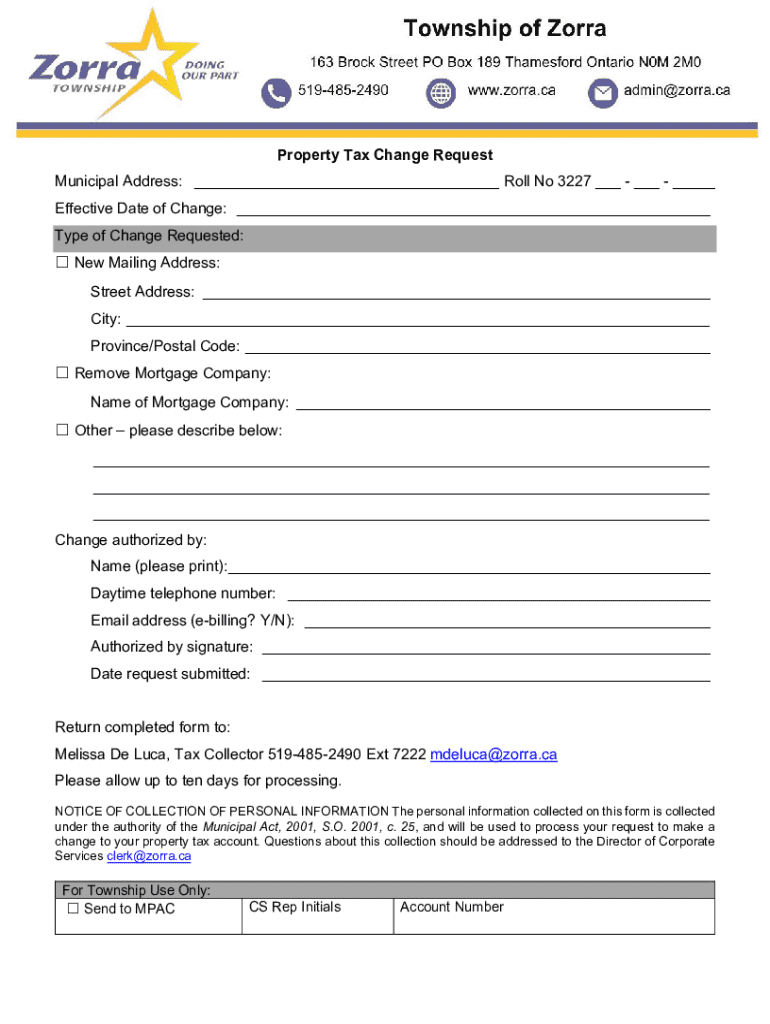

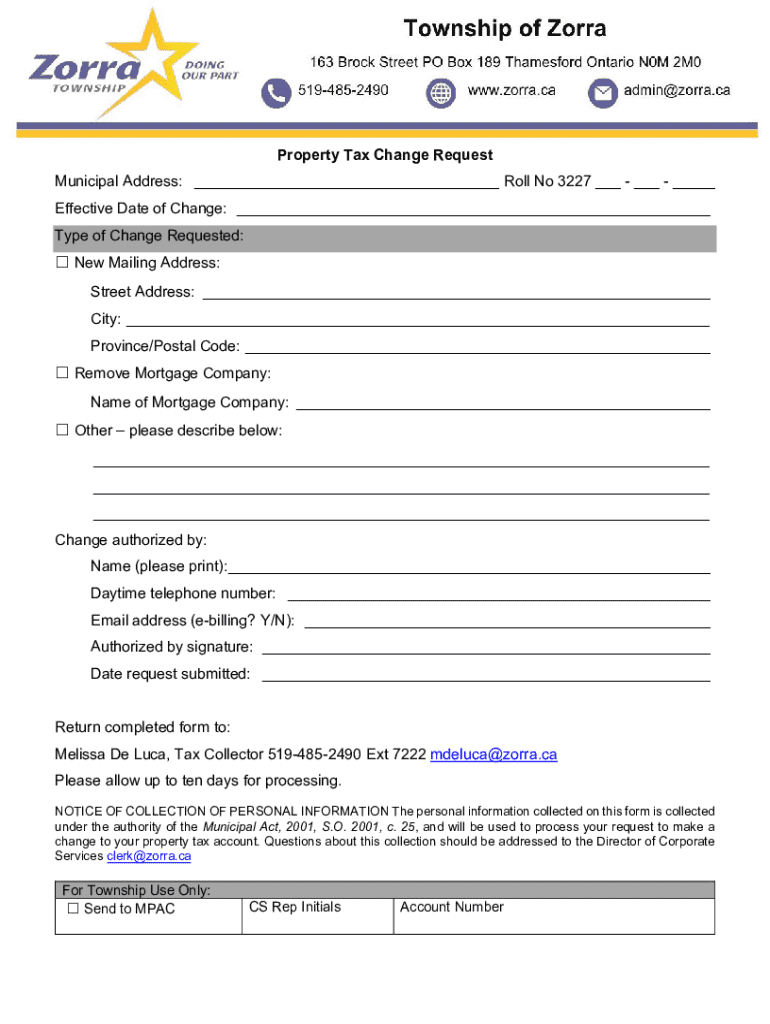

Get the free Property Tax Change Request

Get, Create, Make and Sign property tax change request

Editing property tax change request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax change request

How to fill out property tax change request

Who needs property tax change request?

