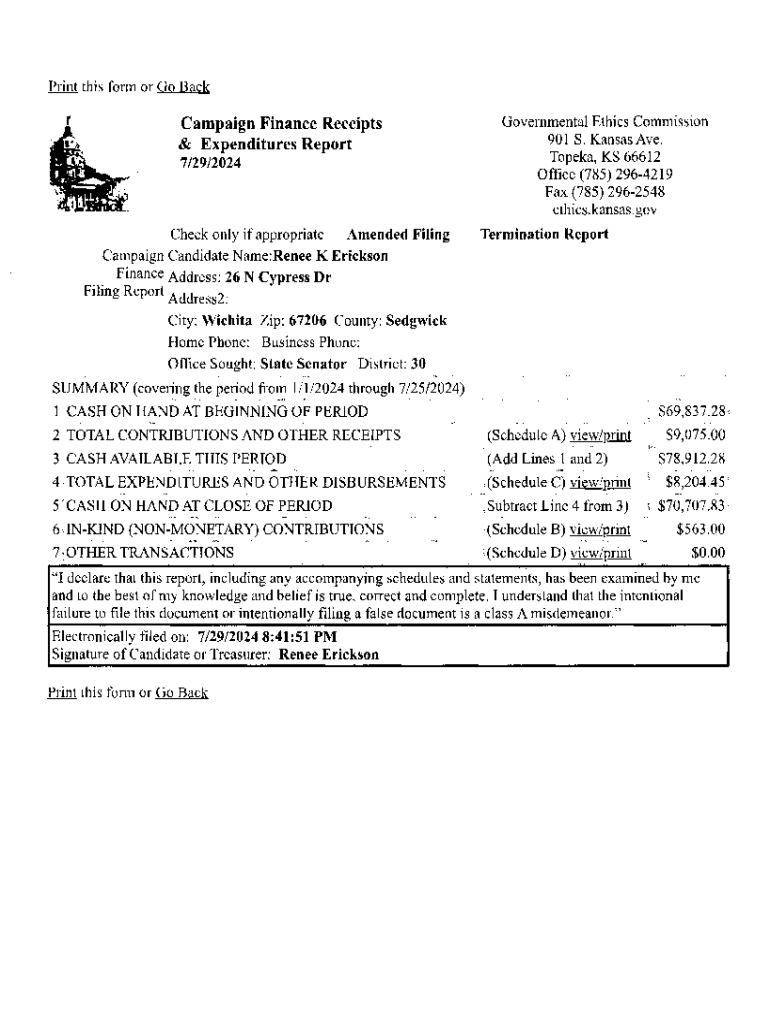

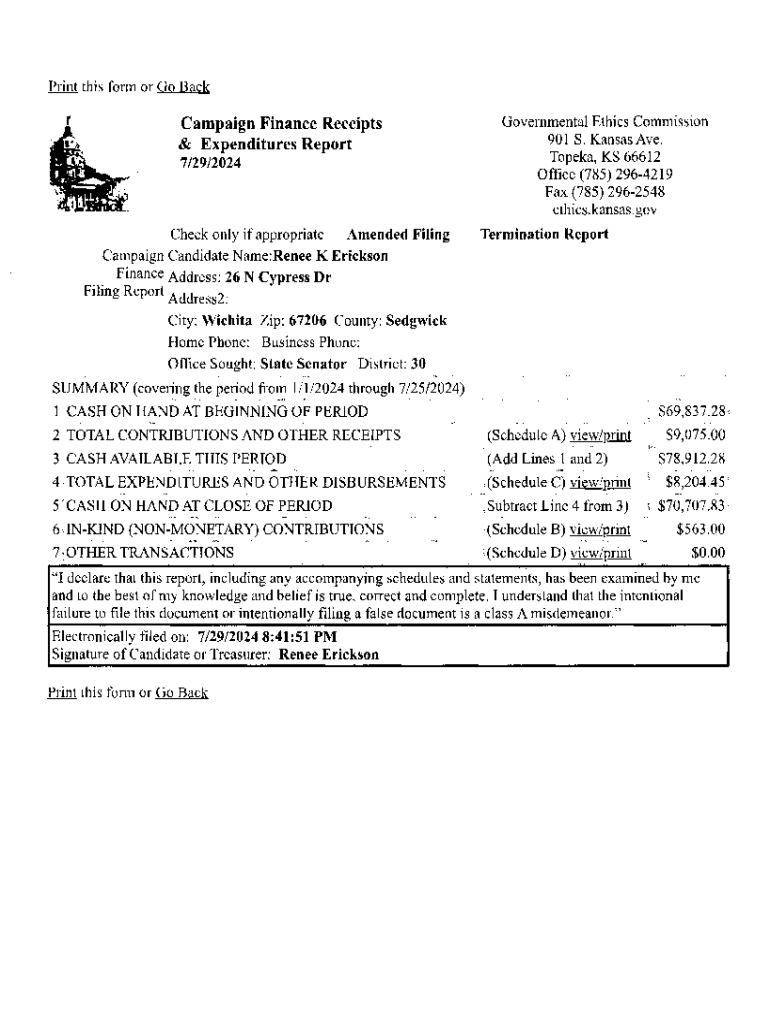

Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

How to edit campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Campaign Finance Receipts Expenditures Form: A Comprehensive Guide

Understanding campaign finance forms

Campaign finance forms play a critical role in the electoral process, serving as a transparent means to track the flow of money during campaigns. Ensuring compliance with campaign finance laws is essential for candidates and political entities. These regulations not only promote fairness in elections but also hold campaigns accountable to the electorate.

