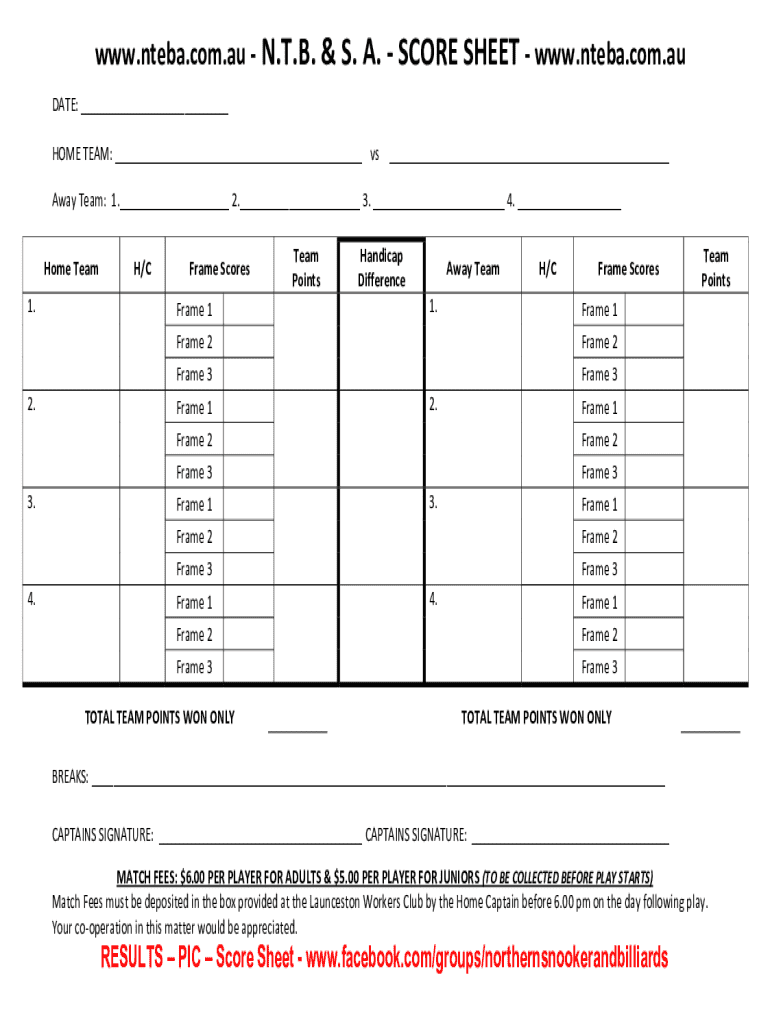

Get the free N.t.b. & S. a. - Score Sheet

Get, Create, Make and Sign ntb s a

Editing ntb s a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ntb s a

How to fill out ntb s a

Who needs ntb s a?

NTB S A Form - How-to Guide Long-Read

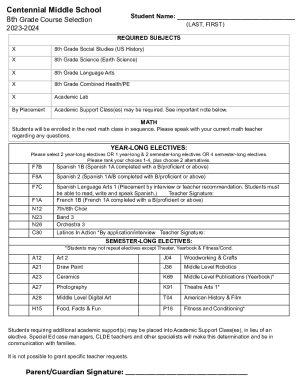

Understanding the NTB S A Form

The NTB S A Form is a critical document used across various sectors, including business, legal, and personal purposes. This form serves as a standardized method to capture essential information related to transactions or agreements that require formal documentation. Its accurate completion is fundamental, as errors can lead to delays or complications in processing applications or requests.

In business contexts, the NTB S A Form may be pivotal for financing or legal agreements, while in personal situations, it might relate to asset management or loan applications. Understanding the significance of this form in your specific scenario is vital to ensure compliance and efficient processing.

Key components of the NTB S A Form

The NTB S A Form is structured into several key components that capture varied information necessary for effective documentation. These components typically include:

Familiarizing yourself with common terminologies associated with the form will further enhance your ability to fill it out correctly. Terms such as 'obligor,' 'beneficiary,' and 'collateral' often appear within the text and have specific meanings that are crucial for precise completion.

Preparing to fill out the NTB S A Form

Before diving into filling out the NTB S A Form, gather all necessary information to streamline the process. You will typically require documentation such as identification cards, financial statements, and prior agreements that relate to the current form. These documents ensure that you can provide accurate details without delays.

