Get the free Form 6-k

Get, Create, Make and Sign form 6-k

Editing form 6-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 6-k

How to fill out form 6-k

Who needs form 6-k?

Comprehensive Guide to Form 6-K: Everything You Need to Know

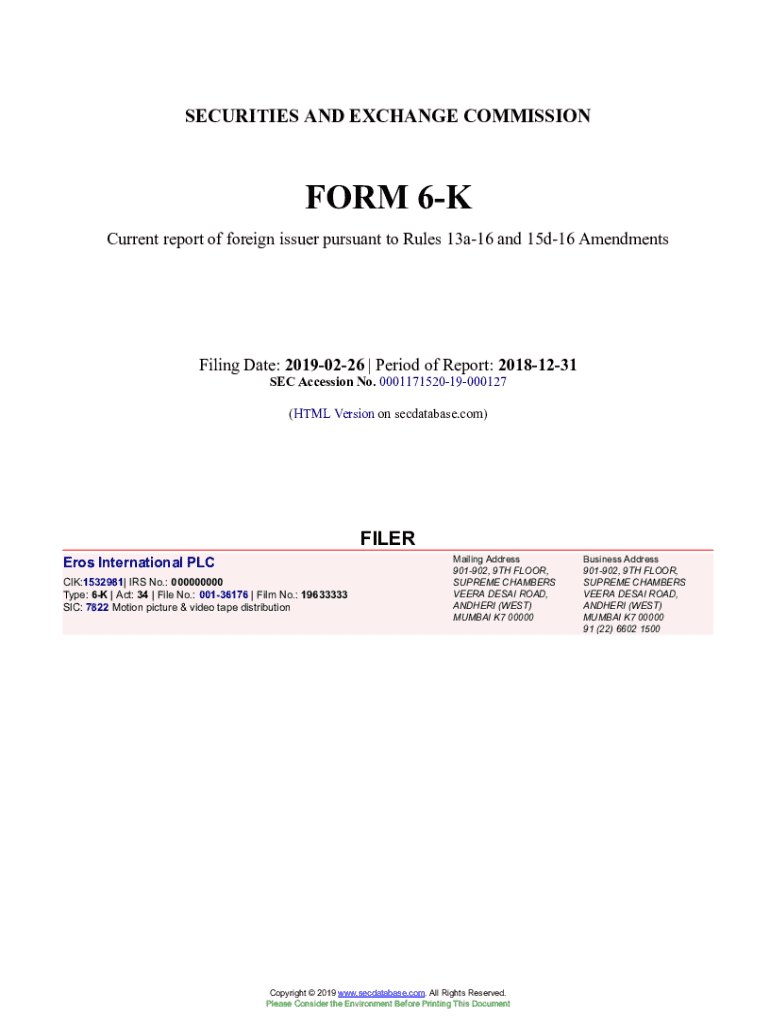

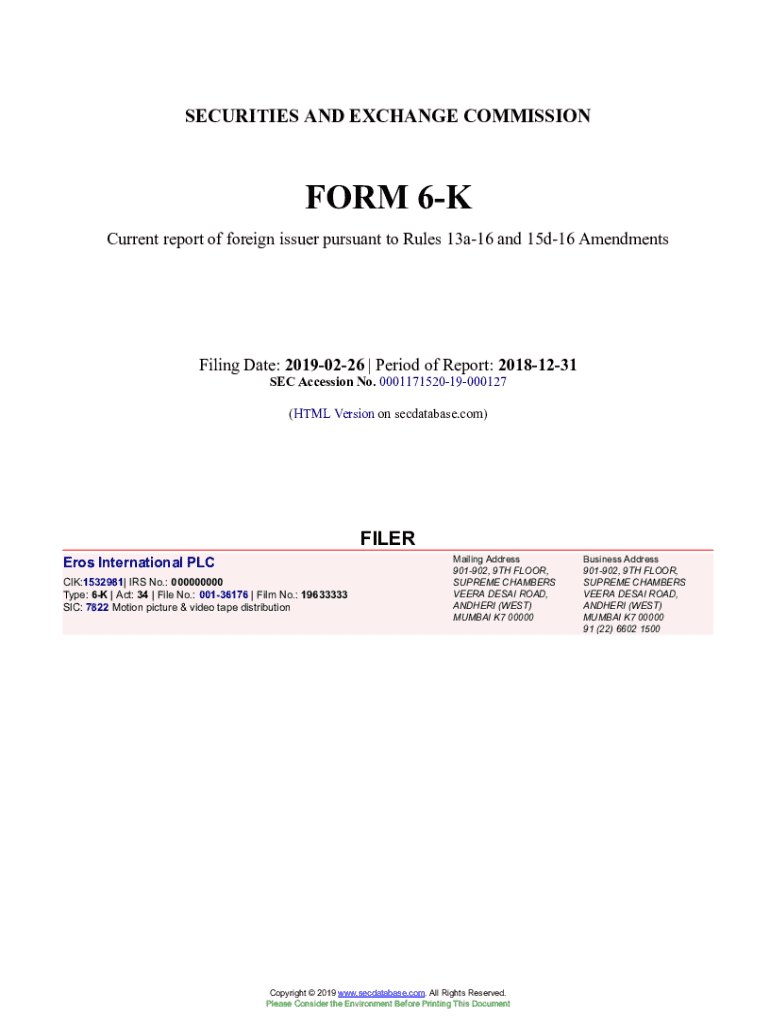

Understanding Form 6-K

Form 6-K is a crucial document required by the U.S. Securities and Exchange Commission (SEC) specifically for foreign private issuers to disclose material information that may be of interest to investors. This form serves as a bridge between foreign companies and U.S. capital markets, ensuring transparency and compliance with American regulations. Without Form 6-K, foreign issuers would struggle to communicate essential updates regarding their financial performance and governance.

The significance of the Form 6-K lies not only in compliance but also in fostering investor confidence. By mandating regular updates, it provides a platform for foreign issuers to convey relevant data, mitigating information asymmetry that often exists in cross-border investments.

When is Form 6-K required?

Form 6-K is required when foreign private issuers must report new information that is material to investors. This may include earnings announcements, changes in corporate governance, significant transactions, or severe economic events. Unlike Forms 10-K and 20-F, which are required annual and periodic reports, respectively, Form 6-K is filed on an as-needed basis.

