Get the free Return of Organization Exempt From Income Tax

Get, Create, Make and Sign return of organization exempt

How to edit return of organization exempt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out return of organization exempt

How to fill out return of organization exempt

Who needs return of organization exempt?

Return of Organization Exempt Form - A Comprehensive Guide

Understanding the Return of Organization Exempt Form

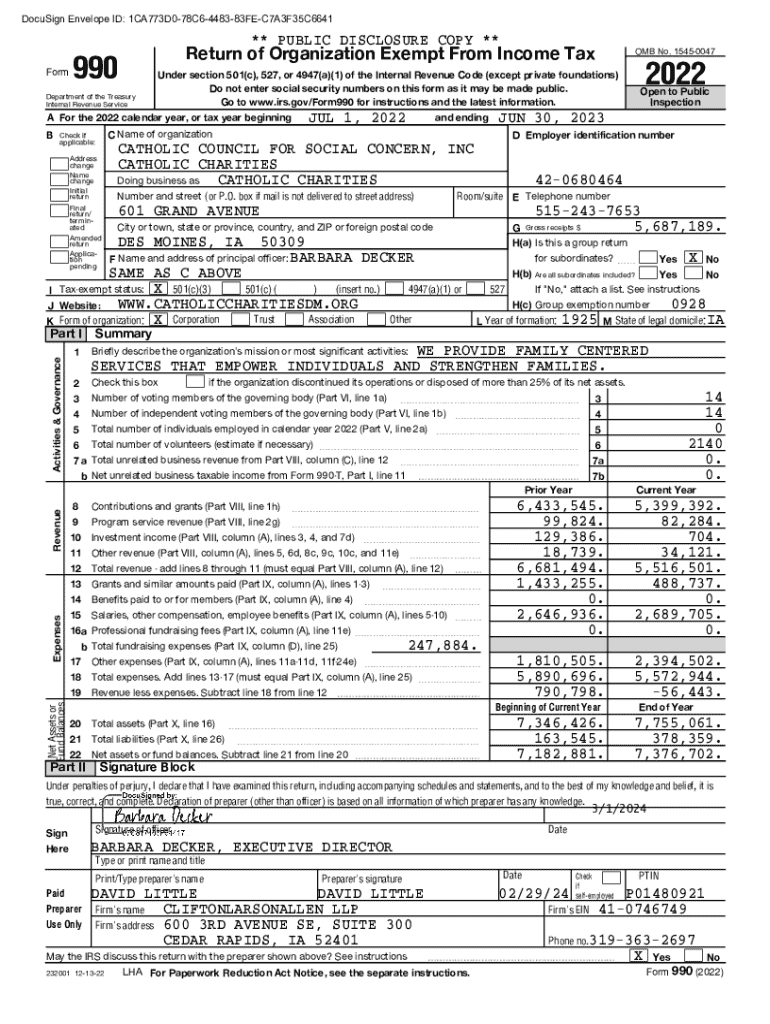

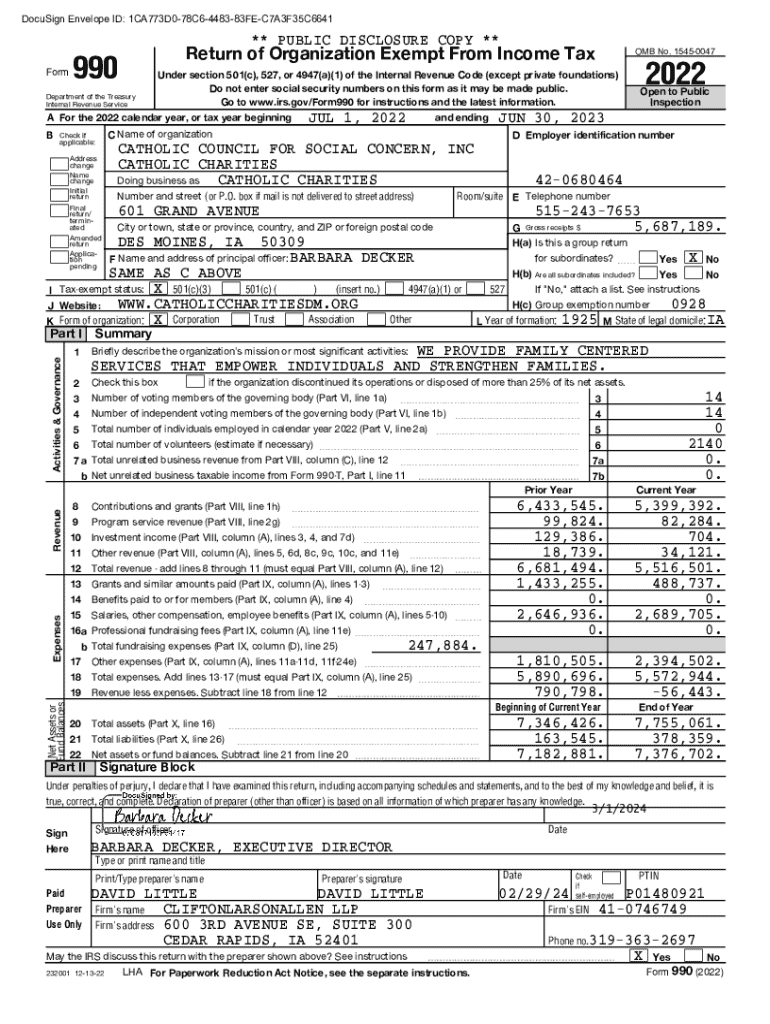

The Return of Organization Exempt Form (commonly referred to as Form 990) is a crucial document that tax-exempt organizations in the United States must file annually with the Internal Revenue Service (IRS). This form provides transparency regarding the organization's financial practices and activities, making it easier for the IRS to monitor compliance and ensuring that tax-exempt entities operate within their defined regulations. Filing this form is essential for maintaining tax-exempt status, as it allows the IRS to assess whether an organization is adhering to its mission and spending funds appropriately.

The importance of the Return of Organization Exempt Form extends beyond federal requirements. It serves as a public disclosure mechanism that enables stakeholders, including donors, members of the public, and researchers, to obtain financial information about nonprofits. This transparency fosters trust and accountability within the nonprofit sector, which is key for securing funds and maintaining public support.

Understanding the IRS requirements for filing this form is critical. Organizations must adhere to specific guidelines regarding the type of Form 990 they need to file, based on their size and purpose. Failure to comply with these filing requirements can lead to penalties and potential revocation of their tax-exempt status.

Types of forms available

There are several variations of the Return of Organization Exempt Form, each tailored to specific types and sizes of organizations. Understanding which form to use is crucial for compliance and maintaining valid tax-exempt status. Here's a breakdown of the types of forms available:

