Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

Editing campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Campaign finance receipts expenditures form: A comprehensive guide

Understanding campaign finance forms

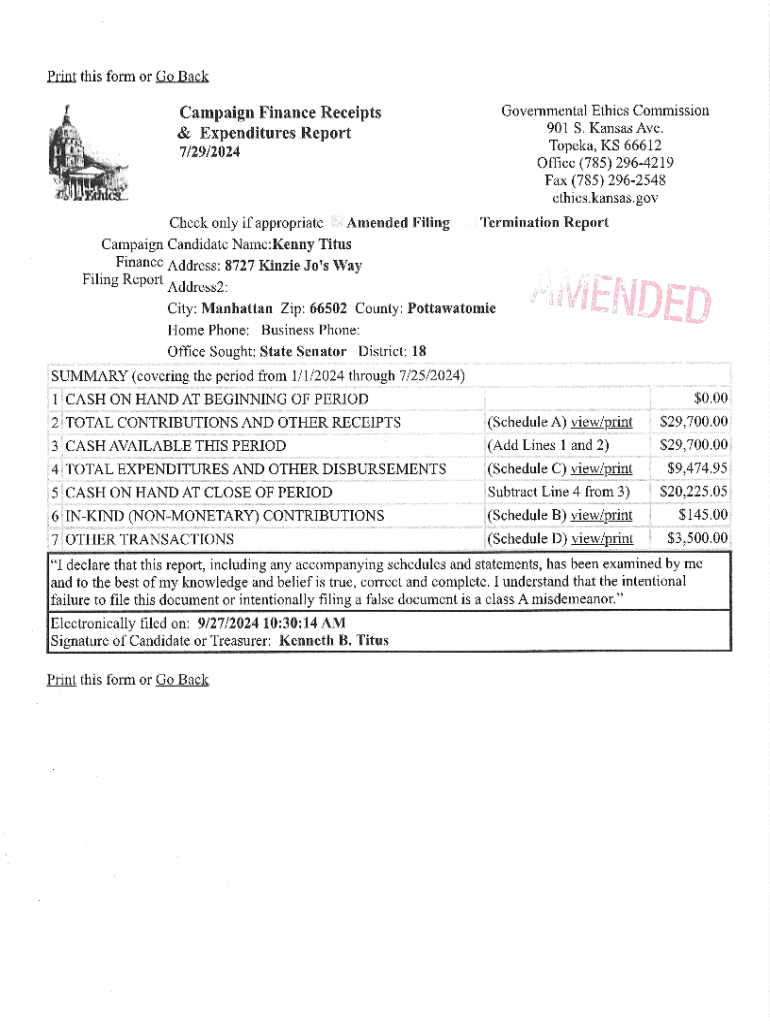

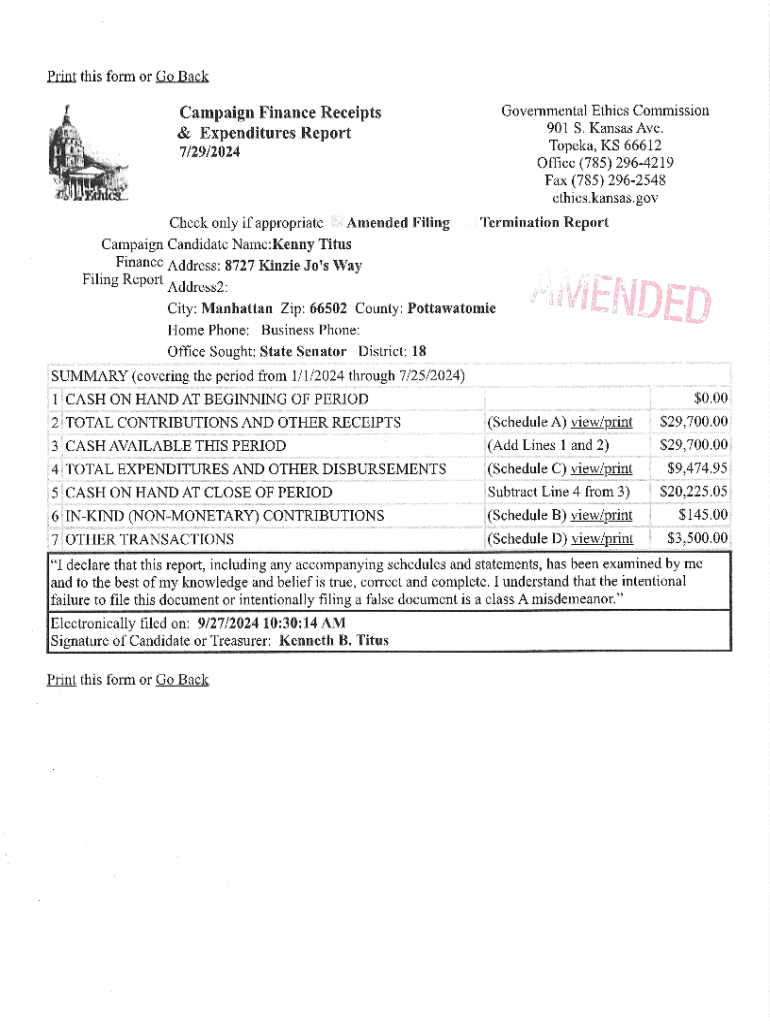

Campaign finance receipts expenditures forms are essential documents used in the political landscape to track and report the financial activities of campaigns. These forms serve as a systematic way to record the money received (receipts) and spent (expenditures) during the campaign period. They not only ensure transparency but also adhere to the compliance requirements outlined by campaign finance laws, making accurate reporting crucial for avoiding legal repercussions.