Campaigns are responsible for accurately reporting their financial activities through various forms, including receipts and expenditures. By understanding these forms, candidates can ensure they meet legal obligations while fostering trust with constituents.

Detailed breakdown of receipts and expenditures

Understanding the intricacies of receipts and expenditures is vital for any campaigning team. Receipts refer to the funds received by a campaign, indicating its financial support, while expenditures represent the money spent to further the campaign's objectives.

These components form the basis of campaign finance reporting, outlining how money is raised and spent. Familiarity with these terms and their implications can significantly affect a campaign's financial health and legal standing.

Receipts in campaign finance

Receipts in campaign finance are defined as all cash inflows received by a campaign, encapsulating contributions from various sources. A common example includes individual contributions, which often form the backbone of a candidate's fundraising efforts.

Additionally, corporate donations and Political Action Committees (PACs) can provide substantial funding. Each type comes with its own set of regulations, which campaigns must adhere to meticulously to remain compliant.

Required information on receipts form

To ensure accuracy and compliance, the receipts form must include key information: contributor details, the amounts donated, and the dates of contributions. Each piece of information is crucial for transparency, allowing electoral bodies to track the financial backing of all campaigns.

It is imperative that campaigns maintain detailed records to support these entries, as adherence to the regulations can influence public perception and support.

Expenditures in campaign finance

Expenditures refer to all money spent by the campaign, representing a significant aspect of financial reporting. They include operational costs such as salaries, campaign promotions, and essential administrative expenses. Accurate tracking of these expenditures is vital to understanding campaign viability and effectiveness.

A well-documented expenditures form details what funds are spent on, enabling campaigns to reflect on their spending patterns, ensuring they stay aligned with their overarching strategies.

Required information on expenditures form

The form for reporting expenditures requires specific information, including vendor details, the purpose of each expenditure, and related amounts and dates. This comprehensive disclosure is crucial not only for compliance with legal requirements but also for establishing trust with staff, volunteers, and voters.

Step-by-step guide to completing campaign finance forms

Completing campaign finance forms accurately is essential for maintaining legal compliance and transparency. The process begins with thorough preparation, ensuring that all necessary documents and understanding reporting requirements are in place.

Preparation steps

Before diving into form completion, gather essential documents such as financial statements and previous reports. Understanding the unique reporting requirements of your jurisdiction is imperative, as these can vary significantly across local, state, and federal levels.

Setting a timeline for submissions ensures all parties involved are aligned and deadlines are met, minimizing the risk of penalties associated with late filings.

Filling out the receipts form

When filling out the receipts form, it is vital to follow detailed instructions carefully. Each field should be accurately completed, reflecting the necessary information to ensure compliance and transparency.

Common pitfalls include misreporting amounts or failing to capture all relevant contributor details. Avoid these by cross-checking entries with bank records and using tracking software designed for campaign finance.

Filling out the expenditures form

The expenditures form serves a similarly critical function as the receipts form. Detailed instructions should be followed closely, ensuring that each field is filled out correctly.

Common mistakes include omitting details or categorizing expenses inaccurately. Compliance with regulations should be maintained, including securing necessary signatures and approvals, and retaining receipts for auditing purposes.

Tools and resources for managing campaign finance documentation

Utilizing modern technology can significantly streamline the management of campaign finance documentation. Cloud-based solutions, like pdfFiller, offer robust tools for form management, enabling users to edit, eSign, collaborate, and manage documents seamlessly.

Leveraging cloud-based solutions

With pdfFiller, campaigns can quickly fill out forms electronically, ensuring that corrections can be made efficiently and all changes are stored securely. These tools not only simplify the process but also enhance compliance through real-time updates.

Utilizing interactive tools

Interactive tools within cloud-based platforms facilitate collaboration within teams, allowing multiple users to contribute to document preparation and verification. This integrated approach fosters accountability and enhances accuracy through shared insights and real-time communication.

Tracking campaign financials

Regularly tracking campaign financials with tools like pdfFiller ensures up-to-date documentation and informed decision-making. Maintaining transparent records will reflect positively on a campaign, helping to re-establish trust with supporters and the general public.

Compliance and filing requirements

Understanding the compliance landscape is crucial for navigating campaign finance successfully. Federal and state regulations impose strict guidelines on how campaigns must report their finances, which can vary significantly across different jurisdictions.

Being aware of these differences can save campaigns from inadvertent violations that may result in significant penalties. Familiarity with key statutes governing campaign finance enhances a campaign’s operational effectiveness.

Common filing deadlines and expectations

Filers must keep track of critical deadlines to ensure timely submissions. Regular updates from regulatory agencies will help maintain awareness of upcoming deadlines, allowing campaigns to plan accordingly and avoid the repercussions of non-compliance.

FAQs about campaign finance forms

As campaigns navigate their financial reporting obligations, having access to clear guidance is essential. Common questions often arise regarding errors on forms and the process for amending submitted documents. Effective management can alleviate many potential issues and misunderstandings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit campaign finance receipts expenditures from Google Drive?

Can I sign the campaign finance receipts expenditures electronically in Chrome?

How do I fill out campaign finance receipts expenditures on an Android device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.