navigate directly to the pdfFiller website and search for the 2024 form template. Once you've located it, you can begin filling out the document. It’s essential to pay attention to each section, ensuring that information is entered accurately.

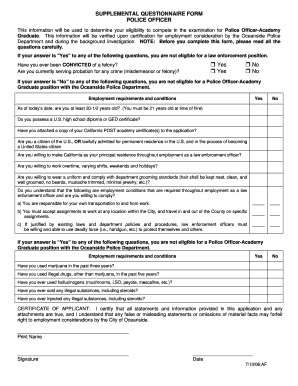

When filling out the form, each section has specific requirements that must be adhered to. For instance, in Section A, Personal Information, ensure that your name, address, and Social Security number are correctly entered; accuracy here is crucial to prevent delays. Section B, Income Reporting, necessitates a comprehensive listing of all earnings and is pivotal for your overall tax liability.

Once you've filled out the 2024 form, pdfFiller allows you to make changes easily post-completion. Users can utilize version control to track changes and collaborate with team members, ensuring everyone involved is informed of updates, thereby avoiding potential errors.

Managing your 2024 form documents

Once the 2024 form is completed, pdfFiller provides various options for saving and storing your document securely. Users can save files in different formats or directly in cloud storage, ensuring access from anywhere at any time. Proper document management is paramount; creating a structured system for saved forms can save you valuable time and prevent confusion when needed later.

Sharing your completed 2024 form via email or download is also seamless with pdfFiller. The platform allows you to review sharing settings and set permissions, ensuring that sensitive data remains secure while also facilitating collaboration with stakeholders who might require access.

Frequently asked questions about the 2024 form

Users often encounter challenges when filling out the 2024 form, especially concerning specific sections that may require extra attention. Common issues include discrepancies in income reporting or misunderstanding deduction limits. To alleviate these problems, it’s beneficial to carefully review guidelines provided by the IRS and consult tax professionals when in doubt.

If changes are needed after submission, the process for updating your information varies based on the nature of the error. It's crucial to familiarize yourself with the corrections policy for forms submitted to the IRS or relevant tax authority, ensuring that any alterations are compliant with the law.

Best practices for using the 2024 form efficiently

To optimize your experience with the 2024 form, consider using pre-filled sections or templates when available, as these can significantly accelerate your workflow. Additionally, setting aside dedicated time for filling out your form without distractions can enhance focus and minimize mistakes.

Utilizing interactive tools within pdfFiller further enriches your form-filling experience. Features like guided help in each section can provide instant feedback and direct answers to questions that often arise while completing the form.

Staying updated on tax law changes ensures you are well-prepared for future filing seasons. Regularly check relevant tax authority websites for announcements regarding alterations in forms and procedures, which can affect how you complete your documents.

Exploring additional features on pdfFiller

pdfFiller is not just a tool for filling out the 2024 form; it also integrates with various platforms to enhance your document-filling workflow. By connecting with cloud storage (like Google Drive or Dropbox) and email services, users can optimize their processes for easier access and sharing.

Furthermore, community resources and tutorials provided by pdfFiller offer accessible guidance, empowering users to maximize their usage of the platform. These resources include step-by-step video tutorials and forums where users can share tips and experiences.

Spotlight on user experience

Users have reported positive experiences with pdfFiller while working on the 2024 form, citing the intuitive interface and robust editing capabilities. Testimonials reveal that many individuals and teams have found the platform indispensable in managing their document workflows efficiently.

Case studies further exemplify how various users—from small business owners to freelancers—have streamlined their form handling processes through pdfFiller. These real-world applications highlight pdfFiller's potential in resolving common documentation challenges, and optimizing interactions with essential tax forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2024 to be eSigned by others?

How do I edit 2024 straight from my smartphone?

How do I complete 2024 on an Android device?

What is 2024?

Who is required to file 2024?

How to fill out 2024?

What is the purpose of 2024?

What information must be reported on 2024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.