When preparing, consider these tips for ensuring accuracy and completeness: Double-check names and numbers, ensure you have the latest financial information, and cross-reference with any necessary legal documents. This attention to detail will mitigate errors that could lead to rejection or delays.

Understanding submission requirements

Identifying who needs to submit the form can help clarify your responsibilities. Typically, the involved parties, such as borrowers or sellers, are required to submit the NTB S A Form. Knowing the submission methods is also crucial. Depending on your location and the nature of the form, submissions can often be done electronically or in person. Each method has its guidelines regarding how and where to submit, which can vary by jurisdiction.

Step-by-step guide to completing the NTB S A Form

Step 1: Filling personal information

Starting with the personal information section, clearly and accurately input all required details. This section is essential as it identifies all parties involved. Ensure to avoid common errors like misspellings in names or entering incorrect identification numbers.

Step 2: Inputting financial details

Financial details often hold significant weight in the processing of the NTB S A Form. Gather income and expense statements to provide accurate financial details. Pay special attention to figures; ensuring that they align with your documentation will help in avoiding mismatches during review.

Step 3: Reviewing and signing the form

After filling out the form, it's crucial to double-check all entries. Even minor mistakes can lead to delays or rejections. Different signing methods, like digital and handwritten signatures, should be used based on the submission requirements. Digital signatures enhance the security of your submission.

Step 4: Final submission process

To submit the NTB S A Form electronically, ensure you follow the platform's prompts closely. Once submitted, take note of confirmation receipts or any acquisition numbers; these documents may serve as proof of submission, should any issues arise later.

Navigating common challenges with the NTB S A Form

Encountering challenges while filling out the NTB S A Form is commonplace. Among frequently encountered issues is providing inconsistent or incomplete information. Solutions include using checklists to monitor the completeness of your entries or consulting guides specific to the form.

Understanding rejection reasons can help avoid them in the future. Key factors include inaccuracies in personal and financial details or missing required signatures. If your form is rejected, contact the appropriate department to understand the reasons and steps for correction and resubmission.

Utilizing pdfFiller for effective form management

pdfFiller provides tools specifically designed to make managing the NTB S A Form efficient. Its editing tools allow users to fill out the form easily, adding annotations for better clarity. With the ability to add comments, it helps clarify any doubts or ensures all stakeholders are on the same page.

eSigning features of pdfFiller

pdfFiller's eSigning features further secure the signing process. Users can employ digital signatures for the NTB S A Form, which reduces paperwork and enhances security. Leveraging these features streamlines the process of obtaining and submitting signed documents.

Collaborating on the NTB S A Form

Collaboration is made simple with pdfFiller. Team members can be invited to review and edit the NTB S A Form simultaneously. The functionality of tracking changes grants oversight on who made edits, allowing for efficient management and oversight within teams.

Best practices for managing your NTB S A Form

Organizing forms effectively is essential. With pdfFiller, users can categorize and store their NTB S A Form neatly. Tags, folders, and labels enhance the ease of navigation through numerous documents and facilitate quick retrieval.

Maintaining legal compliance is a priority. Keeping abreast of regulations and requirements ensures that your submissions adhere to current standards. Regularly checking for updates about the NTB S A Form or related legislation will save you from non-compliance issues.

Interactive tools and resources

Accessing fillable PDF templates through pdfFiller simplifies the form filling process. These templates are designed to guide users efficiently, ensuring required fields are highlighted and instructions are clear.

Additionally, users can benefit from webinars and tutorials focused on using the NTB S A Form. These sessions provide practical insights and guidance from experts, ensuring you get the most out of your experience with document management.

Feedback loop: engaging with users

Gathering user experiences about the NTB S A Form can provide valuable insights for improvement. Engaging with others who have filled it out can expose you to various techniques and best practices that you may not have previously considered.

A community forum allows users to collaborate, providing a platform for sharing knowledge and solutions regarding the NTB S A Form.

Frequently asked questions (FAQ)

Addressing common queries is essential to demystify the NTB S A Form for users. Many individuals often wonder about specifics like eligibility criteria for submission or the implications of errors found in the submission process.

For issues requiring expert advice, establishing a method to contact professionals can streamline your approach. Knowing the best practices for reaching out for help can save you time and lead to faster resolutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ntb s a online?

How do I make changes in ntb s a?

How do I fill out ntb s a using my mobile device?

What is ntb s a?

Who is required to file ntb s a?

How to fill out ntb s a?

What is the purpose of ntb s a?

What information must be reported on ntb s a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.