It is essential to understand that while Form 6-K is a flexible reporting tool, it must adhere to specific timelines involving disclosure. Failing to file this form appropriately can result in administrative sanctions and other consequences from the SEC.

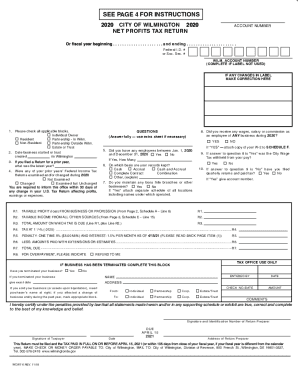

Key Components of Form 6-K

The Form 6-K has several key components that need to be carefully addressed. The required information includes sections such as the issuer's name, SEC file number, and the date of the report. Each section is designed to help investors quickly grasp the material changes occurring within a company.

Additionally, inserting optional information can greatly enhance the value of the Form 6-K filing. Such information may include a summary of recent corporate developments, investor presentations, or management's discussion and analysis. Including these optional sections can provide much-needed context and insight into the current status and future projections of the company.

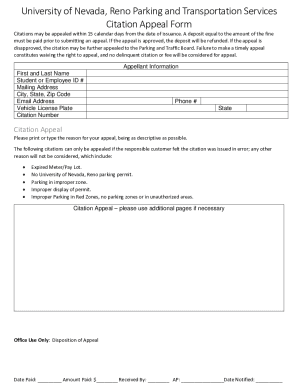

Step-by-step guide on filling out Form 6-K

Filling out Form 6-K takes a methodical approach. The first step involves gathering all necessary documents and information to support your filing. This includes previous financial statements, recent press releases, board meeting minutes, and any other documentation that may be relevant to your material disclosures.