Who must file the Return of Organization Exempt Form?

Most tax-exempt organizations, including charities, social clubs, and civic leagues, are required to file one of the versions of the Return of Organization Exempt Form annually. The IRS outlines specific criteria that determine whether an organization must file, including its gross receipts and total assets.

While many organizations are subject to this requirement, certain exceptions apply. For instance, specific religious organizations and governmental entities often do not need to file. It is essential for organizations to understand these exceptions because failing to file can lead to severe consequences, such as substantial fines, loss of tax-exempt status, and negative impacts on future fundraising efforts.

Filing modalities

Organizations can submit the Return of Organization Exempt Form through various modalities, each designed to streamline the filing process and enhance compliance. The IRS provides options for both online filing and paper submissions, accommodating different organizational preferences.

Filing online via the IRS website is the preferred method for many organizations as it allows for expedited processing and enhanced efficiency. The online platform also offers guided assistance and ensures that all necessary fields are completed. Paper filing, though an option, is generally slower and may require additional time for processing. Each form has set deadlines that organizations must adhere to, with implications for late or incomplete submissions.

Maintaining accurate records is vital for successful filing. Organizations should keep comprehensive documentation to support their submitted information, including financial statements, bylaws, and governance documents, which may be required by the IRS during audits or reviews.

Completing the Return of Organization Exempt Form

Completing the Return of Organization Exempt Form involves several critical steps. When filling out Form 990, organizations need to gather detailed information that accurately reflects their financial activities, governance structures, and operational purposes.

