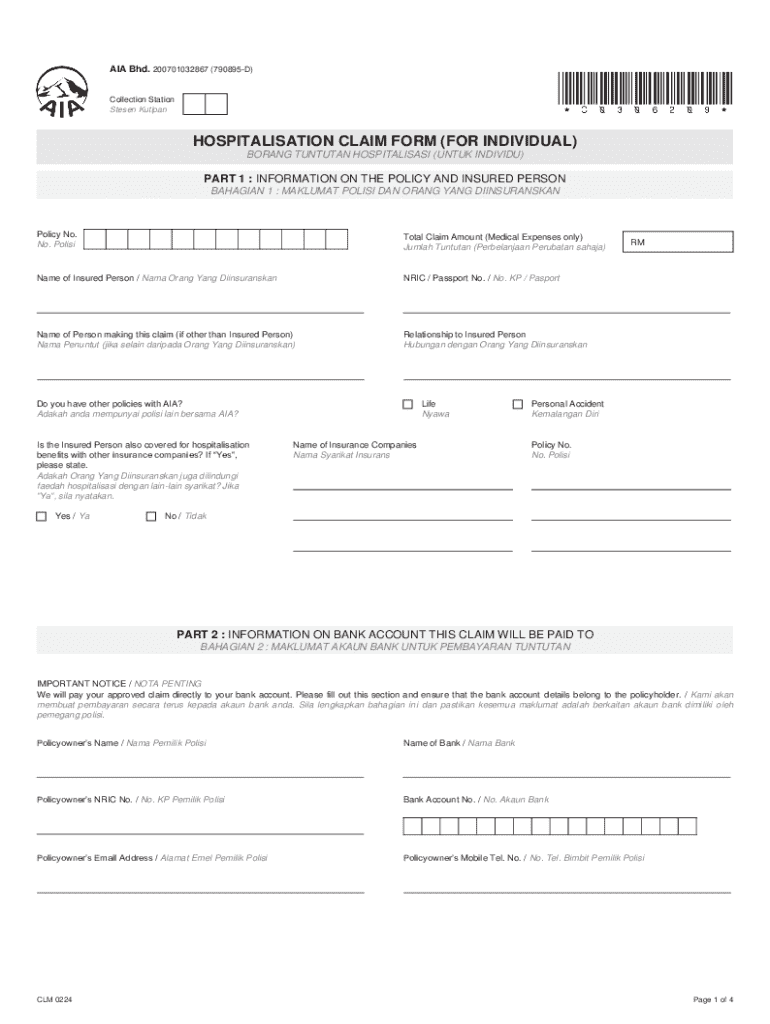

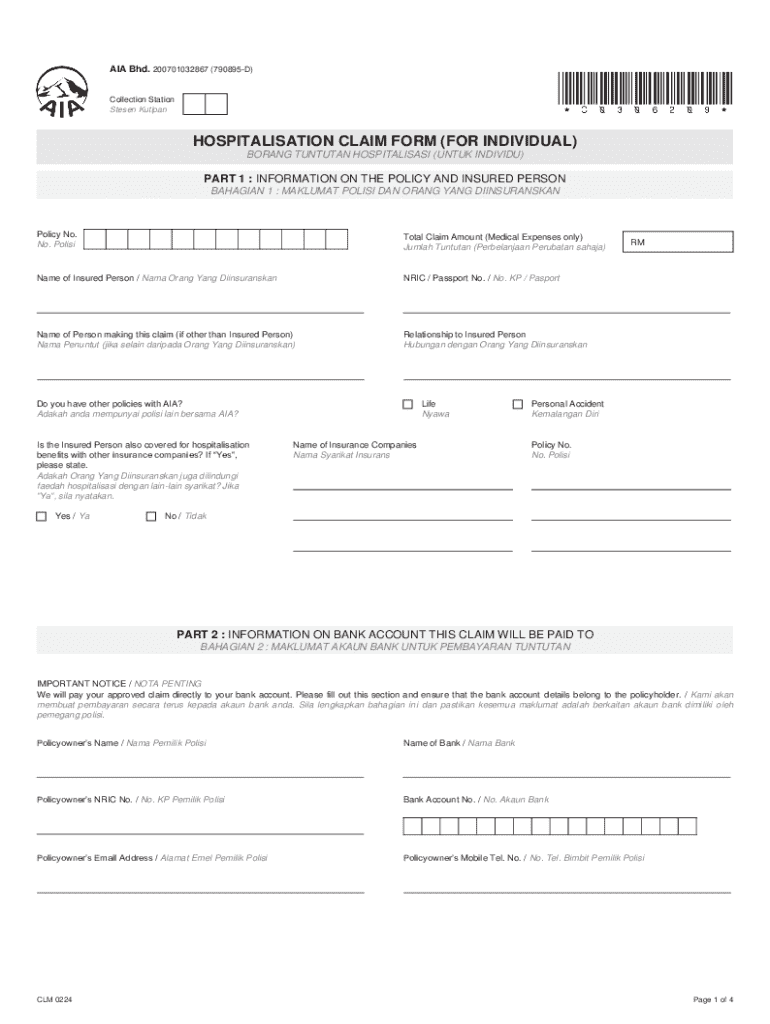

Get the free Hospitalisation Claim Form (for Individual)

Get, Create, Make and Sign hospitalisation claim form for

Editing hospitalisation claim form for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hospitalisation claim form for

How to fill out hospitalisation claim form for

Who needs hospitalisation claim form for?

