Get the free Customer Due Diligence - Individual

Get, Create, Make and Sign customer due diligence

How to edit customer due diligence online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer due diligence

How to fill out customer due diligence

Who needs customer due diligence?

Comprehensive Guide to Customer Due Diligence Forms

Understanding customer due diligence ()

Customer due diligence (CDD) refers to the process by which financial institutions and other regulated entities verify the identity, suitability, and risks associated with their clients. This practice is crucial in preventing fraud and maintaining the integrity of financial markets. Ensuring proper CDD can protect businesses from illicit activities such as money laundering and terrorist financing, which can result in significant legal and reputational repercussions.

Effective CDD processes not only provide security but also foster trust between businesses and their customers. By implementing thorough CDD, companies can demonstrate a commitment to compliance and ethical practices.

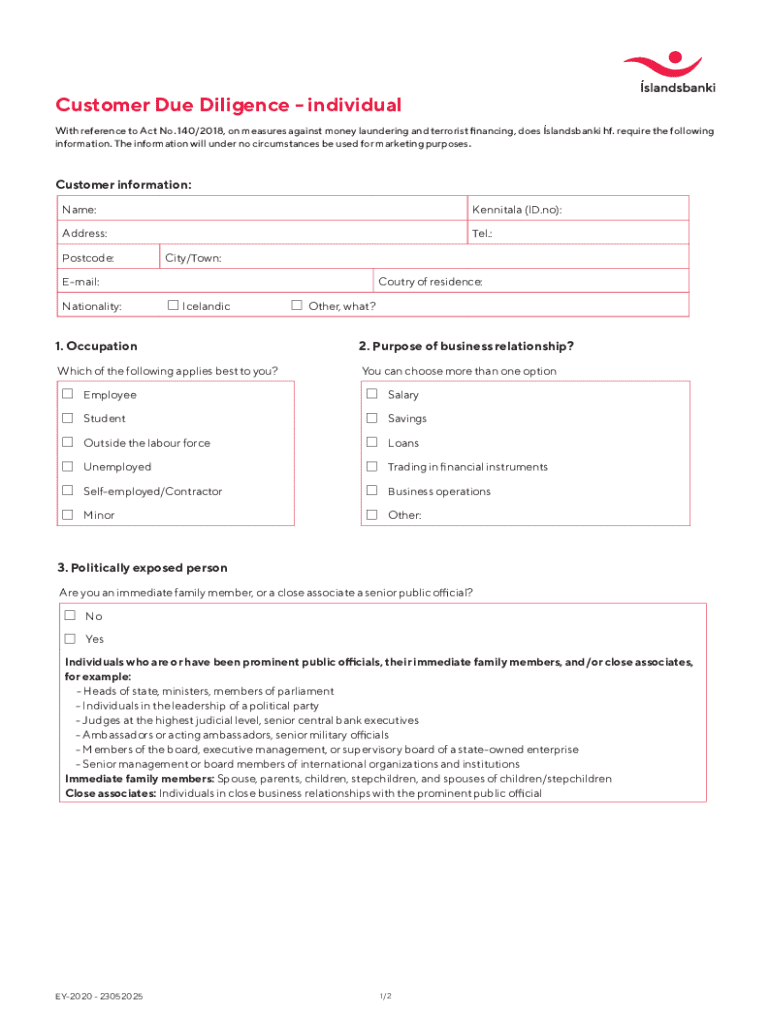

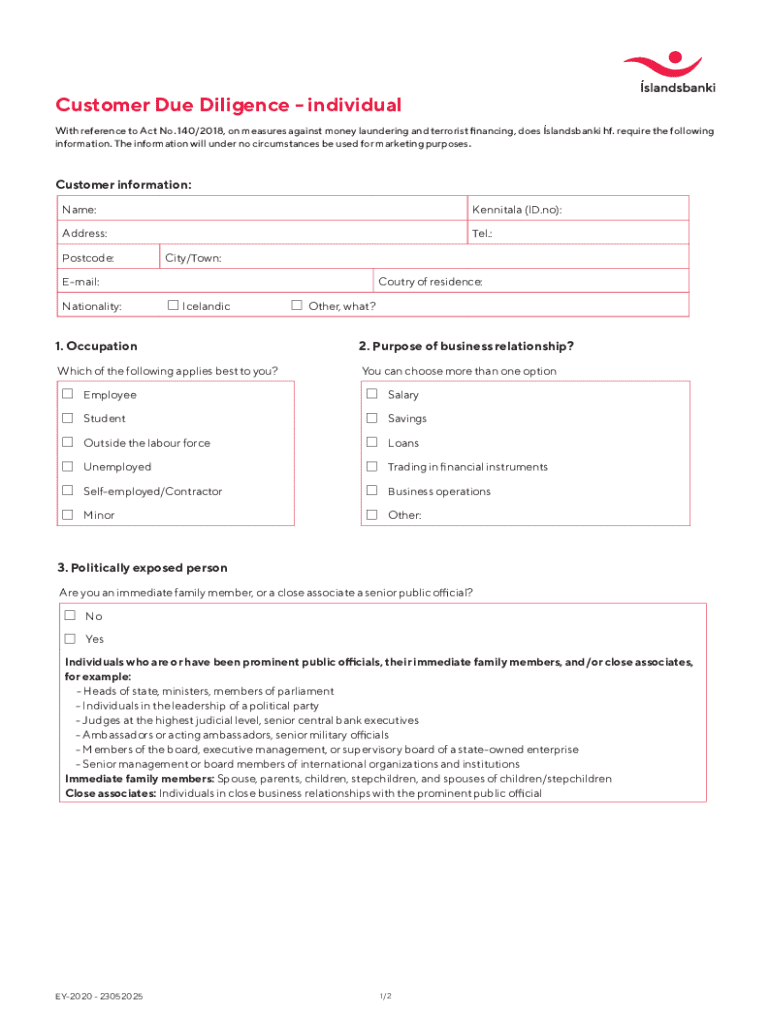

Key components of a customer due diligence form

A well-structured customer due diligence form encompasses various key components, each serving a unique purpose in verifying customer identity and assessing risk. These elements are essential for advancing regulatory compliance and fostering secure business practices.

Filling out the customer due diligence form

Completing a customer due diligence form can be straightforward if you have all necessary information ready. Here is a step-by-step guide to ensure you complete the process accurately.

Moreover, businesses need to evaluate whether digital or paper forms best suit their needs. Digital forms offer enhanced accessibility and security, whereas paper forms may be more appropriate in traditional or less tech-savvy environments.

Editing and managing your customer due diligence form

