Get the free Internal Audit Checklist

Get, Create, Make and Sign internal audit checklist

How to edit internal audit checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out internal audit checklist

How to fill out internal audit checklist

Who needs internal audit checklist?

Your Comprehensive Guide to Internal Audit Checklist Forms

Overview of internal audits

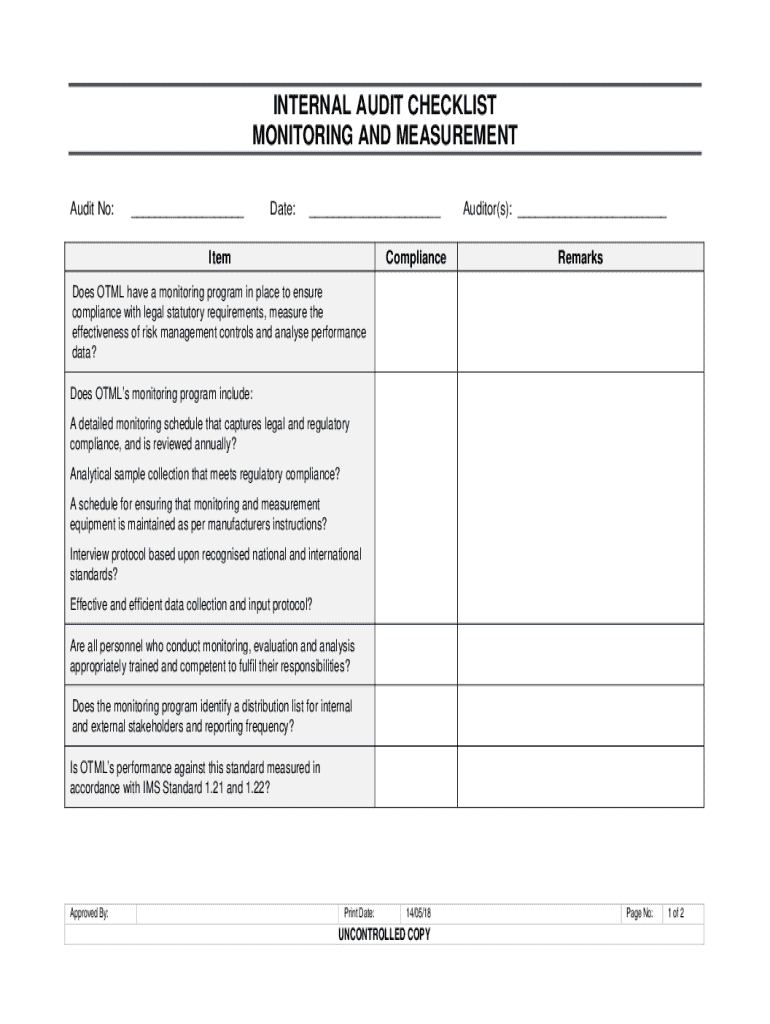

An internal audit serves as a vital tool for organizations to evaluate and improve their operations and compliance. By systematically examining financial contracts, operational processes, and internal controls, an internal audit helps ensure that an organization is efficiently managing its risks while adhering to necessary regulations. The purpose of an internal audit is not only to detect any current or potential issues but also to aid in fostering an environment of continuous improvement.

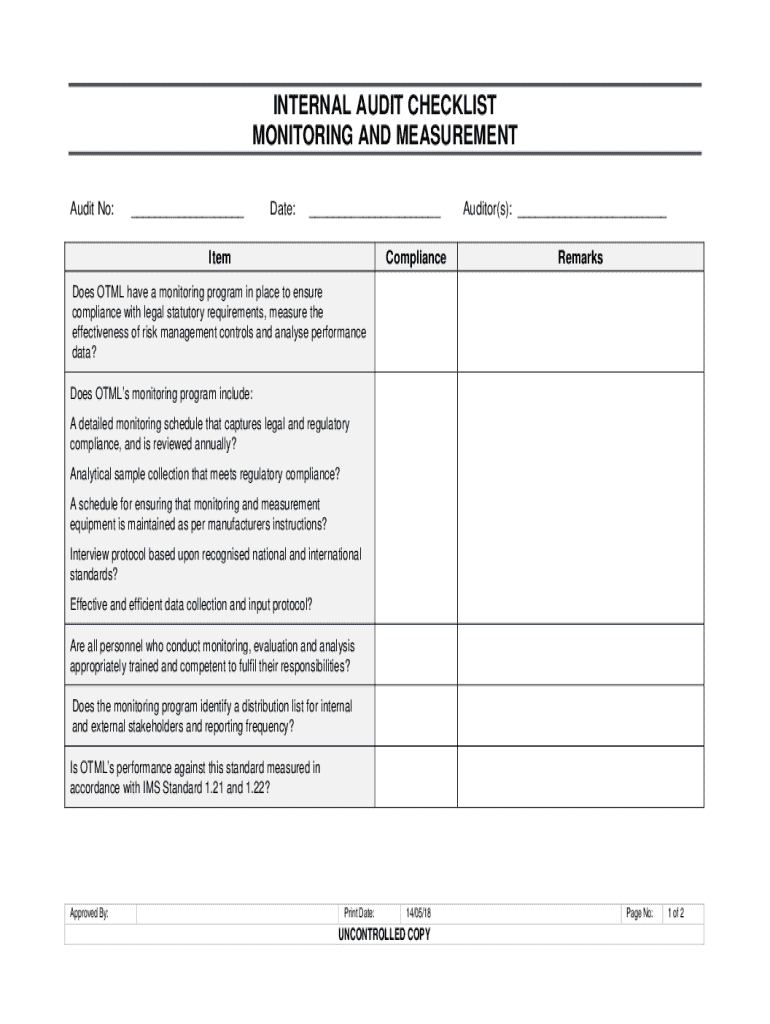

The role of checklists within this process cannot be overstated. An internal audit checklist form serves as a structured guide that streamlines the auditing process, helping auditors remain organized and focused. Utilizing a checklist ensures that no necessary items are overlooked, facilitating a comprehensive review of the organization's operations and compliance to internal and external standards.

