Get the free Untaxed Income Verification Worksheet

Get, Create, Make and Sign untaxed income verification worksheet

How to edit untaxed income verification worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out untaxed income verification worksheet

How to fill out untaxed income verification worksheet

Who needs untaxed income verification worksheet?

Untaxed Income Verification Worksheet Form - How-to Guide Long-read

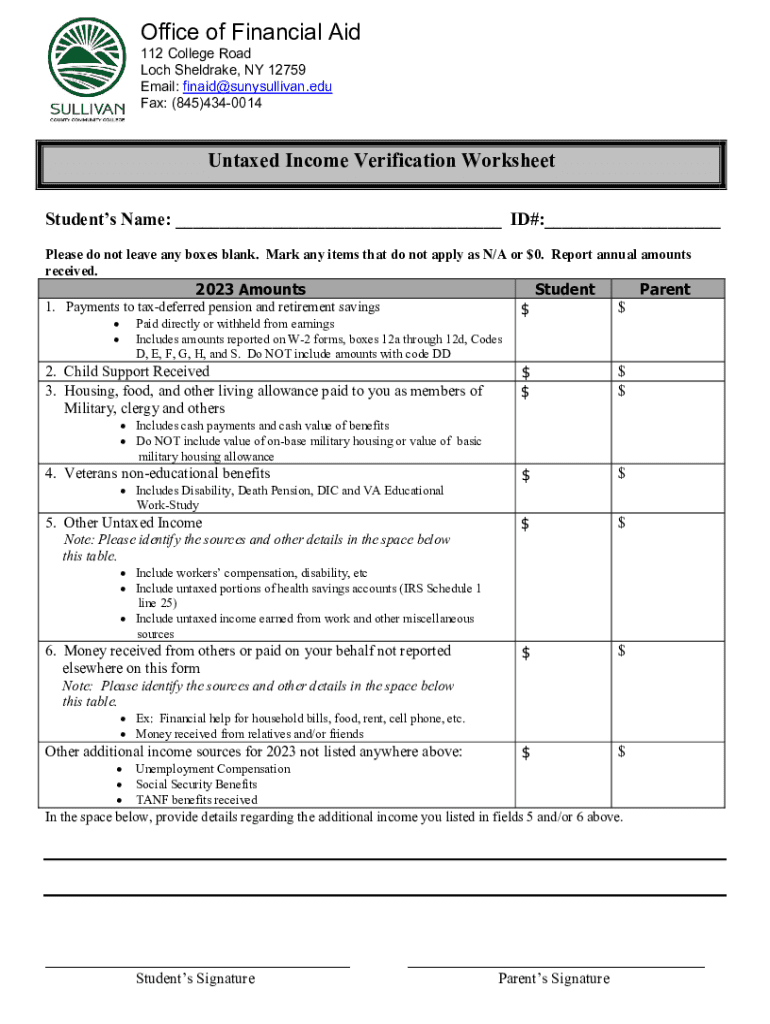

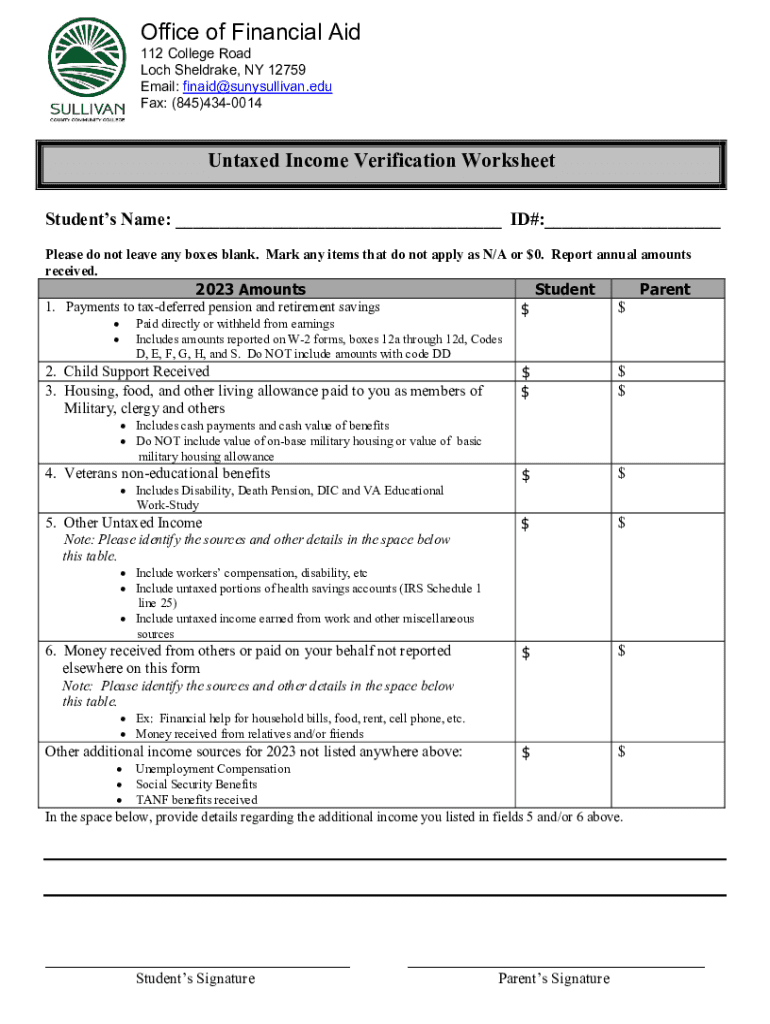

Understanding the Untaxed Income Verification Worksheet Form

The untaxed income verification worksheet form serves as a crucial document in various financial processes, especially when assessing eligibility for financial aid, loans, or other assistance programs. This form is designed to capture income that, while not subject to federal taxes, plays a significant role in determining a person's financial capability. The primary purpose of this worksheet is to provide a clear and comprehensive account of untaxed income sources, ensuring that all factors affecting an individual's financial status are considered.

Verifying untaxed income is essential as it helps institutions make informed decisions regarding financial support. Whether you're a college student applying for FAFSA or an adult seeking a loan, understanding and accurately reporting untaxed income can be the key to receiving the necessary funds. Common scenarios where this form is utilized include applying for government assistance programs, student financial aid, and mortgages, highlighting its wide-reaching significance.

Types of untaxed income that may need verification

Several types of untaxed income may require thorough verification when filling out the worksheet. Identifying these sources accurately can significantly streamline the application process for financial aids and loans. The following are the most common sources classified as untaxed income:

Preparing to fill out the worksheet

Before you begin filling out the untaxed income verification worksheet form, gathering the necessary documentation is crucial. Having all required documents at hand not only ensures that you can complete the form accurately but also speeds up the submission process. Here are some essential documents that you should prepare:

Key information needed for completion includes your personal details, the period for which you're reporting income, and specific monetary amounts for each untaxed income type. Having precise figures allows for a more efficient review and increases the likelihood of successful processing.

