Get the free 2025-2026 Parent Taxable Grant & Scholarship Statement

Get, Create, Make and Sign 2025-2026 parent taxable grant

How to edit 2025-2026 parent taxable grant online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 parent taxable grant

How to fill out 2025-2026 parent taxable grant

Who needs 2025-2026 parent taxable grant?

Your Guide to the 2 Parent Taxable Grant Form

Overview of the 2 Parent Taxable Grant Form

The 2 parent taxable grant form is a pivotal document in the financial aid process, specifically targeted towards parents who receive taxable grants for their children’s education. This form plays a significant role in determining a family's eligibility for various financial aid opportunities, making it vital for parents to accurately complete it.

Understanding the purpose and details of the parent taxable grant form can influence financial planning and college funding strategies significantly. Parents who prepare this documentation can provide a clearer financial picture to institutions, improving their child's chances of receiving sufficient aid.

Who should use this form

The 2 parent taxable grant form is designed for parents whose financial situations involve taxable grants. Eligibility criteria focus on parents with dependent students who are aiming for financial aid based on their combined income. This can include grants received from state, local, or federal sources that are considered taxable.

Completing and submitting this form can significantly impact a student’s financial aid package. Proper documentation of financial aid need is crucial, as it allows institutions to assess how much support they can provide, affecting not just the current year but potentially future eligibility as well.

Key sections of the Parent Taxable Grant Form

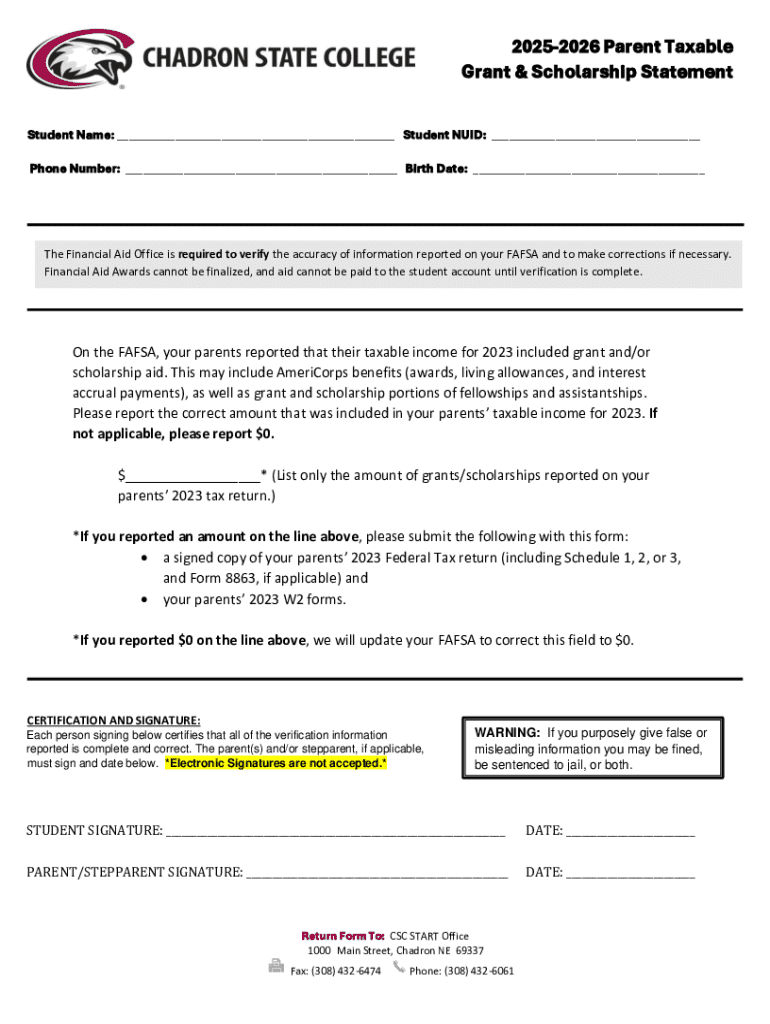

Filling out the parent taxable grant form requires attention to specific sections that capture essential financial data. The first step involves entering personal information, which includes required demographic details such as names, Social Security numbers, and contact information. Parents should ensure that all submitted information is accurate and consistent with other financial documents.