A comprehensive guide to the hospitalisation claim form

Understanding the hospitalisation claim form

A hospitalisation claim form is a crucial document designed to facilitate the process of claiming insurance reimbursement for medical treatments received during a hospital stay. Its primary purpose is to gather all necessary information related to your hospitalisation, ensuring that health insurance providers can assess and approve claims efficiently. This form is vital not only for individuals seeking reimbursement but also for healthcare teams involved in documentation and processing insurance claims.

Understanding the hospitalisation claim form is essential as it binds the patient and insurance provider in a mutual agreement regarding coverage and expenses. This understanding can significantly affect recovery times in the claims process and the financial burden on patients. Proper completion can expedite reimbursement, while errors may lead to prolonged waits or denials.

Key terms and concepts

To navigate the hospitalisation claim form effectively, it's essential to familiarize yourself with some key terms. For instance, a 'co-pay' refers to the fixed amount you pay for a specific medical service, while a 'deductible' is the amount you need to pay out-of-pocket before your insurance kicks in. Other important terms include 'network provider,' which identifies if the healthcare provider is contracted with your insurance plan, and 'pre-authorization,' which indicates that prior approval from the insurer is needed before certain medical services can be performed.

The importance of accurate form submission

Submitting an accurate hospitalisation claim form is critical for a seamless claims process. Common mistakes include incorrect personal information, missing signatures, and failing to attach necessary documentation such as medical bills and reports. Each of these errors can lead to delays or outright rejection of your claim, adding stress to an already challenging time. To mitigate such issues, take extra caution while filling out your form.

Providing accurate information is vital, as the insurance company bases its approval on the data you submit. Missing or incorrect information may trigger red flags in the insurance company’s verification process. There are specific legal requirements depending on your location regarding the submission of claims. Ensuring you are compliant with these regulations not only protects your rights but also expedites the approval process.

Step-by-step guide to filling out the hospitalisation claim form

Filling out a hospitalisation claim form requires careful attention. First, you need to gather all necessary information and documents. This typically includes your medical records, hospital bills, and insurance policy details. Ensuring you have everything at hand will make the process smoother and more efficient.

After gathering your documents, you can start filling out the form. Begin with the personal information section. Ensure that your name, address, and contact details are accurate. The next section involves entering your insurance information; provide the name of your provider, policy number, and any other required details carefully.

Completing each section might seem daunting, but focus on accuracy. Pay particular attention to the itemisation of medical expenses, as this supports your claim's legitimacy.

Editing and reviewing your form

Once your hospitalisation claim form is filled out, reviewing and ensuring accuracy is the next critical step. Utilizing pdfFiller’s tools for document management, you can easily edit your PDF. You may also want to collaborate with others for review, allowing for additional insights into your submission.

A final checklist can streamline this process: confirm your personal details are correct, confirm your insurance policy details align with those on file, verify hospitalisation information, and check that all receipts and supporting documents are attached. This systematic approach can drastically reduce the risk of errors.

eSigning and submitting the hospitalisation claim form

eSigning your hospitalisation claim form offers several benefits, including a streamlined submission process that minimizes the time between completion and submission. When using pdfFiller, security measures ensure that your eSignature remains protected, allowing peace of mind while submitting sensitive information.

When it comes to submitting the form, various methods may be available. You can choose to submit your claim online or via traditional mail. Whichever method you select, ensure you follow submission best practices: keep a copy of what you submit, note any tracking numbers if applicable, and verify that you send it to the correct address or online portal ultimately relevant to your insurer.

Tracking your claim status

Understanding the claim processing timeline can help set expectations. Claim processing times can vary widely depending on the insurer, but typically, you might expect anywhere from a few days to several weeks for claims to be processed. Tracking your claim status is crucial to ensure your expenses are reimbursed as planned.

Using tools provided by pdfFiller can aid in monitoring your submission status. By maintaining access to your submission records, you’ll be in a strong position to follow up if necessary, ensuring you remain informed throughout the process.

Common issues and how to resolve them

If your claim is denied, don't panic. First, review the denial letter carefully to understand the reasons behind the decision. The next step is to reach out to your insurance provider to initiate the appeal process. Document all communications, and if possible, request any additional information or evidence that may support your case.

In addition to appeals, it's common to find a range of frequently asked questions surrounding claim processing. Addressing common concerns proactively can significantly ease the anxiety surrounding the claims process. Engaging with customer service representatives and understanding policy details can make a world of difference.

Successful strategies for future claims

To ensure future claims are handled smoothly, implementing a systematic approach to record-keeping is invaluable. Maintaining organized documentation of all medical treatments and associated expenses not only aids in the claims process but also empowers your future healthcare journeys.

Leveraging pdfFiller's capabilities can also enhance your experience. PDF templates can be reused for similar claims and adapted accordingly, decreasing the time spent on future submissions. A streamlined process makes future claims less stressful and increases the likelihood of timely reimbursements.

Utilizing interactive tools on pdfFiller

To maximize your efficiency, pdfFiller offers interactive tools that can dramatically enhance your ability to complete claims. Utilizing pre-made templates specifically designed for hospitalisation claims can save time and ensure that you include all necessary information from the onset.

Additionally, customization options allow users to create forms tailored to their particular needs. Whether you require basic edits, added text fields, or specific sections, tailoring your hospitalisation claim form is simple with pdfFiller's user-friendly interface.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit hospitalisation claim form for online?

Can I create an electronic signature for the hospitalisation claim form for in Chrome?

How can I edit hospitalisation claim form for on a smartphone?

What is hospitalisation claim form for?

Who is required to file hospitalisation claim form for?

How to fill out hospitalisation claim form for?

What is the purpose of hospitalisation claim form for?

What information must be reported on hospitalisation claim form for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.