Get the free 2024 Property Tax Notice

Get, Create, Make and Sign 2024 property tax notice

Editing 2024 property tax notice online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 property tax notice

How to fill out 2024 property tax notice

Who needs 2024 property tax notice?

2024 Property Tax Notice Form: Your Comprehensive Guide

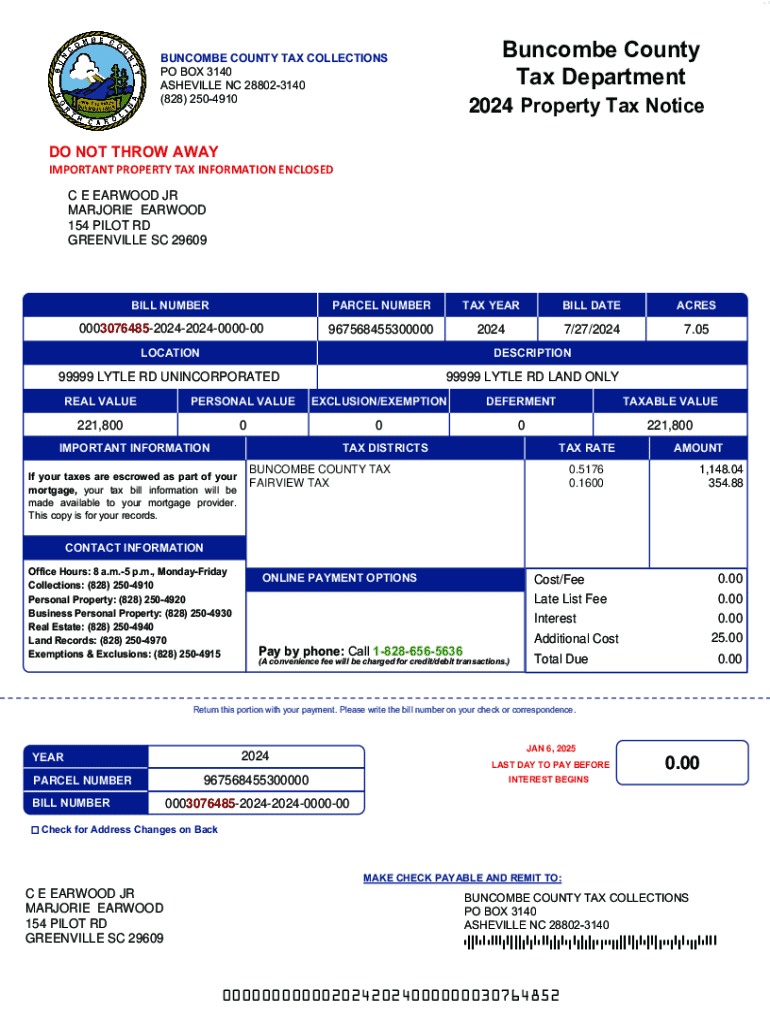

Overview of property tax notices for 2024

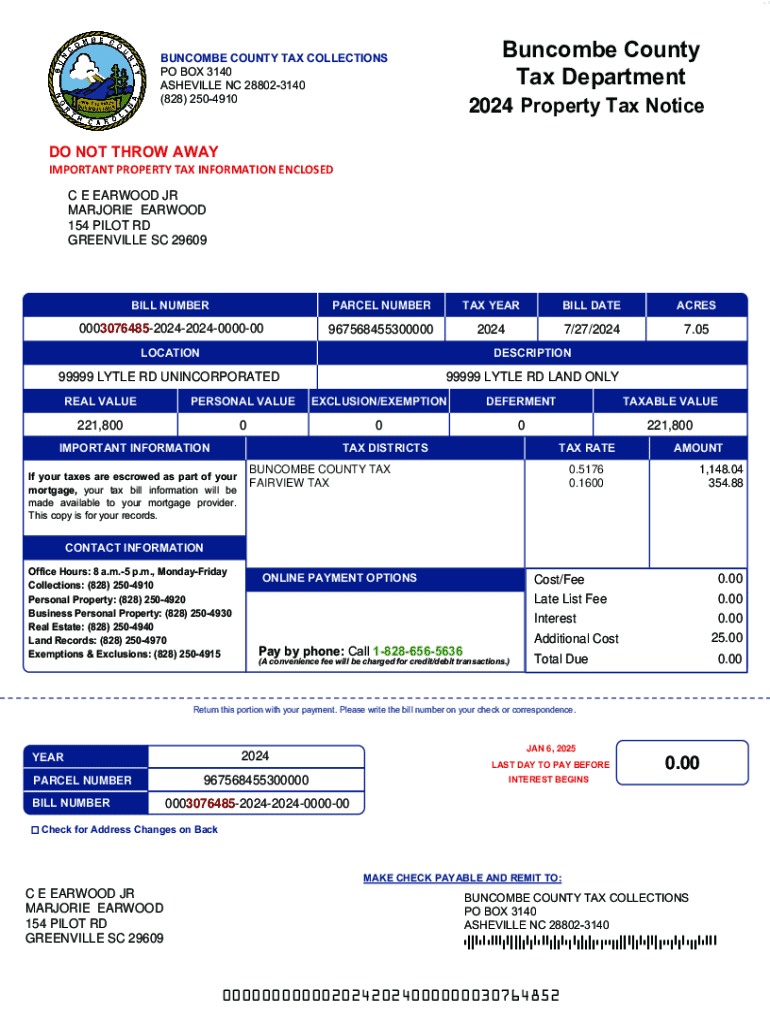

Property tax notices for 2024 serve as essential communications from local tax authorities, informing property owners about their assessed tax liabilities. These notices provide critical information on property values, tax rates, and payment timelines, making it vital for homeowners to understand their implications. Ignoring this notice can lead to late payments and potential penalties, underscoring the importance of being well-informed.

