Get the free Employee Authorization for Payroll Deduction to Health Savings Account

Get, Create, Make and Sign employee authorization for payroll

How to edit employee authorization for payroll online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee authorization for payroll

How to fill out employee authorization for payroll

Who needs employee authorization for payroll?

Understanding the Employee Authorization for Payroll Form

Understanding the Employee Authorization for Payroll Form

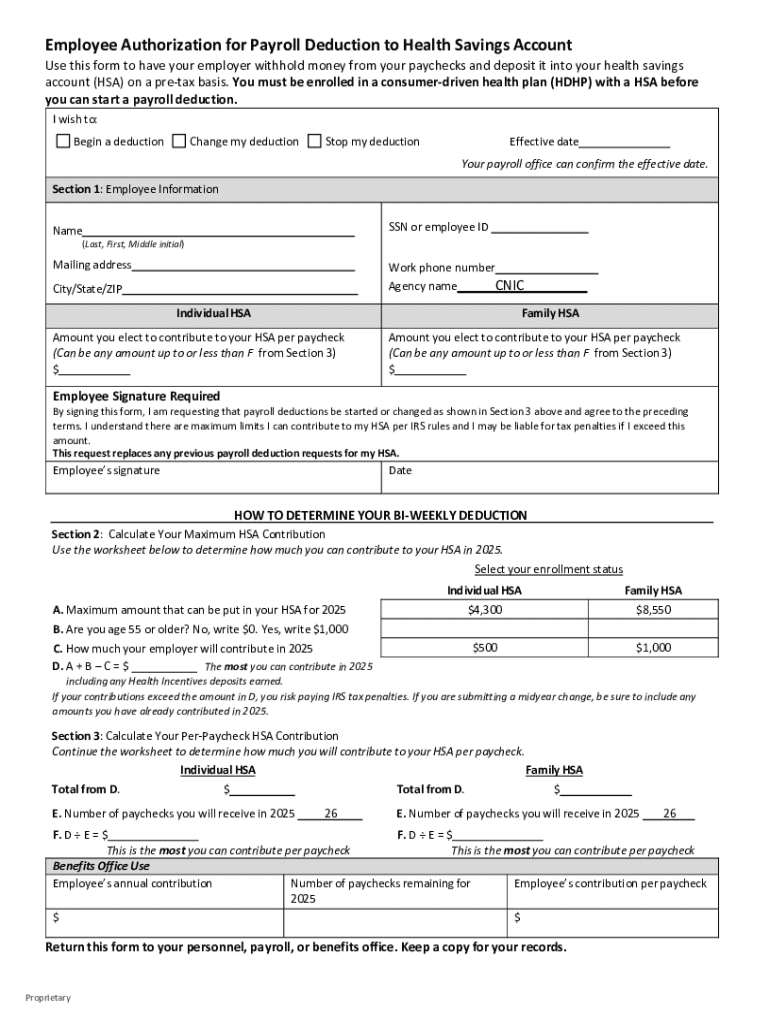

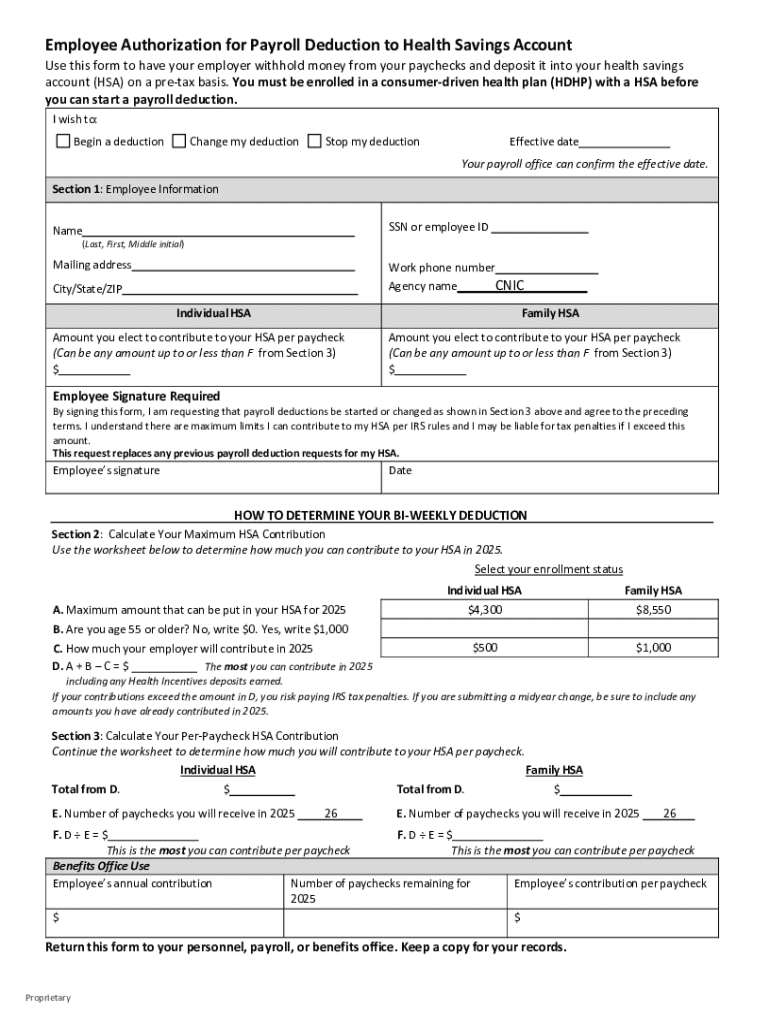

An employee authorization for payroll form is a crucial document that ensures the proper handling of payroll-related transactions. It is designed to collect and organize data about an employee’s pay structure, deductions, and preferences for receiving payment. This form serves multiple purposes, including establishing a clear record of the employee's consent for various payroll activities, which is essential for both the employer and the employee.

Ensuring the presence and accuracy of this form is vital for lawful payroll processing. Not only does it help organizations adhere to labor laws, but it also minimizes the risk of errors that could lead to financial discrepancies. By obtaining explicit authorization from employees, employers can also provide a transparent payroll experience, fostering trust within the workforce.

When is the Employee Authorization for Payroll Form Needed?

The employee authorization for payroll form becomes essential in various employment scenarios. Primarily, it is required during employee onboarding to facilitate the initial setup of payroll processes for new hires. This is the starting point where all required payroll information is collected, ensuring that the employee's details are recorded accurately from day one.

Additionally, when there are changes in employment status, such as promotions or transfers, the form is needed to update the relevant payroll details. Any updates to bank information or changes to direct deposit accounts require a new submission of this form, along with adjustments in payroll deductions, which might include changes in tax information or benefits selections.

Step-by-step instructions for filling out the employee authorization for payroll form

Filling out the employee authorization for payroll form correctly is crucial for ensuring that all payroll activities proceed smoothly. Here’s a step-by-step guide to help you through the process.

Best practices for managing employee authorization for payroll forms

Managing employee authorization for payroll forms efficiently is critical for keeping payroll processes organized. Secure storage of completed forms is paramount to ensure confidentiality and compliance. It is advisable to have a dedicated system, either physical or digital, for storing these forms.

Accessibility is equally important; HR and payroll staff should be able to retrieve the forms without delay. Establishing regular audits and updates to the forms can prevent outdated information from lingering in the system. Communicating these updates to affected employees is also essential for maintaining compliance.

Additionally, consider utilizing digital solutions like those offered by pdfFiller for streamlining forms management. Features such as e-signature capabilities and collaborative editing tools can enhance efficiency, making it easier to handle modifications and track changes.