Step-by-step guide to completing the untaxed income verification worksheet form

Completing the untaxed income verification worksheet requires attention to detail. Here’s a step-by-step guide to help you navigate through the form:

Common mistakes to avoid when filling out the form

When filling out the untaxed income verification worksheet form, avoiding common pitfalls can save you time and potential complications. Here are some mistakes to watch out for:

Tips for using pdfFiller for submission

Using pdfFiller to manage the completion and submission of your untaxed income verification worksheet form can simplify the process significantly. Here’s how to effectively utilize pdfFiller's features:

After completion: What to do with the form

Once you have accurately filled out the untaxed income verification worksheet form, the next steps involve submission and record-keeping. Different institutions may have varying guidelines for submission. It's crucial to follow these guidelines to ensure your document reaches the right hands promptly.

Troubleshooting common issues

Even with thorough preparation, you may encounter issues with the untaxed income verification worksheet form. It's important to know how to address these problems effectively:

Interactive tools and resources available via pdfFiller

pdfFiller provides a range of interactive tools that can further enhance your experience with the untaxed income verification worksheet form. From additional templates to document management features, these resources are designed to streamline your paperwork process.

User stories: How others have benefited from pdfFiller

Many users have shared their success stories after using pdfFiller to complete the untaxed income verification worksheet form. Their experiences highlight the platform's effectiveness and user-friendly interface.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in untaxed income verification worksheet?

How do I edit untaxed income verification worksheet straight from my smartphone?

How do I edit untaxed income verification worksheet on an Android device?

What is untaxed income verification worksheet?

Who is required to file untaxed income verification worksheet?

How to fill out untaxed income verification worksheet?

What is the purpose of untaxed income verification worksheet?

What information must be reported on untaxed income verification worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.