Furthermore, having a clear grasp of the property tax notice form can aid in making financial decisions regarding property ownership. As local jurisdictions adjust assessments to reflect changes in the market, staying updated with your property’s tax status can help avoid surprises and allow for planning adjustments.

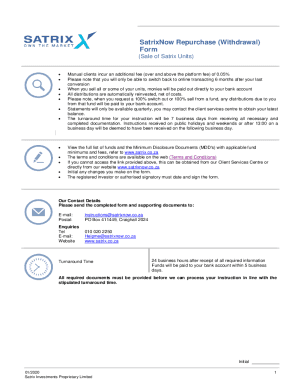

Key components of the 2024 property tax notice form

The 2024 property tax notice form is structured to present a range of critical information. Essential sections within the form include your property's description, details of ownership, the assessed value of the property, and the payment due dates. Understanding these components is vital for effectively managing your property tax obligations.

The property description typically includes the address, parcel number, and property type (residential, commercial, etc.). Owner details will feature the name(s) of the property owner and their correspondence address. The tax assessment value represents the valuation placed on the property by the tax assessor and is essential for calculating your tax liability.

Understanding tax rates and how they are calculated is equally important. Tax rates are determined by various factors, including local budgetary needs, property values in the area, and current economic conditions. These rates are essential in determining the total tax owed, calculated as follows: (Tax Assessment Value) x (Tax Rate) = Total Property Taxes Due. Considerations can include recent sales data or changes in local governance impacting tax collections.

Step-by-step instructions for completing the property tax notice form

Completing the 2024 property tax notice form may seem daunting, but by breaking it down into steps, the process becomes manageable. Before you start filling, gather all necessary documents such as your prior tax return, property deeds, and any previous tax notices. Having this information on hand will ensure a smoother process.

Follow these detailed steps to complete your property tax notice form:

Common mistakes to avoid include overlooking property identifiers, providing incorrect owner details, or miscalculating the assessed tax amount. Verify all entries before submission to ensure accuracy and compliance.

Options for editing and managing your form

Utilizing pdfFiller offers a streamlined way to edit your 2024 property tax notice form. With its intuitive interface, you can easily input or modify details without the hassle of pen and paper. Editing is made simple with options to highlight text, add comments, or attach additional documentation as needed.

For signing and collaborating on the document in real-time, pdfFiller provides features that allow multiple users to work on a single document simultaneously. You can invite homeowners, tax advisors, or family members to review and provide input directly on the form. Furthermore, the cloud-based nature of pdfFiller enables you to save versions of your document and track changes efficiently.

eSigning the 2024 property tax notice form

Signing your property tax notice form electronically through pdfFiller is both secure and straightforward. The eSignature process complies with legal requirements, allowing you to seal your document with the confidence of its validity. To initiate, simply select the eSign option and follow the prompts to place your signature.

It's essential to ensure that your eSignature meets compliance standards. Familiarize yourself with your jurisdiction's requirements for electronic signatures to avoid any issues during submission. Generally, ensuring authenticity and preventing fraud are core aspects of regulatory compliance, making it necessary to use secure platforms like pdfFiller.

Frequently asked questions (FAQs) regarding the 2024 property tax notice form

Navigating property taxes can lead to numerous questions. Here are common queries associated with the 2024 property tax notice form:

Contact information for additional support

Should you need further assistance with your 2024 property tax notice, local tax authorities are your first point of contact. Look for official websites or call the offices directly for queries regarding assessments or payments.

Furthermore, online resources and community forums can provide additional support. Many cities host forums where taxpayers can share experiences and solutions, making it easier to find answers.

Interactive tools for property tax management

pdfFiller provides helpful interactive tools to aid in property tax management. These tools simplify the calculation and payment processes to ease any burden during tax season. Utilizing calculators for assessing property taxes can provide clarity on your total obligations.

Consider also using the payment planning tool to budget for upcoming expenses. These calculators provide insights regarding your potential tax payments, allowing for more informed financial planning.

Recent updates and changes in 2024 property tax legislation

As we enter 2024, various updates might impact property owners. Legislation changes can include adjustments to tax rates, reassessment policies, and exemptions that homeowners need to be aware of. Staying informed about these updates is critical, as they could influence your assessment and payment responsibilities significantly.

Regularly consult local tax authorities or governmental websites for the latest news. Being proactive about these changes will prepare property owners for any shifts in their financial obligations concerning their properties.

Best practices for managing property taxes

Managing property taxes effectively requires vigilance and organization. Here are some best practices to keep in mind:

Resources and links related to property tax notices

Understanding property taxes can greatly benefit from utilizing official guidelines. government websites typically offer detailed instructions, forms, and necessary resources for property owners.

Additionally, pdfFiller can provide resources for templates and specific forms required for your property tax submissions. Reading articles and blogs online about property tax management will also enhance your knowledge in this area.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2024 property tax notice?

How do I complete 2024 property tax notice online?

Can I sign the 2024 property tax notice electronically in Chrome?

What is 2024 property tax notice?

Who is required to file 2024 property tax notice?

How to fill out 2024 property tax notice?

What is the purpose of 2024 property tax notice?

What information must be reported on 2024 property tax notice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.