Once you have gathered the information, start filling out the basic sections of the form. Pay meticulous attention to header details, like your company's name and SEC file number, as these elements establish the authenticity of your report. Following the header includes a description of any financial reports or material events. Provide clear, concise information to assist investors in understanding the nuances of the disclosed events.

When it comes to formatting, adhering to specific guidelines is crucial. For instance, numerical data should be presented in thousands or millions, avoiding unnecessary decimal points. Dates must follow MM/DD/YYYY formatting for consistency. Aim for clarity; straightforward language aids not only compliance but promotes investor engagement.

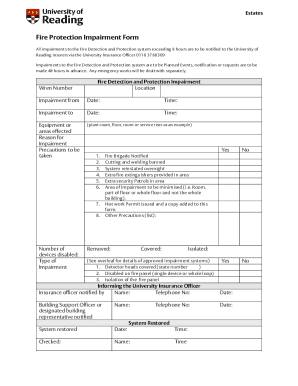

Reviewing your Form 6-K before submission

Reviewing your Form 6-K is critical, as errors or omissions can lead to significant consequences, including regulatory penalties and reputational damage. Effective review processes can mitigate these risks. Engage team members who can provide different perspectives on the accuracy and comprehensiveness of your filings. A fresh set of eyes can often catch mistakes that may have been overlooked.

Common pitfalls include neglecting to double-check the attached documents, failing to align financial statements with reported material events, or overlooking the formatting guidelines. By focusing on these areas, you can enhance the quality and reliability of your submission.

Submitting Form 6-K to the SEC

Submitting Form 6-K is facilitated primarily through the SEC’s EDGAR filing system, which is designed for efficient electronic submissions. While paper submissions are still an option, online filing represents a far more efficient method, reducing the chances of paperwork getting lost or delayed.

Adhering to filing deadlines is critical. Keep a calendar marking essential dates for your filings, especially if they coincide with significant events for your company. Staying organized will not only help you meet regulatory expectations but will also keep investors informed.

Post-submission: Managing your Form 6-K filing

After submission, it's essential to track the status of your Form 6-K. The SEC provides systems where you can confirm if your filing was accepted and whether there are any follow-up inquiries. Regularly check this status as part of your post-filing compliance routine.

In case the SEC requires additional information or clarification, it's vital to respond promptly and thoroughly. Having a established team protocol for addressing SEC inquiries not only demonstrates compliance but fosters a stronger relationship with regulators.

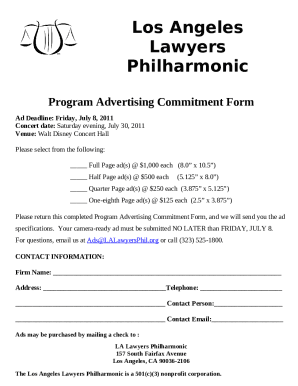

Resources and tools for managing Form 6-K

In the realm of digital document management, platforms like pdfFiller can dramatically streamline the process of filling out and submitting Form 6-K. This user-friendly service offers solutions for efficient PDF editing, ensuring that your filings are accurately completed with the necessary signatures and collaborative features for team inputs.

Investing in technology that simplifies compliance and documentation can save valuable time and minimize errors. From version control to tracking changes, these tools can enhance the overall filing experience, making it informative and less cumbersome.

Best practices for ongoing compliance

Staying updated with regulatory changes affecting Form 6-K is vital for all foreign private issuers. The SEC often revises guidelines, and being aware of these modifications can influence how you approach disclosures. Subscribe to SEC newsletters and regularly review related news outlets to remain in the loop.

Establishing a filing calendar is another best practice for ensuring timely submissions. By scheduling regular reviews of significant events and corporate actions, issuers can create a proactive culture surrounding compliance and information transparency. This calendar should list all necessary filings, their due dates, and any material events that could trigger the need for a Form 6-K.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 6-k in Gmail?

How do I complete form 6-k online?

How do I make changes in form 6-k?

What is form 6-k?

Who is required to file form 6-k?

How to fill out form 6-k?

What is the purpose of form 6-k?

What information must be reported on form 6-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.