Get the free Credit Application (housing and/or Mortgage)

Get, Create, Make and Sign credit application housing andor

How to edit credit application housing andor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application housing andor

How to fill out credit application housing andor

Who needs credit application housing andor?

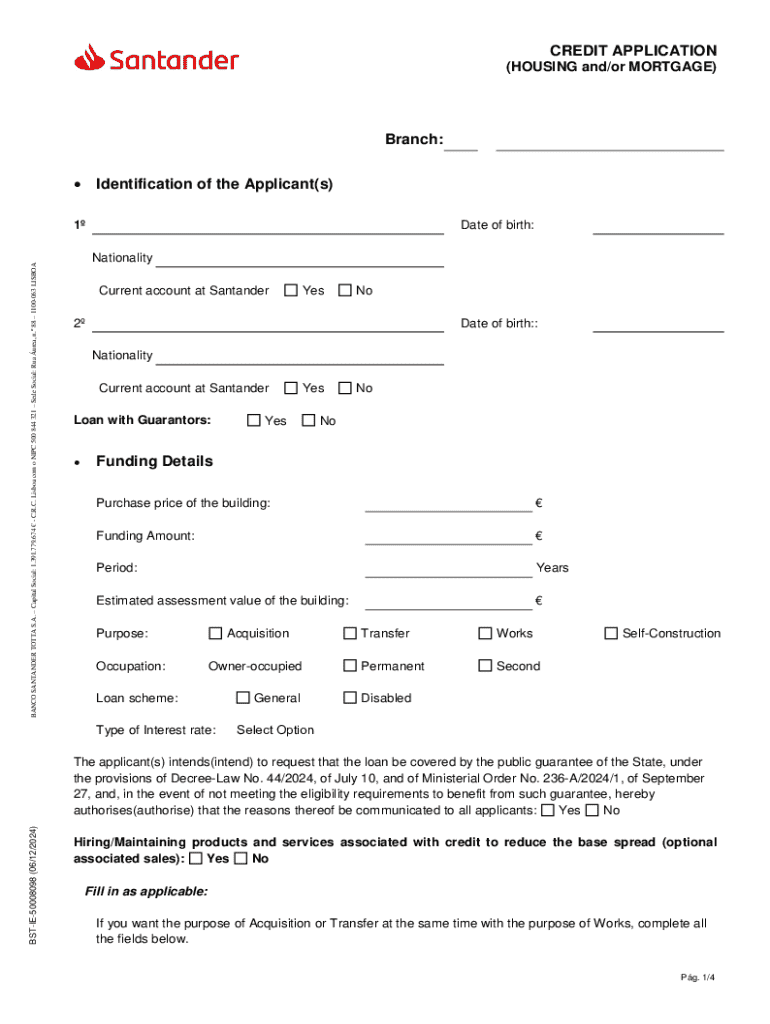

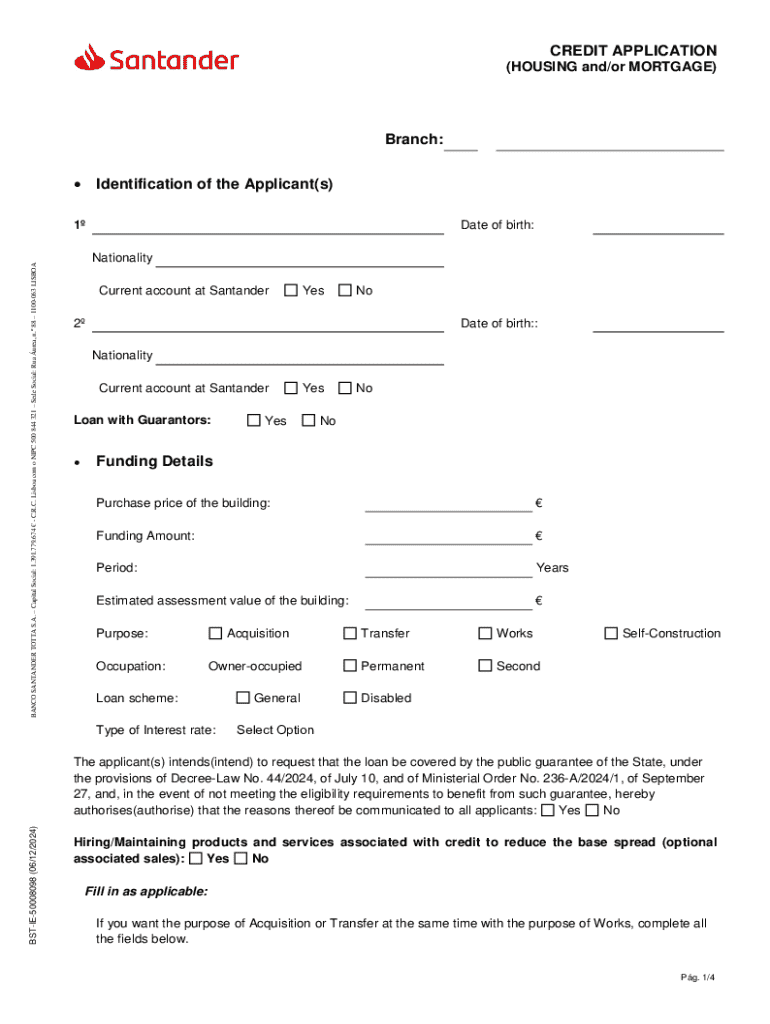

Understanding Credit Application Housing and/or Form: A Comprehensive Guide

Understanding the credit application process for housing

A credit application for housing is a critical step in the renting or purchasing process. It serves as a key document that landlords or lenders use to assess the financial reliability of applicants. A well-prepared application can significantly enhance an individual's chances of securing housing. When seeking to lease an apartment, buy a house, or rent a condo, understanding the nuances of the credit application can mean the difference between approval and rejection.

Eligibility criteria for housing credit applications

To qualify for a housing credit application, applicants must meet specific eligibility criteria set by landlords and lenders. The minimum credit score is usually a significant factor, but it is not the only one. Each aspect of an applicant’s financial history is considered holistically to paint a complete picture of their reliability.

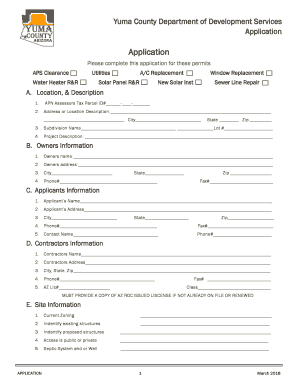

Essential documents needed to complete a credit application

Completing a credit application for housing requires various documents to support your financial claims. Gathering all necessary paperwork in advance can expedite the approval process and increase your chances of being accepted.

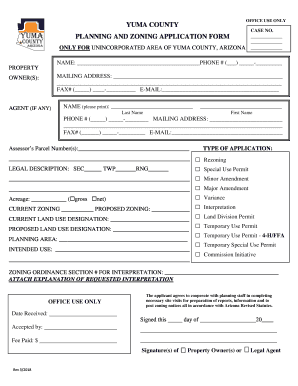

Step-by-step guide to filling out the housing credit application form

Filling out a housing credit application form can seem daunting, but with a structured approach, the process becomes manageable. It’s essential to be accurate and thorough in every section.

Common mistakes to avoid when completing a housing credit application

Small errors or omissions on a credit application can lead to significant consequences. Being aware of common pitfalls can help prevent mistakes that may jeopardize your housing application.

Interactive tools to help manage your credit application for housing

Utilizing interactive tools can simplify the credit application process significantly. Various resources can be employed to enhance your efficiency and confidence as you navigate your application.

