Get the free Form Adv

Get, Create, Make and Sign form adv

Editing form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

Form ADV: Your Essential Guide to Understanding and Utilizing Financial Advisory Disclosure

Understanding Form ADV: Your essential guide

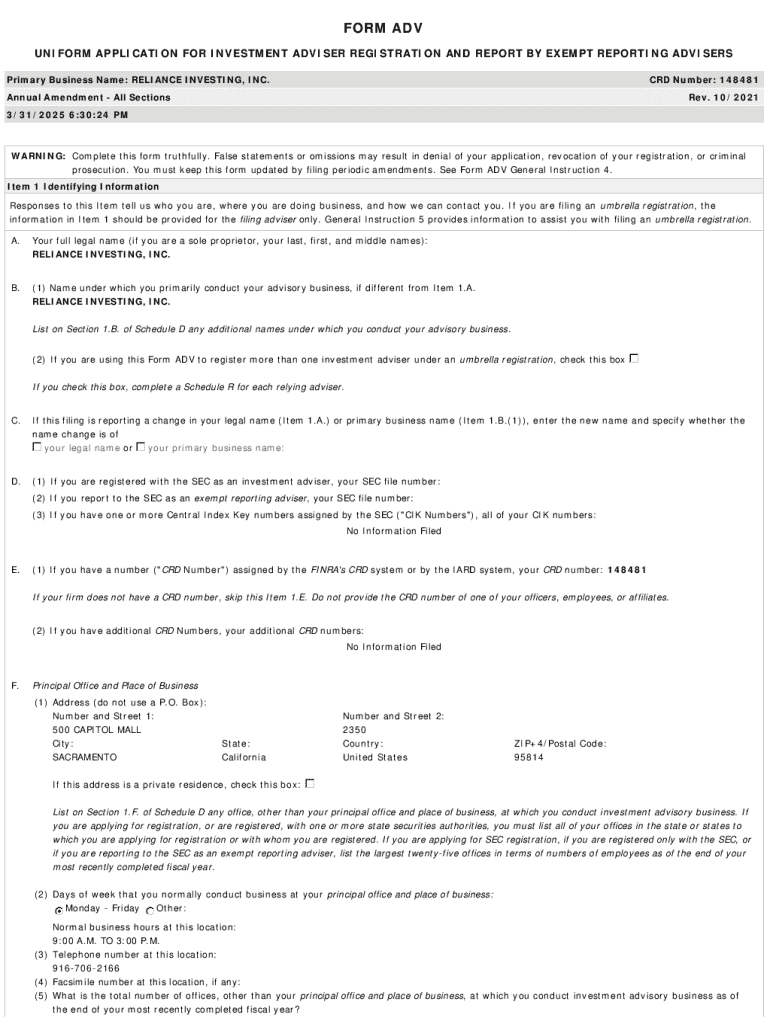

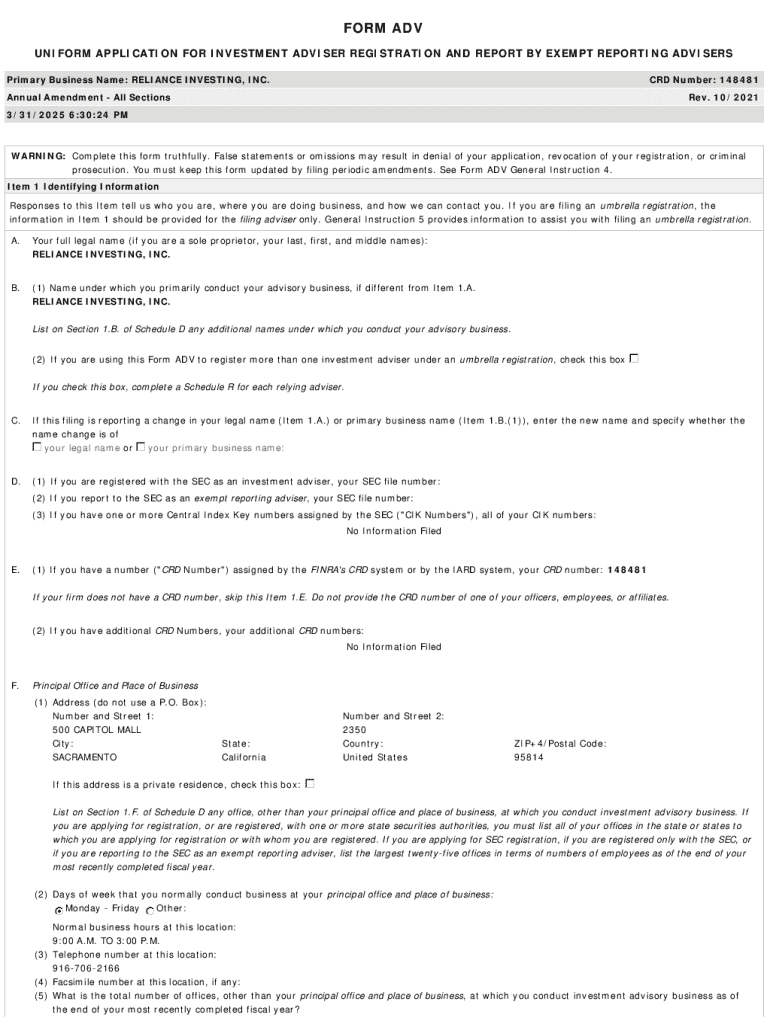

Form ADV is a crucial document in the realm of financial advisory services, designed to provide essential information about investment advisors and their firm practices. This form, mandated by the Securities and Exchange Commission (SEC), serves both to protect investors and to enhance transparency within the advisory industry. Understanding Form ADV is pivotal for anyone looking to work with a financial advisor or become an investment manager themselves.

Comprising two main parts, Form ADV Part I focuses on firm and business details, while Part II dives deeper into disclosures about fees, services, and risks. Familiarity with these sections will empower you to make informed decisions about financial advisory services.

Analyzing Form ADV Part

Part I of Form ADV primarily contains information that allows investors to understand the structure and operations of the advisory firm. Here, you'll find several key sections, each packed with valuable details:

Common terminology used in this part includes 'Assets Under Management' (AUM), which indicates the total market value of the assets that the firm manages on behalf of clients, and 'Fiduciary Duty,' which mandates advisors to act in the best interest of their clients.

Delving into Form ADV Part

Form ADV Part II offers a comprehensive overview of the advisor's services, terms, and potential risks. Each item provides critical insights into what clients can expect. Here’s a detailed exploration:

Each section in Part II plays a significant role in evaluating a firm's quality and trustworthiness. For instance, the disclosure of disciplinary actions can serve as a pivotal warning for prospective clients.

Accessing a firm's Form ADV: Step-by-step instructions

Finding a firm’s Form ADV can be straightforward through the SEC’s Investment Adviser Public Disclosure (IAPD) website. Here’s how to navigate the process efficiently:

Interpreting Form ADV can seem daunting, but using tools like pdfFiller can significantly streamline the process, allowing for easier management and understanding of the form's contents.