Once your customer due diligence form is filled out, editing is often necessary. Using platforms like pdfFiller simplifies this process remarkably, allowing seamless revisions and updates.

Effective collaboration tools ensure that multiple stakeholders can participate in the processing of customer due diligence forms, optimizing workflow and enhancing productivity.

eSigning your customer due diligence form

The increasing acceptance of electronic signatures has transformed the way documents, including customer due diligence forms, are executed. eSigning is not only convenient but also holds legal validity across many jurisdictions worldwide.

Best practices for customer due diligence

To maintain compliance and mitigate risks, businesses must adhere to best practices regarding customer due diligence. Regular updates of customer information and stringent security measures are critical components in this ongoing process.

Common FAQs about customer due diligence forms

As customers engage with the due diligence process, numerous questions often arise regarding the procedures, timeframes, and handling of forms. Addressing these queries promptly fosters confidence in the system.

Leveraging pdfFiller for streamlined processes

pdfFiller enhances the management of customer due diligence processes through its wide array of features and user-friendly interface. Leveraging these tools can significantly streamline documentation and compliance efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get customer due diligence?

How do I make edits in customer due diligence without leaving Chrome?

Can I sign the customer due diligence electronically in Chrome?

What is customer due diligence?

Who is required to file customer due diligence?

How to fill out customer due diligence?

What is the purpose of customer due diligence?

What information must be reported on customer due diligence?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.