Your Comprehensive Guide to the Property Tax Change Request Form

Understanding property tax change requests

A property tax change request is a formal application submitted by property owners to adjust the assessed value of their property for tax purposes. This request can be essential when a property has undergone changes that may affect its market value or when there are discrepancies in property descriptions.

Understanding the importance of property tax change requests cannot be overstated. These requests allow homeowners to appeal for lower taxes, ensuring they pay taxes based on an accurate assessment of their property's value. Common reasons to submit such a request include significant changes in the housing market, renovations that alter property characteristics, or errors in property records, potentially leading to reduced tax liabilities.

Eligibility criteria for filing a change request

To file a property tax change request, homeowners must meet specific eligibility criteria. Generally, only individuals or entities with ownership rights can submit these requests. Homeowners should provide proof of ownership, such as title deeds, and typically must reside in the property they are requesting changes for, although some local laws may vary.

The types of changes eligible for appeal often include adjustments to the property’s assessed value, corrections to property descriptions, and changes in ownership status. For instance, if a property has experienced a decrease in market value due to external factors like economic downturns or neighborhood developments, homeowners may be justified in appealing for lower tax assessments.

Preparing to submit your change request

Before submitting your property tax change request, proper preparation is key. Start by gathering necessary documents such as title deeds, copies of recent tax assessments, and any supporting evidence that substantiates your case, including photographs of the property, professional appraisals, or comparable market analysis.

It’s also crucial to understand local regulations surrounding property tax assessments. Research your local tax laws as they can significantly impact your filing process. Compliance with specific state and municipal guidelines can make or break your chances of a successful request, so ensure you are well-informed.

How to fill out the property tax change request form

Filling out the property tax change request form can be a straightforward process if approached methodically. Follow these step-by-step instructions to navigate your submission successfully.

Be sure to double-check all information for accuracy before submission. If you find the form complex, consider seeking professional assistance to help navigate the nuances of property tax law.

Submitting your request

Once your form is filled out, you have options for submitting your request. Online submission via pdfFiller is generally the most convenient. This method allows you to electronically file your request, streamlining the process significantly.

If you prefer traditional methods, ensure you prepare your documents for postal delivery accurately. Include all relevant paperwork, and opt for a mailing method that provides tracking to confirm that your changes have been sent and received.

Tracking the status of your change request

After submitting your request, it's important to know when and how you can track its status. Expect a waiting period during which local tax authorities review your application. Processing times may vary, but they typically range from a few weeks to several months, depending on local practices and the volume of requests.

If you file electronically through pdfFiller, you can utilize tracking tools on the platform to monitor the progress of your submission. It’s beneficial to stay proactive and check regularly to address any potential issues quickly.

Handling responses to your change request

After processing your request, the local tax authority will respond, presenting you with several options. If your request is approved, you will receive documentation detailing the adjusted tax assessment. Alternatively, they may ask for additional information or clarification to support your case.

If your request is denied, don’t be disheartened; you can file an appeal. Understanding the process for filing an appeal and preparing a well-documented case can significantly increase your chances of a favorable outcome. Gather any additional evidence needed and provide clear justification in your appeal submission.

Frequently asked questions (FAQs)

Homeowners often have specific questions about the property tax change request process. Queries might include how long it takes to receive a response after submission or whether requests can be amended post-filing. It's also common to wonder about the implications of mid-year property tax changes.

Typically, the timeframe for responses varies, with many jurisdictions aiming for resolutions within a standard fiscal period. However, this can differ based on local laws and workload. If a homeowner realizes a need to amend their request after submission, they should consult local regulations, as policies can differ.

Tools and resources available on pdfFiller

pdfFiller offers a suite of interactive tools designed to make the property tax change request process as seamless as possible. Features like PDF editing allow users to customize documents directly within the platform, eliminating the need for multiple applications.

The e-signature capabilities facilitate secure and timely approvals, making it easier for homeowners to submit crucial documents promptly. Additionally, pdfFiller’s collaboration tools enable teams to work together effectively, streamlining communication and document management while enjoying the advantages of cloud storage.

Supporting information on property taxes

To understand the broader context of your property taxes, it’s essential to be informed about the various types of property taxes and how they function. Typically, property taxes are based on assessed value, meaning fluctuations in property market values directly impact tax amounts. Tax proportions can also vary based on local tax strategies and regulations, so always stay updated with your local government’s assessments and procedures.

Educating yourself about the property tax landscape will empower you to make informed decisions regarding your property, be it through challenges to your assessments or understanding market changes affecting your taxes.

Case studies of successful change requests

Real-world examples can illustrate the effective use of property tax change requests. Homeowners who actively engage in assessing their property values often succeed in reducing their tax burdens. For instance, after identifying outdated property descriptions in assessment records, one homeowner was able to file a correction request that led to significant tax savings over several years.

Additionally, some cases reflect a homeowners' engagement with market analysis to contest their assessments after a sharp decline in local property values. Learning from these scenarios provides valuable insights for those looking to file change requests themselves.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify property tax change request without leaving Google Drive?

Can I create an electronic signature for signing my property tax change request in Gmail?

How can I edit property tax change request on a smartphone?

What is property tax change request?

Who is required to file property tax change request?

How to fill out property tax change request?

What is the purpose of property tax change request?

What information must be reported on property tax change request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.