Common mistakes to avoid when filling out the payroll form

When filling out the employee authorization for payroll form, attention to detail is paramount. One of the most common mistakes is incomplete information, which can lead to delays in processing or incorrect payroll calculations. Missing fields, especially contact information or bank details, can cause complications in receiving payments.

Another frequent error involves incorrect signatures. It is crucial to ensure the use of accurate names and titles when signing the document. Relying on outdated forms can pose risks as well; always verify that the form version being used is the latest to ensure compliance with company policies.

FAQs about employee authorization for payroll forms

Understanding the nuances of the employee authorization for payroll form may raise a few common questions. One frequent inquiry is: 'What if I make a mistake on my form?' In the case of an error, simply correct it immediately and re-sign the form or discuss it with HR for proper guidance.

Another common question is, 'How often do I need to update my payroll authorization?' It is advisable to review and update the form whenever a significant change occurs, such as altering bank information, job title, or payroll deductions. For specific inquiries regarding the form, reaching out to your HR department is always a good practice.

Interactive tools and resources available for employees

For those looking to streamline their experience with the employee authorization for payroll form, pdfFiller offers extensive interactive tools. Users can access customizable templates that allow them to tailor forms specifically to their needs, which greatly enhances engagement and accuracy in submissions.

The eSignature features provided by pdfFiller simplify the signing process, enabling users to electronically sign forms without the hassle of physical paperwork. Collaboration among team members is made seamless as well, as pdfFiller allows users to work together on forms simultaneously, ensuring that everyone involved is on the same page.

Understanding your rights and responsibilities

As an employee, it’s essential to be aware of your rights regarding payroll processing. One of the fundamental rights is the assurance of privacy; your personal and financial information should be handled confidentially and securely. Employers are obligated to protect this information rigorously, ensuring that unauthorized personnel do not gain access to it.

On the employer's side, responsibilities include ensuring timely processing of payroll modifications and adherence to labor laws concerning payroll authorizations. This includes accurately updating records and communicating any changes effectively to the employees involved, creating an open and transparent work environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send employee authorization for payroll for eSignature?

How do I edit employee authorization for payroll in Chrome?

Can I edit employee authorization for payroll on an Android device?

What is employee authorization for payroll?

Who is required to file employee authorization for payroll?

How to fill out employee authorization for payroll?

What is the purpose of employee authorization for payroll?

What information must be reported on employee authorization for payroll?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.