Each section of Form 990 requires precise information. Organizations should include mission statements, financial summaries, and details about their governing bodies. It's important to provide a candid overview of the organization’s activities to maintain transparency and avoid misreporting, which can lead to penalties. Utilizing the right tools, such as pdfFiller, can streamline this process by offering interactive templates and allowing for real-time collaboration among team members.

Filing requirements and implications

When filing the Return of Organization Exempt Form, organizations must include specific attachments and documentation to support their filings. This includes financial statements, governance documents, and any relevant records that corroborate the information provided in the form.

Noncompliance with filing requirements can result in significant repercussions. The IRS may impose penalties for late submissions, resulting in fines that can accumulate over time. Furthermore, failure to adhere to requirements may jeopardize an organization’s tax-exempt status, leading to potential back taxes and loss of public trust. It's additionally essential for foreign organizations operating in the U.S. to understand unique requirements, including additional reporting standards related to foreign sources of income.

Public inspection regulations

Form 990 filings are subject to public inspection regulations, making them accessible to anyone interested in reviewing an organization’s financial practices. This transparency is intended to hold nonprofits accountable to their donors and the communities they serve.

Organizations are required to make their Form 990 filings available for public inspection, often through their websites or by providing copies upon request. Understanding how to access these filings, particularly for research or evaluation purposes, is paramount for researchers, stakeholders, and the general public as they assess financial health and governance of nonprofit organizations.

History of the Return of Organization Exempt Form

The Return of Organization Exempt Form has evolved over the years, significantly impacting how nonprofit organizations report their activities and finances. Initially created to enhance transparency and accountability in the nonprofit sector, the form has undergone numerous modifications to reflect changing regulatory environments and the growing need for detailed financial reporting.

Historically, the requirements for the form have expanded, particularly with increasing scrutiny from the IRS and the public regarding nonprofit operations. Updates have included revisions to reporting thresholds, expanded categories for expenditures, and enhanced questions regarding governance practices, all aimed at providing a clearer picture of an organization's financial landscape.

Utilizing Form 990 data for research

Form 990 serves as a vital resource for scholars, evaluators, and funders who seek to analyze nonprofit organization activities and performance. Researchers often leverage this data to derive important metrics that contribute to a broader understanding of financial trends, governance practices, and field-wide benchmarks.

Important metrics derived from Form 990 include financial health indicators such as the ratio of expenses to revenue and the efficiency of fundraising efforts. These insights help stakeholders make informed decisions when donating or investing in different nonprofit initiatives.

Support for completing the form

Completing the Return of Organization Exempt Form can be daunting, but several support options are available to assist organizations throughout the process. Platforms like pdfFiller offer comprehensive resources, including templates, customer support, and community forums where users can share experiences and solutions.

Organizations can also access IRS resources for filing inquiries, including dedicated customer service lines and FAQs on the IRS website. Engaging with these resources promotes accuracy and minimizes the risk of errors, ultimately aiding in efficient and compliant filing.

Additional tools and tips

To further facilitate compliance, organizations can utilize various tax tools and software designed specifically for nonprofit management. These tools help automate the calculations required for financial reporting and ensure that no critical information is overlooked during the filing process.

Best practices include maintaining meticulous records throughout the year to assist in future filings and ensuring that the organization stays updated with IRS announcements. By adhering to these practices, organizations can streamline their financial reporting and filing procedures, ultimately reducing stress at the time of file preparation.

Engaging with the community

Networking with other organizations can provide invaluable insights and support as you navigate the complexities of nonprofit management. Joining forums and organizations dedicated to tax-exempt entities enables leaders to share best practices, experiences, and resources.

Collaborative efforts allow organizations to learn from one another's successes and challenges, thereby enhancing their operational effectiveness and strengthening their capabilities in compliance and governance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit return of organization exempt in Chrome?

Can I sign the return of organization exempt electronically in Chrome?

How do I edit return of organization exempt straight from my smartphone?

What is return of organization exempt?

Who is required to file return of organization exempt?

How to fill out return of organization exempt?

What is the purpose of return of organization exempt?

What information must be reported on return of organization exempt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.