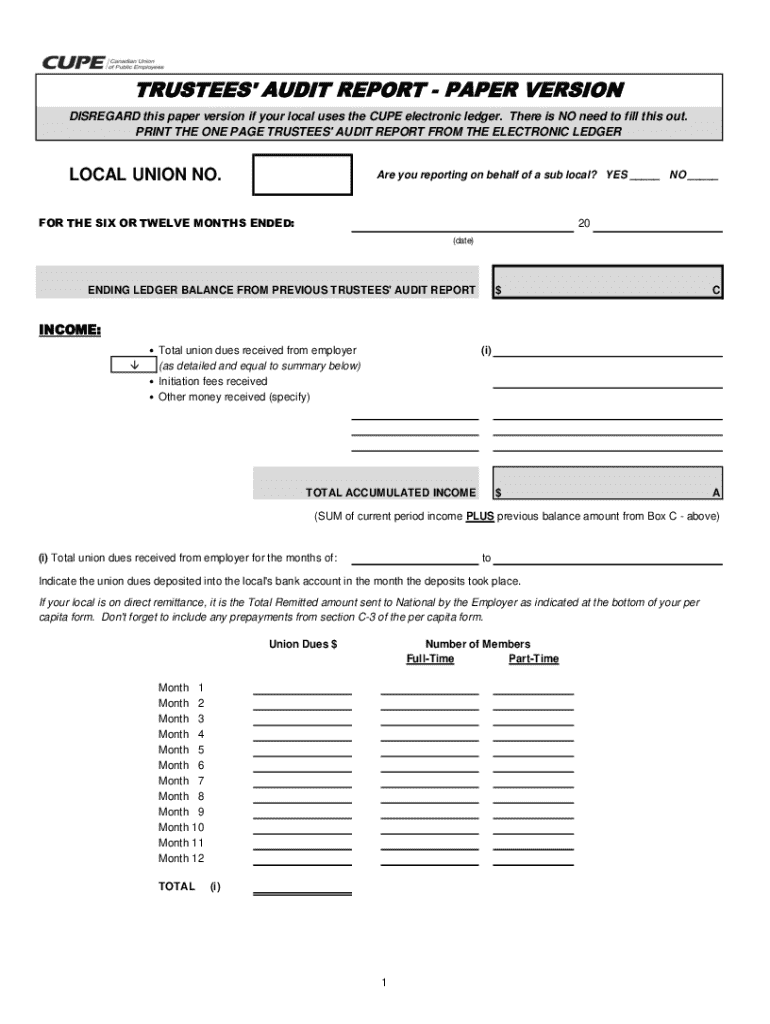

Get the free Trustees' Audit Report - Paper Version

Get, Create, Make and Sign trustees audit report

How to edit trustees audit report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out trustees audit report

How to fill out trustees audit report

Who needs trustees audit report?

Trustees Audit Report Form: A Comprehensive How-to Guide

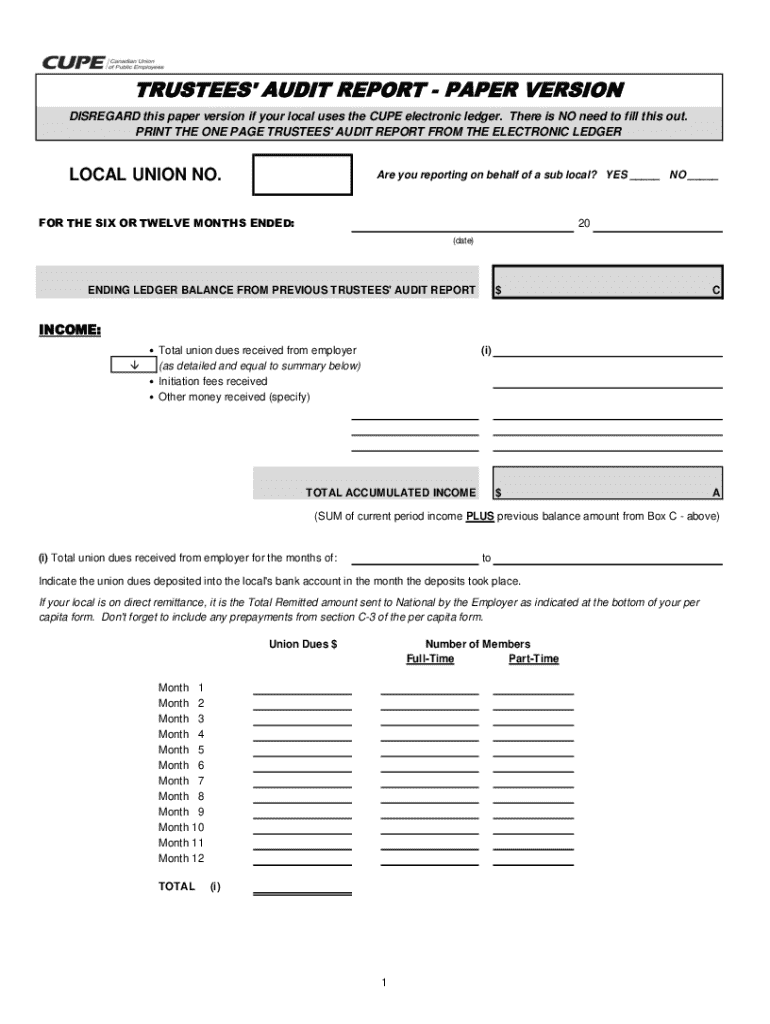

Overview of the trustees audit report form

Trustees audit reports play a critical role in maintaining transparency and accountability within trusts. These reports serve as a detailed overview of financial statements, revealing a trust’s financial health and ensuring compliance with relevant regulations. A well-structured trustees audit report form is essential in documenting this information clearly and accurately, which facilitates effective oversight and informed decision-making by trustees, beneficiaries, and regulatory bodies.