Income reporting is another critical section, encompassing all sources of taxable income. This may include salaries, bonuses, and taxable grants. It is vital to document these correctly, as inaccuracies can lead to delays or rejections of financial aid applications. Special attention should be paid to how to report these numbers accurately to prevent issues.

Adjustments to income

Understanding adjustments to income is crucial when preparing the 2 parent taxable grant form. Parents may deduct certain qualifying expenses such as contributions to retirement accounts or certain medical expenses when calculating adjusted gross income. This step can lead to significant savings in terms of tax liability and financial aid eligibility.

A step-by-step guide for calculating adjusted gross income can start by taking total income from the income reporting section and subtracting any allowable adjustments. Understanding these deductions can ensure that parents are maximizing their financial positions, improving both tax outcomes and financial aid eligibility.

Verification and supporting documents

Completing the 2 parent taxable grant form requires parents to gather several supporting documents to verify the information provided. Essential documents typically include prior tax returns, W-2 forms from employers, and any 1099 statements that indicate other income sources. Collecting these documents in advance can streamline the process significantly.

Moreover, organizing these documents effectively can prevent last-minute scrambles and errors when submitting the form. Utilizing digital tools like pdfFiller can assist significantly in this organization and record-keeping effort, allowing for seamless management of documentation.

Step-by-step instructions for completing the form

Completing the form requires a section-by-section walkthrough to ensure accuracy and completeness. Each section may have distinct requirements, so parents should carefully follow any provided instructions. Starting with personal information, continuing through income reporting, and finally adjustments can ensure nothing is overlooked.

Common pitfalls include failing to double-check calculations or forgetting to sign the form before submission. Familiarizing oneself with the pdfFiller platform can also ease the process. Utilizing features like auto-fill and electronic signatures can minimize errors and speed up the completion.

Frequently asked questions about the Parent Taxable Grant Form

Once the parent taxable grant form is submitted, parents may have various questions regarding the process. One common concern revolves around error corrections after submission. The process typically allows for corrections to be made on the submitted form if necessary, ensuring accurate financial information is relayed to aid offices.

Understanding the important deadlines for submission is also crucial. Applications for financial aid and completing the necessary forms have specific dates that must be adhered to in order to avoid forfeiting potential funding opportunities.

Additional considerations for parents

As parents navigate the complexities of financial aid through the 2 parent taxable grant form, it’s essential to consider future implications. The information reported can influence subsequent years’ financial aid applications, which means that consistency and accuracy are paramount.

Unique situations, such as those involving divorced parents or non-traditional family structures, can complicate the aid process. Guidance specific to these circumstances can aid in ensuring that all eligible resources are tapped into and that financial needs are fully represented.

Utilizing pdfFiller to manage taxable grant forms

pdfFiller provides a comprehensive solution to managing the 2 parent taxable grant form. With collaborative features, parents can work alongside others in their household or team up with professionals to ensure the form is filled out accurately. This accessibility can be essential in sharing necessary information effortlessly.

Additionally, cloud-based document management through pdfFiller offers a secure platform for storing and handling sensitive information. The capability to add electronic signatures simplifies not only compliance but also expedites the submission process when deadlines loom.

Tips for maximizing financial aid through taxable grants

To maximize financial aid, parents must understand the different types of grants available. Federal grants often have more stringent eligibility requirements than state or institutional grants, so understanding these nuances can help in formulating applications that appeal directly to funding bodies.

Successful grant applications often come down to detail and thoroughness. Following best practices, including submitting all required documentation accurately and on time, can boost your chances of securing funding significantly.

Legal and compliance information

Every parent must understand their rights and responsibilities when submitting the 2 parent taxable grant form. Familiarity with legal aspects, including the implications of inaccurately reported information, helps mitigate risk throughout the financial aid process.

For additional support, various organizations and government bodies can provide assistance. From financial aid offices to educational consultants, utilizing available resources can enhance understanding and outcomes related to financial aid applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2025-2026 parent taxable grant in Chrome?

How do I fill out 2025-2026 parent taxable grant using my mobile device?

How do I complete 2025-2026 parent taxable grant on an iOS device?

What is 2025-2026 parent taxable grant?

Who is required to file 2025-2026 parent taxable grant?

How to fill out 2025-2026 parent taxable grant?

What is the purpose of 2025-2026 parent taxable grant?

What information must be reported on 2025-2026 parent taxable grant?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.