Understanding the review process after submission

Once a credit application for housing is submitted, the review process begins. Understanding this stage can help applicants manage their expectations and remain patient.

Tips for strengthening your housing credit application

Enhancing your credit application can substantially amplify your chances of approval. Being proactive in preparing your application can set you apart from other candidates.

Frequently asked questions about housing credit applications

Navigating the nuanced world of housing credit applications often leads to various questions. Here are some frequently asked queries to aid your understanding.

Support and resources for filling out housing credit applications

When filling out a housing credit application, accessing support and resources can make the journey less daunting. From troubleshooting to expert advice, numerous tools are available.

Sharing your experience

Communicating your credit application journey can not only foster community support but also provide valuable insights to others. Sharing personal experiences helps empower prospective applicants and informs them of best practices.

Understanding your rights and responsibilities

Understanding your rights during the credit application process ensures that you are treated fairly and that your information is secure. Familiarity with the Fair Credit Reporting Act (FCRA) is essential for every applicant.

Privacy and security in the credit application process

In today’s digital age, safeguarding your personal information during the credit application process is paramount. Knowing your data protection rights helps you navigate your application journey safely.

Contact and feedback section

Having accessible support during your housing credit application journey is crucial. When questions or concerns arise, knowing how to reach out for help can alleviate anxiety.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the credit application housing andor electronically in Chrome?

Can I edit credit application housing andor on an Android device?

How do I complete credit application housing andor on an Android device?

What is credit application housing andor?

Who is required to file credit application housing andor?

How to fill out credit application housing andor?

What is the purpose of credit application housing andor?

What information must be reported on credit application housing andor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.