Key features of a trustees audit report form revolve around capturing essential data on the trust’s finances, including income, expenditures, assets, and liabilities. Accessibility is magnified through platforms like pdfFiller, which allows users to create, edit, and manage these reports efficiently. Digital management is invaluable in today’s fast-paced environment, enabling easy retrieval and sharing of information.

Understanding the audit process for trustees

An audit constitutes a systematic examination of financial records to assess their accuracy and compliance. The significance of audits for trustees cannot be overstated; they provide an objective evaluation of a trust’s financial condition and operations. Types of audits applicable to trusts include internal audits, external audits, and compliance audits, each serving distinct purposes.

Trustees play an essential role during audits, with responsibilities including ensuring the availability of necessary records and facilitating communication between auditors and beneficiaries. Successful audits rely on the collaboration between trustees and auditors, with clear expectations and open lines of communication fostering a productive environment.

Step-by-step guide to completing the trustees audit report form

Gathering the necessary information is vital when preparing a trustees audit report. Required documents typically include bank statements, invoices, receipts, prior reports, and documentation of assets and liabilities. To streamline this process, organizing financial records ahead of time is advisable. This involves creating folders for each category of information, tagging electronic files, and ensuring all records are up-to-date.

When filling out the trustees audit report form, it’s essential to approach it systematically. Break the form down into sections: Basic Information, Financial Overview, Assets and Liabilities, and Compliance and Regulatory Requirements. Each section should be completed with attention to detail. It's recommended to double-check financial figures and compliance information to mitigate errors. Common pitfalls include neglecting to include all required documents or misrepresenting figures.

Utilize pdfFiller’s editing tools to customize the report for clarity and presentation. Adjust formatting, highlight key figures, and ensure the final document is professional and user-friendly.

eSigning and collaborating on the audit report

eSigning is essential for audit reports due to its legal validity and the security it provides. In an increasingly digital world, electronic signatures simplify operations by reducing turnaround times and promoting a more seamless process for document management. Auditors, trustees, and beneficiaries can review and sign reports without the delays associated with traditional paper methods.

To initiate an eSignature using pdfFiller, navigate to the document, select the eSign option, and follow the step-by-step instructions to add signatures. Additionally, pdfFiller allows you to invite collaborators, ensuring everyone involved can review and provide input on the audit report before it reaches final approval.

Managing and storing the completed reports

Organizing and storing audit reports effectively is paramount for compliance and efficiency. Cloud storage offers the best practices for secure document management, providing multiple layers of protection against data loss or unauthorized access. Implementing a structured filing system with clear labeling can facilitate quick retrieval for any future audits or inquiries.

pdfFiller enhances document management capabilities by providing features that track document versions and edits. This makes it easier to recover previous versions of reports, review changes, and share the most current document securely with relevant stakeholders.

Common challenges faced during the audit process

Financial discrepancies often raise concerns during audits, impacting trust and transparency. Common issues might include incorrect figures, missing documentation, or failure to account for all transactions. Address these challenges proactively by conducting regular internal reviews and audits to catch inconsistencies early.

Navigating compliance issues can be daunting, especially within the limits set by legal frameworks like the Labor Management Reporting and Disclosure Act (LMRDA). Understanding these regulations is crucial; ensure all required forms and documentation are in place to remain compliant and avoid penalties. Maintaining open lines of communication with financial and legal advisors can further solidify adherence.

Resources for further learning

For deeper insights into the audit process, consider exploring topics related to financial audits specific to trusts or the essential roles of financial officers. Engaging with reputable financial blogs or forums can provide updated information and resources relevant to trustees and their audit processes.

To find professional assistance, research online directories for reputable audit consultants specializing in trust management. Such experts can guide you through complex regulatory requirements and develop tailored strategies for your trust’s financial health.

Interactive tools and features on pdfFiller

Navigating the audit report process can be significantly streamlined using interactive tools available on pdfFiller. Features include easy form filling, electronic signature capabilities, and secure document sharing, all designed to reduce friction in the report creation workflow.

By integrating pdfFiller into your document management strategy, you enhance the overall workflow of creating and managing audit reports, ensuring that every task from completion to sharing is efficient, secure, and straightforward.

User testimonials and case studies

Many individuals and organizations have shared their success stories using pdfFiller to streamline their audit processes. Users often report significant reductions in the time taken to prepare and finalize reports, allowing them to focus on the strategic aspects of trust management.

Real-life case studies highlight how pdfFiller has revolutionized document management for trustees, illustrating the efficiencies gained through automated editing, eSigning, and secure document storage. Users praise the platform for empowering them with tools that simplify complex processes, thereby enhancing compliance and clarity in their audit operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute trustees audit report online?

How do I edit trustees audit report in Chrome?

Can I edit trustees audit report on an iOS device?

What is trustees audit report?

Who is required to file trustees audit report?

How to fill out trustees audit report?

What is the purpose of trustees audit report?

What information must be reported on trustees audit report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.