The forms are designed to facilitate a clear understanding of the financial health of a campaign, thus helping candidates, campaign managers, and donors alike. By breaking down financial activities into easily digestible information, the forms promote accountability within the electoral process.

Overview of the campaign finance process

Campaign finance plays a pivotal role in shaping electoral outcomes. It encompasses everything from raising funds to spending them in ways that support candidates' campaign goals. Understanding the process helps candidates create robust financial strategies while ensuring compliance with laws aimed at preventing corruption and promoting fairness. Various forms are used to gauge the monetary dynamics of campaigns, including the campaign finance receipts expenditures form.

The lifecycle of campaign fundraising begins with identifying potential donors and sources of funding. Once funds are raised, the reporting phase kicks in, where every contribution and expenditure must be documented meticulously. The timeline for submissions varies by jurisdiction, but candidates often face pressing deadlines that can influence strategic decision-making.

Essential components of campaign finance forms

The campaign finance receipts expenditures form typically consists of two key sections: receipts and expenditures. In the receipts section, candidates must categorize contributions, identifying the source and amount of each donation. Contributions can be monetary or in-kind, and each must be reported accurately to reflect the true financial state of the campaign.

On the other hand, the expenditures section is crucial for detailing how campaign funds are spent. This might include direct payment for advertising, staff salaries, or event hosting. Categorizing expenditures into specific types—such as operational costs, communications, and travel—helps ensure compliance and provides transparency. Common pitfalls candidates encounter include failing to report certain expenditures or misclassifying expenses, which could lead to penalties.

Step-by-step instructions for completing the campaign finance form

Completing the campaign finance receipts expenditures form requires systematic preparation. Start by gathering all necessary documentation, such as bank statements, contribution records, and receipts for expenditures. This foundation ensures you have accurate and complete information when filling out the form.

Next, proceed with filling out the form itself. Begin with entering details about the contributors, including names and amounts, followed by documenting each expenditure clearly. It's essential to double-check entries for accuracy to ensure compliance with legal requirements. Consider using templates to make data collection easier, as this can streamline the process significantly.

Interactive tools for form management

Innovative tools such as pdfFiller can significantly simplify the process of managing campaign finance receipts expenditures forms. Users can edit and enhance their PDF forms effortlessly, which allows for more efficient data entry and adjustments when necessary. Utilizing the e-signature feature can also expedite the approval process by allowing contributors to sign off electronically.

Collaboration is crucial in campaign finance management, especially for teams handling large amounts of data. PdfFiller provides collaboration tools that enable multiple team members to share the form, offer input, and track changes. This ensures that everyone involved is on the same page, and variations of the document can be managed effectively.

Common challenges and solutions

Campaign finance reporting is riddled with challenges. Common errors include missing contributions or expenditures, which can lead to discrepancies that raise red flags during audits. To avoid such pitfalls, candidates must adopt meticulous record-keeping practices, ensuring that every source of income and outgoing expense is logged.

In instances of late submissions or amendments, candidates should be proactive. It's advisable to familiarize oneself with the policies governing late submissions to avoid penalties. For more complex situations, seeking assistance from campaign finance experts or utilizing resources provided by related regulatory bodies can offer clarity.

Insights from experts

Insights from campaign finance experts reveal best practices that can enhance reporting accuracy. Successful campaign managers emphasize the importance of regular audits of financial records to catch discrepancies early. They also advocate for comprehensive training for all team members involved in finance management, ensuring everyone understands the critical nature of compliance.

Real-life examples of effective reporting often highlight the impact of being transparent about finances. Campaigns that publish their reports proactively tend to build trust with their supporters and the public, translating to greater campaign success.

State-specific guidelines for campaign finance forms

Campaign finance requirements can vary significantly between states, creating a patchwork of regulations that candidates must navigate. Understanding these variations is crucial for ensuring compliance and avoiding potential penalties. Some states require more detailed disclosures, while others have lenient requirements for certain types of contributions or expenditures.

Candidates should consult their state election office for specific guidelines tailored to their jurisdiction, including deadlines for submission and potential consequences for noncompliance. Being well-informed about local laws will enhance campaign integrity and operational success.

Accessing additional support and tools

PdfFiller is a valuable resource for those looking to streamline the campaign finance process. The platform offers a library of templates and forms that simplify the documentation required for campaign finance receipts expenditures. For users needing assistance, pdfFiller provides live support and tutorials that can facilitate understanding and execution of the forms.

Leveraging these tools not only enhances the efficiency of the filling process but also empowers candidates and their teams to handle the complexities of campaign finance with confidence and precision.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in campaign finance receipts expenditures without leaving Chrome?

Can I create an eSignature for the campaign finance receipts expenditures in Gmail?

Can I edit campaign finance receipts expenditures on an iOS device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.