What Form ADV doesn’t tell you: The hidden insights

While Form ADV is a critical resource, it does have its limitations. Investors should be cognizant of certain gaps and conduct further research. Here are some insights:

Combining the data from Form ADV with other resources gives you a broader understanding of the advisor, facilitating better investment decisions.

Tips for reading and understanding Form ADV

Reading through Form ADV requires a strategic approach given the complexity of its language. Here are some practical tips to enhance comprehension:

Approaching Form ADV with a critical eye bolstered by external resources will help you develop a more informed perspective when selecting a financial advisor.

Top financial advisors: Utilizing Form ADV for smart choices

Finding the right financial advisor can be a daunting task, but Form ADV provides a concrete starting point for comparing and selecting advisors. Here’s how to use Form ADV effectively:

By utilizing Form ADV in conjunction with modern technology, you can navigate the financial advisory landscape more confidently and efficiently.

Practical application: Filling out and managing Form ADV using pdfFiller

If you’re an advisor or firm seeking to fill out and manage Form ADV, pdfFiller offers an intuitive solution. Here’s a step-by-step guide to use pdfFiller effectively:

pdfFiller’s interactive tools facilitate smooth document handling, making it easier to maintain compliance and adapt to regulatory changes.

Conclusion: Maximizing your document strategy with pdfFiller

Form ADV is not just a regulatory necessity; it is an invaluable resource for both investors and advisors. Understanding its contents and implications is fundamental to making smart financial decisions. By effectively leveraging pdfFiller, firms can manage their forms efficiently, ensuring accuracy and compliance.

Embarking on your financial advisory journey armed with the insights from Form ADV and the tools offered by pdfFiller will bolster your confidence as you navigate the investment landscape. With these resources at your disposal, you are now better equipped to make informed decisions and optimize your financial strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form adv online?

Can I create an electronic signature for the form adv in Chrome?

How can I fill out form adv on an iOS device?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.