Essential components of an internal audit checklist

An internal audit checklist is often composed of various essential components that ensure a thorough examination of the organization’s practices. These components can be categorized into general audit parameters and specific areas of focus. To begin, compliance is vitally important. This means checking that organizational policies align with local laws and industry regulations. Following compliance, the risk management aspect involves identifying vulnerabilities that could undermine the organization’s objectives and allow for areas of improvement.

Other key areas to examine include:

Creating your internal audit checklist form

Developing a customized internal audit checklist begins with identifying the scope of the audit. This includes determining which processes, departments, or legal areas will be scrutinized. Engaging relevant stakeholders is crucial for effective input gathering, as they can provide insight into specific expectations and potential focus areas that may not be immediately apparent.

Once you have the necessary information, defining specific evaluation criteria is next. This may involve setting measurable key performance indicators (KPIs) or qualitative benchmarks to enable an accurate assessment. Utilizing tools like pdfFiller provides various templates and interactive options that facilitate the customization of your checklist. This helps you tailor the form to meet your organization’s unique requirements.

Filling out the internal audit checklist form

Filling out the checklist accurately lays the foundation for an effective audit. Start by gathering all necessary documentation and records pertaining to the processes being audited. It's essential to assign roles and responsibilities to team members early on. This ensures accountability and clarity during the audit process.

When using pdfFiller’s editing tools, leverage them to clarify information directly on the form. This means correcting entries, making annotations, and ensuring that every detail aligns accurately with your findings. Common errors to avoid during this process include incomplete assessments, which can lead to oversights, and ambiguous responses that can create confusion or misinterpretation of the findings.

Analyzing completed audit checklists

Once the internal audit checklist form is completed, interpreting the results becomes paramount. Understanding findings accurately and assigning risk ratings helps categorize issues based on severity. This clarity helps management prioritize issues that need immediate attention and corrective action. Categorizing issues may involve differentiating between high, medium, and low-risk findings.

Next steps would typically include drafting recommendations for corrective actions and discussing potential solutions with team members. Prioritizing identified issues for resolution ensures that the most critical vulnerabilities are addressed promptly, ultimately protecting the organization from future risks.

Collaboration and communication in internal audits

Collaboration and communication within the auditing team can significantly enhance process effectiveness. Using tools like pdfFiller allows for seamless sharing of the checklist form, enabling team members to contribute in real-time. Incorporating comments and suggestions directly into the form fosters a collaborative environment that can highlight different perspectives in problem-solving.

Additionally, documenting the audit process is vital for maintaining transparency and accountability. A well-organized archive of completed checklists creates a valuable repository for future reference and can support continuous improvement efforts as subsequent audits can build from prior findings.

Regular review and update of internal audit checklist

Creating a regular review schedule ensures that your internal audit checklist remains relevant amidst evolving regulatory environments and business processes. Establishing a specific frequency for audits along with a timeline for updating checklists helps maintain an agile and responsive auditing strategy. Factors influencing how often you should update depend on the frequency of compliance changes and observed issues from previous audits.

Moreover, incorporating feedback into checklist revisions is crucial. By utilizing lessons learned from past audits, organizations can refine their checklist over time to better address new challenges and improve the overall auditing process.

Use cases for internal audit checklist

Internal audit checklists have been effectively employed across various industries, highlighting their versatility and importance. For example, in the financial services sector, organizations often use checklists to assess compliance with the Sarbanes-Oxley Act, ensuring they maintain complete and accurate financial records.

Similarly, healthcare organizations utilize checklists to remain compliant with HIPAA regulations regarding patient information security. The success stories from organizations employing these checklists reinforce their role in identifying areas for operational improvement and achieving compliance.

Benefits of using pdfFiller for internal audits

By migrating your internal audit checklist to a cloud-based platform like pdfFiller, your document management becomes efficiently streamlined. Cloud-based solutions provide easy access and enhance convenience for remote teams, allowing for collaborative editing and real-time updates regardless of team member location.

Moreover, the robust security features offered by pdfFiller, including eSignature integration, add an additional layer of trust and compliance for sensitive documents, ensuring that all internal audit processes adhere to data protection regulations and best practices.

Staying informed and updated

To maintain efficacy in internal auditing, it’s crucial to stay up-to-date with the latest trends and evolving practices in the field. New auditing technologies and methodologies emerge regularly, making continuous education essential for professionals in the field. Organizations can benefit from recommended readings, webinars, and professional courses to stay informed.

By subscribing to pdfFiller’s newsletter, users can receive ongoing updates about best practices, tips, tools, and resources that facilitate more effective internal audits, ensuring they stay ahead of regulatory and industry trends.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send internal audit checklist to be eSigned by others?

How do I fill out internal audit checklist using my mobile device?

How do I edit internal audit checklist on an Android device?

What is internal audit checklist?

Who is required to file internal audit checklist?

How to fill out internal audit checklist?

What is the purpose of internal audit checklist?

What information must be reported on internal audit checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.